Increase in Advanced Technology Penetration Signals Battle Heating Up, JD Power Finds

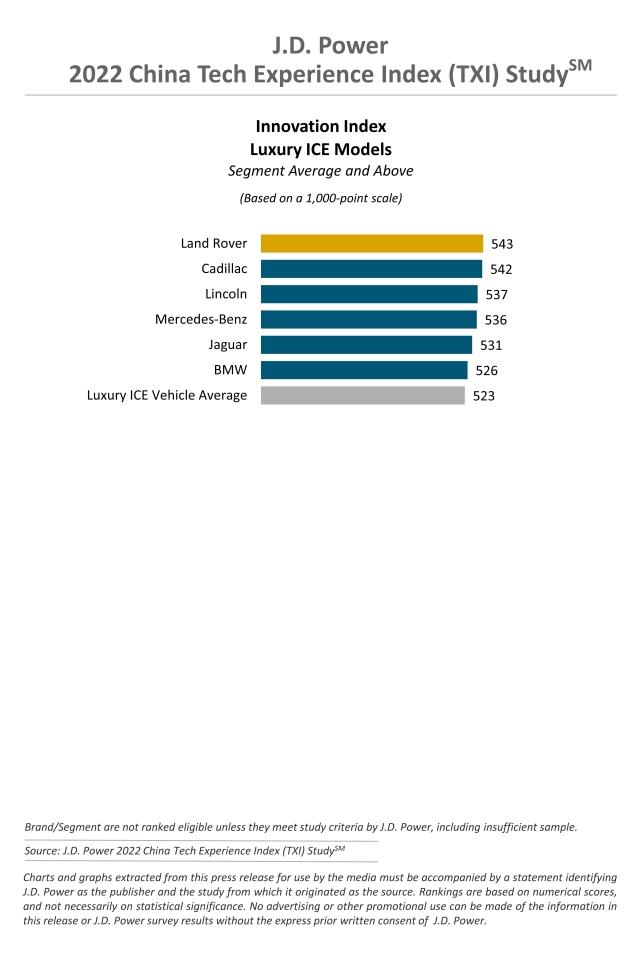

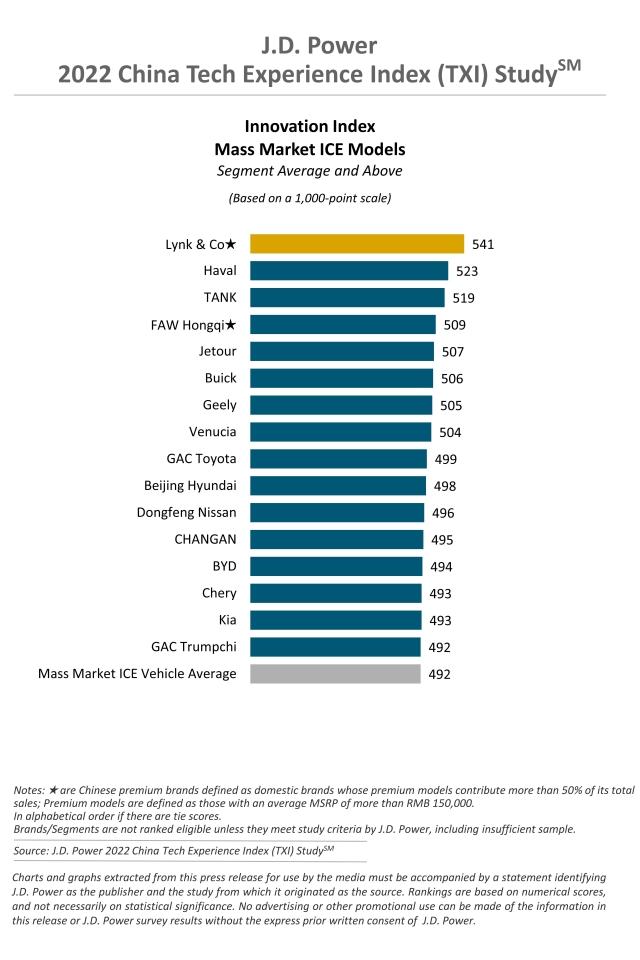

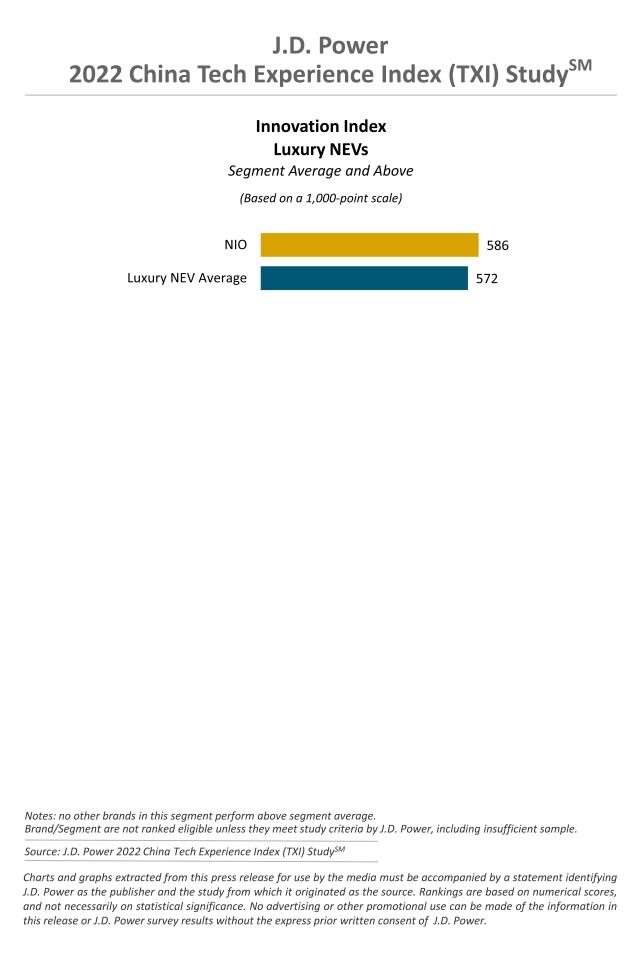

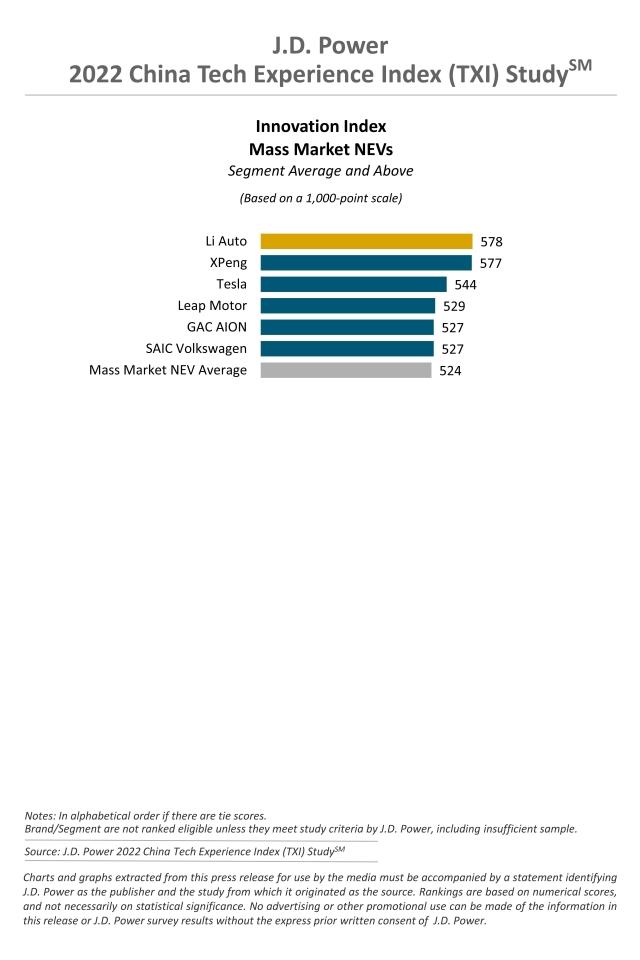

Land Rover, Lynk & Co, NIO and Li Auto Rank Highest in Respective Segments

SHANGHAI: 4 Aug. 2022— The penetration level of advanced technologies in the China vehicle market has notably increased and a battle between automakers is heating up, according to the JD Power 2022 China Tech Experience Index (TXI) Study,SM released today.

The study, now in its third year, focuses on new-vehicle owners’ perceptions of 29 advanced technologies and 13 basic technologies when first introduced in the market. The TXI Innovation Index—which consists of the Technology Execution Index[1] and Market Depth Index,[2] both of which are equally weighted—measures how effectively each automotive brand brings these technologies to market. The index combines the level of adoption of new technologies for each brand with the excellence in execution. The execution metric examines how much owners like the technologies and how many problems they experience while using them.

The study finds that the overall industry TXI Innovation Index in 2022 is 505 (on a 1,000-point scale). The Market Depth Index has notably increased, to 120 in 2022 from 80 in 2021. However, the Technology Execution Index has decreased, to 829 in 2022 from 880 in 2021. For China startup automakers, the Market Depth Index is 242 and the Technology Execution Index is 831, thus these automakers continue leading the advanced technology battle with the two other automaker groups. In comparison, the scores in the Market Depth Index and the Technology Execution Index for domestic traditional automakers are 112 and 828, respectively, and for international automakers are 118 and 829, respectively. The gap in these two indices between domestic traditional and international automakers is narrow, indicating the advanced technology battle among domestic traditional and international automakers is heating up.

“The intelligent vehicle field has been the most important battlefield for more and more automakers,” said Elvis Yang, general manager of auto product practice at JD Power China. “The acceptance of advanced technologies by consumers has gradually improved, which not only gives the power of innovation to automakers but also promotes the intelligent transformation for the whole industry. Therefore, centering on user demand and user experience to undertake research and development is critical, as well as on user education, which is also very important for all automakers. By focusing on exploring user demand from different scenarios, brands can lead the intelligent development of the China market to the next level.”

Following are additional findings of the 2022 study

- The increasing penetration of advanced technologies leads to the growth of problems: The industry average number of problems of technologies this year is 32.4 problems per 100 vehicles (PP100), which has increased by 4.8 PP100 from last year. The PP100 for Smart Cockpit has increased by 3.9 PP100 with the highest increase in the metric for broken/not working; in Smart Driving, problems have increased by 0.6 PP100 and the largest increase is for difficult to understand/use.

- User experience has increased for Smart Cockpit and Smart Driving technologies: In 2022, owners are more satisfied with both technology ecosystems. Ease of use is the top-rated experience metric in Smart Cockpit, while effectiveness, usefulness and responsiveness also have risen, which indicates increasing satisfaction with the functionality of the technologies. However, Smart Driving has yet to provide the same level of satisfaction for usefulness and effectiveness as well as interface aesthetics, which indicates that owners are paying more attention to the functionality of these features as smart driving technologies penetrate the market. To stay competitive in this category, OEMs need to consider the technology value for their target customers.

- Luxury brand owners most satisfied with digital key, mass market owners most satisfied with ground view camera: In multiple metrics, luxury brand owners are most satisfied with phone-based digital key while interior gesture control is one of the least satisfying features in terms of functionality and reliability. In multiple metrics among mass market brand owners, ground view camera receives the highest satisfaction and face ID receives low satisfaction for functionality and trust.

- Demand of advanced technologies by owners varies by age group: Generation X owners are more interested in technologies that can offer safety and convenience when driving. Repurchase intention among this group for camera rear-view mirror and trip tracker and driving assessor are higher than industry average by 8 and 5 percentage points, respectively. Generation Z owners are drawn to technologies that have connectivity. Repurchase intention among this group for phone-based digital key and vehicle-home connection system are 10 and 9 percentage points, respectively, higher than industry average.

Highest-Ranked Brands

Land Rover ranks highest among luxury internal combustion engine (ICE) models with a score of 543, followed by Cadillac (542) and Lincoln (537). Lynk & Co ranks highest among mass market ICE models with a score of 541, followed by Haval (523) and TANK (519). NIO (586) ranks highest among luxury new energy vehicles (NEVs); no other brand in this segment performs above segment average. Li Auto ranks highest among mass market NEVs with a score of 578. Xpeng (577) ranks second and Tesla (544) ranks third.

The 2022 study is based on responses from 35,277 ICE vehicle owners who purchased their vehicle between June 2021 and March 2022, as well as 5,686 NEV owners who purchased their vehicle between September 2021 and March 2022. The study includes 247 ICE models from 56 brands and 65 NEV models from 36 brands. The study was fielded from December 2021 through May 2022 in 70 major cities across China.

The China Tech Experience Index (TXI) Study, which complements the China Initial Quality Study (IQS) and the China Automotive Performance, Execution and Layout (APEAL) Study, is used extensively by automakers and suppliers worldwide to provide an overview of how vehicle owners perceive the advanced technology features and to help the industry address any problematic areas before the technologies are made widely available across automotive portfolios, thus improving the future owner experience.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Phyllis Zuo, JD Power; China; +86 21 8026 5719/ phyllis.zuo@jdpa.com

Geno Effler, JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

[1] The Technology Execution Index is formulated from respondents’ overall experience and the total problems experienced with the advanced technologies they have and use. The index weights are derived from survey responses using multivariate linear regression. As a result, the index weights could differ by study market or study year.

[2] The Market Depth Index is a measurement of the penetration level of advanced technologies. The calculation encompasses the popularity of equipping and usage of advanced technologies.