The Quality of Newly Launched NEVs Lags Behind Carry-Over Models, JD Power Finds

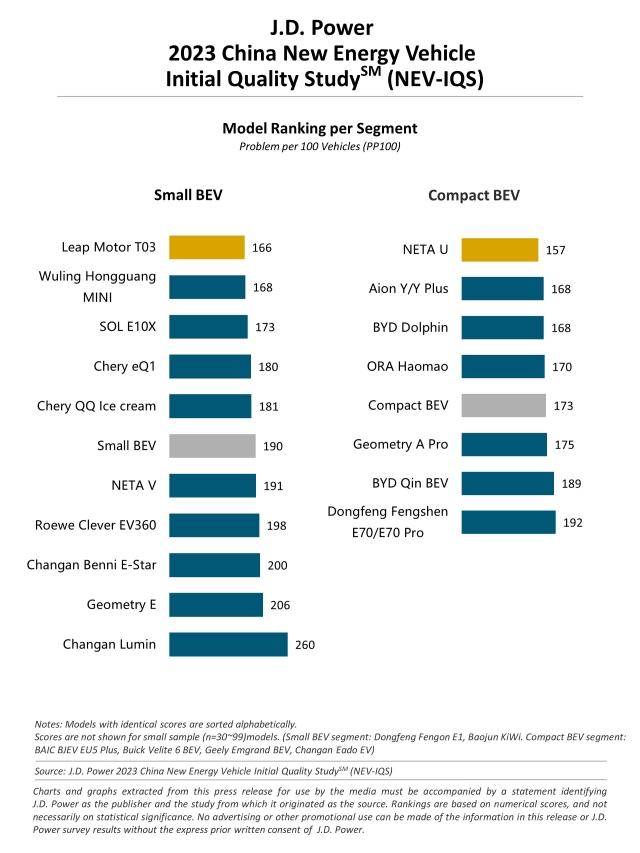

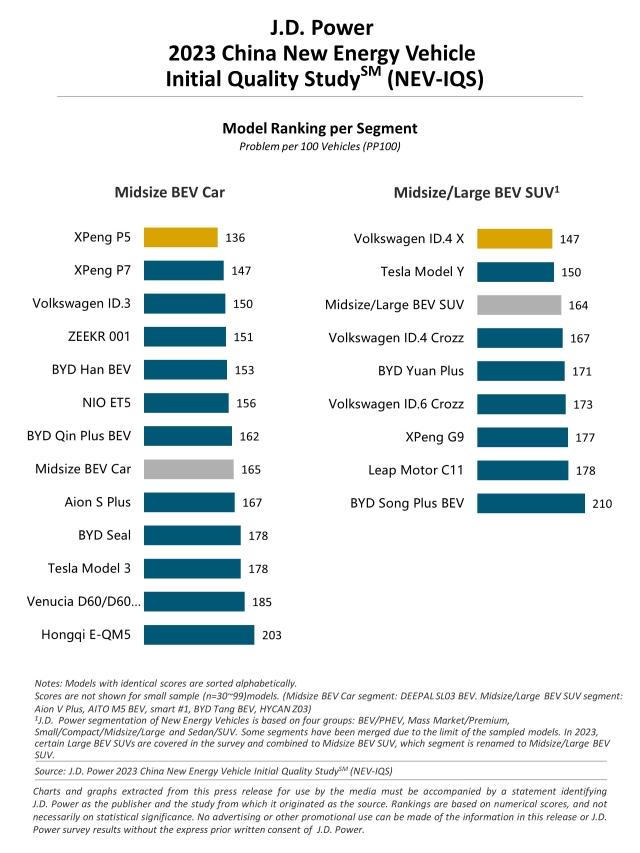

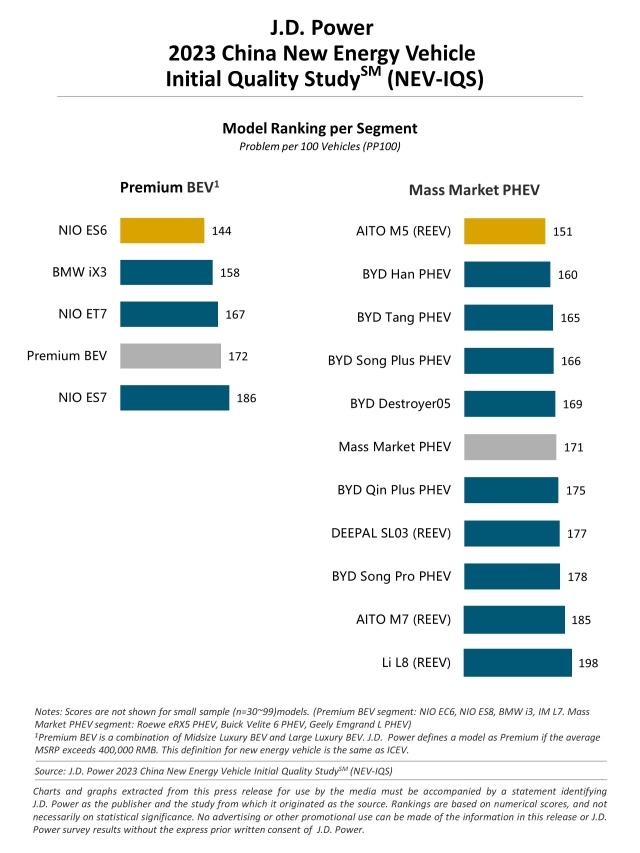

Leap Motor T03; NETA U; XPeng P5; Volkswagen ID.4 X; NIO ES6 and AITO M5 Rank Highest in Respective Segments

SHANGHAI: 1 June 2023 – The overall average quality of new energy vehicles (NEVs) this year, measured as problems per 100 vehicles (PP100), is 173 PP100, an increase of 21 PP100 from 2022, according to the JD Power 2023 China New Energy Vehicle Initial Quality Study (NEV-IQS),SM released today. A lower number of problems indicates higher quality.

The study, first published in 2019, is based on the annual JD Power U.S. Initial Quality StudySM (IQS). The NEV-IQS measures new-vehicle quality by examining problems experienced by NEV owners in China within the first two to six months of ownership.

The study shows that the number of NEV-related problems have increased. The quality problems of newly launched NEV models is 184 PP100, which is 15 PP100 higher than that of carry-over models. The quality of all-new models lags that of carry-over models in almost all categories measured in the study, especially in driving experience, which is 3.6 PP100 higher than carry-over models. Additionally, the number of quality problems in carry-over models has also increased year over year, up 20 PP100 from 2022.

“The competition in the NEV market is heating up, with various automakers constantly launching new models and improving the product matrix to seize market share,” said Elvis Yang, general manager of auto product practice at JD Power China. “The quality of new models is lower than of carryover models and a shorter R&D period and adaptation of complex technological configuration are contributing to this decline. Automakers need to pay more attention to user experience and quality management as they accelerate the launching of new models.”

Following are some key findings of the 2023 study:

- Interior smell and excessive road noise are most-often-cited problems: Unpleasant interior smell (9.3 PP100) is cited most often by NEV owners. This and excessive road noise (7.5 PP100) are two problems that have been cited among the top three quality problems for five consecutive years. Additionally, these two problems are also among the most-often-cited problems by owners of fuel-powered cars, reflecting the fact that vehicle owners in China have similar quality requirements for their vehicles regardless of power source.

- Midsize SUV segment is most competitive between BEV and PHEV: Currently, the midsize SUV segment has the largest sales proportion of battery-operated vehicles (BEVs) and plug-in hybrid electric vehicles ( PHEVs) and it is also the segment with the most newly launched NEVs. Compared with 2022, sales of midsize BEV SUVs have increased 8.7% and sales of midsize PHEV SUVs have increased 7.3%. With regard to PP100, midsize PHEV SUVs perform better on basic quality (e.g., driving experience, climate, seats), while midsize BEV SUVs perform better on powertrain.*

- Proportion of replacement purchases grows fastest: In 2023, the proportion of replacement purchase customers has grown the fastest in NEV market and the average transaction price is higher than that for first-time purchase and additional purchase customers. However, the overall quality satisfaction of replacement purchase vehicles is worse, 180 PP100, higher than for first-time purchases (by 6 PP100) and additional purchases (by 15 PP100).

* Sales data: Sales volume of 81 cities surveyed during the delivery period of qualified samples (July 2022-January 2023).

Highest-Ranked NEV Models

Models that rank highest in their respective segments are:

- Small BEV segment: Leap Motor T03

- Compact BEV segment: NETA U

- Midsize BEV car segment: XPeng P5

- Midsize/Large BEV SUV segment: Volkswagen ID.4 X

- Premium BEV segment: NIO ES6

- Mass Market PHEV segment: AITO M5

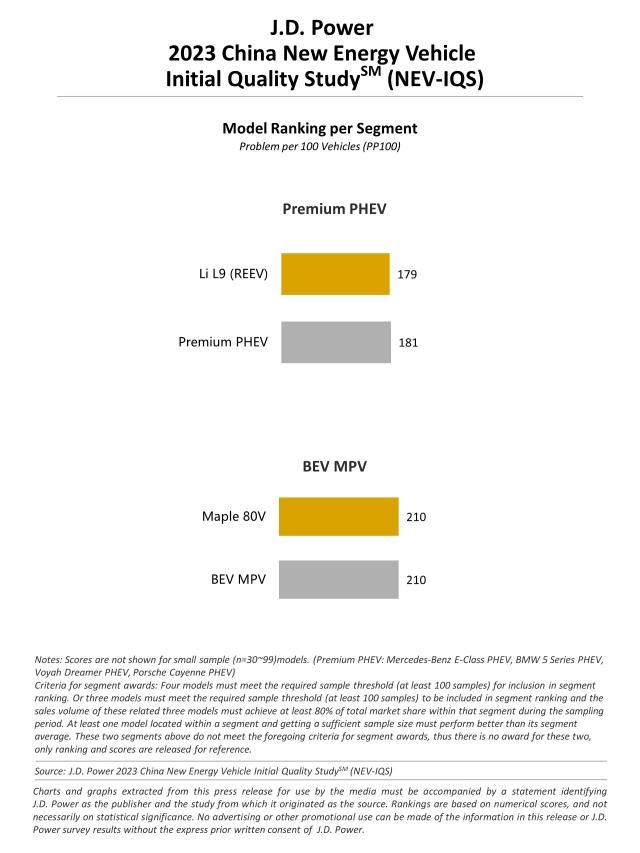

In the Premium PHEV and BEV MPV segments, criteria for awards were not met, thus no awards are given this year.

The China New Energy Vehicle Initial Quality Study (NEV-IQS) measures new-vehicle quality by examining problems experienced by NEV owners in two segments: design-related problems and defects/ malfunctions. Specific diagnostic questions include 236 problem symptoms across 10 categories: features/ controls/ displays; exterior; interior; infotainment system; seats; driving experience; driving assistance; powertrain; battery/ charging; and climate.

The study is based on responses from 7,191 vehicle owners who purchased their vehicle between July 2022 and January 2023. The study includes 76 models from 36 different brands, among which 53 models have sufficient samples. The study was fielded from January through March 2023 in 81 cities across China.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Mengmeng Wang, JD Power; China; +86 21 8026 5719; mengmeng.wang@jdpa.com

Geno Effler, JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

# # #

NOTE: Four chart follows.