Vehicle Dependability in China Declines for Second Consecutive Year, JD Power Finds

Land Rover, FAW Toyota and Chery Each Rank Highest in Respective Segment

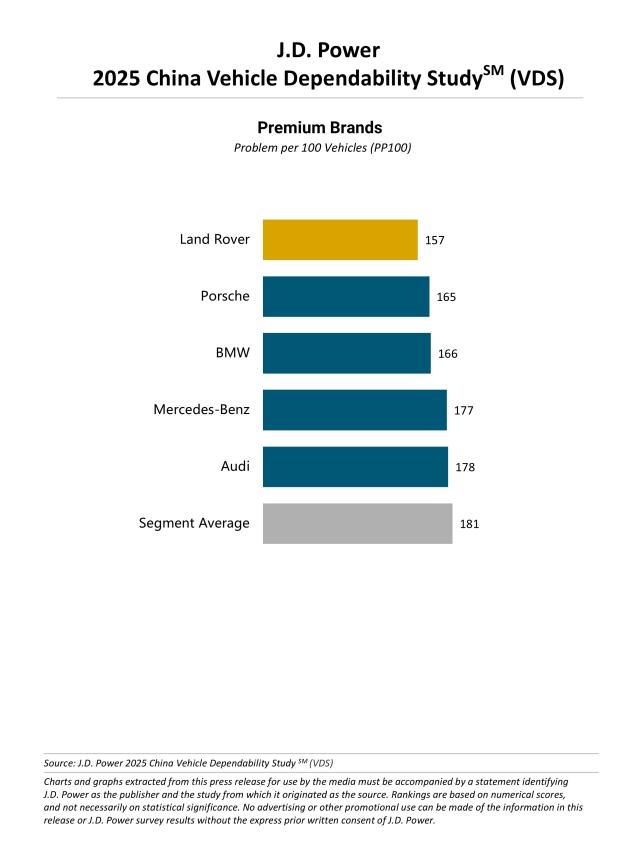

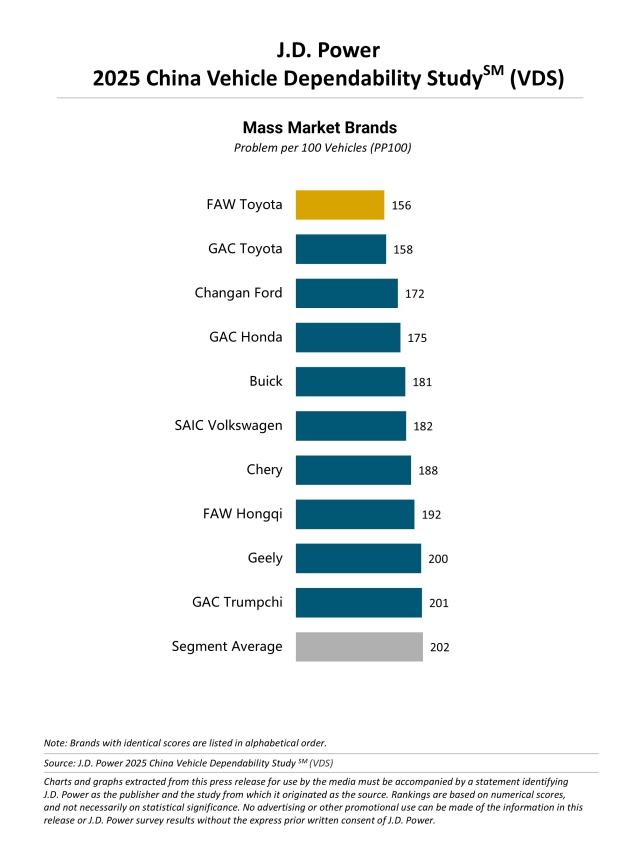

SHANGHAI: 24 Oct. 2025 – Due to an increase in design-related problems that owners experience with their vehicles in China, the number of dependability problems has risen to 197 problems per 100 vehicles (PP100) industry-wide, according to the JD Power 2025 China Vehicle Dependability StudySM (VDS), released today. Year over year, this represents an overall increase of 7 PP100, while the average score for premium brands and mass market brands are 181 PP100 and 202 PP100, respectively. A lower score indicates higher vehicle quality.

According to the study, problems with internal combustion engine (ICE) vehicles have continued to rise for two consecutive years, with a cumulative increase of 9% during the past three years. Among ICE vehicles, design-related problems have surged 20%, accounting for 45% of all problems, becoming the main driver of long-term quality deterioration. Meanwhile, malfunction-related problems have increased 2.8 PP100 from 2024, revealing a dual imbalance between design optimization at the source and component reliability management across the industry.

The study, now in its 16thyear, measures the number of problems experienced per 100 vehicles during the past six months by owners of 13- to 48-month-old vehicles. The study covers 177 specific problems grouped into nine major vehicle categories: exterior; interior; driving experience; features/controls/displays (FCD); infotainment; climate; seats; powertrain; and driving assistance.

“The industry performance of the Initial Quality Study and Vehicle Dependability Study has been on a steady decline the past two years,” said Elvis Yang, general manager of the auto product practice at JD Power China. “Notably, VDS quality issues now emerge earlier within 1-2 years of ownership, and this should be a wake-up call for all stakeholders. Long-term reliability, durability and big data validation were once ICE vehicles’ core edges over NEVs. Yet under dual pressures of faster electrification and price cuts, how ICE makers maintain quality has become critical.”

Following are additional findings of the 2025 study:

- Long-term quality declines: Among ICE vehicle owners’ long-term complaints, noise/vibration issues (+6.6 PP100) and ease-of-use problems (+2.3 PP100) have increased most significantly year over year. Together, smart feature malfunctions and noise, vibration and harshness (NVH) problems account for more than 75% of the increase in the top 10 deteriorating problem areas. The former includes failures in voice recognition, infotainment systems and driver assistance functions, while the latter involves tire noise, wind noise and rattling in windows and suspension. This trend indicates that the rushed rollout of smart technologies, combined with cost-cutting in traditional craftsmanship, has created a dual pressure that poses a major challenge to long-term quality management for ICE vehicles.

- Durability crisis deepens: Feedback from owners of ICE vehicles with 1- to 2-year ownership periods shows that long-term quality has declined for three consecutive years—now 195 PP100 from 168 PP100 in 2023. By problem category, infotainment systems and seats have declined the most during the past three years, with problems increasing by 8.9 PP100 and 5.4 PP100. Meanwhile, as ownership periods lengthen, international brands and premium brands show growing long-term quality advantages. Over the past three years, domestic brands have seen steady rises in average new-car prices, narrowing the gap with mainstream internationals and boosting their premium power. Yet their quality complaints (exterior, driving experience, infotainment, powertrains) worsen sharply as ownership extends.

- Conflict between R&D validation and cost reduction: Across brand segments, design-related problems have surged markedly. Domestic brands have seen design-related problems climb to 102 PP100 this year from 84 PP100 in 2023. Premium brands had an even sharper rise to 84 PP100 from 66 PP100 as aggressive price competition eroded product premium due to mounting design flaws. International brands have increased by 12 PP100 over two years. Notably, the rate of increase in design-related problems has exceeded that of malfunction-related problems across all brand segments, revealing a widening gap between inadequate R&D validation systems and mounting cost pressures—now emerging as a systemic risk to overall quality stability.

Highest-Ranked Brands and Models

Land Rover ranks highest in vehicle dependability among premium brands with 157 PP100. Porsche (165 PP100) ranks second and BMW (166 PP100) ranks third.

FAW Toyota is the highest-ranked mass market brand with 156 PP100. GAC Toyota (158 PP100) ranks second and Changan Ford (172 PP100) ranks third.

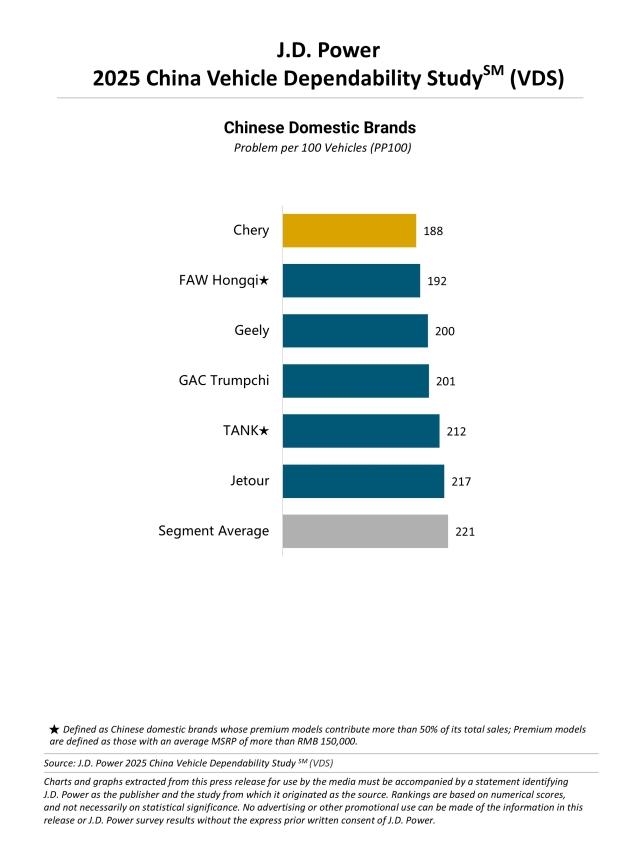

Chery is the highest-ranked Chinese domestic brand with 188 PP100. FAW Hongqi (192 PP100) ranks second and Geely (200 PP100) ranks third.

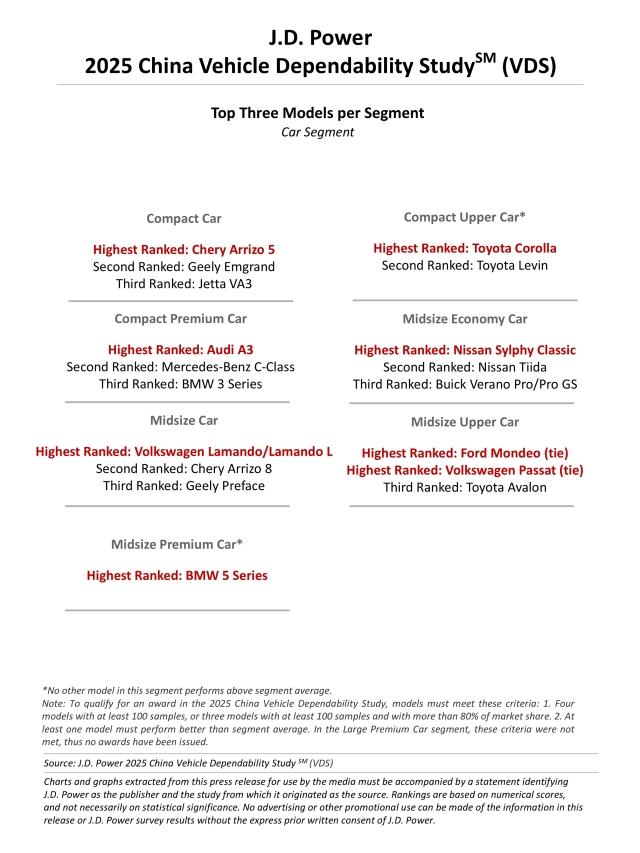

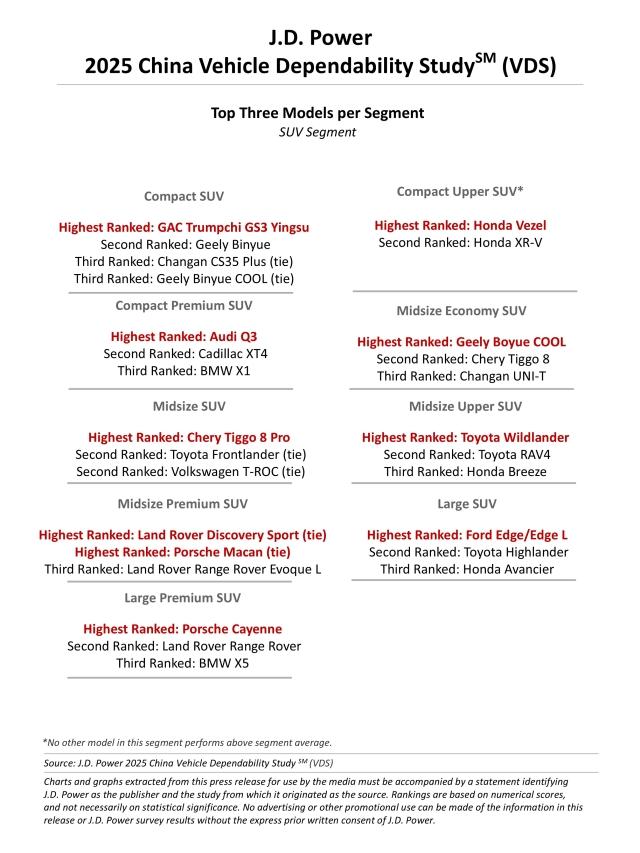

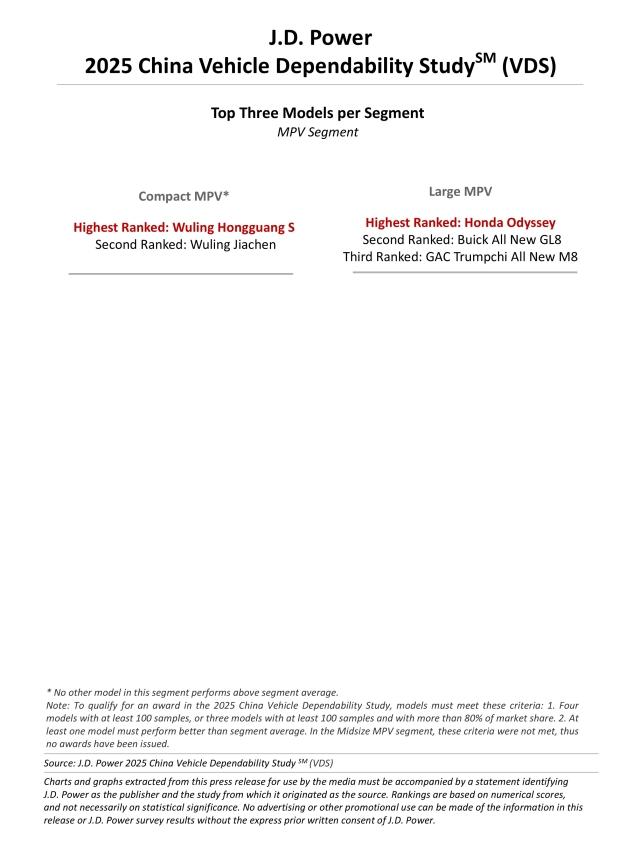

In the 2025 study, 20 models from 14 brands are eligible for awards across 18 segments.[1]

- Audi models ranking highest in their respective segment: Audi A3 and Audi Q3.

- Chery models ranking highest in their respective segment: Chery Arrizo 5 and Chery Tiggo 8 Pro.

- Changan Ford models ranking highest in their respective segment: Ford Edge/Edge L and Ford Mondeo.

- GAC Honda models ranking highest in their respective segment: Honda Odyssey and Honda Vezel.

- Porsche models ranking highest in their respective segment: Porsche Cayenne and Porsche Macan.

- SAIC Volkswagen models ranking highest in their respective segment: Volkswagen Lamando/Lamando L and Volkswagen Passat.

Other models that rank highest in their respective segment are BMW 5 Series; Geely Boyue COOL; GAC Trumpchi GS3 Yingsu; Land Rover Discovery Sport; Nissan Sylphy Classic; Toyota Corolla; Toyota Wildlander and Wuling Hongguang S.

The 2025 China Vehicle Dependability Study (VDS) is based on responses from 22,941 vehicle owners who purchased their vehicle between February 2021 and June 2024. The study includes 169 models from 38 different brands, of which 166 models met the minimum sample size requirement, and was fielded from February through July 2025 in 81 major cities across China.

To learn more about the China Vehicle Dependability Study (VDS), please contact us: china.marketing@jdpa.com

About JD Power

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Wenjing Ji, JD Power; China; +86 21 8026 5719; wenjing.ji@jdpa.com

Joe LaMuraglia, JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

[1] Brands listed in alphabetical order.