China NEV-APEAL Satisfaction Score Highest in History of Study, JD Power Finds

Perceived Differences in Experience between PHEVs and BEVs Continue to Narrow

SHANGHAI: 29 May 2025 – The industry average satisfaction score for China’s new energy vehicles (NEVs) has reached 806 (on a 1,000-point scale), the highest score since the study was first published in 2021, according to the JD Power 2025 China New Energy Vehicle–Automotive Performance, Execution and Layout (NEV-APEAL) Study, released today. Each factor measured in the study has increased more than 12 points year over year.

The study examines NEV owners’ appeal—or emotional attachment and level of excitement—with their new vehicle within the first two to six months of ownership. The data is used extensively by NEV manufacturers to design and develop more appealing vehicles.

The 2025 study shows a structural shift in China’s NEV market: the proportion of first-time NEV buyers has dropped below 60%, the market is transitioning from growth driven by first-time buyers to one shaped by replacement and additional purchases. Notably, the proportion of females entering the market as incremental buyers has increased 5 percentage points from 2024, accounting for 33% of all female users. While the proportion of males entering as incremental buyers has only increased 2 percentage points during the same period, reaching 25% of all male users. This makes females an emerging growth engine in the NEV market. Meanwhile, domestic startups have achieved breakthroughs in both sales and appeal scores, overtaking many international brands that are now facing mounting pressure and risks of marginalization.

“The overall industry score continued to rise this year, primarily driven by continuous advancements in battery technology,” said Elvis Yang, general manager of auto product practice at JD Power China. “For mainstream models priced under RMB 300,000, battery pack capacities have increased to varying degrees, effectively addressing core user demands for extended range. With the implementation of a new national battery safety standard on the horizon, the focus on battery development is expected to shift gradually from maximizing range to ensuring safety.”

Additionally, Yang adds, “The growing influence of female buyers has spurred demand for more diverse exterior and interior options. A visually appealing paint color not only enhances customer satisfaction and boosts sales but also generates additional revenue through optional customization charges. Lastly, the rapid rise of domestic emerging and startup brands—fueled by fierce competition in technology and feature offerings—has become increasingly evident. In contrast, how international brands will respond, innovate and regain consumer favor amid China’s intense competitive landscape has become a central point of industry attention.”

Following are some key findings of the 2025 study:

- Range anxiety alleviated: Scores for range economy and charging experience have increased from 2024 by 22 and 18 points, respectively, reflecting a consumer shift toward practicality and convenience. User feedback indicates that performance under high-load conditions (e.g., cold weather or air conditioning usage) has improved compared to 2024, with the proportion of range falling short of expectations in these two scenarios has decreased by 4% and 8% respectively. Charging infrastructure expansion has further boosted satisfaction as scores have increased year over year by 6 points in Tier-1 cities; 21 points in Tier-2; and 16 points in Tier-3.

- Acceptance of plug-in hybrid electric vehicles (PHEVs) continues to grow: PHEV ownership has increased 9 percentage points year over year to 41.5%, suggesting growing market acceptance of hybrid technologies. Perceived differences in experience between PHEVs and battery electric vehicles (BEVs) continue to narrow, with gaps in styling, driving feel and infotainment each now within 2 points.

- Pre-purchase knowledge gaps amplify dissatisfaction: Aspects that are hard to assess prior to purchase, such as charging convenience, infotainment usability and material quality, receive low scores. These issues stem not from excessively high consumer expectations, but from an information gap during the shopping process. When actual experience deviates from assumptions, perceived gaps are magnified, leading to disappointment.

Highest-Ranked Models

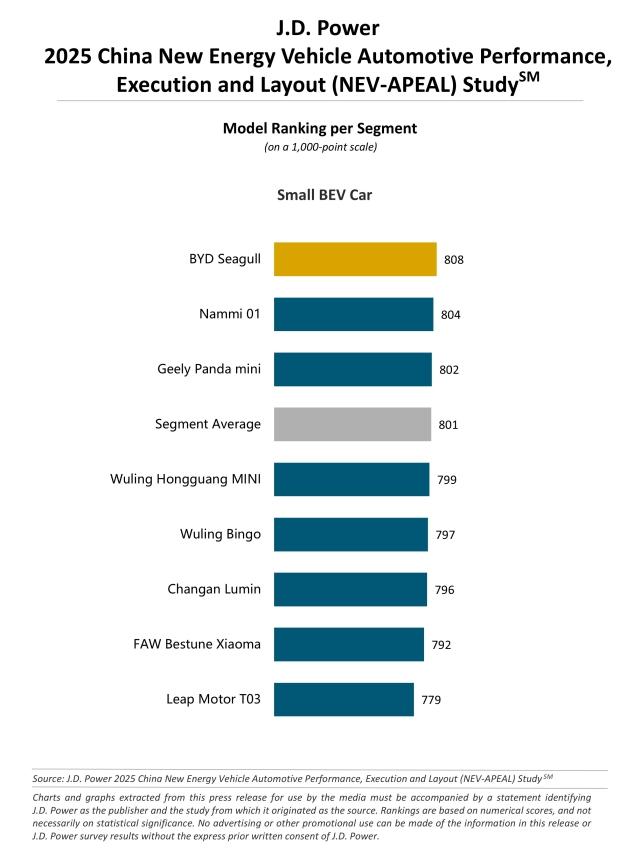

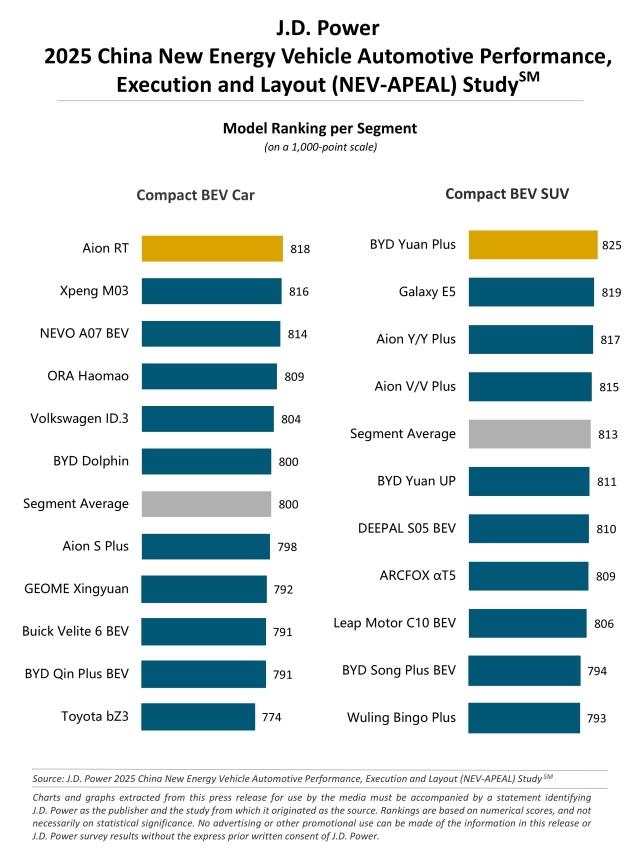

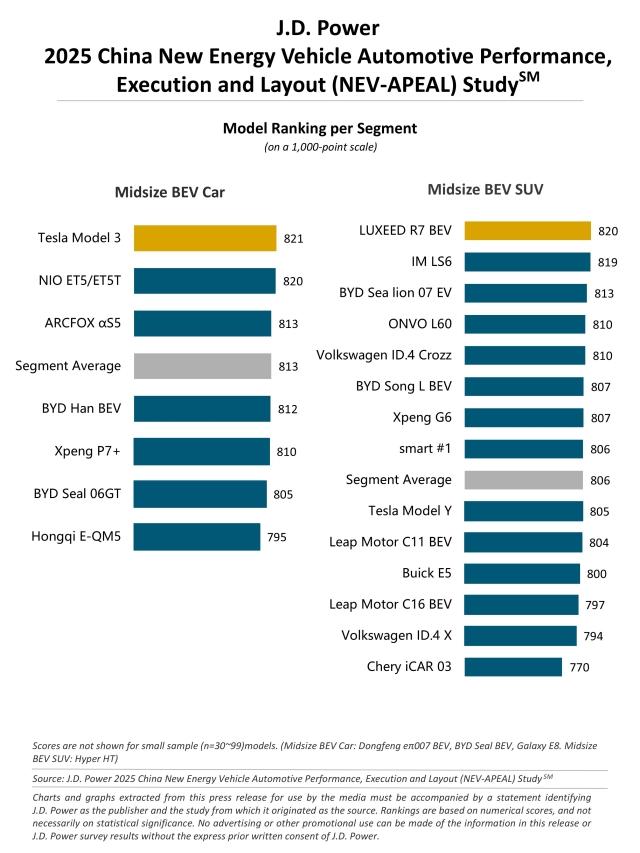

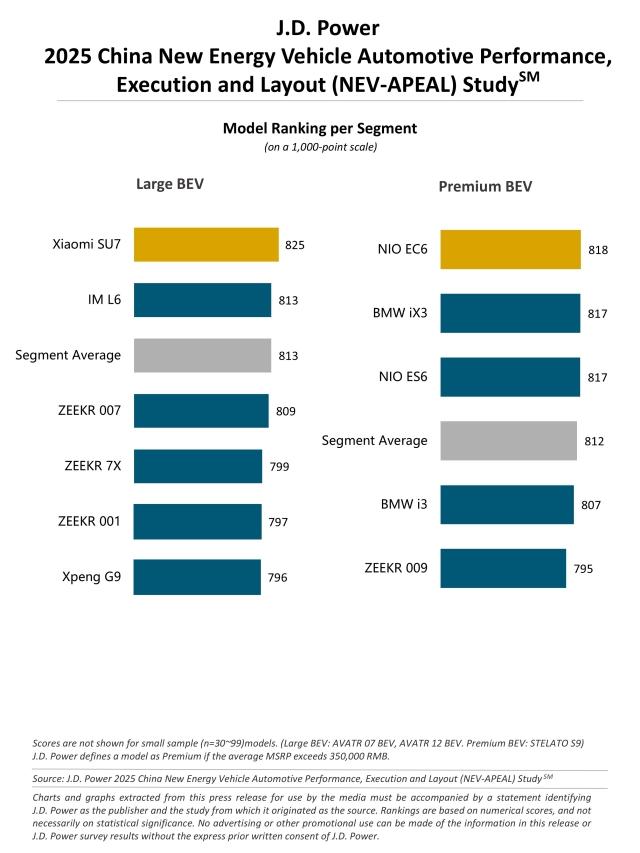

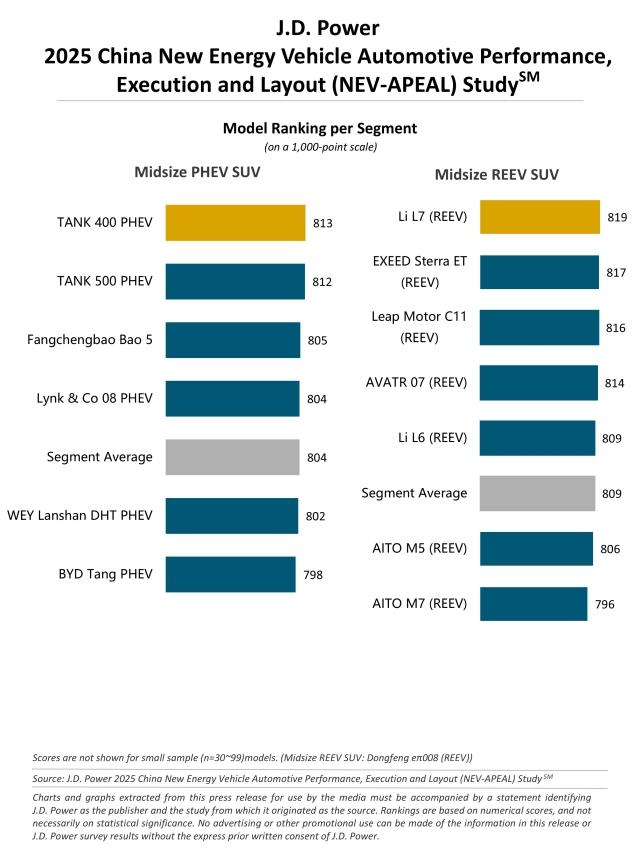

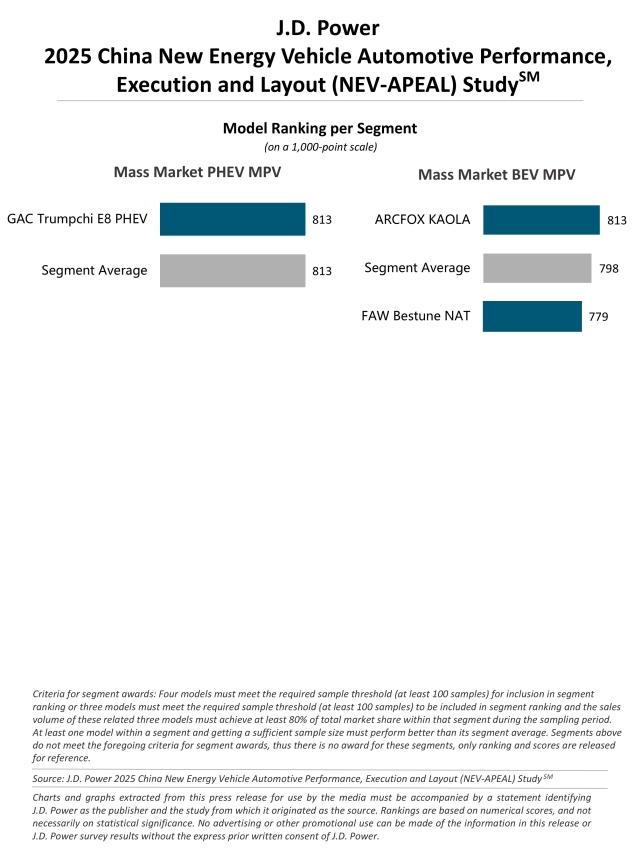

Models that rank highest in their respective segments are:

- Small BEV Car: BYD Seagull

- Compact BEV Car: Aion RT

- Compact BEV SUV: BYD Yuan Plus

- Midsize BEV Car Tesla Model 3

- Midsize BEV SUV: LUXEED R7 BEV

- Large BEV: Xiaomi SU7

- Premium BEV: NIO EC6

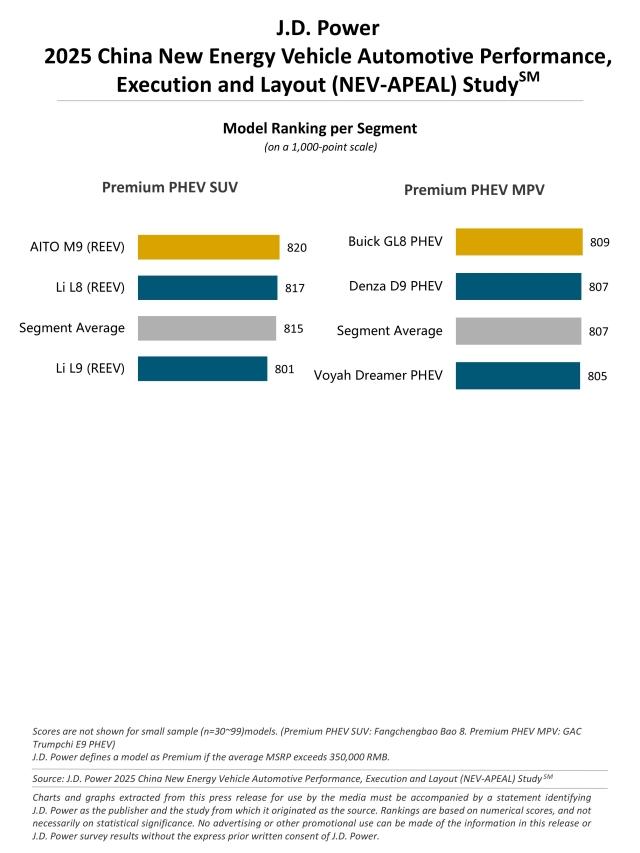

- Premium PHEV SUV: AITO M9 (REEV)

- Premium PHEV MPV: Buick GL8 PHEV

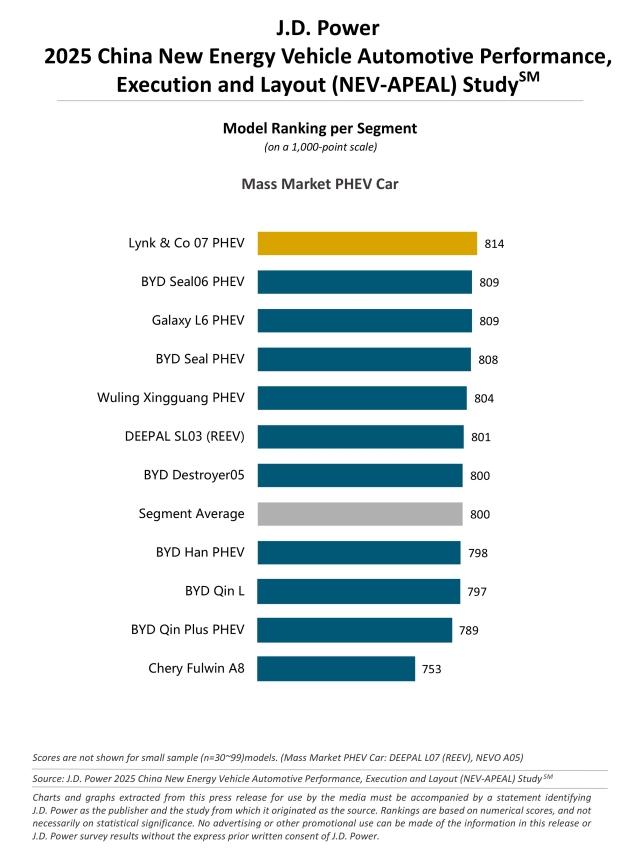

- Mass Market PHEV Car: Lynk & Co 07 PHEV

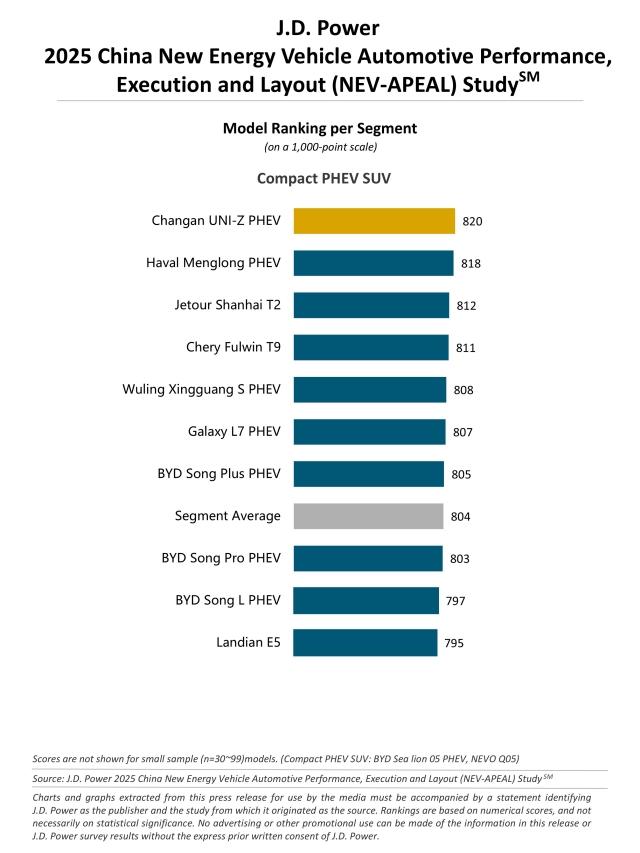

- Compact PHEV SUV: Changan UNI-Z PHEV

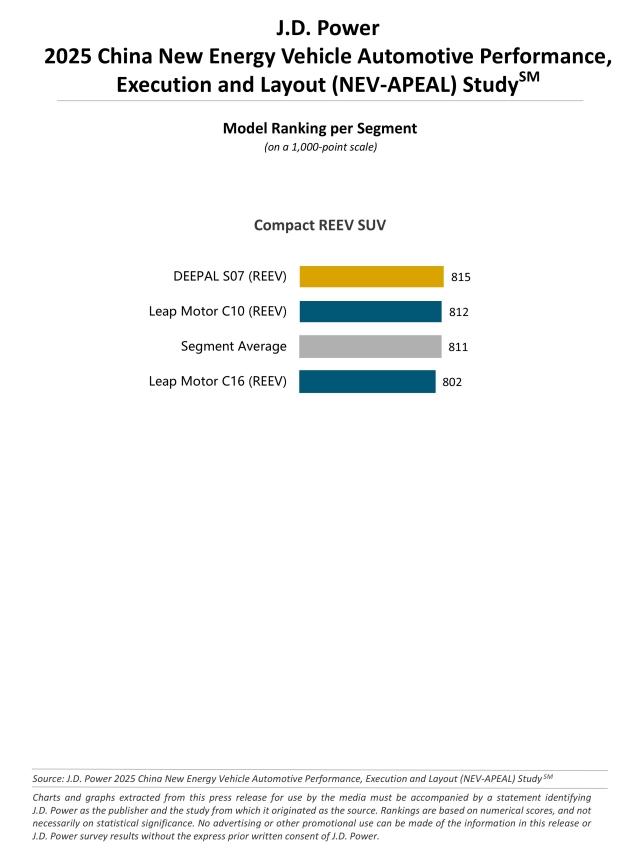

- Compact REEV SUV: DEEPAL S07 (REEV)

- Midsize PHEV SUV: TANK 400 PHEV

- Midsize REEV SUV: Li L7 (REEV)

The Small BEV SUV, Premium PHEV Car, Mass Market PHEV MPV and Mass Market BEV MPV segment criteria for awards were not met, therefore no awards are given this year.

The China New Energy Vehicle–Automotive Performance, Execution and Layout (NEV-APEAL) Study measures NEV owners’ emotional attachment to and level of excitement with their new vehicle across 45 attributes in 11 vehicle experience categories: exterior; setting up and starting; getting in and out; interior; performance; driving feel; keeping you safe; infotainment; driving comfort; fuel economy and driving range; and charging experience.

The 2025 study is based on responses from 21,211 new energy vehicle owners who purchased their vehicle between July 2024 and January 2025. The study includes 122 models from 48 different brands, among which 107 models have sufficient samples. The study was fielded from January 2025 through March 2025 in 81 cities across China.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Wenjing Ji, JD Power; China; +86 21 8026 5719; wenjing.ji@jdpa.com

Geno Effler, JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info