Vehicle Dependability in China Decreases Due to Design-Related Problems, JD Power Finds

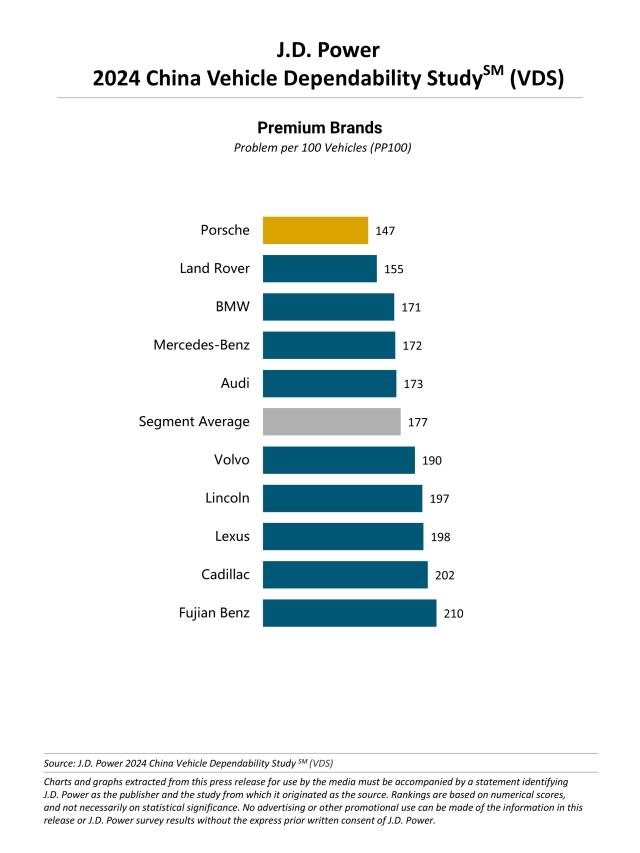

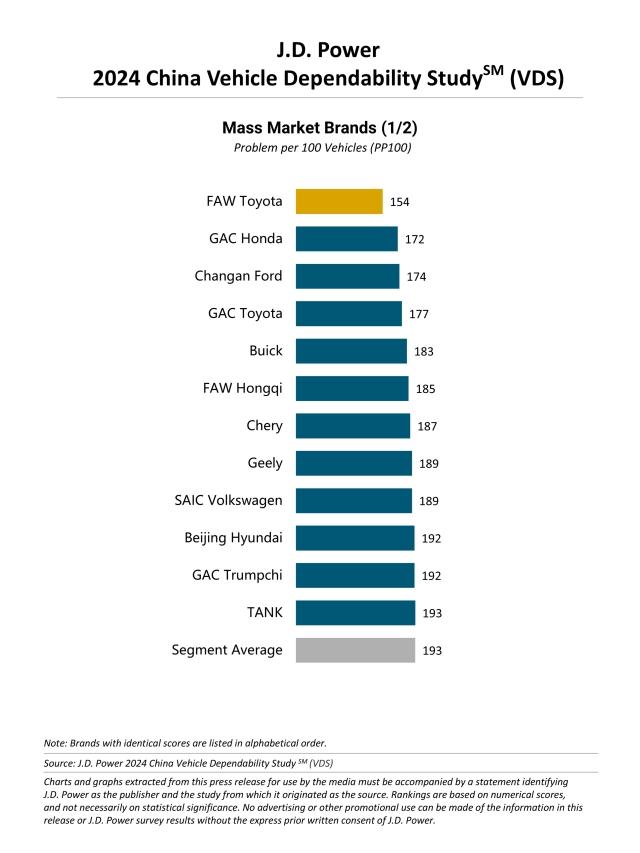

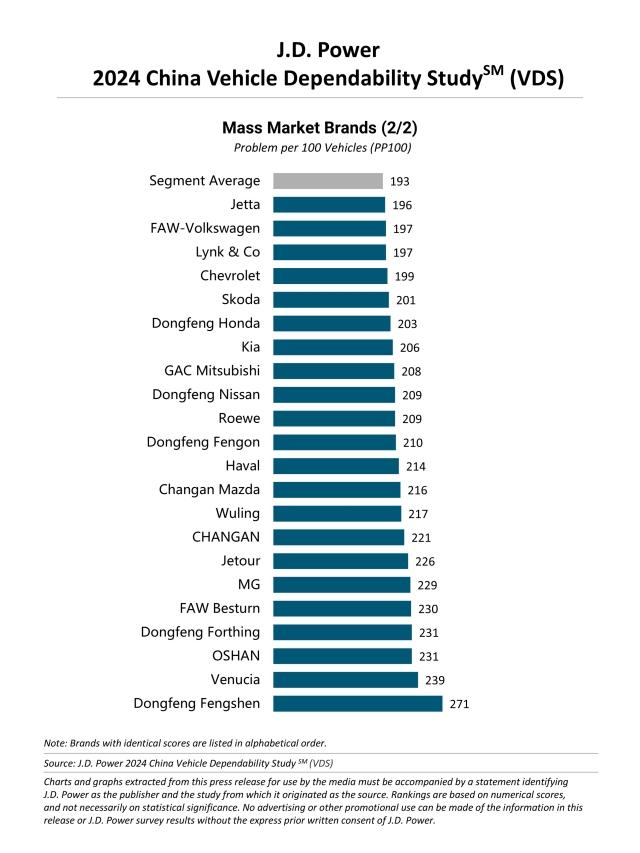

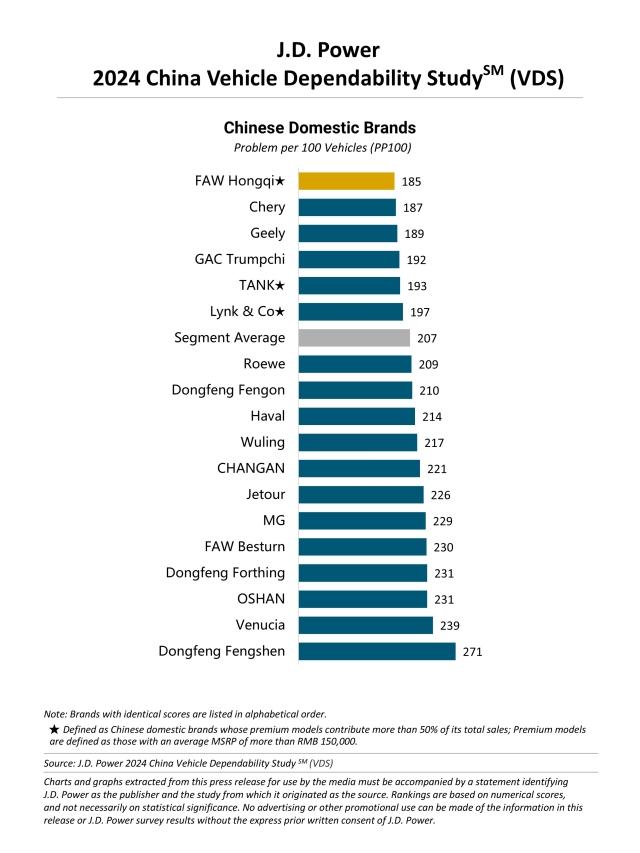

Porsche, FAW Toyota and FAW Hongqi Each Rank Highest in Respective Segment

SHANGHAI: 31 Oct. 2024 – Due to an increase in design-related problems that owners experience with their vehicles in China, the number of dependability problems has risen to 190 problems per 100 vehicles (or PP100) industry-wide, according to the JD Power 2024 China Vehicle Dependability Study (VDS), released today. Year over year, this represents in an overall increase of 9.3 PP100, while design-related problems have risen 9.1 PP100 to 84 PP100.

According to the study, malfunction-related problems have decreased 1 PP100 compared with 2023. The proportion of PP100 for the top 20 problems has increased slightly compared with a year ago (36% vs. 34%, respectively). Problems with infotainment, driving assistance and seats show the highest increases among nine major vehicle categories, rising 5.3 PP100, 2.5 PP100 and 1.9 PP100, respectively.

The study, now in its 15th year, measures the number of problems experienced per 100 vehicles during the past six months by owners of 13- to 48-month-old vehicles. A lower score reflects higher vehicle quality. The study covers 177 specific problems grouped into nine major vehicle categories: exterior; interior; driving experience; features/controls/displays (FCD); infotainment; climate; seats; powertrain; and driving assistance.

“The decline in China’s vehicle dependability performance in 2024 should serve as a wake-up call for automakers,” said Elvis Yang, general manager of auto product practice at JD Power China. “In recent years, the pace of new model launches in the Chinese market has accelerated and development cycles have continuously shortened. Balancing the speed of new model launches with high product reliability and durability will be a critical long-term challenge for automakers. Especially as Chinese brands gradually enter international markets, the long-term reliability of their products will also affect the resale value and new-vehicle sales in overseas markets. Additionally, the rapid iteration of technology features makes 'timeless design' in infotainment and driver assistance systems increasingly important. If owners’ experiences cannot be continually optimized through OTA updates, they are likely to experience dissatisfaction through comparison."

Following are additional findings of the 2024 study:

- Design-related problems in infotainment systems now top problem: Infotainment systems have now surpassed exterior as the category with the highest number of problems experienced. The top five issues in this category include unresponsive touchscreen; Bluetooth pairing/connection problems; voice command recognition; wi-fi pairing/connection problems; and inaccurate in-car navigation. Among these, problems with unresponsive touchscreen have the highest increase from 2023, rising 1.3 PP100. From a city-level perspective, owners in tier-one cities experienced significantly more problems with infotainment systems than those in tier-two, tier-three and tier-four cities, reaching 31 PP100.

- Female owners surpass male drivers in number of problems experienced: The number of problems experienced by female owners continues to rise for a second consecutive year, increasing to 196 PP100 in 2024 from 188 PP100 in 2023, with the most frequently cited problem being the infotainment system.

- Chinese domestic brands need to focus on improving vehicle exterior: The gap between Chinese domestic brands (207 PP100) and mass market brands (193 PP100) has narrowed by 1 PP100 compared with 2023. The three areas where Chinese domestic brands show the largest gaps compared to mass market brands are exterior, features/controls/displays (FCD) and infotainment, with the widest gap in exterior at 3.5 PP100 year over year. The smallest gap is in problems related to driving assistance systems, at 0.8 PP100.

- Types of problems experienced related to ownership length: Problems experienced in the past year have risen significantly among those who have owned their vehicle for 2-3 years, increasing 30.2 PP100 compared with those who have owned their vehicle for 1-2 years. Problems related to powertrain have the largest increase. Among those who have owned their vehicle for 3-4 years, the infotainment system has the largest increase, rising 4 PP100 compared with 2-3 years of ownership.

Highest-Ranked Brands and Models

Porsche ranks highest in vehicle dependability among premium brands with 147 PP100, while Land Rover (155 PP100) ranks second and BMW (171 PP100) ranks third.

FAW Toyota is the highest-ranked mass market brand with 154 PP100. GAC Honda (172 PP100) ranks second and Changan Ford (174 PP100) ranks third.

FAW Hongqi is the highest-ranked Chinese domestic brand with 185 PP100. Chery (187 PP100) ranks second, while Geely (189 PP100) ranks third.

In the 2024 study, 20 models from 11 brands are eligible for awards across 19 segments.[1]

- BMW models ranking highest in their respective segment are BMW 7 Series and BMW X1.

- Beijing Hyundai models ranking highest in their respective segment are Hyundai Celesta and Hyundai ix35.

- Changan Ford models ranking highest in their respective segment are Ford Focus, Ford Mondeo and Ford Edge/Edge L.

- FAW Toyota models ranking highest in their respective segment are Toyota Vios/Vios FS; Toyota Corolla; Toyota IZOA; and Toyota RAV4.

- GAC Honda models ranking highest in their respective segment are Honda Vezel and Honda Odyssey.

- Porsche models ranking highest in their respective segment are Porsche Macan and Porsche Cayenne.

Other models that rank highest in their respective segment are Audi A4L; GAC Trumpchi GS3; Kia Sportage R; Mercedes-Benz E-Class; and Wuling Hongguang S3.

The 2024 China Vehicle Dependability Study (VDS) is based on responses from 33,317 vehicle owners who purchased their vehicle between January 2020 and June 2023. The study includes 229 models from 44 different brands and was fielded from February through July 2024 in 81 major cities across China.

To learn more about the China Vehicle Dependability Study (VDS), please contact us: china.marketing@jdpa.com

JD Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, JD Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 55 years. The world's leading businesses across major industries rely on JD Power to guide their customer-facing strategies.

JD Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Wenjing Ji, JD Power; China; +86 21 8026 5719; wenjing.ji@jdpa.com

Geno Effler, JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

[1] Brands listed in alphabetical order.