Sales Satisfaction Declines Despite Heavy Price Discounting in Auto Retailers, JD Power Finds

Audi Ranks Highest among Luxury Brands; Dongfeng Citroën Ranks Highest among Mass Market Brands

SHANGHAI: 30 June 2016 — Despite automakers and dealers offering larger discounts to vehicle buyers than in 2015, overall sales satisfaction in China has declined from last year, according to the JD Power 2016 China Sales Satisfaction Index (SSI) Study,SM released today.

The study, now in its 17th year, measures customer satisfaction with the new-vehicle sales experience based on five factors (in order of importance): delivery process (23%); sales initiation (21%); deal (20%); dealer facility (19%); and salesperson (17%). Sales satisfaction is calculated on a 1,000-point scale.

In the luxury segment, the average discount per vehicle has increased to RMB 33,468 in 2016 from RMB 17,108 in 2014, and the average discount per vehicle in the mass market segment has increased to RMB 9,303 from RMB 7,316. However, overall sales satisfaction has decreased in both the luxury and mass market brand segments, presenting a significant challenge to the industry to balance between discounting and delivering a fulfilling sales experience.

“Despite these challenges, we believe tremendous opportunities exist for dealers to make an impact on the sales experience beyond focusing on discounting,” said Jason Jiang, general manager, auto sales and marketing at JD Power. “Personalized one-on-one services during and after the purchase are more likely to impress shoppers and maximize the value of a long-term relationship with customers.” For example, study findings show that in both the mass market and luxury segments, satisfaction is significantly higher among customers who say their salesperson made them “feel pleasant.”

Additionally, satisfaction increases by 54 points when the vehicle is delivered to the customer with a special ceremony. Other study findings show that vehicle performance is playing an increasingly important role in the purchase decision. For the first time in the study, performance is the third most influential reason new-vehicle shoppers choose a specific make and model, cited by 11% of customers in 2016, up from 6% in 2015.

“Valuing vehicle performance is good news for dealers, as consumers are spending more time online shopping, but the best opportunity for them to experience vehicle performance is to visit a dealer,” said Jiang. “Dealers must use the vehicle to impress shoppers during the test drive and engage customers beyond the final sale.”

Overall satisfaction among new-vehicle owners who were offered the option to choose a different test route during the test drive is 682, compared with 638 among those who were not offered a test route option.

Other key findings of the study include:

- Using Internet as Information Source Saves Money: On average, new-vehicle owners who used the Internet during the shopping process received a discount of RMB 12,856, compared with RMB 10,130 among non-Internet users. Additionally, satisfaction is higher among owners who used the Internet as an information source while shopping (672) than among those who did not (657).

- 1990s Generation Presents Unique Needs: Compared to other generations, consumers born in the 1990s have stronger needs for finance and insurance services when buying a new vehicle. The study shows more owners in the 1990s generation purchase their vehicle via a loan/installation (21%) and buy the car insurance recommended by the dealer (79%), compared with those in the older generations. These service offerings significantly impact satisfaction scores. For example, satisfaction among those in the 1990s generation whose dealer recommended their preferred insurance company is 55 points higher than among those whose dealer did not recommend their preferred insurer (691 vs. 636, respectively).

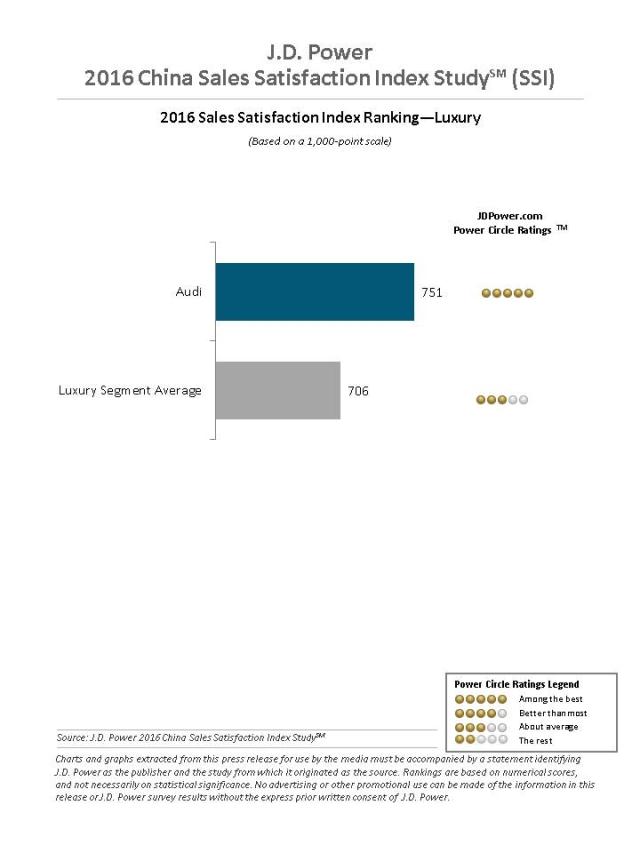

Audi ranks highest among luxury brands in satisfaction with the new-vehicle sales experience for a fourth consecutive year, with a score of 751. This also marks the seventh consecutive year Audi has ranked highest in the study.1

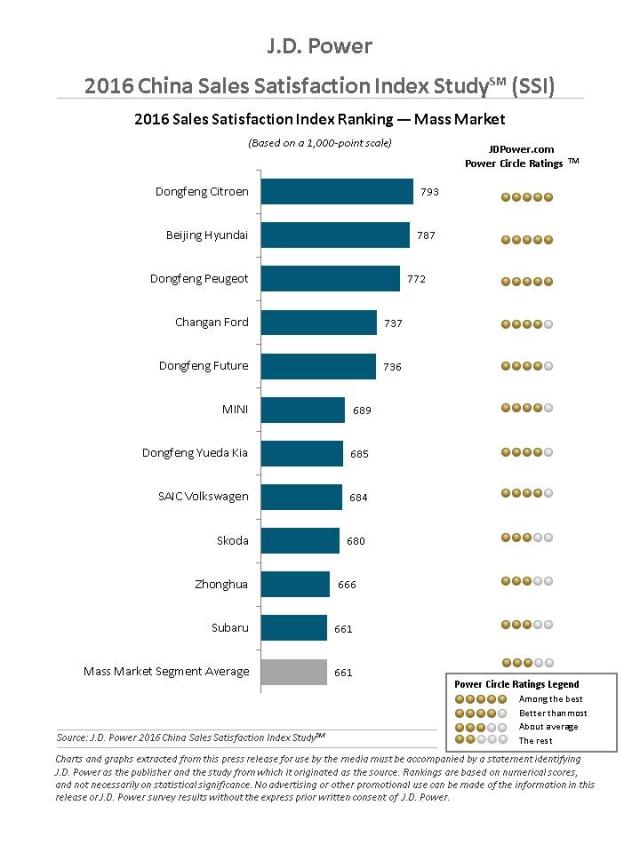

Dongfeng Citroën ranks highest among mass market brands, with a score of 793. Beijing Hyundai ranks second (787) and Dongfeng Peugeot ranks third (772).

The 2016 China Sales Satisfaction Index (SSI) Study is based on responses from 15,180 vehicle owners who purchased their new vehicle between May 2015 and February 2016. The study was fielded from November 2015 through April 2016.

About JD Power

JD Power has offices in Tokyo, Singapore, Beijing, Shanghai, Malaysia and Bangkok that conduct customer satisfaction research and provide consulting services in the automotive, information technology and finance industries in the Asia Pacific region. Together, the six offices bring the language of customer satisfaction to consumers and businesses in Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Taiwan, Thailand and Vietnam. Information regarding JD Power and its products can be accessed through the Internet at asean-oceania.jdpower.com. About JD Power and Advertising/Promotional Rules www.jdpower.com/about-us/press-release-info

----------------------

1 Audi ranked highest in the 2010, 2011 and 2012 studies, when all brands were included in one segment.