International Brands and Domestic Startups Lead as NEV-APEAL Continues to Improve, JD Power Finds

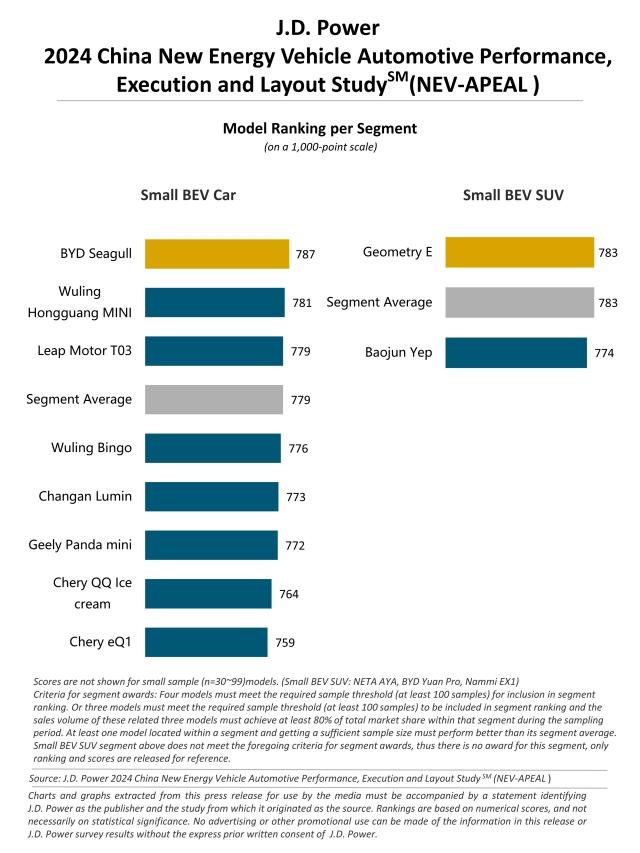

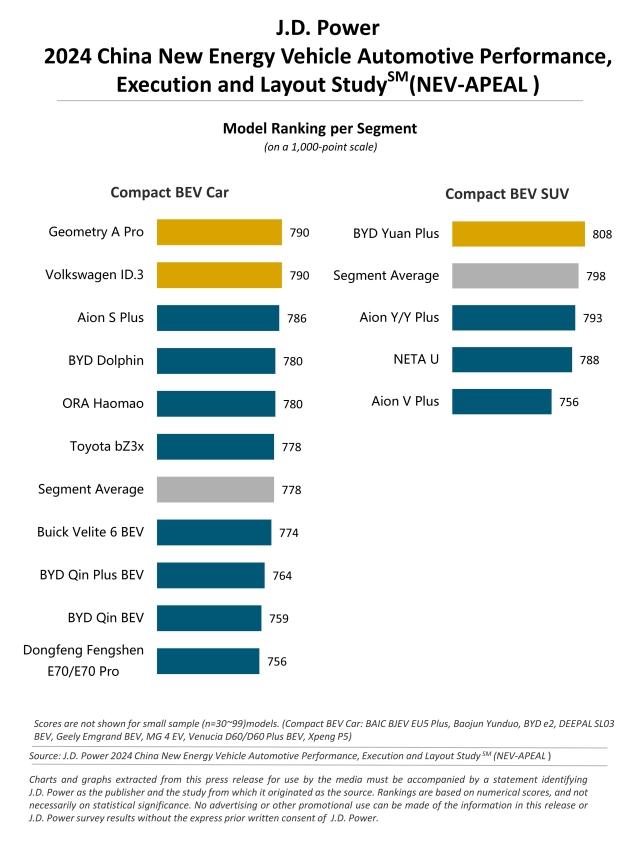

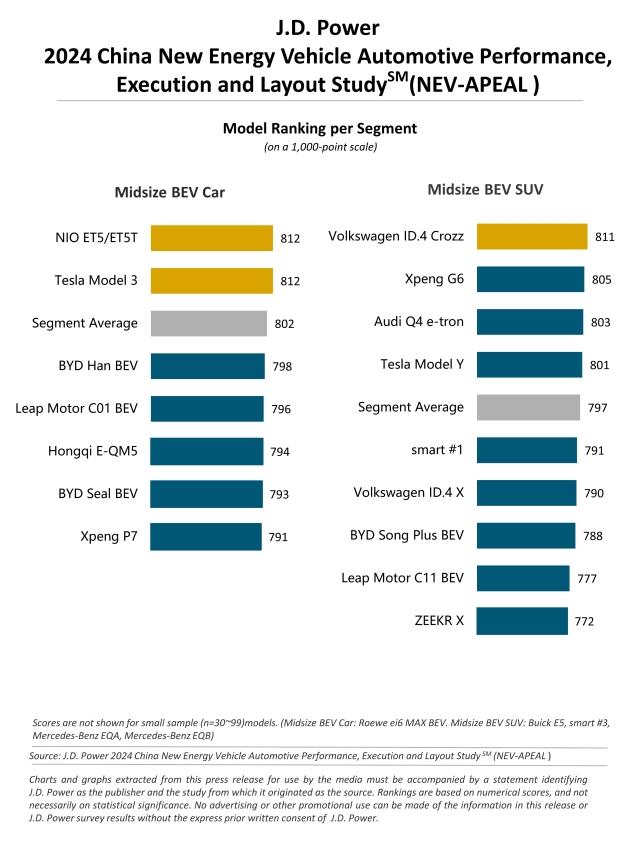

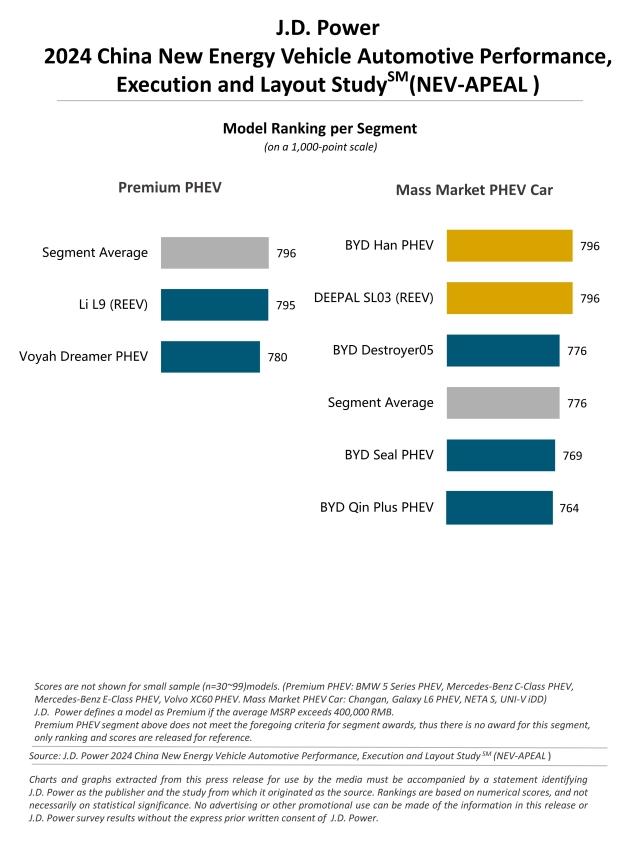

BYD Seagull, Geometry A Pro, Volkswagen ID.3, BYD Yuan Plus, NIO ET5/ET5T, Tesla Model 3, Volkswagen ID.4 Crozz, ZEEKR 001, NIO ES6, BYD Han PHEV, DEEPAL SL03 and AITO M5 Rank Highest in Respective Segments

SHANGHAI: 30 May 2024 – New energy vehicles (NEVs) have made consistent progress year over year, according to the JD Power 2024 China New Energy Vehicle–Automotive Performance, Execution and Layout (NEV-APEAL) Study,SM released today. The average NEV-APEAL score for Chinese NEVs is 789 (on a 1,000-point scale), an increase of 13 points from 2023.

The study examines NEV owners’ assessment of their new vehicle within the first two to six months of ownership. The data is used extensively by NEV manufacturers to design and develop more appealing vehicles.

The study shows that among OEM types, international brands (800) score highest for a second consecutive year. Domestic startups (798) have made the greatest progress, with a significant increase of 17 points from 2023. Among 11 experience categories, fuel economy and driving range has the most significant increase, rising 16 points to 796. Additionally, the importance weighting for safety has increased by 1.5 percentage points to 8.4%, reflecting a growing concern about NEV safety.

"International brands have made rapid progress,” said Elvis Yang, general manager of auto product practice at JD Power China. “Leveraging their brand and product advantages from the internal combustion engine era, they have shown outstanding product strength this year. As China NEV owners’ range anxiety decreases, they are increasingly focusing on safety and driving experience. Although the NEV-APEAL score for this category has risen, the growth rate has slowed. OEMs should understand owner needs and avoid product homogenization to create standout products.”

Following are some key findings of the 2024 study:

- NEV exterior scores advance, custom colors gain popularity: In 2024, overall satisfaction for exterior is 818, up 11 points year over year. Among exterior preferences, 26% of owners who have vehicles with non-traditional colors (other than black, white, grey, silver, red or blue) consider the color their favorite aspect, significantly higher than among owners whose vehicles have a traditional color. This reflects the growing popularity of custom colors among owners.

- BEVs excel in performance and driving feel: Battery electric vehicles (BEVs) outperform plug-in hybrid electric vehicles (PHEVs) in both performance and driving feel. Last year, PHEVs led in engine/motor sound, power and smoothness. This year, BEVs surpassed them in all three factors, with the largest gap in engine/motor sound. In terms of driving feel, PHEVs, which previously led in ride comfort, steering/handling, and braking performance, have fallen behind, especially in suburban and mid-low speed driving scenarios.

- Charging experience improves, slow charging efficiency needs enhancement: The charging experience has significantly improved, an increase of 14 points from a year ago. However, slow charging efficiency remains the lowest-scoring factor, with a notable gap compared to other factors. In 2024, the slow charging time averages 7.1 hours, down from 7.6 hours in 2023. Despite a reduction of 0.5 hours, slow charging times still fall short of owner expectations, indicating a need for further enhancement.

Highest-Ranked Models

Models that rank highest in their respective segments are:

- Small BEV Car segment: BYD Seagull

- Compact BEV Car segment: Geometry A Pro, Volkswagen ID.3, in a tie

- Compact BEV SUV segment: BYD Yuan Plus

- Midsize BEV Car segment: NIO ET5/ET5T, Tesla Model 3, in a tie

- Midsize BEV SUV segment: Volkswagen ID.4 Crozz

- Large BEV segment: ZEEKR 001

- Premium BEV segment: NIO ES6

- Mass Market PHEV Car segment: BYD Han PHEV, DEEPAL SL03, in a tie

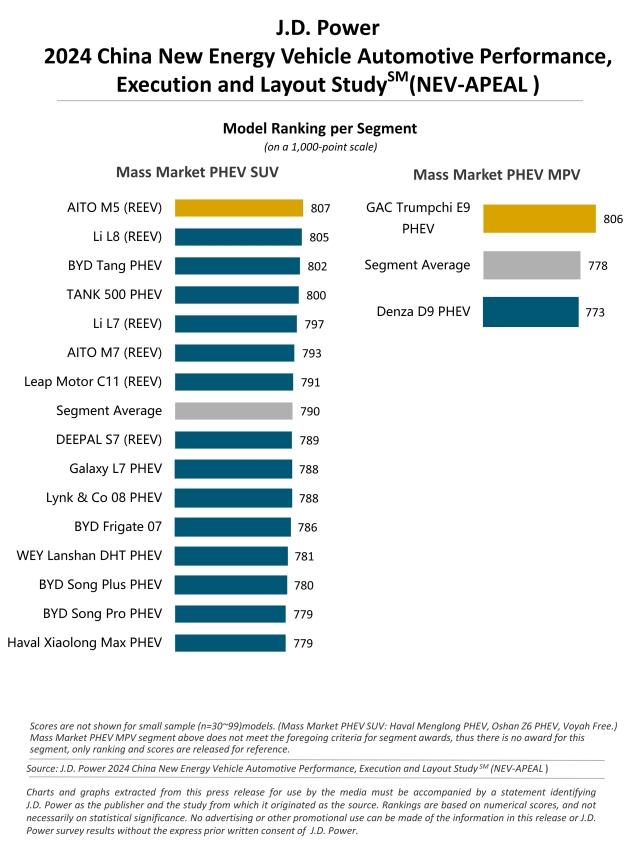

- Mass Market PHEV SUV segment: AITO M5

The Small BEV SUV, Premium PHEV, Mass Market PHEV MPV and Mass Market BEV MPV segment criteria for awards were not met, therefore no awards are given this year.

The China New Energy Vehicle–Automotive Performance, Execution and Layout (NEV-APEAL) Study measures NEV owners’ emotional attachment to and level of excitement with their new vehicle across 45 attributes in 11 vehicle experience categories: exterior; setting up and starting; getting in and out; interior; performance; driving feel; keeping you safe; infotainment; driving comfort; fuel economy and driving range; and charging experience.

The 2024 study is based on responses from 9,937 new energy vehicle owners who purchased their vehicle between June 2023 and January 2024. The study includes 105 models from 48 different brands, among which 74 models have sufficient samples. The study was fielded from December 2023 through March 2024 in 81 cities across China.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Mengmeng Wang, JD Power; China; +86 21 8026 5719; mengmeng.wang@jdpa.com

Geno Effler, JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info