New ICE Vehicle Models Achieve Historically High APEAL Scores in China, JD Power Finds

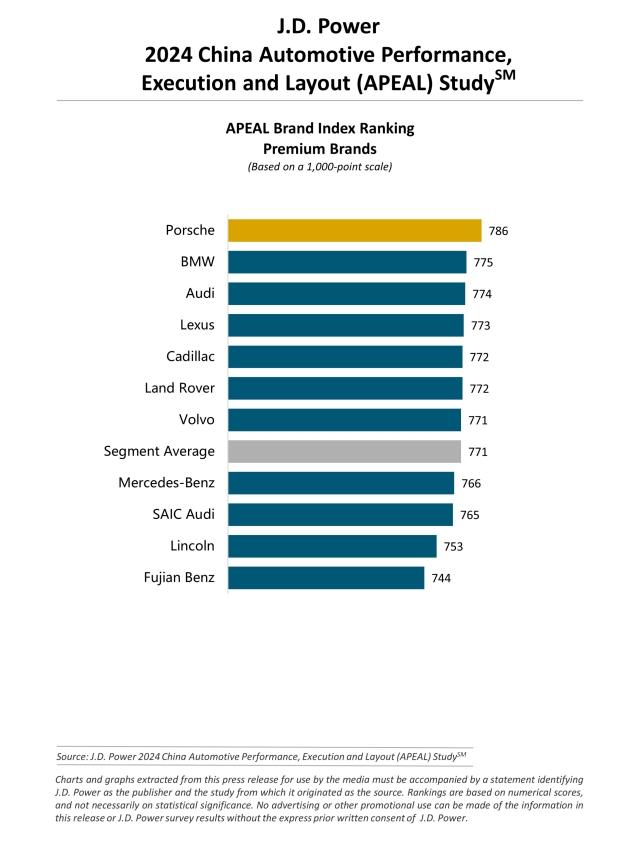

Porsche, FAW-Volkswagen and Chery Rank Highest in Respective Segment

SHANGHAI: 22 Aug. 2024 – Although overall automotive performance, execution and layout (APEAL) satisfaction is down one point from 2023 (on a 1,000-point scale) to 737 in 2024, the APEAL score of new internal combustion engine (ICE) vehicle owners has risen significantly to 741 points, up from 723 a year ago, marking the highest score since 2020, according to the JD Power 2024 China Automotive Performance, Execution and Layout (APEAL) Study,SM released today. Additionally, overall NEV-APEAL score for new energy vehicles (NEVs) is 789, an increase of 13 points from 2023. The rise in APEAL score of new models is mainly due to advancements in exterior, driving feel and driving comfort. The score for carry-over models is 737 points, down 2 points from 2023.

The study, now in its 22nd year, examines owners’ assessments of their new-vehicle experience within the first two to six months of ownership, specifically what appeals most to them based on their emotional attachment to and level of excitement with their new vehicle. The resulting data is used extensively by manufacturers to help them design and develop more appealing models.

“Amid the rising penetration of new energy vehicles, internal combustion engine vehicles are facing unprecedented challenges,” said Elvis Yang, general manager of auto product practice at JD Power China. “NEVs are reshaping the industry with their innovations in design and smart technology. To maintain their market position, ICE vehicle brands need to rethink their unique features and strengths. Gaining deeper insights into consumers’ preferences and seeking breakthroughs in key areas such as exterior design, fuel efficiency, and smart cabin experience will help these brands differentiate from NEVs.”

Following are key findings of the 2024 study:

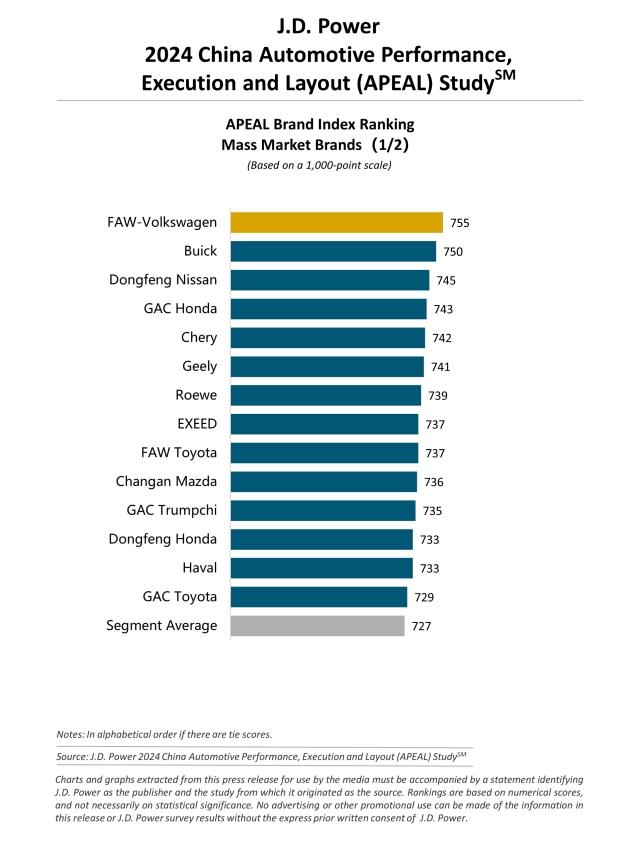

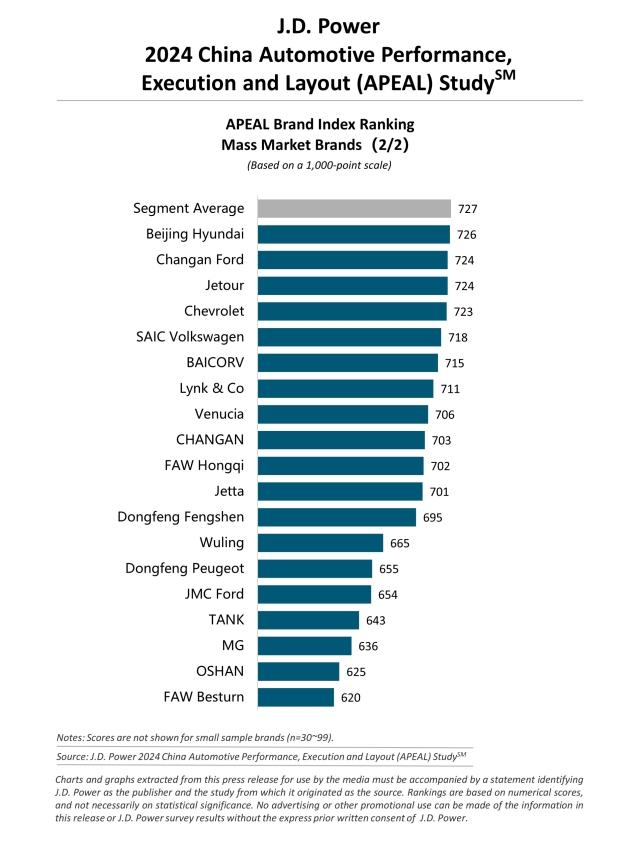

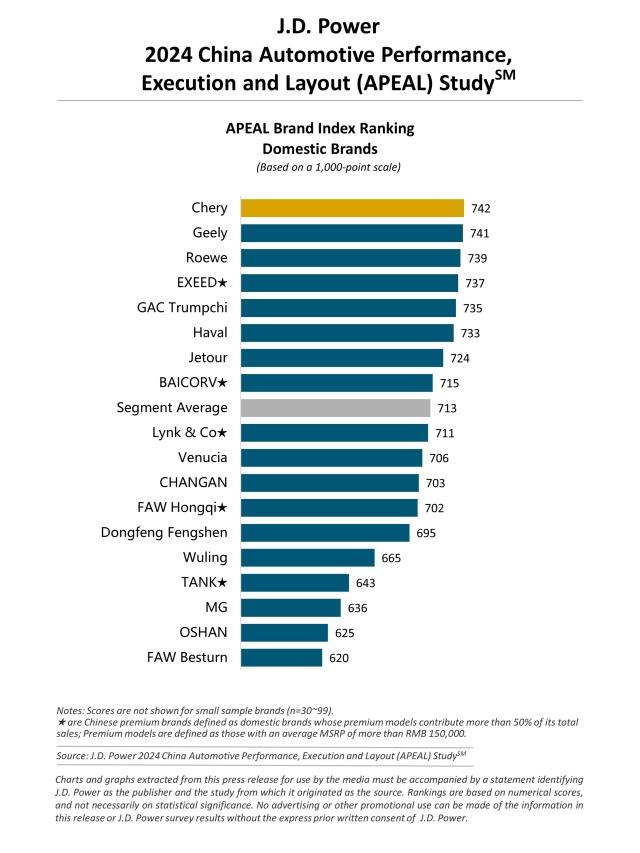

- Gap between premium and mass market brands has widened: In 2024, the APEAL score for premium brands has increased to 771, up 14 points from 2023. In contrast, mass market international brands have declined to 736 this year from 738, and the score for Chinese domestic brands has dropped to 713 from 722.

- Female owners have differing levels of infotainment satisfaction: In 2024, among females the APEAL score for the infotainment system in ICE vehicles has dropped to 732, down 10 points from a year ago, primarily due to frustrations with the infotainment system. Conversely, among females’ satisfaction with NEVs, the APEAL score reached 792, up 16 points year over year, largely driven by improvements in the infotainment system.

- Vehicle owners placing more emphasis on fuel economy: The importance of fuel economy has risen significantly, with its weight increasing to 17.2%, up from 15.4% in 2023. This is the largest increase and fuel economy is the highest weighted factor this year. The shift reflects growing owner concerns regarding vehicle costs and environmental effect, leading to higher expectations for fuel efficiency.

- App installation rates steadily rising: Installation rates for in-vehicle apps have increased across all brand categories. Premium brands have a 67% installation rate, up 7 percentage points from a year ago. Mass market international and Chinese domestic brands have installation rates of 53% and 48%, respectively, rising by 10 and 6 percentage points, respectively. However, remote control experiences through smartphones, smartwatches or other devices have not significantly improved. Satisfaction with premium brand apps has slightly increased (+0.2 points), while satisfaction with mass market international and Chinese domestic brands remains unchanged year over year.

Study Rankings

Porsche ranks highest in APEAL among premium brands with a score of 786. BMW (775) ranks second and Audi (774) ranks third.

FAW-Volkswagen is the highest-ranking mass market brand with a score of 755. Buick (750) ranks second and Dongfeng Nissan (745) ranks third.

Chery ranks highest among Chinese domestic brands with a score of 742. Geely (741) ranks second and Roewe (739) ranks third.

The segment-level APEAL awards by brand are for Chery Tiggo 8,Chery Tiggo 8 Plus, GAC Trumpchi GS3 Yingsu, GAC Trumpchi GS8, Porsche Macan, and Porsche Panamera.

Other models that rank highest in their respective segment are Audi A4L; BMW 5 Series; Buick All New GL8; Cadillac XT4; Geely Emgrand; Honda Accord; Honda XR-V; Land Rover Range Rover; Mercedes-Benz E-Class; Nissan Sylphy Classic; Toyota Wildlander; Volkswagen Bora; Volkswagen Lamando L; and Volvo XC60.

The China Automotive Performance, Execution and Layout (APEAL) Study measures owners’ emotional attachment to and level of excitement with their new vehicle across 37 attributes in 10 vehicle experience groups: exterior; setting up and starting; getting in and out; interior; performance; driving feel; keeping your safe; infotainment; driving comfort; and fuel economy.

The 2024 study is based on responses from 32,728 owners of gas-powered vehicles who purchased their new vehicle between June 2023 and March 2024. The study includes 221 models from 48 different brands and was fielded from December 2023 through May 2024 in 81 major cities across China. Additionally, data from the JD Power China New Energy Vehicle—Automotive Performance, Execution and Layout (NEV-APEAL) Study,SM which measures the APEAL satisfaction of NEV owners, is included for comparison in this study.

To learn more about the China Automotive Performance, Execution and Layout (APEAL) Study, please contact: china.marketing@jdpa.com.

JD Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, JD Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 55 years. The world's leading businesses across major industries rely on JD Power to guide their customer-facing strategies.

JD Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Mengmeng Wang, JD Power; China; +86 21 8026 5719; mengmeng.wang@jdpa.com

Geno Effler, JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info