Potential Vehicle Buyers in China Continue to Lose Before Visiting Dealership, JD Power Finds

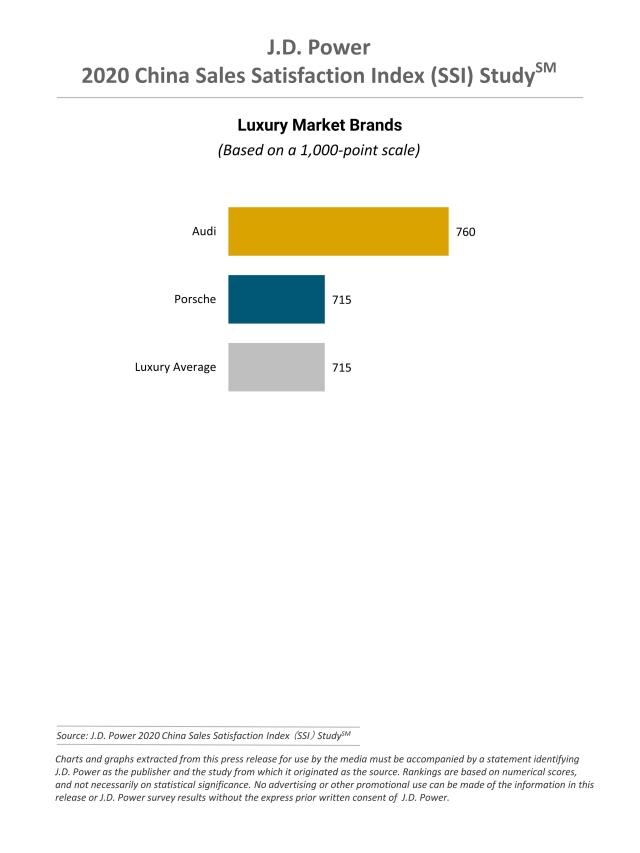

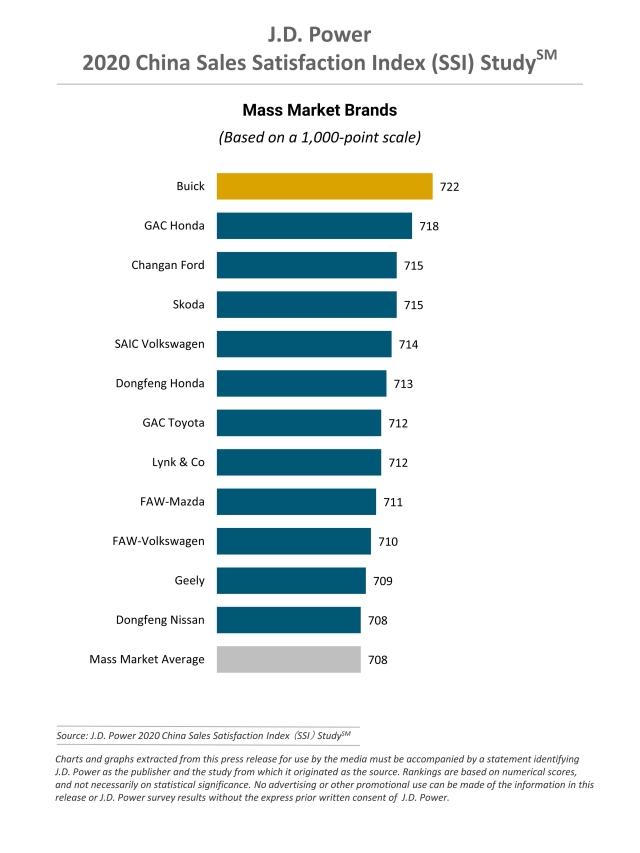

Audi Ranks Highest among Luxury Brands; Buick Ranks Highest among Mass Market Brands

SHANGHAI: 2 July 2020 — The percentage of vehicle buyers who decide against purchasing a particular brand before visiting the dealership has increased for a fourth consecutive year, rising to 43% in 2020 from 10% in 2017, according to the JD Power 2020 China Sales Satisfaction Index (SSI) Study,SM released today. As new-vehicle sales in China slow down, each potential buyer is more precious than ever before. Both brands and dealers should be wary of the increasing loss of potential customers in the early vehicle purchase phase.

The study, now in its 21st year, measures customer satisfaction with the purchase experience among new-vehicle buyers and rejecters, defined as those who consider a brand seriously but ultimately buy another brand.

According to the study, 24% of potential buyers reject a brand when searching vehicle information online, compare with 6% in 2017, and those who reject a brand in the pre-visit communications with dealers has increased to 19% from 4% in 2017. Concerns about products are the main reasons for customer loss in pre-visit phases, such as features of the model do not meet expectations; vehicle appearance is not as expected; and few varieties of models are available.

"Pre-visit communications are critical to win sales,” said Eileen Ren, vice president of digital customer experience at JD Power China. “Customers are likely to make less informed decisions if they do not have hands-on experience with vehicles. That is why dealers need to help customers get a better understanding of the vehicle in pre-visit communications by asking their requirements and inviting them to take a test drive, to prevent them from making hasty decisions.”

The study also finds that the purchase experience is vital to fuel customer purchase decisions. In 2020, five factors that impact the decision of which vehicle to purchase are: purchase experience (16%); vehicle quality (30%); brand (19%); design (18%); and price (16%).

“As the automotive market in China is slowly recovering from the COVID-19 pandemic, automakers and dealers need to concentrate more on the customer purchase experience and utilize the close contact opportunity with customers to fully demonstrate the advantages of vehicle quality and design, in order to drive purchase decisions. Automotive brands and dealers that make continuous investments in products and services are likely to win larger market share after the pandemic,” Ren said.

Following are additional findings of the 2020 study:

- The gap in satisfaction between mass market brands (708) and luxury brands (715) narrows: The gap in overall customer satisfaction between mass market brands and luxury brands has significantly narrowed to 7 points (on a 1,000-point scale) from 29 points in 2019. Satisfaction with domestic brands in China improves constantly, and the gap between domestic brands and the industry average has shrunk to 9 points this year from 22 points in 2018.

- Vehicle buyers under age 30 are more satisfied: The proportion of vehicle buyers under age 30 (32%) has exceeded buyers ages 31 to 35 (30%), 36 to 39 (22%) and over 40 years old (17%) to become the largest customer group. Automakers and dealers have made remarkable progress in improving satisfaction of young customers: the satisfaction of buyers under age 30 increases faster than in any other age group this year and their satisfaction is also at the highest level, which is 76 points higher than in 2017.

- Trade-in business is yet to be explored: The number of vehicle buyers who are interested in trade-in service in 2020 is 3.1 times that in 2017, but trade-in owners only account for 18% of customers who buy an additional vehicle or replace their existing vehicle with a new one. Dealer recommendation on trade-in service can effectively increase the proportion of customers willing to trade in their old vehicle, which can help secure the final deal price as well as promote the used- vehicle business.

Study Rankings

For an eighth consecutive year, Audi ranks highest among luxury brands with a score of 760. Porsche ranks second with a score of 715.

Buick ranks highest among mass market brands with a score of 722. GAC Honda (718) ranks second. Changan Ford and Skoda (each with 715) rank third in a tie.

The JD Power 2020 China Sales Satisfaction Index (SSI) Study measures sales satisfaction among new-vehicle buyers and rejecters. Buyer satisfaction is based on seven measures: online experience (18%); communication before visit (9%); reception (14%); showroom visit (13%); test drive (10%); deal (17%) and delivery process (20%). Rejecter satisfaction is based on six measures: online experience (25%); communication before visit (22%); reception (23%); showroom visit (15%); test drive (7%); and negotiation (9%).

The 2020 study is based on responses from 23,151 vehicle owners in 70 major cities who purchased their new vehicle between May 2019 and February 2020. The study was fielded from November 2019 through April 2020.

For more information about the JD Power China Sales Satisfaction Index (SSI) Study, visit HERE.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Damon Liu; JD Power; China; +86 21 8026 5721; damon.liu@jdpa.com

Geno Effler; JD Power; Costa Mesa, California, USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info