Customer Service Quality Satisfaction in China Improves, JD Power Finds

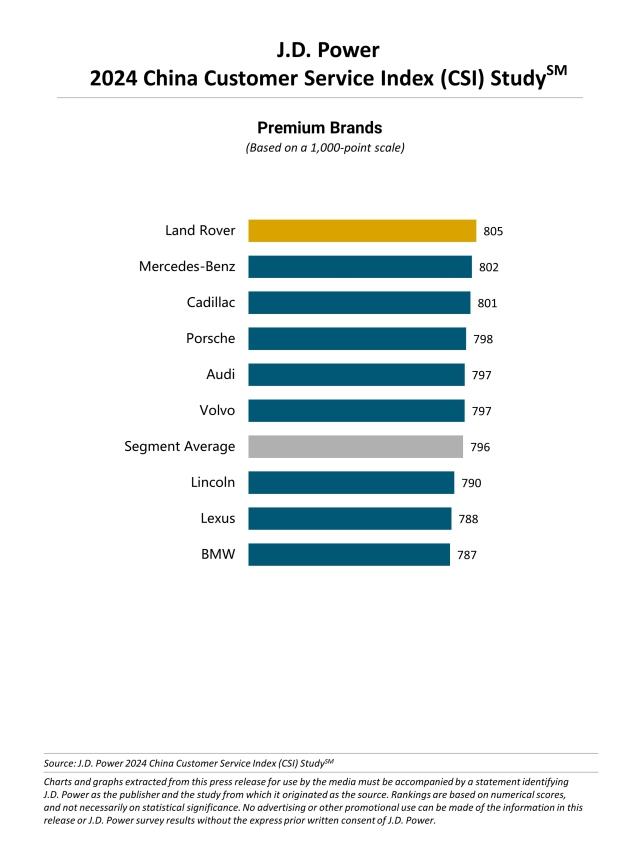

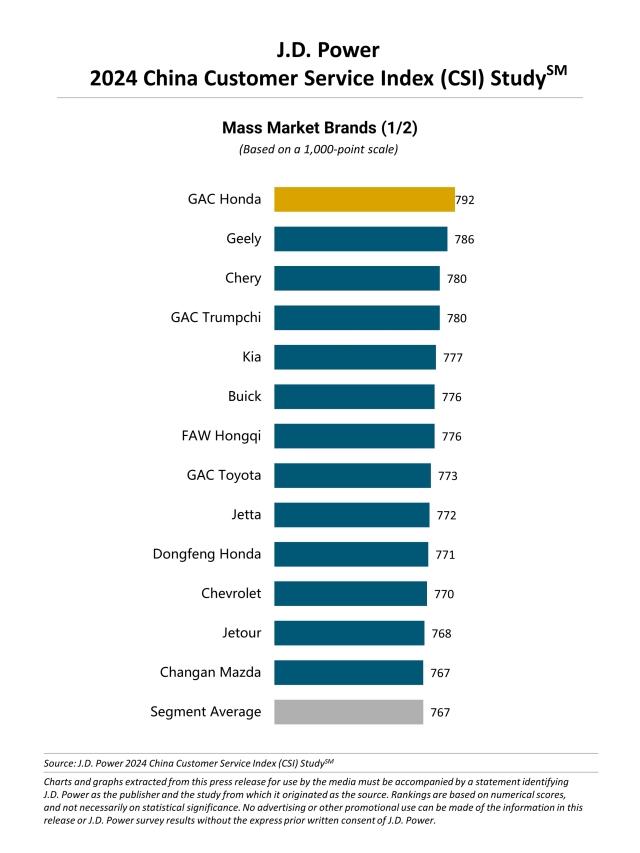

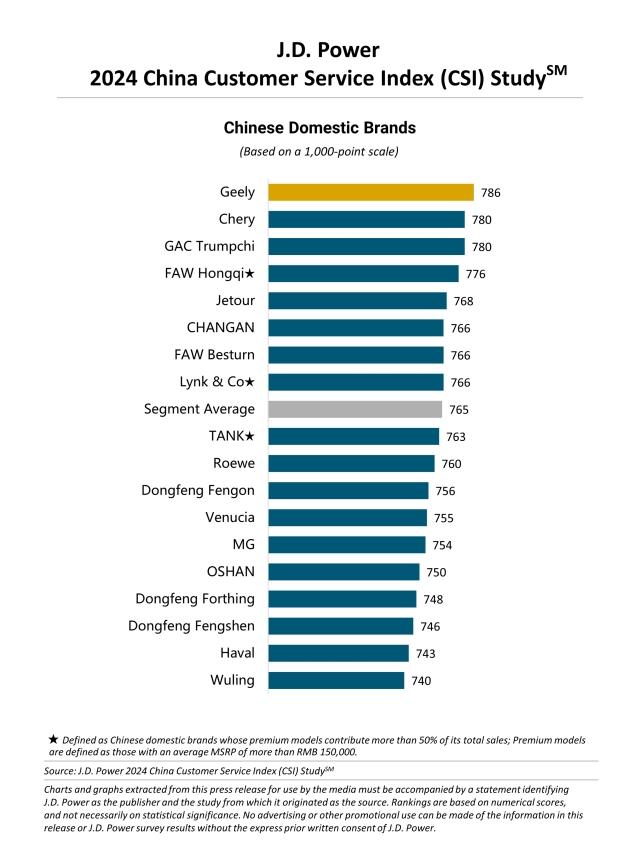

Land Rover, GAC Honda and Geely Rank Highest in Respective Segments

SHANGHAI: 19 Sept. 2024 — Customer service satisfaction in China has significantly improved to 773 (on a 1,000-point scale) in 2024, a 14-point increase from 2023, according to the JD Power 2024 China Customer Service Index (CSI) Study, released today. Satisfaction among owners of premium vehicles has increased 11 points to 796, while scores for mass market vehicles (767) and Chinese domestic vehicles (765) have each increased 14 points from 2023, narrowing the gap with the score for premium vehicles.

The China Customer Service Index (CSI) Study, now in its 24th year, measures satisfaction with after-sales service at authorized dealers in the past 12 months among owners of one- to four-year-old vehicles.

The improvements in scores in 2024 indicate that automakers are placing more emphasis on after-sales service. Of the six factors measured in the study, service quality has seen the highest increase, improving 16 points from 2023.

“With the rise of new energy vehicles (NEVs) and their accompanying direct sales models and digital communication channels, customers who purchase ICE vehicles are now expecting that same service efficiency,” said Ann Xie, general manager of the digital retail consulting practice at JD Power China. “Automakers need to actively adapt to market changes by building efficient digital service systems that reduce costs while also enhancing the customer experience. Striking the right balance between cost control and customer satisfaction will be crucial.”

Following are additional findings of the 2024 study:

- Satisfaction increases most among newer vehicle owners: The largest increase in satisfaction is among customers who have owned their new vehicle for one to two years, improving 25 points, while satisfaction among customers who have owned their new vehicle for three to four years has declined, down 16 points.

- Service transparency has a greater importance for satisfaction: Satisfaction is 77 points higher when customers are shown live footage or video of the service status than those who are not shown, up from a 30-point gap in 2023. Satisfaction is also 91 points higher when all service charges are communicated upfront, up from a 57-point gap a year ago, emphasizing that customers have high expectations for service transparency.

- Digital channels add more value to after-sales service: Satisfaction is 12 points higher for digital reservation channels than for non-digital channels. Additionally, 91% of customers using official apps for reservation are attended to immediately upon arrival. Loyalty is higher among customers who have installed official apps and are also more likely to go to the dealership for repair and maintenance under warranty, which is 8 percentage points higher than among non-app users. These customers also spend more on after-sales services, with an average expenditure that is 718.1 RMB higher than among non-app users (2,330.7 RMB for app users vs. 1,612.6 RMB for non-app users).

- Offering free benefits encourages paid benefits purchases: Customers who are offered free benefits by the automaker are more likely to purchase paid benefits through official channels, with a purchase rate of 38%, compared to 13% for those who were not offered free benefits. Among premium brand customers, 27% say free roadside assistance is valuable, which is 7 percentage points higher than among mass market brand customers.

Study Rankings

Land Rover ranks highest in customer service satisfaction among premium brands with a score of 805. Mercedes-Benz ranks second with a score of 802.Cadillac ranks third with a score of 801.

GAC Honda ranks highest in customer service satisfaction among mass market brands with a score of 792. Geely ranks highest among Chinese domestic brands and ranks second among mass market brands with a score of 786. Chery and GAC Trumpchi rank second in a tie among Chinese domestic brands and rank third in a tie among mass market brands, each with a score of 780.

The China Customer Service Index (CSI) Study measures customer satisfaction based on six factors (in order of importance): service facility (21%); service team (18%); welcome and diagnostic (17%); service quality (16%); service value (15%); and reservation (12%).[①]

The 2024 China Customer Service Index (CSI) Study is based on responses from 33,298 vehicle owners of 43 automotive brands in 81 major cities who purchased their new internal combustion engine (ICE) vehicle between January 2020 and June 2023. The study was fielded from February through July 2024.

To learn more about the China Customer Service Index (CSI) Study, please contact us: china.marketing@jdpa.com

JD Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, JD Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 55 years. The world's leading businesses across major industries rely on JD Power to guide their customer-facing strategies.

JD Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Wenjing Ji, JD Power; China; +86 21 8026 5719; wenjing.ji@jdpa.com

Geno Effler, JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

[①] The weights are presented in rounded form, and the actual calculation is based on decimal places.