Customer Satisfaction with Auto Financing from Banks Exceeds Captive Companies, JD Power Finds

Mercedes-Benz Auto-Finance and China Merchant Bank Rank Highest in Respective Segments

SHANGHAI: 27 July 2023 – Overall customer satisfaction with auto financing in China is 776 (on a 1,000-point scale), according to the inaugural JD Power China Customer Financing Satisfaction (CFS) Study,SM released today. Specifically, customer satisfaction with auto finance companies (775) is slightly lower than that of banks (777).

The study comprehensively examines the experience given by auto finance institutions in terms of auto finance product introduction, loan application process, approval efficiency, contract signing and after-sales service. The study also examines the comprehensiveness and convenience of auto finance institutions' digital functions.

The study finds that compared with captive companies, banks have become more satisfying for customers, specifically with auto financing. According to the JD Power 2023 China Dealer Financing StudySM released previously, dealer satisfaction with captive companies is much higher than that of banks, indicating customer satisfaction with auto finance institutions is not consistent with that of dealers.

“Customers can comprehensively evaluate which finance institutions could provide products and services to better meet their needs according to information found on websites,” said Joseph Yang, director of auto finance practice at JD Power China. “This shows us that the maturity of Chinese customers in the auto loan market has approached developed countries. Experienced vehicle shoppers can put forward their views on the products and services of finance institutions, thus promoting the improvement of the service of the entire auto finance industry."

Following are additional findings of the 2023 study:

- Customer satisfaction with finance institutions directly affects its referral rate: Customer satisfaction with auto-finance institutions is positively correlated with Net Promoter Score (NPS)[1] When the satisfaction score reaches 791, the referral rate is 23%. When the score drops to 756, the referral rate turns to only 4%.

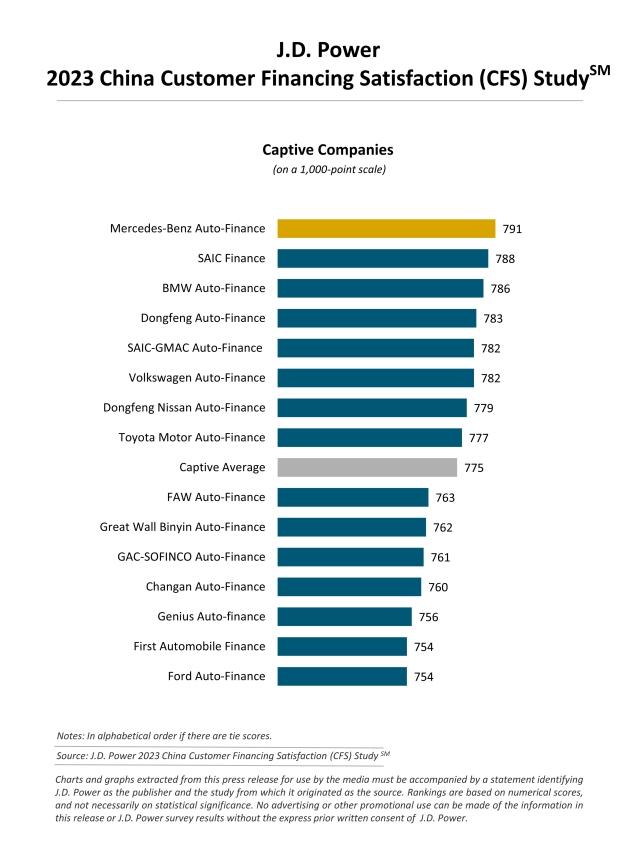

- Satisfaction with captive companies of premium brands is higher than mass market brands: In the captive company segment, Mercedes-Benz Auto Finance (791) and BMW Auto Finance (786) rank in the top three, along with mass market brand SAIC Finance . Satisfaction with captive companies of premium brands is in a leading position, especially in the product introduction and application and approval process.

- Product introduction has greatest effect and highest satisfaction: From the perspective of the five factors driving satisfaction, product introduction has the highest effect with 28% and has the highest satisfaction of 787. Application & approval process and after-sales service each score 771, which has the lowest satisfaction and needs to be improved.

[1] Net Promoter System®, Net Promoter Score®, NPS®, and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.

Study Rankings

In the segment of captive companies, Mercedes-Benz Auto-Finance ranks highest with a score of 791 followed by SAIC Finance (788) and BMW Auto-Finance (786).

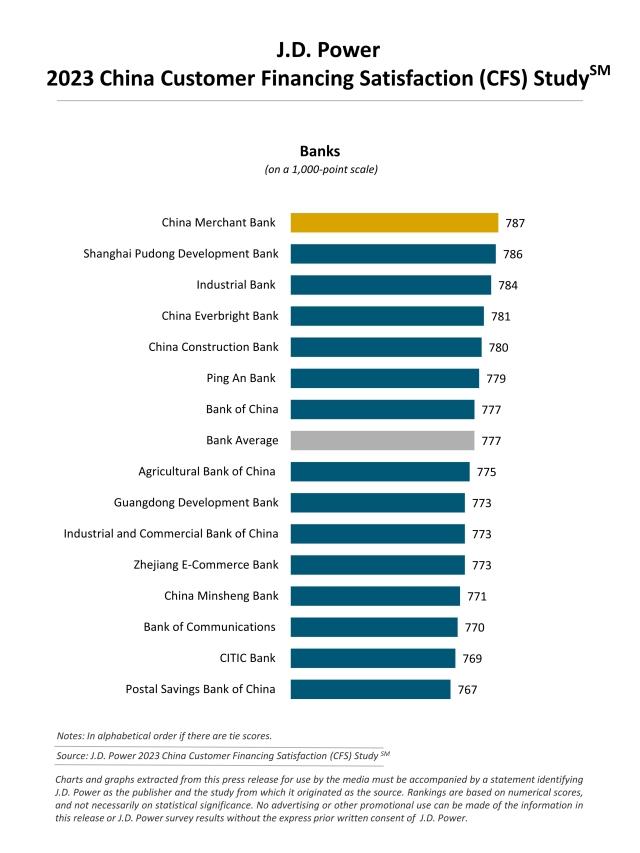

In the segment of banks, China Merchant Bank ranks highest with a score of 787 followed by Shanghai Pudong Development Bank (786) and Industrial Bank (784).

The study interviewed a total of 12,722 new car buyers who have financed their car purchases across 81 cities in China. The study was fielded between December 2022 and May 2023 and examines customers satisfaction in five measures (in order of importance): product introduction (28%); application and approval process (20%); after-sales service (19%); contract signing (16%); and digital experience (16%).[2]

[2] The weights are presented in rounded form, and the actual calculation is based on decimal places.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Mengmeng Wang, JD Power; China; +86 21 8026 5721; mengmeng.wang@jdpa.com

Geno Effler, JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info