International Brands Lead New Energy Vehicle Quality in China, JD Power Finds

SAIC Volkswagen Ranks Highest in PHEV Segment; NIO Ranks Highest in BEV Segment

SHANGHAI: 17 Sept. 2020 – As the New Energy Vehicle (NEV) market in China gets in the fast lane, the quality gap among NEV brands is gradually widening, according to the JD Power 2020 China New Energy Vehicle Experience Index (NEVXI) Study,SM released today. International brands take the leading position in new-vehicle quality, while the domestic NEV startups and domestic traditional automakers still lag.

The study, now in its second year, measures new-vehicle quality by examining problems experienced by NEV owners within the first two to six months of ownership. New-vehicle quality is determined by problems cited per 100 vehicles (PP100), with a lower number of problems indicating higher quality.

The study shows that the average number of problems reported this year by NEV owners is 138 PP100. The number of problems reported by NEV owners of domestic traditional automaker brands (147 PP100) is much higher than that for international brands (112 PP100) and domestic NEV startups (126 PP100).

“As the NEV market is shifting from policy-driven to policy- and market-driven, competition among brands will gradually focus on the product itself,” said Jeff Cai, general manager of auto product at JD Power China. “Compared with international brands and domestic NEV startups, the domestic traditional automakers are weaker in resource integration and less favored by the capital investment market, and if they want to survive in the NEV competition, they need to accelerate technology and product innovation and strive to improve quality.”

The study also finds that international brands perform better in the exterior, infotainment system, seats, powertrain, and interior categories, and domestic NEV startup brands exceed in driving experience, climate and battery/charging.

“Both domestic and foreign startups, such as NIO and Tesla, are more outstanding in exterior design, human-machine interaction and technology innovation, while joint venture brands surpass others in manufacturing techniques,” said Eileen Ren, vice president of NEV solutions at JD Power China. “NEV owners not only expect technological and smart in-vehicle features, but also require high quality, thus NEV makers need to deliver vehicles with both high quality and advanced technology.”

Following are additional findings of the 2020 study:

- NEV owners are younger and more open to NEV brands: The proportion of NEV owners born in the 1990s has increased to 37% this year from 24% in 2019. Additionally, 78% of NEV owners indicate that they would consider any NEV brands when purchasing, which is 6 percentage points higher than the consideration level of fuel vehicle owners.

- Traditional quality problems are cited most often by NEV owners: The four categories in which NEV owners most frequently cite problems are exterior (16%); interior (13%); infotainment system (13%); and driving experience (13%). Unpleasant interior smell and excessive road noise are the top two specific problems.

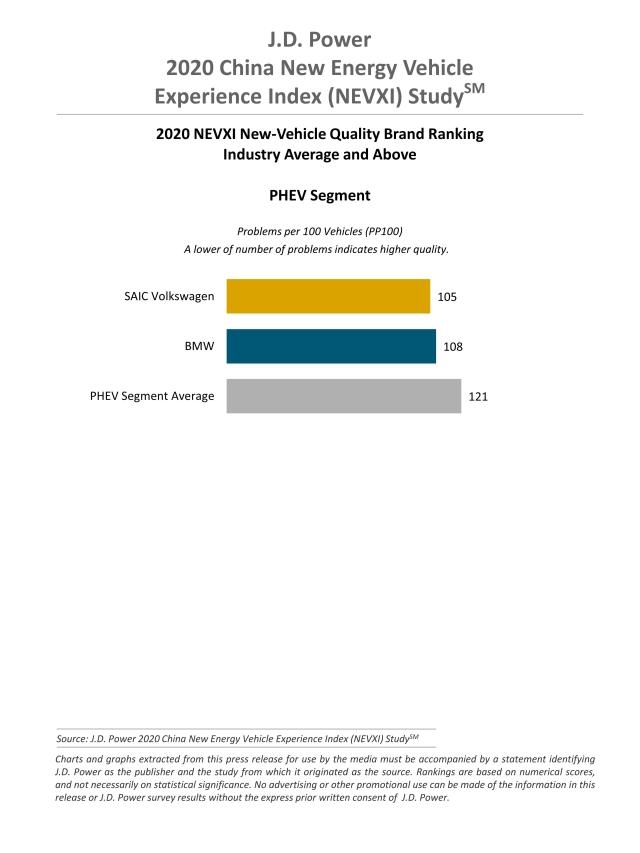

- Fewer problems are cited by PHEV owners than by BEV owners: The problems cited for PHEVs (plug-in hybrid electric vehicles) (121 P100) are 22 PP100 lower than for BEVs (battery electric vehicles). Luxury PHEVs perform better in the exterior and infotainment categories than do mass market PHEVs.

- Quality problems in small BEVs outnumber problems in other BEVs: The average number of problems cited by small BEV owners is 164 PP100, which is much higher than by owners of compact BEVs (141 PP100); midsize BEVs (124 PP100); and large BEVs (116 PP100).

Highest-ranked brands and models

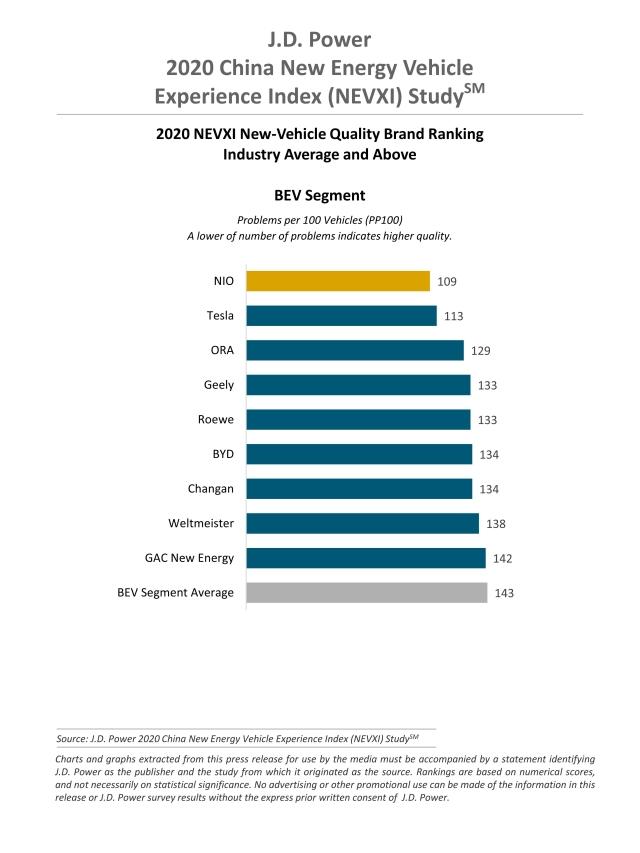

SAIC Volkswagen ranks highest in NEV new-vehicle quality among all brands in the PHEV segment, with 105 PP100. BMW ranks second with 108 PP100. NIO ranks highest among all brands in the BEV segment with 109 PP100, followed by Tesla (113 PP100) and ORA (129 PP100).

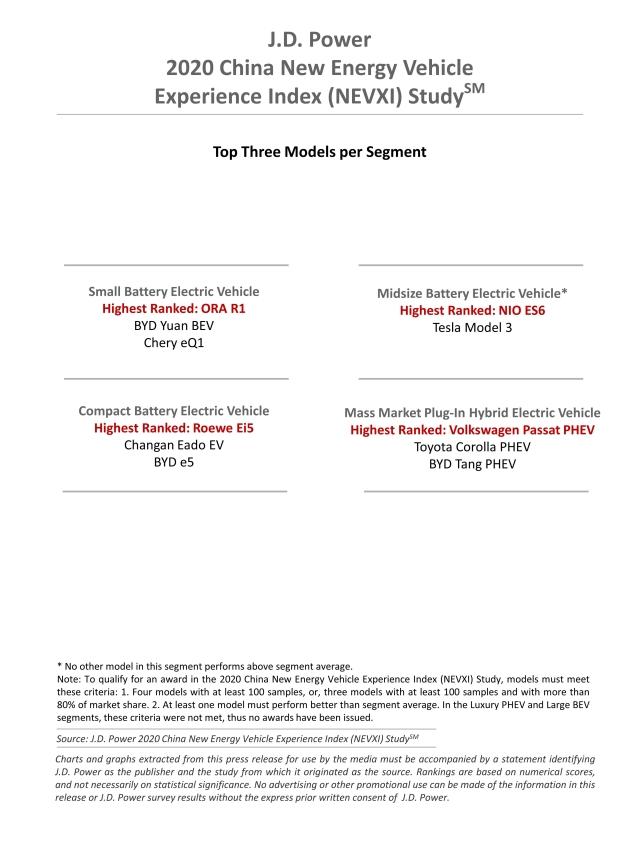

Models that rank highest in their respective segments are: ORA R1 in the small BEV segment; Roewe Ei5 in the compact BEV segment; NIO ES6 in the midsize BEV segment; and Volkswagen Passat PHEV in the mass market PHEV segment. In the luxury PHEV and large BEV segments, criteria for awards were not met, thus no awards are given this year in these segments.

The JD Power China New Energy Vehicle Experience Index (NEVXI) Study measures new-vehicle quality by examining problems experienced by NEV owners in two categories: design-related problems and defects/ malfunctions. Specific diagnostic questions include 236 problem symptoms across 10 categories: features/ controls/displays; exterior; interior; infotainment system; seats; driving experience; driving assistance; powertrain; battery/charging; and climate.

The study is based on responses from 3,267 vehicle owners who purchased their vehicle between May 2019 and May 2020. The study includes 40 models from 20 different brands and was fielded from May through July 2020 in 28 major provinces across China.

For more information about the JD Power China New Energy Vehicle Experience Index (NEVXI) Study, visit HERE.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Damon Liu, JD Power; China; +86 21 8026 5721; damon.liu@jdpa.com

Geno Effler, JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info