New Energy Vehicle Customer Service Satisfaction Shows Significant Regional Inversion; Mobile Service Emerges as a New Battleground, JD Power Finds

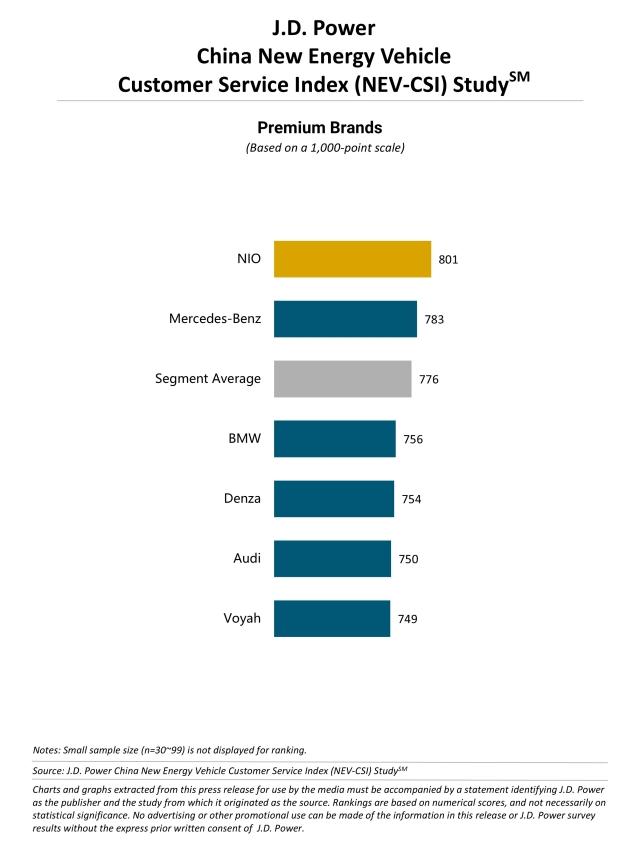

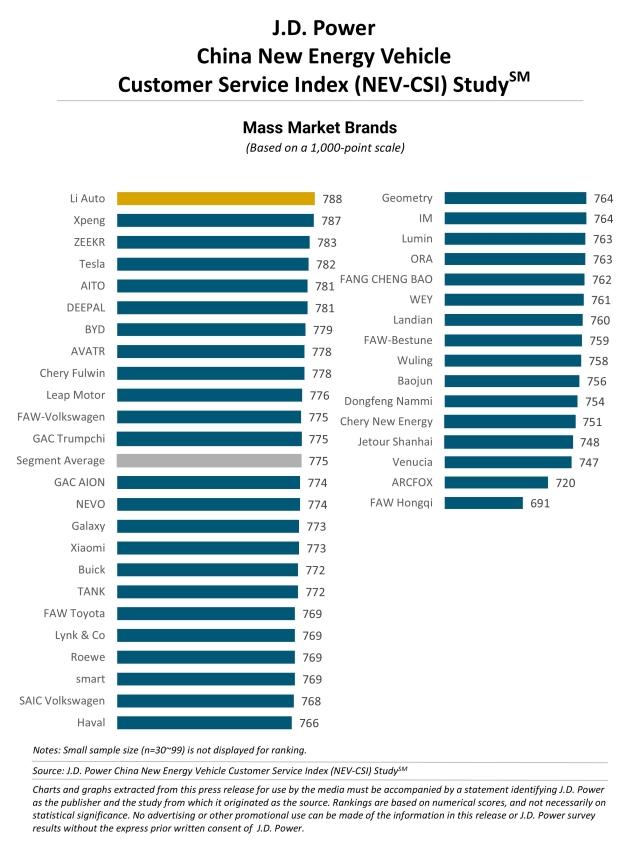

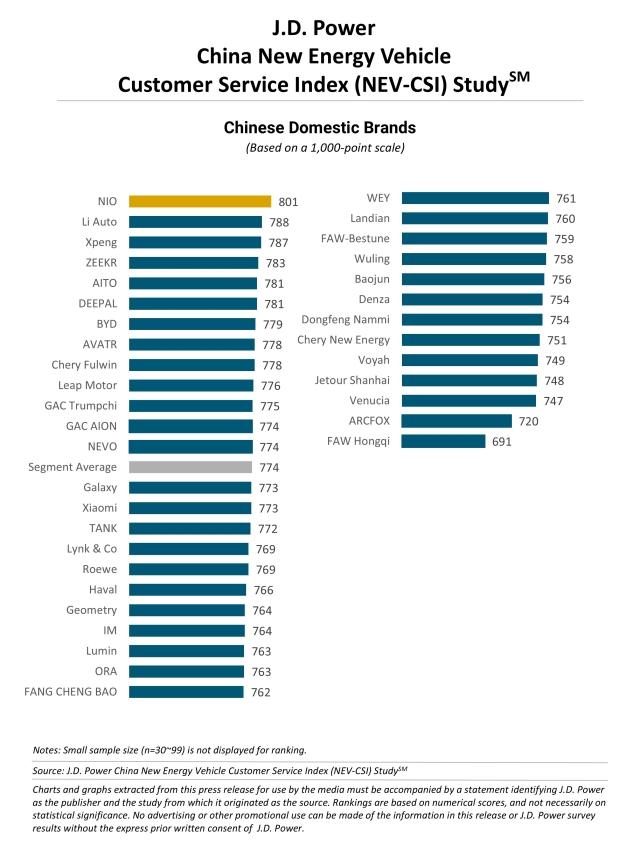

NIO and Li Auto Rank Highest in Respective Segment

SHANGHAI: 21 Aug. 2025 – Overall satisfaction with the customer service experience among new energy vehicle (NEV) owners in China is 775 points (on a 1,000-point scale), according to the inaugural JD Power China New Energy Vehicle Customer Service Index (NEV-CSI) Study,SM released today. By brand category, overall satisfaction is nearly identical—776 for premium brands, 775 for mass market brands and 774 for domestic brands. In 2025, NEV after-sales service in China shows a clear “regional inversion” as satisfaction scores are inversely correlated with city tier, with Tier 1 and Tier 2 cities scoring 18 points lower than in Tier 3 and Tier 4 cities. This is driven by higher customer expectations in major cities—meaning that even when the same level of service is provided, satisfaction tends to be lower and any gap between expectations and delivery results in sharper declines.

The study evaluates the customer service experience of NEV owners between two and 24 months of ownership. Index scores are based on measurements across six categories: customer service; customer equity; energy service; service initiation; service reception; and service quality. The study also includes trending topics in the NEV industry, such as credits, charging/refueling options, digital services and flexible service models that provide NEV manufacturers with deeper insight into customers’ priorities, current experiences and unmet needs in after-sales service.

The study finds that in 2025, usage of mobile onsite service rises to 32.3%, up 12.4 percentage points from 2024.[1] This model turns low-frequency maintenance scenarios into high-value, high-frequency customer touchpoints—customers who use mobile service have spent, on average, RMB 591 more on after-sales in the past year (excluding prepaid service packages) than those who do not. For automakers, mobile service should be treated as a strategic core offering rather than a peripheral add-on, with continuous investment in coverage, response speed, technician capability and standardized processes. The industry has now entered the second half of the NEV era, in which service experience is a core competitive differentiator. In this environment, expectation management must become central to service design. Automakers should segment customers and tailor service models to expectation profiles while also using mobile on-site service to capture fragmented customer time and thereby convert it into commercial value.

“Competition in the NEV sector has reached the stage where customer trust is the ultimate battleground. Satisfaction with charging, fulfillment of promised benefits and first-time fix rate have become decisive factors in customer choice. Only by transforming digital capabilities into high-quality user experience can a brand gain core competitiveness,” said Ann Xie, general manager of the digital retail consulting practice at JD Power China. “Users never reject technology, but they will resist half-baked digitalization. Only enterprises that can provide smooth service processes can define the final form of new energy. Automakers must pursue the superficial prosperity of digitalization—such as faster response and expanded charging infrastructure—while ignoring the fractures in service processes. The key to winning future service competition lies in building digital credibility by empowering service processes with intelligence, providing users with seamless experiences and making every service interaction a reason for users to recommend.”

Following are some key findings of the 2025 study:

Remote diagnostic services see lower customer satisfaction: In 2025, 23.1% of NEV owners have used remote diagnostics, yet their satisfaction scores are lower than those of non-users. The root issue is that 79.9% of remote diagnostic users still need to visit a physical service center afterward. The optimal experience occurs only when issues are fully resolved within 20 minutes. Currently, remote diagnostics remain in a tech showcase stage, with poor linkage between the diagnosis and repair steps dragging satisfaction scores down. The ultimate goal is to achieve invisible service — a shift where customers go from unnecessary trips to fewer errands, with issues resolved before they even notice.

In-vehicle service responsiveness is improving, problem resolution is slipping: In 2025, the share of customers who say their automaker responded very promptly to usage issues has risen to 55.4% from 52.3% in 2024.[2] However, the proportion reporting that issues were effectively resolved in one visit has fallen to 68.8% from 74.1% year over year.[3] Additionally, 48.2% of NEV owners encounter issues with the fulfillment of benefits/entitlements. When such issues occur, customer satisfaction drops by 31 points. Benefits programs are shifting from a value-add to a trust-damaging factor. Future competition will hinge on upgrading from a fast response to a precise resolution.

- Charging satisfaction continues to decline; experience becomes a key point: In 2025, charging satisfaction shows a sustained downward trend, with the sharpest drop among domestic brands. The problem rate for brand-owned chargers has risen to 47.4% from 44.6% in 2024.[4] Core issues have shifted from availability to usability, such as limited locations, inconvenient placement and cumbersome payments. Meanwhile, the problem rate for finding chargers via brand apps or in-car systems has climbed to 49.7% from 40.7%,[5] with inaccurate locations, failed reservations and inability to book emerging as new pain points. The industry is now in the refined charging experience management phase, and automakers need to redefine charging networks from infrastructure assets to data products—using smart dispatch, seamless interactions, and open ecosystems to deliver a zero-anxiety charging experience.

Study Rankings

NIO ranks highest among premium brands with a score of 801. Mercedes-Benz (783) ranks second.

Li Auto ranks highest among mass market brands with a score of 788. Xpeng (787) ranks second. ZEEKR (783) ranks third.

NIO ranks highest among Chinese domestic brands with a score of 801. Li Auto (788) ranks second. Xpeng (787) ranks third.

The China New Energy Vehicle Customer Service Index (NEV-CSI) Study measures the service stage across six categories (in order of importance): service reception (39%); service quality (37%); energy service (35%); customer equity (34%); customer service (32%); and service initiation (24%).[6]

The 2025 study is based on responses from 13,253 vehicle owners in 81 major cities who purchased their new energy vehicle between March 2023 and April 2025. The study was fielded from March through June 2025 and includes 61 brands; among them, 46 brands achieved sufficient samples.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Wenjing Ji, JD Power; China; +86 21 8026 5719; wenjing.ji@jdpa.com

Geno Effler, JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

[1] Source: JD Power 2024 China New Energy Vehicle Customer Experience Value Index (NEV-CXVI) StudySM

[2] Source: JD Power 2024 China New Energy Vehicle Customer Experience Value Index (NEV-CXVI) StudySM

[3] Source: JD Power 2024 China New Energy Vehicle Customer Experience Value Index (NEV-CXVI) StudySM

[4] Source: JD Power 2024 China New Energy Vehicle Customer Experience Value Index (NEV-CXVI) StudySM

[5] Source: JD Power 2024 China New Energy Vehicle Customer Experience Value Index (NEV-CXVI) StudySM

[6] The weights are presented in rounded form, and the actual calculation is based on decimal places. Six categories are divided into Usage (48%) and Service (52%), Usage stage including customer service (32%); customer equity (34%); and energy service (35%). Service stage including service initiation (24%); service reception (39%); and service quality (37%).