Vehicle Buyers in China Have Become Increasingly More Decisive, JD Power Finds

Porsche, GAC Honda, CHANGAN and GAC Trumpchi Rank Highest in Respective Segments

SHANGHAI: 20 July 2023 – Fuel Vehicle shoppers in China are more decisive in their car purchasing decisions, as they have a specific model in mind before their purchase and are less likely to be persuaded otherwise, according to the JD Power 2023 China Sales Satisfaction Index (SSI) Study,SM released today. Specifically, the percentage of shoppers who have already thought about the model/brand before buying a car and finally purchased is as high as 73%, an increase of 5.3% compared with 2022. These shoppers also visit the dealership sooner and make the transaction faster, while considering the least number of brands and making the fewest amount of dealer visits.

The study measures customer satisfaction with the purchase experience among new-vehicle buyers as well as among rejecters, defined as those who seriously consider a brand but ultimately buy another brand.

The study also finds that in the purchase process, "decisive" consumers pay more attention to the basic product performance of the model, including safety, power, controlling, etc., and their concern about price is relatively low. Automotive media and professional evaluation have become important information sources and car buyers are paying attention to these messages. Additionally, they are also more likely to recommend a vehicle model with the highest return and repurchase intentions. Therefore, paying more attention to them will bring long-term value to automakers.

“The current Chinese auto market is full of uncertainties,” said Ann Xie, digital retail consulting practice at JD Power China. “However, as shoppers have become more decisive in the purchase process, how to enter someone’s favorite list in advance has become the key focus of automakers’ marketing. Dealers also need to change from a sales model centered on the selling points of products in the past to the motivation of customers. Identifying customers' in-store needs, accurately responding to customers' questions, helping them verify their choices and dispelling concerns, will help dealers achieve the sale.”

Following are additional findings of the 2023 study:

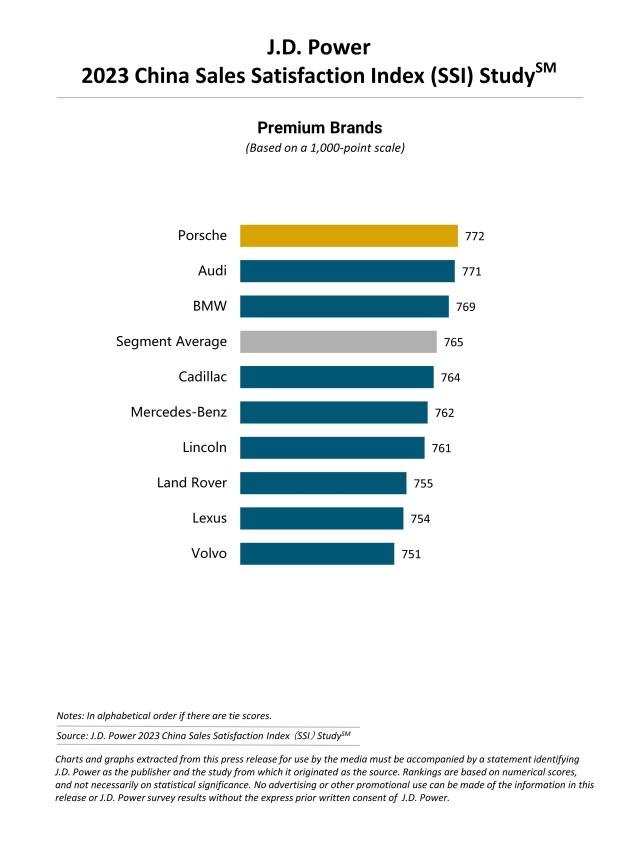

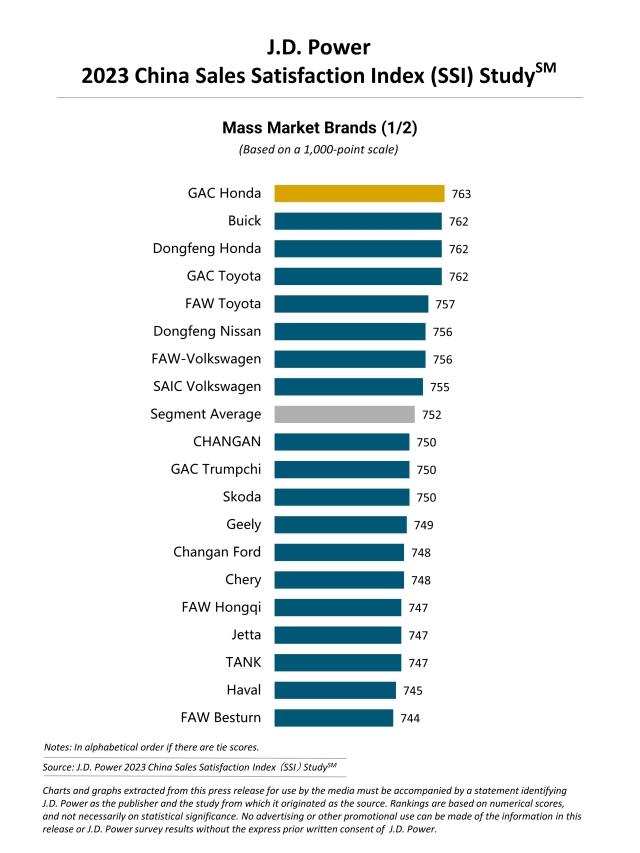

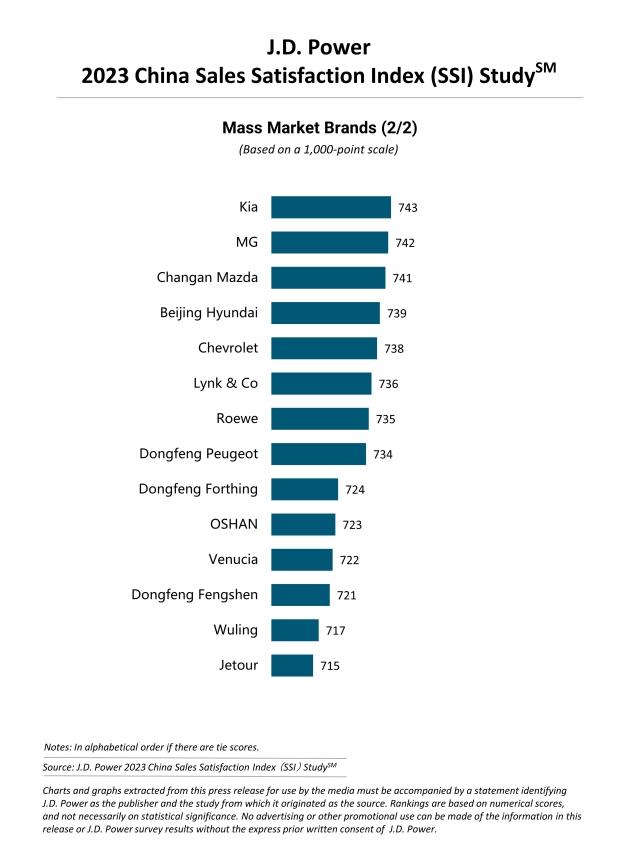

- Advantage of sales satisfaction with premium brands further expanded: Sales satisfaction in the premium segment and mass market segment are 765 (on a 1,000-point scale) and 752, respectively. The lead of premium segment over mass market expanded to 13 points from 9 points in 2022. In various indicators of purchase index, the two segments have performed best in the communication before visit and delivery process. Satisfaction of the test-driving experience has decreased significantly in both segments.

- The satisfaction of New Energy Vehicle(NEV) was better than Internal Combustion Engine(ICE): From the perspective of rejecters, the overall service satisfaction score of NEV (738) was higher than ICE (715) especially in the product experience of showroom visit and test driving. ICE lagged behind NEV in sections of salesperson’s introduction, the amount of active invitation to test drive and adequate understanding of product.

- Customer satisfaction in third- and fourth-tier cities lags behind first- and second-tier cities: The satisfaction score of customers in third- and fourth-tier cities is 749 points, which is 25 points behind that in first- and second-tier cities (774 points). The satisfaction of each experience factor is lower than that of car buyers in first- and second-tier cities. The transaction process has the widest gap, which is 27 points lower than that of car buyers in first- and second-tier cities. If the negotiation process is too lengthy, the consumers in third- and fourth-tier cities who make a deal within a week will fall to 30% from 42% if the process is not too lengthy.

Study Rankings

Porsche ranks highest among premium brands with a score of 772. Audi (771) ranks second. BMW (769) ranks third.

GAC Honda ranks highest among mass market brands with a score of 763. Buick, Dongfeng Honda and GAC Toyota rank second in a tie, each with a score of 762.

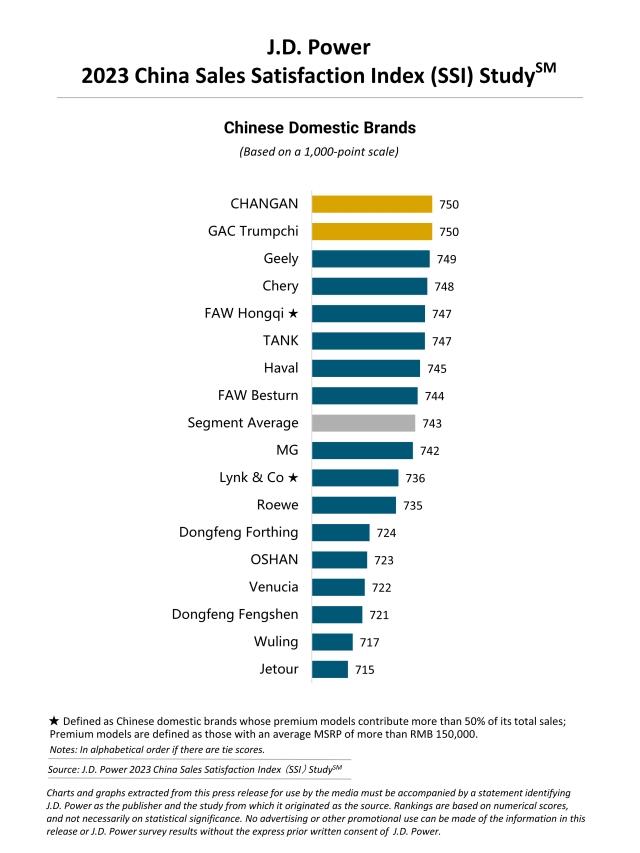

CHANGAN and GAC Trumpchi rank highest in a tie among Chinese domestic brands, with a score of 750. Geely (749) ranks third.

The 2023 China Sales Satisfaction Index (SSI) Study measures sales satisfaction among new-vehicle buyers and rejecters. Buyer satisfaction is based on seven measures: online delivery process (22%); deal (16%); showroom visit (15%); experience (14%); reception (14%); test drive (10%) and communication before visit (9%).Rejecter satisfaction is based on six measures: online experience (23%); reception (21%); communication before visit (20%); showroom visit (15%); test drive (11%) and negotiation (10%).

The 2023 study is based on responses from 25,260 vehicle owners in 81 major cities who purchased their new vehicle between June 2022 and March 2023. The study was fielded from December 2022 through May 2023.

For more information about the China Sales Satisfaction Index (SSI) Study, visit HERE.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Mengmeng Wang, JD Power; China; +86 21 8026 5719; mengmeng.wang@jdpa.com

Geno Effler, JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

# # #

NOTE: Four charts follow.