APEAL Scores Rise Sharply, with Chinese Domestic Brands Showing Strong Gains, JD Power Finds

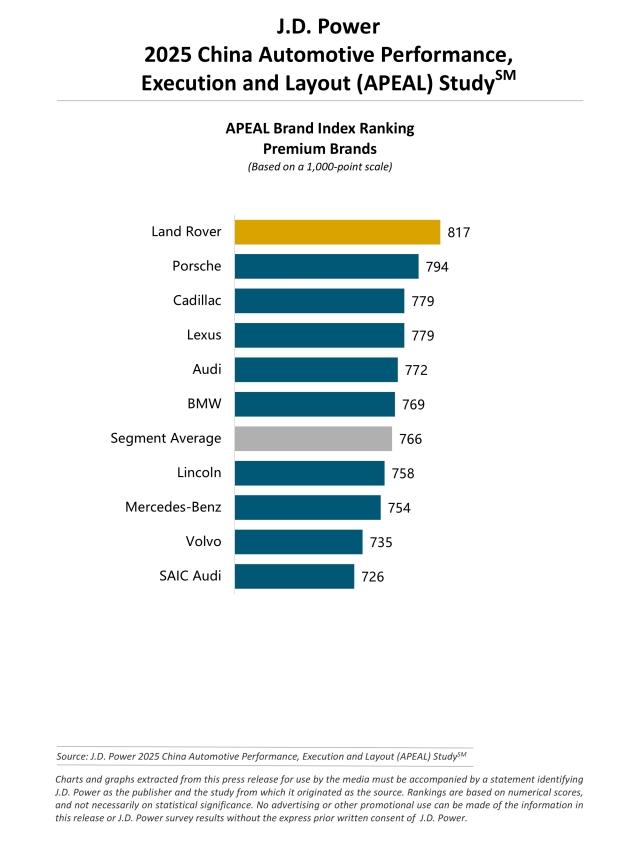

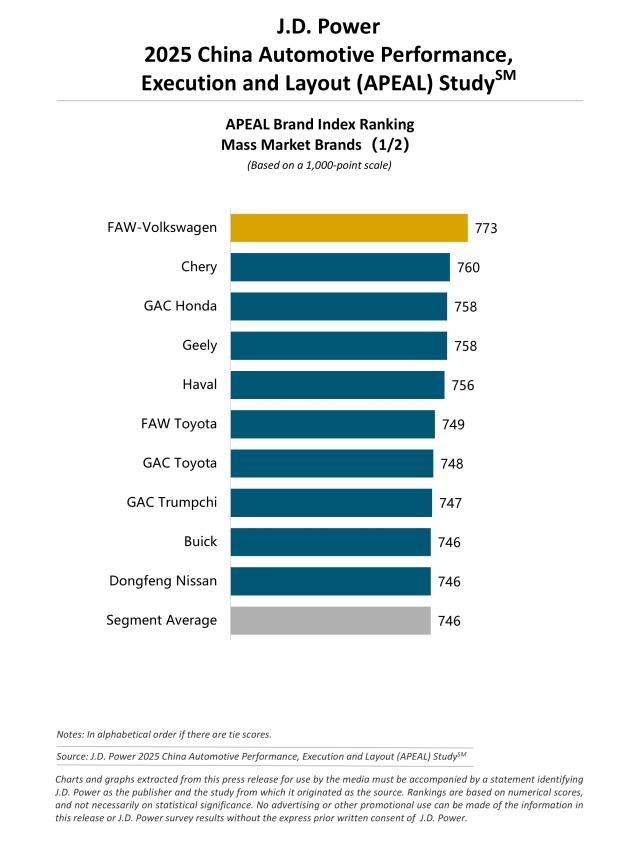

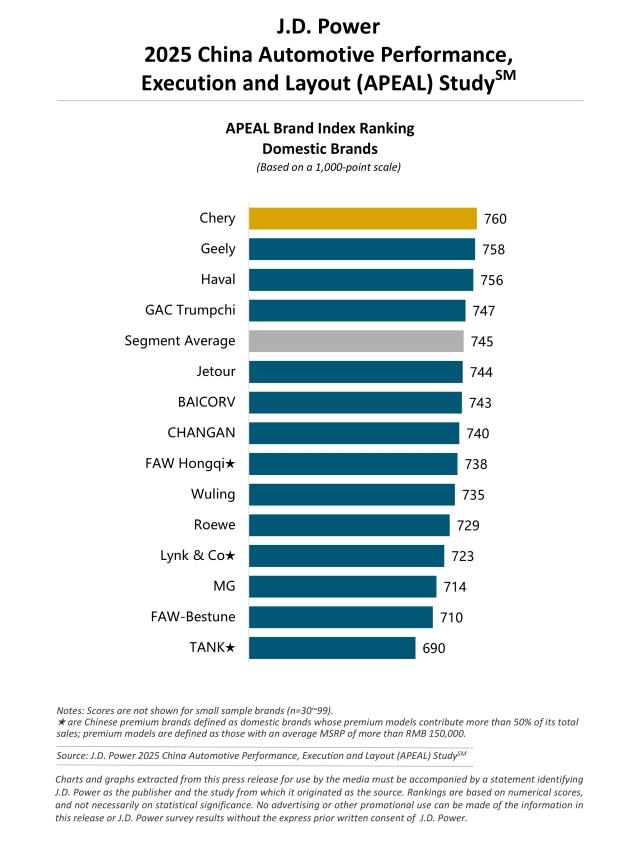

Land Rover, FAW-Volkswagen and Chery Rank Highest in Respective Segment

SHANGHAI: 14 Aug. 2025 – New-vehicle owner experience satisfaction has risen a significant 14 points to 751 (on a 1,000-point scale) from 2024, according to the JD Power 2025 China Automotive Performance, Execution and Layout (APEAL) Study,SM released today. This marks the largest year-over-year improvement since the study was redesigned in 2020. This notable increase in APEAL satisfaction is primarily driven by vehicle experience improvements in fuel economy (+17 points); getting in and out (+13); exterior (+12); interior (+12); and setting up and starting (+12).

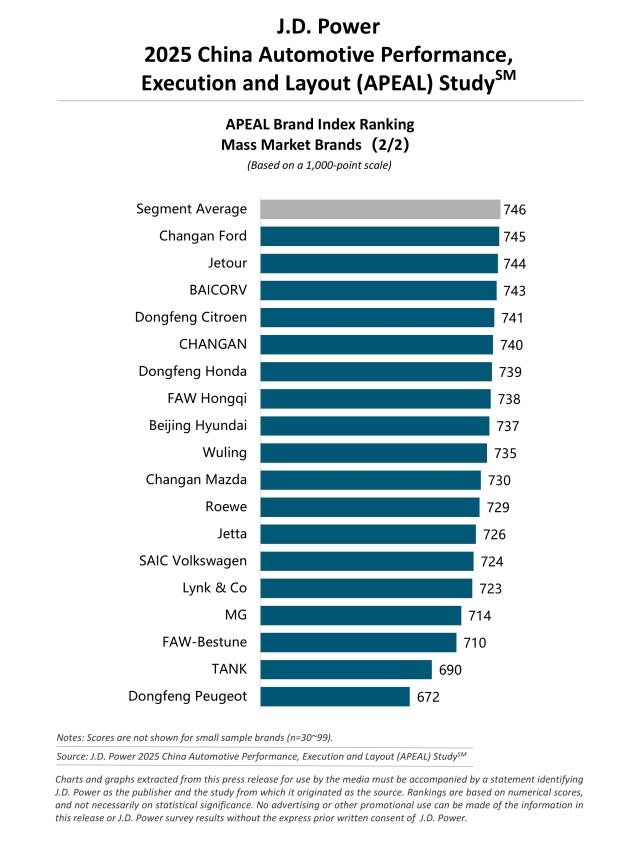

At brand level, there are significant gains in score among domestic brands in the internal combustion engine (ICE) vehicle market, reaching an overall APEAL satisfaction score of 745, an increase of 32 points from 2024. Mass market brands provide an additional 11-point increase to the overall industry brand-level uplift. Meanwhile, the score for premium brands has dropped for the first time in five years, declining by 5 points to 766. As a result, the gap between premium brands, mass market brands, and domestic brands has narrowed significantly. The gap between mass market and domestic brands has declined to just 2 points in 2025 from 23 points in 2024, reflecting a major shift in competitive dynamics.

The study, now in its 23rdyear, examines ICE vehicle owners’ assessments of their new-vehicle experience within the first two to six months of ownership, specifically what appeals most to them based on their emotional attachment to and level of excitement with their new vehicle. The resulting data is used extensively by manufacturers to help them design and develop more appealing models.

“The industry’s sharpest score increase in five years shows that ICE vehicles still hold strong competitiveness in the face of surging new energy vehicle (NEV) adoption—and even greater potential for improvement,” said Elvis Yang, general manager of auto product practice at JD Power China. “In particular, the leap in product appeal for domestic brands stands out. With better fuel economy, more attractive designs, and prices that are more competitive than comparable NEV models, ICE vehicles continue to offer compelling value to consumers. As the market becomes increasingly segmented, both ICE and NEV models will become better aligned with the needs of different customer groups, ensuring every consumer can find a suitable option. At the same time, ICE vehicle automakers must improve their smart technology experience such as the smooth operation and reliability of voice assistance. A vibrant market relies on diverse competition, and innovation thrives in such an environment. JD Power looks forward to seeing automakers continue to introduce more exciting and appealing products.”

Following are key findings of the 2025 study:

- Scores for power performance and fuel consumption have improved: Customer satisfaction with fuel economy has increased 17 points in 2025, making it one of the key contributors to overall satisfaction growth year over year. Satisfaction with overall power performance has also risen, suggesting an improvement in the driving experience. This dual progress reflects engine technology advancements in both efficiency and performance.

- Smart features catching up, but user experience lags: ICE brands are quickly narrowing the gap with NEVs in terms of smart technologies. Advanced hardware such as intelligent driving and voice interaction is also becoming widespread. However, hardware adoption alone has not led to corresponding improvements in user experience, particularly with in-vehicle infotainment systems. Owners report lagging response times, complex startup processes, and lack of interface smoothness. This has resulted in a disconnect between feature availability and usability—what some call a “specs-rich but experience-poor” dilemma. Moving forward, improvements in system optimization and interaction design will be critical in shaping consumer perception of ICEV smart technology.

- ICE SUVs excel in high-intensity and multi-scenario usage: While new energy SUVs are well-suited for urban commuting, ICE SUVs still dominate in high-intensity and diverse-use scenarios. For instance, 35% of ICE SUV owners report using their vehicle for off-road purposes at least once per month, compared to 28% of new energy SUV owners. In addition, annual mileage among ICE SUV owners is more than 13% higher than among new energy SUV owners. These owners rely heavily on core ICE SUV attributes such as long range, instant refueling, and strong load capacity, which are not yet fully matched by most NEV offerings.

Study Rankings

Land Rover ranks highest among premium brands with a score of 817. Porsche (794) ranks second, and Cadillac (779) and Lexus (779) rank third in a tie.

FAW-Volkswagen ranks highest among mass market brands with a score of 773. Chery (760) ranks second, and GAC Honda (758) and Geely (758) rank third in a tie.

Chery ranks highest among Chinese domestic brands with a score of 760. Geely (758) ranks second and Haval (756) ranks third.

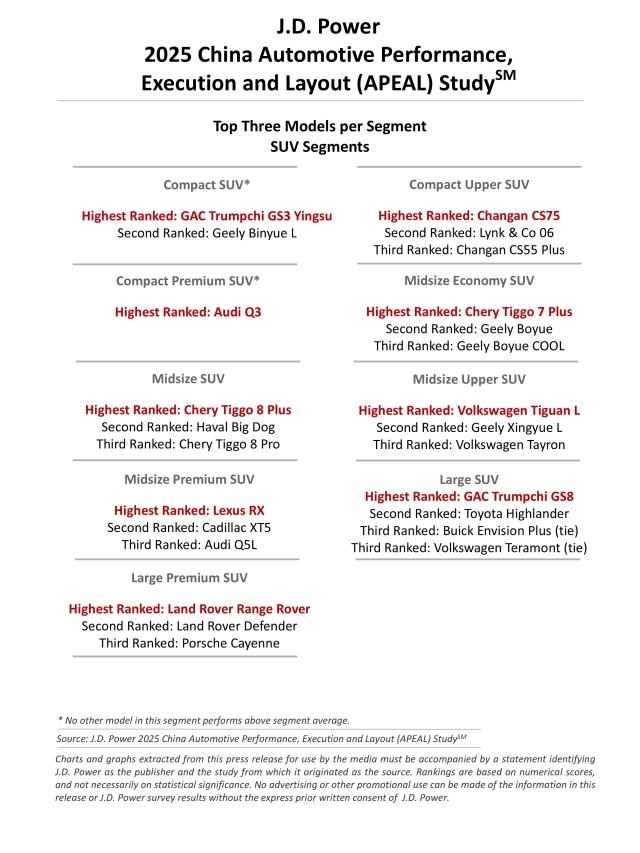

The segment-level APEAL awards by brand are: Chery Tiggo 7 Plus; Chery Tiggo 8 Plus; Volkswagen Bora; Volkswagen Magotan; GAC Trumpchi GS3 Yingsu; GAC Trumpchi GS8; Volkswagen Lamando L; and Volkswagen Tiguan L.

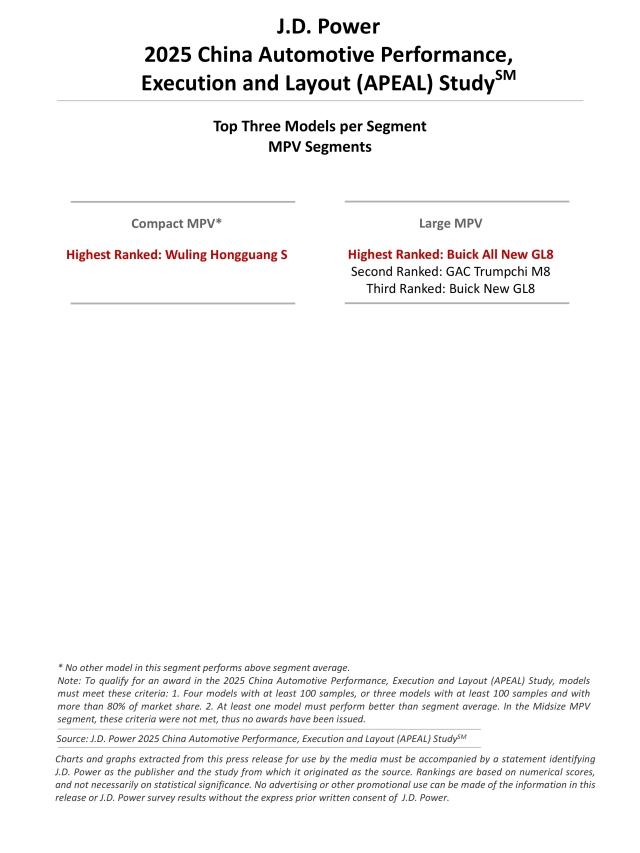

Other models that rank highest in their respective segment are Audi Q3; BMW 3 Series; Buick All New GL8; Changan CS75; Geely Emgrand; Land Rover Range Rover; Lexus RX; Mercedes-Benz E-Class; Toyota Levin; and Wuling Hongguang S.

The China Automotive Performance, Execution and Layout (APEAL) Study measures owners’ emotional attachment to and level of excitement with their new vehicle across 37 attributes in 10 vehicle experience groups: exterior; setting up and starting; getting in and out; interior; performance; driving feel; keeping your safe; infotainment; driving comfort; and fuel economy.

The 2025 study is based on responses from20,226 owners of gas-powered vehicles who purchased their new vehicle between July 2024 and March 2025. The study includes 148 models and 39 different brands, among them, 143 models and 38 brands achieved sufficient samples. The study was fielded from January through May 2025 in 81 major cities across China.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Wenjing Ji, JD Power; China; +86 21 8026 5719; wenjing.ji@jdpa.com

Geno Effler, JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info