Automotive Tech Experience Index in China Reaches New High as Advanced Vehicle Feature Penetration Soars, JD Power Finds

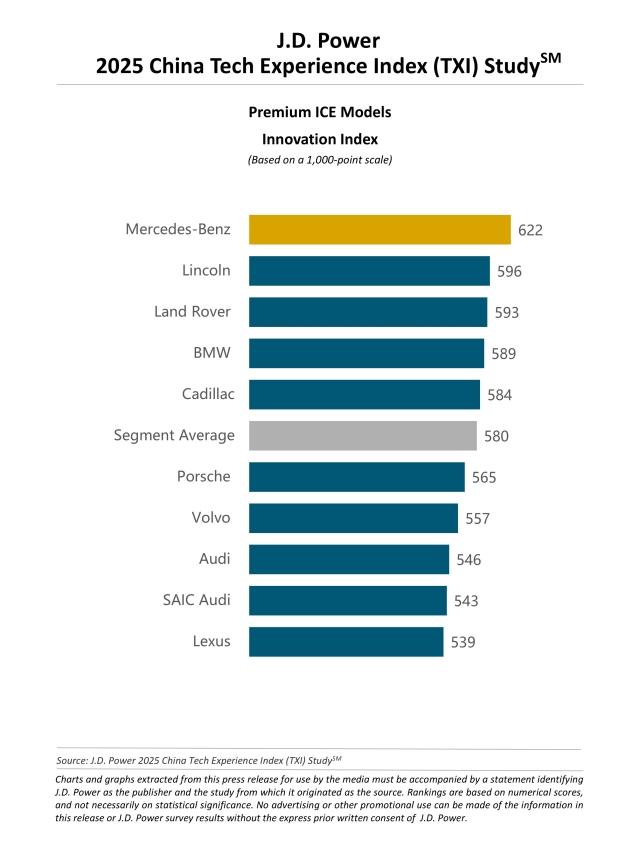

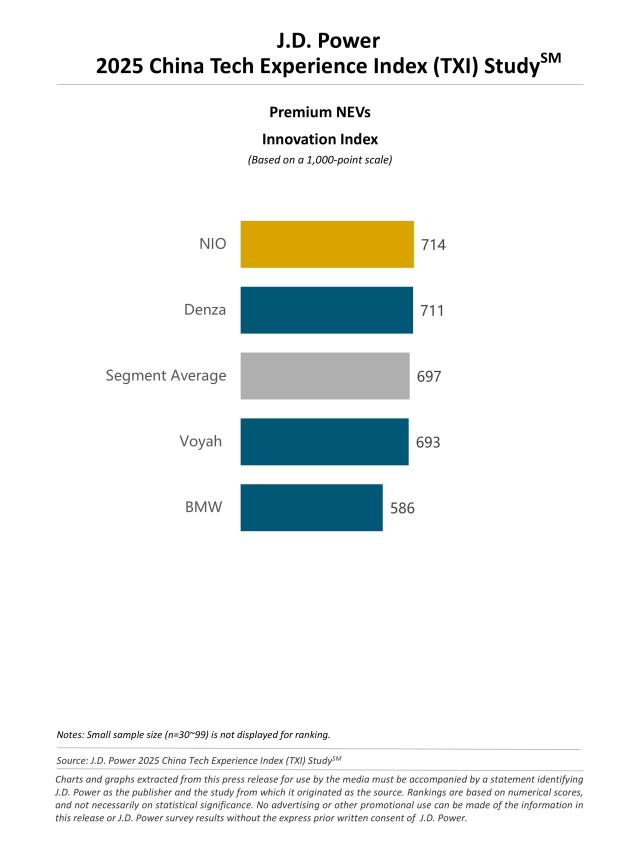

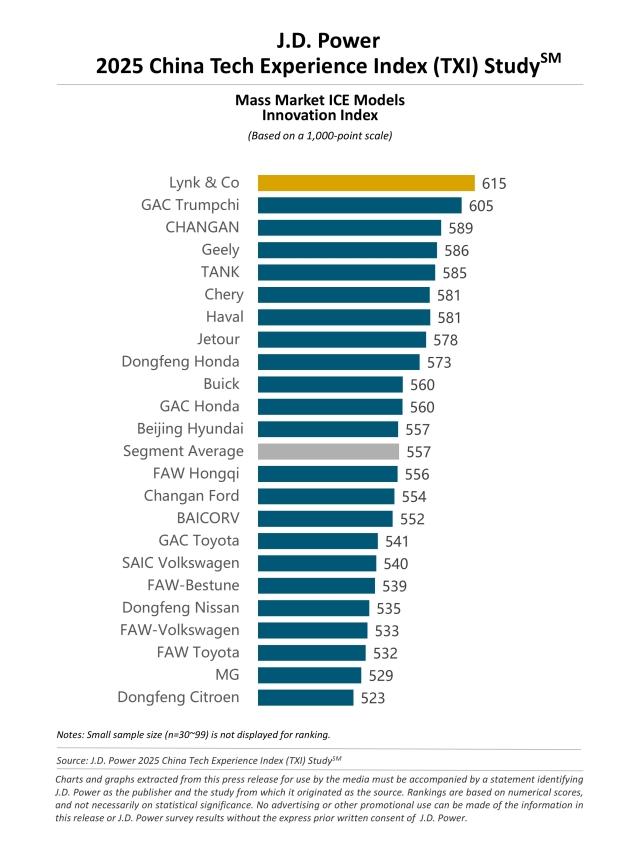

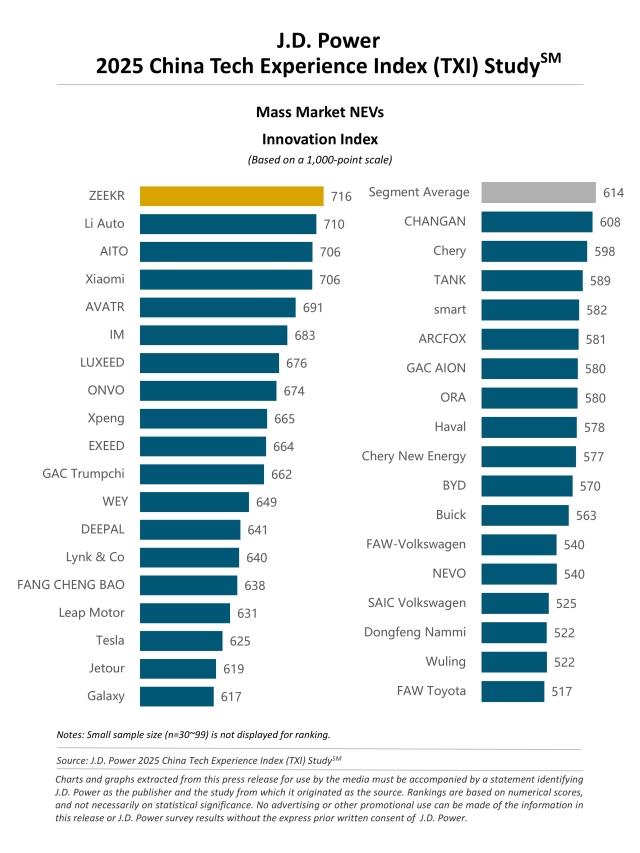

Mercedes-Benz, NIO, Lynk & Co and ZEEKR Rank Highest in Respective Segment

SHANGHAI: 31 July 2025 – Scores for new-vehicle owners’ perceptions of 32 advanced technologies and eight basic technologies when first introduced to the market has reached a record high of 588 (on a 1,000-point scale) in 2025, an increase of 38 points from 2024, according to the JD Power 2025 China Tech Experience Index (TXI) Study,SM released today. This notable score not only reflects a significant leap in consumer acceptance and satisfaction with automotive technologies but also signals a positive shift in the industry’s ability to align technological innovations with real-world user needs.

The study, now in its sixth year, measures the TXI Innovation Index—which consists of the Technology Execution Index[1] and Market Depth Index,[2] both of which are equally weighted—to determine how effectively each automotive brand brings technologies to market. The indices combine the level of adoption of new technologies for each brand with excellence in execution. In addition, the Execution Index examines how much owners like the technologies and how many problems they experience while using them.

The Market Depth Index score has reached a record high at 275 in 2025, an increase of 80 points from 2024. In the index’s product category, the new energy vehicle (NEV) segment continues to lead the way in intelligent innovation, supported by a notable year-over-year 86-point surge to 339 from 2024. From a brand perspective, however, the industry is witnessing intensified polarization. On one hand, Chinese domestic brands are accelerating iteration cycles and responding quickly to user needs, leading to fierce internal competition around intelligent features. On the other, international brands are taking a more measured approach, prioritizing technical maturity and system stability over rapid rollouts.

“The continued rise of the TXI score this year marks a turning point in China’s automotive intelligence development,” said Elvis Yang, general manager of auto product practice at JD Power China. “We are now entering the second phase, which presents three key characteristics. Initially, for the first time, the growth rate of problems users experience with tech features has outpaced the growth in perceived feature installations—reaching an average of 10.7 problems per 100 (PP100) for each advanced feature. This suggests that vehicle owners are no longer paying for feature quantity, but instead expecting a better experience. Secondly, cockpit features and user interface design are becoming increasingly homogenized, while advanced driver assistance systems (ADAS) are at a pivotal inflection point. User awareness and attentiveness to these features have risen significantly. Moving forward, enhancing trust and safety while evolving toward human-like ADAS experiences will be key to accelerating mainstream adoption. Lastly, AI capabilities are emerging as the next competitive frontier for intelligent cockpits. Users now expect more than just basic voice commands or vehicle control. The market is eager for ‘killer apps’ in specific usage scenarios. The era of Automotive Intelligence 2.0 is officially underway.”

Following are some key findings of the 2025 study:

Smart features are crossing the “adoption chasm”: Vehicle owner awareness of intelligent features continues to rise, reaching an average of 6.9 perceived features in 2025—which marks the fourth consecutive year of growth. Owner awareness of ADAS and safety-related technologies has increased significantly, with many features now shifting into the “early majority” mainstream segment. Notably, safety protection and post-exit assistance functionalities have surpassed the adoption threshold, underscoring safety as a core owner concern. Remote smart parking has officially entered the “majority” category, signaling that assisted driving technologies are gaining traction among broader user groups.

- Ease of use emerges as a pain point: While overall intelligence levels are improving, the complexity of quality issues is increasing. In 2025, industry-wide problems owners have experienced have risen by 34.8 PP100 year over year, with usability concerns taking center stage. In intelligent cockpit features, issues related to “difficulty to understand or operate” account for 36% of problems, while malfunction-related issues have declined significantly—indicating that vehicle owners now expect vehicles to be not only functional but also user-friendly. Accuracy in recognition and comprehension remains a major pain point in the instance of voice assistants. Owners indicate they have higher expectations for AI to truly enhance interaction efficiency in the future.

- Safety takes center stage in smart experience: Among in-vehicle tech features, demand remains strong for convenience functions such as digital keys and control apps. Additionally, vehicle safety has become a fast-rising vehicle owner priority. In 2025, safety-related functions—such as post-exit assistance, driver monitoring, safety protection and proactive alerts—have both high usage frequency and high repurchase intent. This reflects the growing demand for everyday safety assurance in real-world driving scenarios.

Highest-Ranked Brands

Mercedes-Benz ranks highest among premium internal combustion engine (ICE) models with a score of 622, followed by Lincoln (596) and Land Rover (593).

NIO (714) ranks highest among premium new-energy vehicles (NEVs), followed by Denza (711) and Voyah (693).

Lynk & Co ranks highest among mass market ICE models with a score of 615, followed by GAC Trumpchi (605) and CHANGAN (589).

ZEEKR ranks highest among mass market NEVs with a score of 716, followed by Li Auto (710), AITO and Xiaomi rank third in a tie with a score of 706.

Advanced Technology Award Recipients

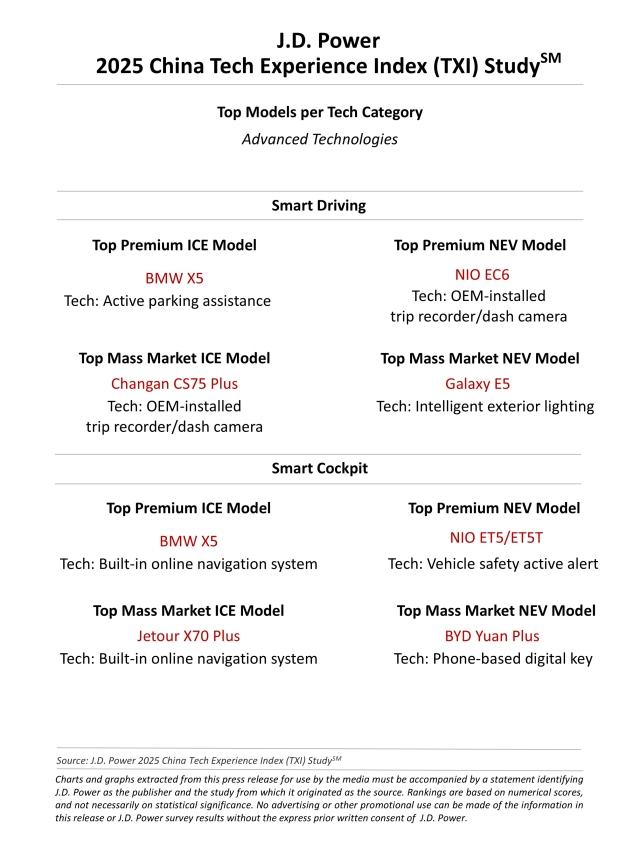

The China Tech Experience Index (TXI) Study analyzes 40 automotive technologies, which are divided into two categories: smart driving; smart cockpit. Only the 32 technologies classified as advanced are award eligible.

In Smart Driving Category:

- BMW X5 is the premium ICE model that receives the award for active parking assistance.

- NIO EC6 is the premium NEV model that receives the award for OEM-installed trip recorder/dash camera.

- Changan CS75 Plus is the mass market ICE model that receives the award for OEM-installed trip recorder/dash camera.

- Galaxy E5 is the mass market NEV model that receives the award for intelligent exterior lighting.

In Smart Cockpit Category:

- BMW X5 is the premium ICE model that receives the award for built-in online navigation system.

- NIO ET5/ET5T is the premium NEV model that receives the award for vehicle safety active alert.

- Jetour X70 Plus is the mass market ICE model that receives the award for built-in online navigation system.

- BYD Yuan Plus is the mass market NEV model that receives the award for phone-based digital key.

The China Tech Experience Index (TXI) Study, which complements the JD Power China Initial Quality StudySM (IQS) and JD Power China Automotive Performance, Execution and Layout (APEAL) Study,SM is used extensively by automakers and suppliers worldwide to provide an overview of how vehicle owners in China perceive the advanced technology features in their new vehicle and to help the industry address any problematic areas before the technologies are made widely available across automotive portfolios, thus improving the future owner experience.

The 2025 study, which includes 139 ICE models from 35 brands and 115 NEV models from 45 brands, is based on responses from 19,135 ICE vehicle owners who purchased their vehicle between July 2024 and March 2025, as well as 19,617 NEV owners who purchased their vehicle between July 2024 and January 2025. The study for ICE vehicle owners was fielded from January through May 2025 and the study for NEV vehicle owners was fielded from January through March 2025 in 81 major cities across China.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Wenjing Ji, JD Power; China; +86 21 8026 5719; wenjing.ji@jdpa.com

Geno Effler, JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

[1] The Technology Execution Index is formulated from respondents’ overall experience and the total problems experienced with the advanced technologies they have and use. The index weights are derived from survey responses using multivariate linear regression. As a result, the index weights could differ by study market or study year.

[2] The Market Depth Index is a measurement of the penetration level of advanced technologies. The calculation encompasses the level of equipment penetration and usage of advanced technologies.