Vehicle Shoppers in China Extend Purchasing Timeline, JD Power Finds

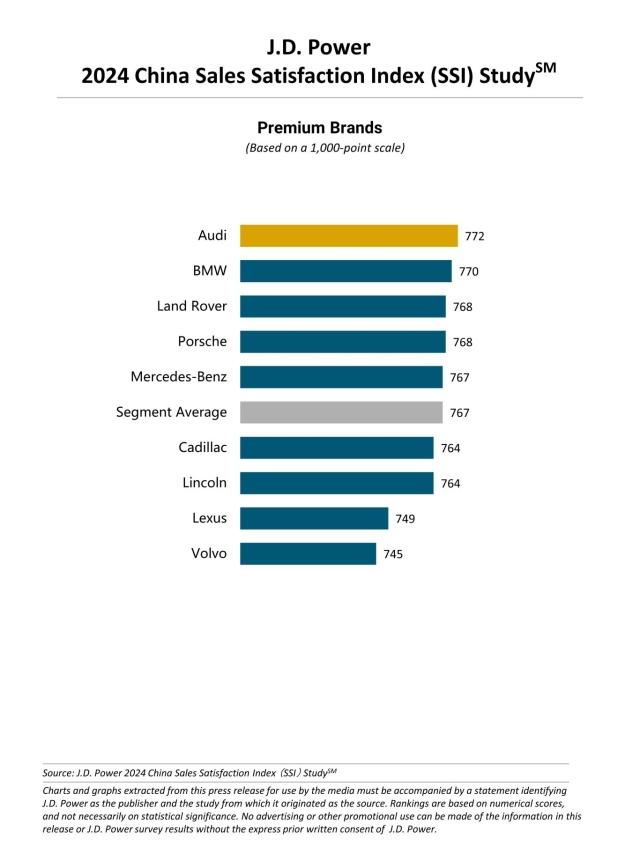

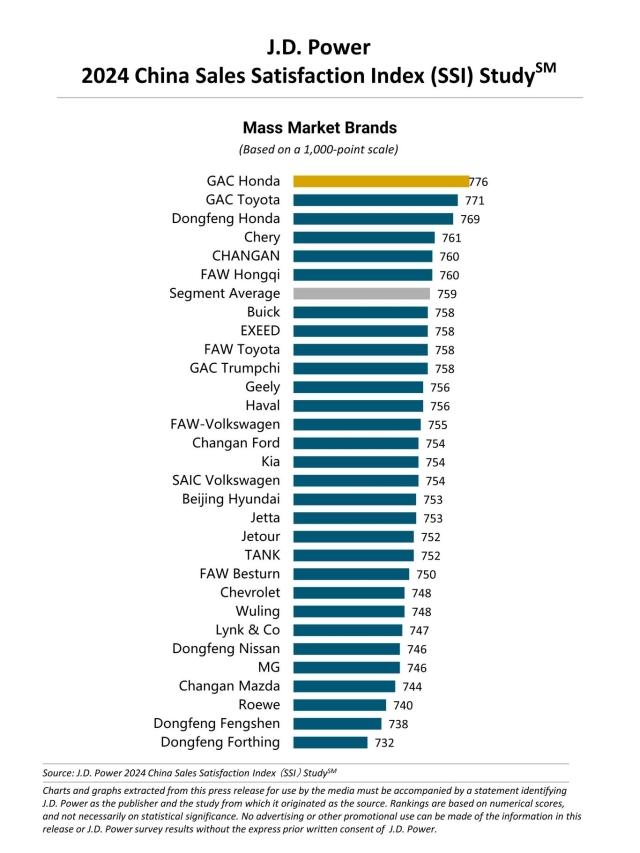

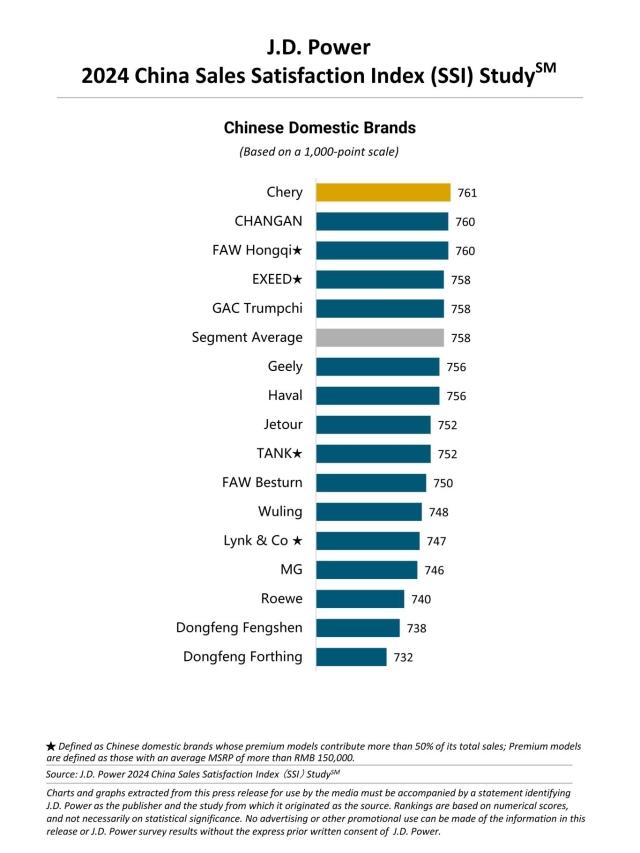

Audi, GAC Honda and Chery Rank Highest in Respective Segment

SHANGHAI: 1 Aug. 2024 – Vehicle shoppers in China looking for internal combustion engine (ICE) vehicles are taking longer to make their purchase decision, according to the JD Power 2024 China Sales Satisfaction Index (SSI) Study,SM released today. Specifically, the proportion of shoppers taking more than three weeks from store visit to decision-making has increased by 5 percentage points year over year, to 23% in 2024 from 18% in 2023.

The study measures customer satisfaction with the purchase experience among new-vehicle buyers and rejectors, defined as those who seriously consider a brand but ultimately buy another brand.

The study finds that the average time from information search to a dealership visit is 10.4 days this year, an increase of two days from 2023. Meanwhile, the loyalty of ICE vehicle buyers has further declined, with 65% purchasing their initially planned model or brand, a decrease of 8 percentage points from 2023, the lowest percentage in the past three years. Additionally, the proportion of buyers considering multiple brands or models has risen to 20.1% in 2024, up from 13.9% in 2023.

“The rapid growth of the new energy vehicle market in 2024 has created significant challenges for traditional automakers,” said Ann Xie, general manager of the digital retail consulting practice at JD Power China. “Potential buyers are taking longer to decide, which puts more pressure on sales services. Traditional ICE vehicle brands need to quickly capture consumer interest by highlighting product and service benefits from the user's perspective. By integrating online and offline marketing, brands can improve their presence on buyers’ shortlists and shorten the decision-making process.”

Following are additional findings of the 2024 study:

- Overall satisfaction increases: The overall sales satisfaction score has increased to 761 (on a 1,000-point scale), up 6 points from 2023. Among brand segments, the sales satisfaction scores for premium and mass market brands are 767 and 759 points, respectively. The lead for premium brands has narrowed to 8 points this year from 13 points in 2023.

- Chinese domestic brands show greatest improvement: The overall sales satisfaction score for Chinese domestic brands is 758, a substantial increase of 15 points from 743 in 2023. This marks the most significant improvement among the segments this year. Among other vehicle segments, Japanese brands (764) have surpassed German brands (762) to achieve the highest sales satisfaction, while American brands (758) have fallen below the industry average for the first time.

- Young shoppers prioritize service efficiency and attitude: Post-95 shoppers (those born after 1995) highly value follow-up efficiency after providing their contact information. Overall satisfaction significantly increases to 825 when a dealer follows up within an hour but drops sharply to 792 if it takes more than three hours. These shoppers also care about waiting efficiency, as immediate reception upon entering the store and during test drives effectively boost satisfaction. Additionally, these shoppers are sensitive to service attitude–perceived as a cold demeanor from staff whether before entering the store, during the showroom visit or at delivery–which greatly reduces their satisfaction.

- High-frequency use of official apps enhances shopper loyalty: Among shoppers who log in to the brand's official app multiple times a day, 35.6% say they would repurchase the same brand and 37.3% say they would buy from the same dealer again. These rates are significantly higher than among low-frequency shoppers, 21.5% would repurchase the same brand and 22.9% would buy from the same dealer, demonstrating that frequent use of the official app can effectively increase repurchase rates.

Study Rankings

Audi ranks highest among premium brands with a score of 772. BMW (770) ranks second. Land Rover and Porsche rank third in a tie, each with a score of 768.

GAC Honda ranks highest among mass market brands with a score of 776. GAC Toyota (771) ranks second. Dongfeng Honda (769) ranks third.

Chery ranks highest among Chinese domestic brands, with a score of 761. CHANGAN and FAW Hongqi rank second in a tie, each with a score of 760.

The China Sales Satisfaction Index (SSI) Study measures sales satisfaction among new-vehicle buyers and rejecters. Buyer satisfaction is based on seven measures: delivery process (20%); deal (18%); showroom visit (14%); online experience (13%); reception (13%); test drive (11%) and communication before visit (10%). Rejecter satisfaction is based on six measures: online experience (22%); reception (19%); communication before visit (19%); showroom visit (15%); test drive (13%) and negotiation (12%).

*The weights are presented in rounded form, and the actual calculation is based on decimal places.

The 2024 study is based on responses from 23,089 vehicle owners in 81 major cities who purchased their new vehicle between June 2023 and March 2024. The study was fielded from December 2023 through May 2024.

For more information about the China Sales Satisfaction Index (SSI) Study, visit HERE.

JD Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, JD Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 55 years. The world's leading businesses across major industries rely on JD Power to guide their customer-facing strategies.

JD Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Mengmeng Wang, JD Power; China; +86 21 8026 5719; mengmeng.wang@jdpa.com

Geno Effler, JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info