Extended Vehicle Ownership Brings an Increase of Design-Related Problems, JD Power Finds

Porsche, FAW Toyota and WEY Rank Highest in Respective Segments

SHANGHAI: 3 Nov. 2022 – The number of vehicle design-related problems in China has reached 78 PP100 (problems per 100 vehicles), accounting for 43% of the total number in the industry, according to the JD Power 2022 China Vehicle Dependability StudySM (VDS), released today. Additionally, the longer the vehicle ownership, the higher number of design-related problems.

The study, now in its 13th year, measures the number of problems experienced per 100 vehicles (PP100) during the past six months by owners of 13- to 48-month-old vehicles. A lower score reflects higher quality. The study covers 177 specific problems grouped into nine major vehicle categories: exterior; interior; driving experience; features/controls/displays (FCD); infotainment; climate; seats; powertrain; and driving assistance.

According to the study, in different vehicle ownership stages, the malfunction problems are higher than design problems, but the number of the malfunction problems does not change significantly as the ownership period extends, while design-related problems do. During the first one to two years of ownership, design problems experienced by owners averages 68 PP100. When the ownership period entered the stages of two to three years or three to four years, the number of problems rises to 81 PP100 and 94 PP100, respectively.

“The number of design-related problems in long-term quality is increasing, which is consistent with the China Initial Quality Study released earlier this year,” said Elvis Yang, general manager of auto product practice at JD Power China. “Design-related problems continue to affect user experience and satisfaction, both in the new-ownership period and the long-term ownership period. In fact, with the intelligence evolution, both hardware and software will affect the quality dependability. Looking ahead, automakers need to form the strategic thinking of ‘integration’ in the R&D stage to improve the ability of software and hardware collaborative iteration.”

Following are additional findings of the 2022 study

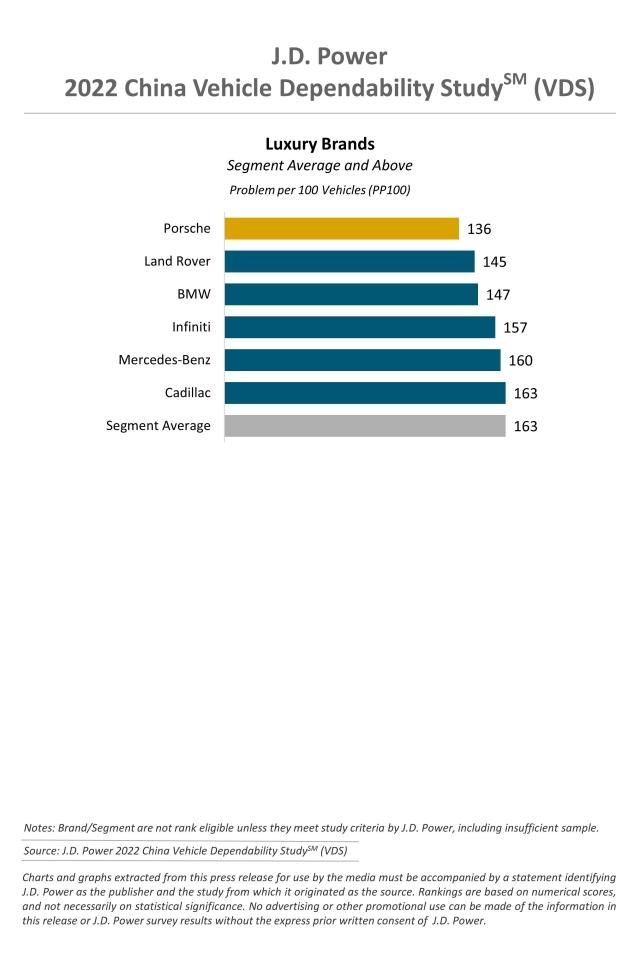

- Luxury brands lead in dependability: In 2022, the dependability of luxury brands is 163 PP100, 21 PP100 less than that of mass market brands (184 PP100). Among luxury brands, the three factors of exterior (7.1 PP100), interior (3.6 PP100) and seats (3.4 PP100) are lower than those of mass market brands.

- Infotainment is leading design-related problem: Issues with infotainment total 24 PP100. Among those, the number of design problems account for 17 PP100, becoming the highest category of design-related problems. Top 5 infotainment design problems are: radio poor/no reception; not enough power plugs/USB ports; touchscreen/display screen - DTU/too much glare/gets dirty too easily; built-in navigation system – inaccurate; built-in voice recognition - frequently doesn't recognize commands/DTU.

- Domestic brands have advantages: From the perspective of segment market, the overall number of domestic brands’ compact cars is 158 PP100, which is better than the industry average of 164 PP100. In addition, the domestic brands are also competitive in midsize car segments, but they fall behind in SUV and MPV segments.

Highest-Ranked Brands and Models

Porsche ranks highest in vehicle dependability among luxury brands with 136 PP100, followed by Land Rover (145 PP100) and BMW (147 PP100).

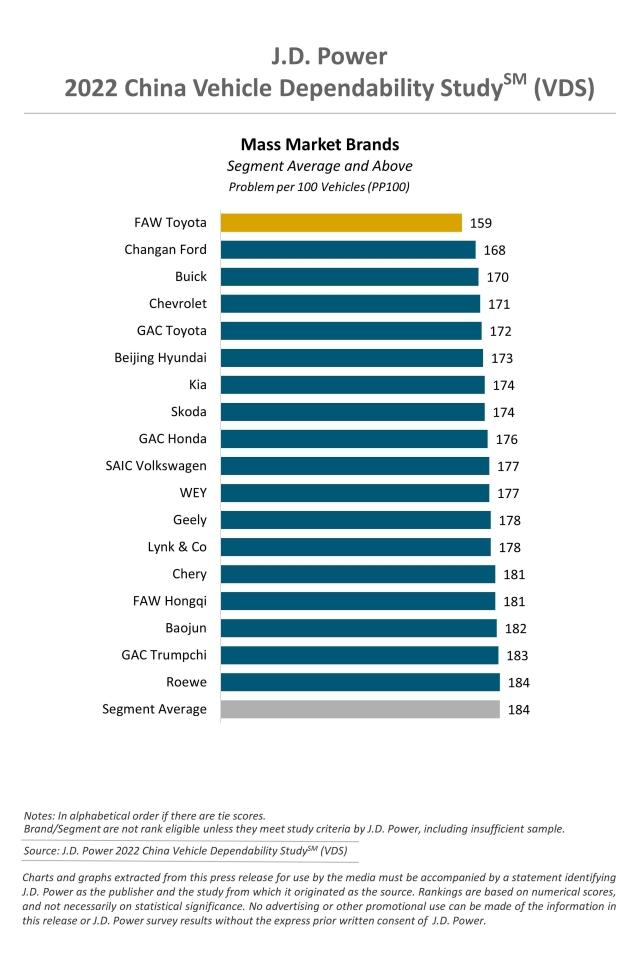

FAW Toyota is the highest-ranked mass market brand with 159 PP100.Changan Ford (168PP100) and Buick (170 PP100) rank second and third, respectively.

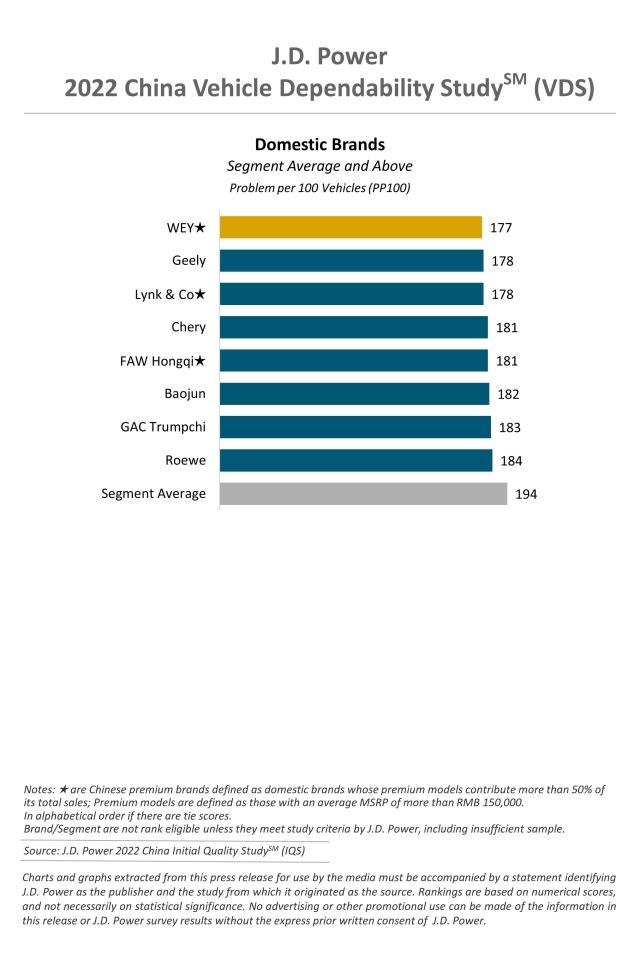

WEY is the highest-ranked Chinese domestic brand with 177 PP100. Geely (178 PP100) and Lynk & Co (178 PP100) rank second in a tie.

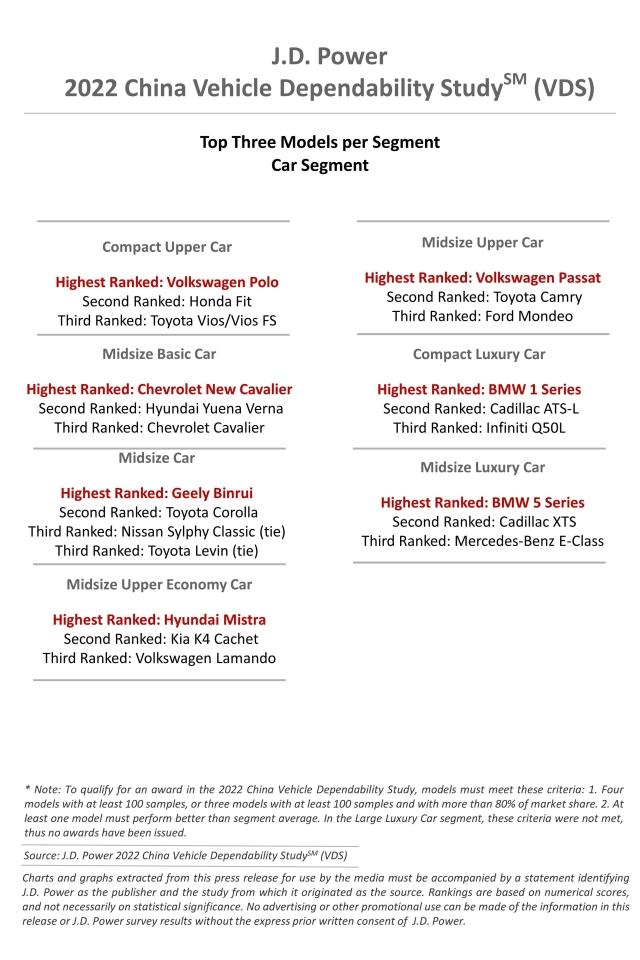

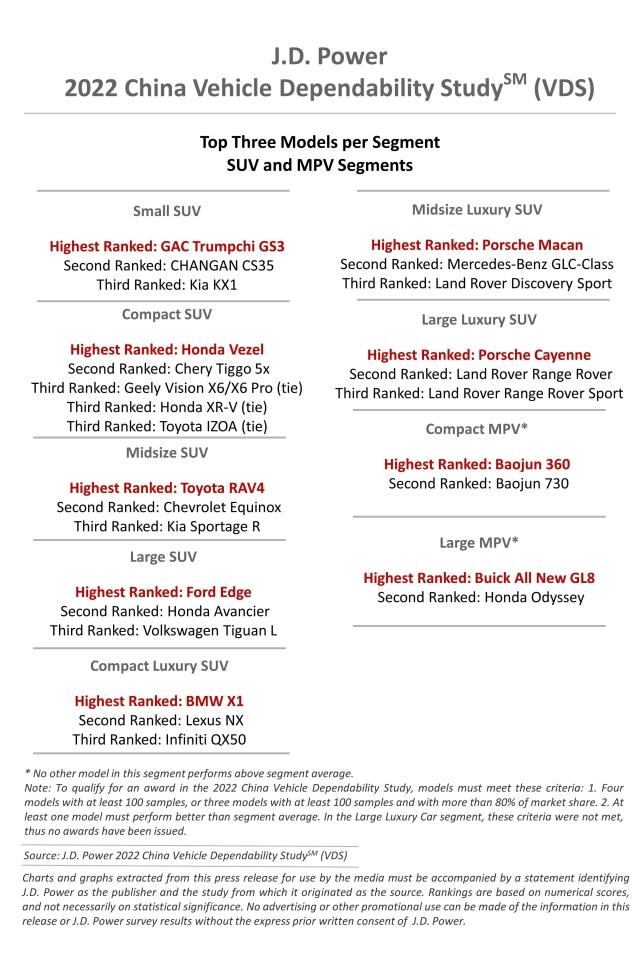

There are 16 models from 12 brands eligible for awards across 16 segments in the 2022 study.

- BMW models that rank highest in their respective segments are BMW 1 Series; BMW 5 Series; and BMW X1

- Porsche models that rank highest in their respective segments are Porsche Cayenne and Porsche Macan

- SAIC Volkswagen models that rank highest in their respective segments are Volkswagen Polo and Volkswagen Passat

Other models that rank highest in their respective segments are Baojun 360; All New Buick GL8; Chevrolet Onix; Ford Edge; GAC Trumpchi GS3; Geely Binrui; Honda Vezel; Hyundai Mistra; Toyota RAV4.

The 2022 study is based on responses from 37,345 vehicle owners who purchased their vehicle between December 2017 and May 2021. The study includes 208 models from 48 different brands and was fielded from January 2022 through June 2022 in 70 major cities across China.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Mengmeng Wang, JD Power; China; +86 21 8026 5719; mengmeng.wang@jdpa.com

Geno Effler, JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info