JD Power China Introduces New Study Highlighting Vehicle Brand Net Promoter Score®

Majority of Vehicle Brands Fail to Achieve Balance between Product, Sales and Service

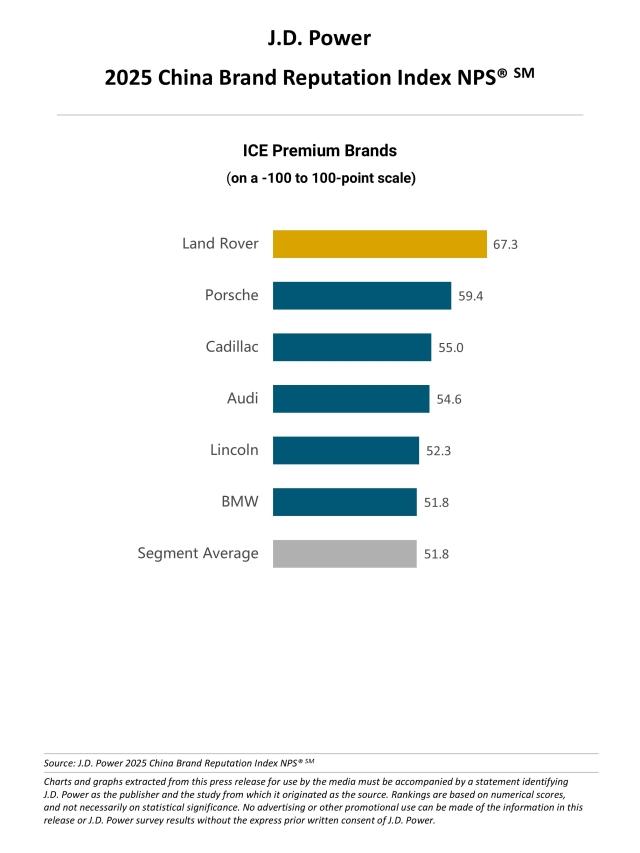

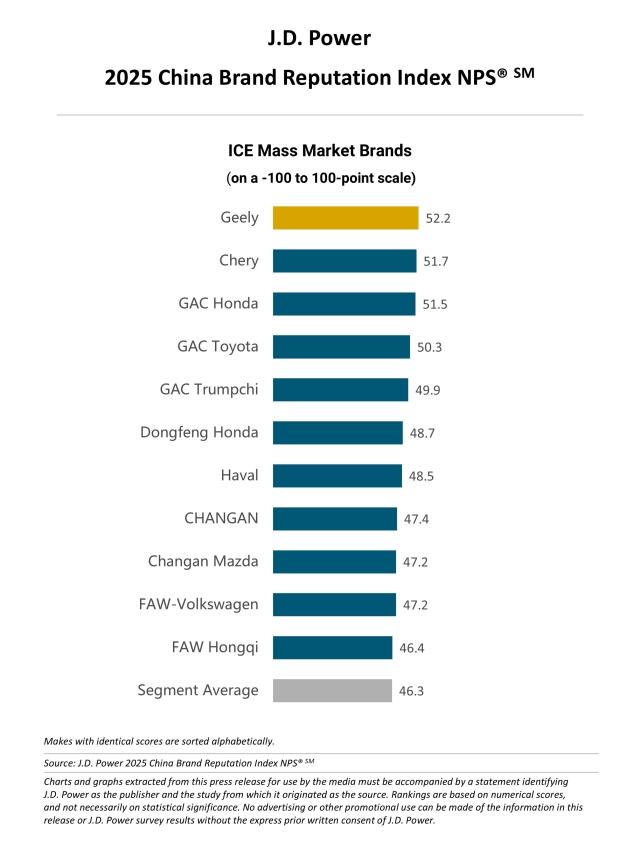

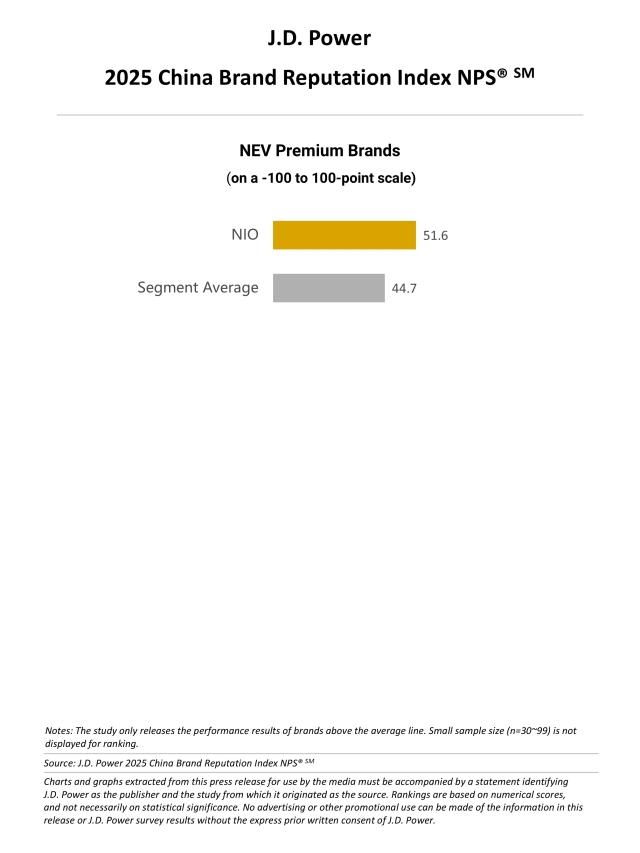

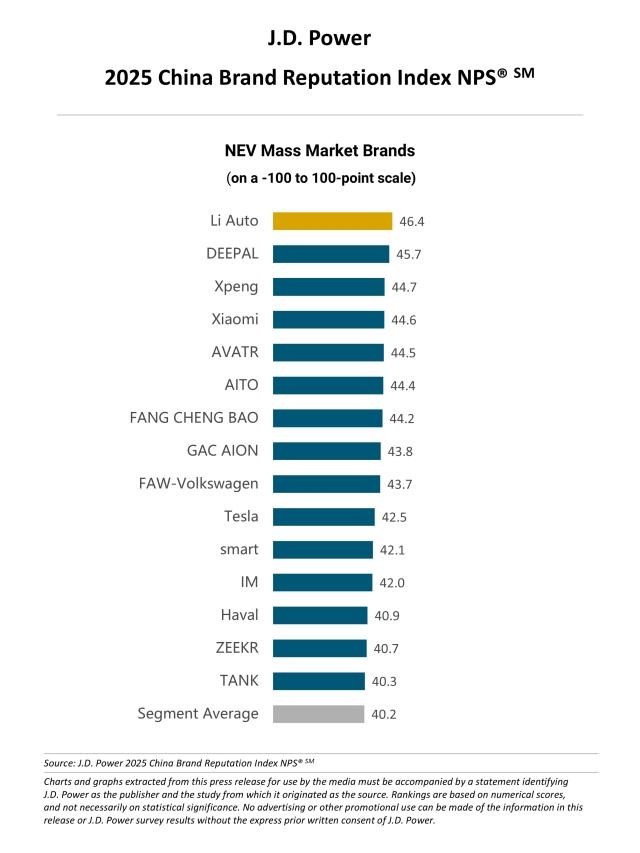

SHANGHAI: 17 Oct. 2025 – The inaugural JD Power 2025 China Brand Reputation Index NPS®[1],℠ released today, reveals that premium internal combustion engine (ICE) brands in China average a score of 51.8 (on a -100 to 100-point scale). Mass market ICE brands score 46.3, while premium new-energy vehicle (NEV) brands average 44.7 and mass market NEV brands score 40.2. The study covers 72 brands across ICE and NEV segments. Only eight brands demonstrate strong performance across product, sales, and service dimensions, while 89% show deficiencies in at least one area.

The China Brand Reputation Index NPS® differs from traditional NPS® models by evaluating brand performance across three dimensions: product NPS®, sales NPS®, and service NPS®. These are combined using a weighted average to form a comprehensive reputation score, offering actionable insights for brand improvement.

The study quantifies more than 800 customer touchpoints—from interior design and driver-assistance performance to vehicle delivery and service response time—and applies correlation and variance analyses to link these experiences to NPS® outcomes. In the ICE market, 42% of touchpoints are basic expectation indicators, which customers penalize when unmet. In the NEV market, 58% are delight indicators, which drive positive word-of-mouth. Both segments also include neutral indicators (8% for ICE, 13% for NEV), where investment has minimal impact on recommendation behavior.

“The rules of competition in China’s auto industry are shifting,” said Ann Xie, general manager of the digital retail consulting practice at JD Power China. “Success now depends on consistent performance across product, sales, and service—not just standout technology or distribution. In the ICE market, consumers value stability and service, while NEV buyers seek innovation and smart features. To win customer loyalty, brands must evolve from specialists to all-round performers.”

Following are some key findings of the 2025 study:

- Competitive landscape evolving: Some brands excel across all dimensions, while others struggle with imbalance. This imbalance is especially pronounced in the NEV segment, where high-performing brands in product innovation are undermined by service and sales inefficiencies, causing overall NPS® to suffer. In contrast, ICE brands are more evenly distributed, with service-driven and sales-driven brands showing stable performance.

Sales process now primary negative contributor: Whether through traditional ICE dealerships or the evolving sales models of NEVs, the sales process has emerged as the largest negative contributor to overall brand reputation. In the ICE segment, 38% of brands fall into the weak foundation category in terms of sales NPS,® driven by a lack of transparency in pre-sales communication, fragmented pricing negotiations and complex financing models that conflict with consumer demands for simplicity and fairness. In the NEV segment, 42% of brands show similar weaknesses, suffering from long delivery times, insufficient sales expertise and unfulfilled promises which lead to a rapid erosion of consumer trust.

- Failure to establish emotional connections in service: In the ICE segment, 38% of brands achieve a healthy service NPS,® but 21% are stuck in the neutral category, showing that while basic service capabilities are reliable, emotional value and personalized experiences are missing. In the NEV segment, 32% of brands have weak service foundations, while 29% remain in the neutral category. These brands are grappling with long wait times, insufficient service networks and a lack of distinctive brand identity which diminishes the overall service experience.

- Satisfaction with products not converted into recommendations: Whether in ICE or NEV, products have become a central aspect of competition. However, despite consumer satisfaction with products, it does not always translate into recommendations. In the ICE sector, 35% of brands fall into the neutral product NPS® category, meaning their products are reliable but fail to create a strong emotional appeal or differentiation. In the NEV sector, 26% of brands exhibit a polarizing product NPS,® with some brands attracting early adopters with bold innovation, only to alienate more conservative consumers due to controversial designs or unproven technology.

Study Rankings

Land Rover ranks highest among ICE premium brands with a score of 67.3. Porsche (59.4) ranks second and Cadillac (55.0) ranks third.

Geely ranks highest among ICE mass market brands with a score of 52.2. Chery (51.7) ranks second and GAC Honda (51.5) ranks third.

NIO ranks highest among NEV premium brands with a score of 51.6.

Li Auto ranks highest among NEV mass market brands with a score of 46.4. DEEPAL (45.7) ranks second and Xpeng (44.7) ranks third.

The China Brand Reputation Index NPS® calculates the NPS® for ICE brands based on the weighted NPS® results from the following five syndicated studies: the China Initial Quality StudySM (IQS); the China Automotive Performance, Execution and Layout (APEAL) StudySM; the China Tech Experience Index (TXI) StudySM; the China Sales Satisfaction Index (SSI) StudySM; and the China Customer Service Index (CSI) StudySM. For NEV brands, The China Brand Reputation Index NPS®SM is derived from the weighted NPS® scores of the China New Energy Vehicle Initial Quality StudySM (NEV-IQS); the China New Energy Vehicle Automotive Performance, Execution and Layout (NEV-APEAL)StudySM; the China Tech Experience Index (TXI) StudySM; the China New Energy Vehicle Sales Satisfaction Index (NEV-SSI) StudySM; and the China New Energy Vehicle Customer Service Index (NEV-CSI) Study.SM

The 2025 study is based on responses from 52,553 ICE vehicle owners and 45,142 NEV owners representing 72 brands with sufficient sample sizes across 81 major cities. For the product NPS® analysis, vehicle ownership ranges from 2 to 6 months; for the sales NPS® analysis, ownership ranges from 2 to 6 months for ICE vehicles and 2 to 12 months for NEVs; and for the service NPS® analysis, ownership ranges from 13 to 48 months for ICE vehicles and 2 to 24 months for NEVs.

About JD Power

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Wenjing Ji, JD Power; China; +86 21 8026 5719; wenjing.ji@jdpa.com

Joe LaMuraglia, JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

[1] Net Promoter®, Net Promoter System®, Net Promoter Score®, NPS®, and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.