New-Vehicle Quality in China Drastically Improves, JD Power Finds

Audi and Dongfeng Yueda Kia Rank Highest Among Luxury and Mass Market Brands, Respectively

BEIJING: 8 Aug 2019 – New-vehicle quality in China has improved significantly with a 10% decrease in problems from 2018, according to the JD Power 2019 China Initial Quality Study (IQS),SM released today. Of the 67 brands included in the study, 52 improved.

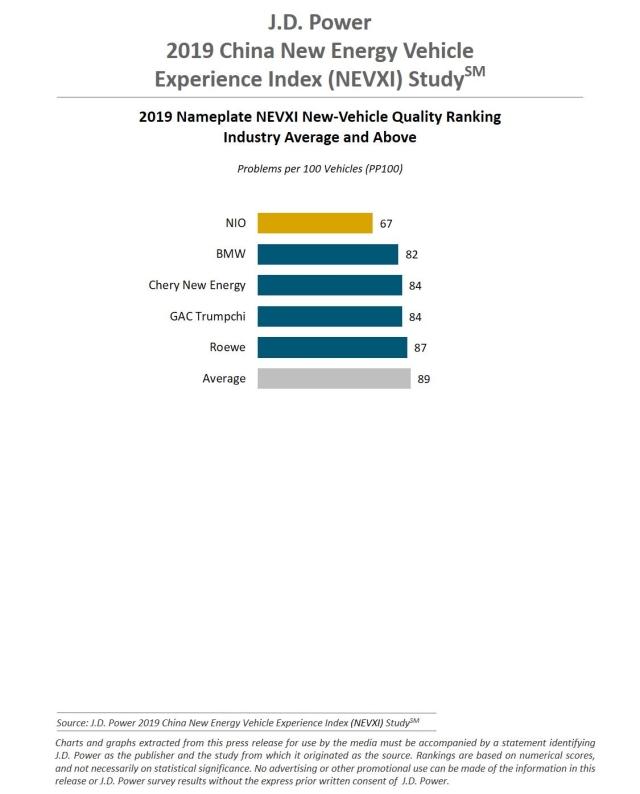

The study, now in its 20th year, measures new-vehicle quality by examining problems experienced by new-vehicle owners within the first two to six months of ownership. The overall initial quality score is determined by problems reported per 100 vehicles (PP100), with a lower number of problems indicating higher quality.

According to the study, the average new-vehicle quality score of the industry this year is 95 PP100, which is 10 PP100 less than last year. Improvements occur in six of eight study categories and the most improved categories are interiors (down 2.9 PP100 from 2018); audio/ communications/ entertainment/ navigation (down 2.9 PP100 from 2018); and seats (down 2.2 PP100 from 2018).

“After stalling for five years, new-vehicle quality in China is at its highest level ever,” said Jeff Cai, General Manager of Auto Product, JD Power China. “This proves that automakers are listening to their customers feedback carefully and putting effort toward improving customer satisfaction. This progress, most notably, is achieved in a downturn market, making it more prominent.”

Following are some key findings of the 2019 study:

- Few most common issues still prevalent: The score of the top 20 problems cited by vehicle owners this year is 1.5 PP100 more than last year (51.4 PP100 vs. 49.9 PP100), and 12 of the top 20 have worsened.

- Quality of Chinese domestic brands improve dramatically: The number of problems among Chinese domestic brands has dropped 12% to 101 PP100 from 115 PP100 in 2018. Seven of the eight categories have improved and the only category to decline is engine/transmission (+2.1 PP100).

- The gap between Chinese domestic brands and international brands narrows: The average gap between the Chinese domestic and international brands had been 14 PP100 for the past three years but has significantly improved to 9 PP100 this year.

Highest-Ranked Brands and Models

Audi ranks highest in initial quality among luxury brands with a score of 73 PP100. Lexus and Porsche (76 PP100) rank second in a tie.

Dongfeng Yueda Kia is the highest-ranked mass market brand, with a score of 83 PP100. MINI ranks second with a score of 86 PP100. Beijing Hyundai, GAC Honda and Jeep (89 PP100) rank third in a tie.

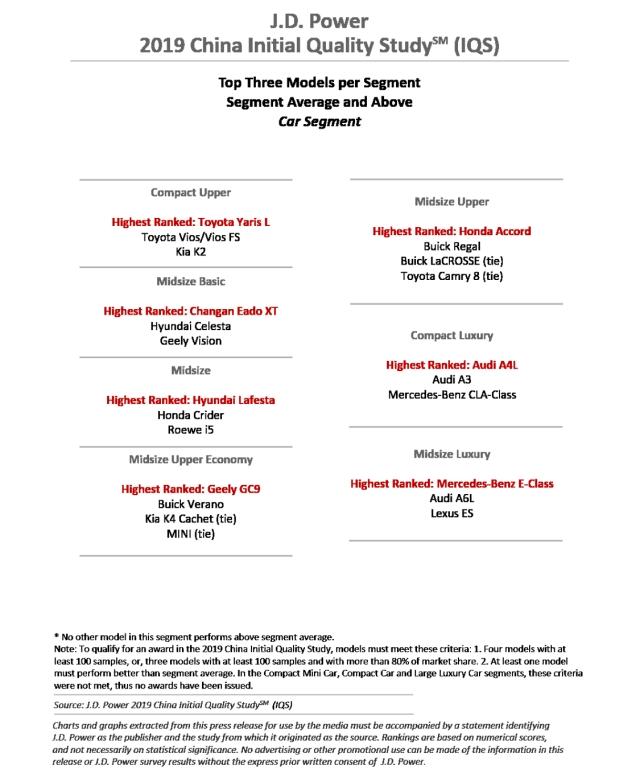

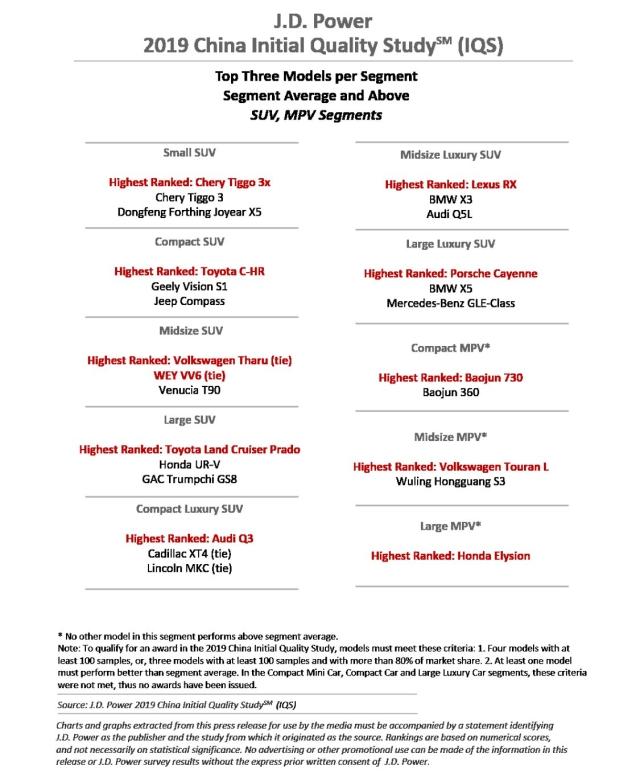

There are 18 models from 15 brands are eligible for awards across 17 segments in the 2019 study.

- GAC Toyota models that rank highest in their respective segments are Toyota Yaris L and Toyota C-HR.

- Audi models that rank highest in their respective segments are Audi A4L and Audi Q3.

- SAIC Volkswagen models that rank highest in their respective segments are Volkswagen Tharu and Volkswagen Touran L.

Other models that rank highest in their respective segments are Baojun 730; Changan Eado XT; Chery Tiggo 3x; Geely GC9; Honda Accord; Honda Elysion; Hyundai Lafesta; Lexus RX; Mercedes-Benz E-Class; Porsche Cayenne; Toyota Land Cruiser Prado; and WEY VV6.

The 2019 China Initial Quality Study measures new-vehicle quality by examining problems in two categories: design-related problems and defects/ malfunctions. Specific diagnostic questions include 233 problem symptoms across eight categories: interior; exterior; engine/ transmission; driving experience; features/ controls/ displays; seats; audio/ communication/ entertainment/ navigation; and heating/ ventilation/ air conditioning.

The 2019 study is based on responses from 33,468 vehicle owners who purchased their cars between May 2018 and March 2019. The study includes 266 models from 67 different brands and was fielded from November 2018 through May 2019 in 75 major cities across China.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, South America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Shana Zhuang; JD Power; China; +86 21 8026 5719; shana.zhuang@jdpa.com

Geno Effler; JD Power; Costa Mesa, California, USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Ruleswww.jdpower.com/business/about-us/press-release-info