Electric Vehicles Made by China Startups Score Highest Among High-Appeal Models While International Automakers Improve the Most, JD Power Finds

NETA V, Aion Y, XPeng P7, BYD Song Plus BEV, NIO ES8 and Li ONE Rank Highest in Respective Segments

SHANGHAI: 28 July 2022 – New energy vehicles (NEVs) made by China startup automakers[1] score highest and international NEV automakers improve the most, while domestic traditional NEV automakers have the lowest performance, according to the JD Power 2022 China New Energy Vehicle–Automotive Performance, Execution and Layout (NEV-APEAL) Study,SM released today.

The study examines NEV owners’ assessments of their new vehicles within the first two to six months of ownership. The data is used extensively by NEV manufacturers to design and develop more appealing models. In 2022, the average NEV-APEAL score for Chinese NEVs is 739 (on a 1,000-point scale). Compared with 2021, the average score has increased 4 points.

The study shows that NEV-APEAL satisfaction among owners of vehicles manufactured by Chinese startups in 2022 is 758, a significantly higher score than those of other manufacturers in each of 11 categories the study measures, including exterior, interior, performance, infotainment, driving range and charging experience. International automaker NEVs (744) have improved the most, increasing 10 points from 2021. However, domestic traditional automaker NEVs (731) perform relatively lower than the manufacturers in the other two categories.

“Product design is the main factor that customers consider when purchasing NEVs,” said Elvis Yang, general manager of auto product practice at JD Power China. “The reason Chinese startups are keeping their leading position in all aspects of vehicle appeal is not only their unique concept and approach to making vehicles but also their pursuit of product design and clear product positioning. In an era of aesthetics first, NEV manufacturers and brands need to understand their customers better, especially those in the next generation. JD Power data can help manufacturers better understand consumer preferences.”

Following are some key findings of the 2022 study

- NEVs perform lower in exterior styling than last year: The NEV-APEAL satisfaction score has decreased in exterior styling, to 763 from 773 in 2021. Conversely, the scores in other vehicle experience categories have all increased.

- Small battery electric vehicles (BEVs) still lag far behind industry average while luxury BEVs and midsize BEV cars are significantly higher: The NEV-APEAL score for small BEVs is 721, 18 points below the industry average, while the score for luxury BEVs is 21 points higher than average and 16 points higher than average for midsize BEVs.

- International automaker NEVs lead in driving range: The average driving range of Chinese NEV vehicles when fully charged is 359 km, representing a 26 km increase from 2021. The average driving range of international automaker NEVs (443 km) has increased 56 km from last year, and is 84 km higher than the average. The average driving range of Chinese startup NEVs (367 km) is 8 km higher than average while those of domestic traditional NEV automakers (320 km) is 39 km lower than average.

- NEV owners have varying preferences for body color: Owners of small BEVs prefer blue body color; compact BEV owners prefer white; midsize BEV owners prefer both black and grey; midsize BEV SUV owners prefer black; and mass market plug-in hybrid electric vehicle (PHEV) owners prefer grey.

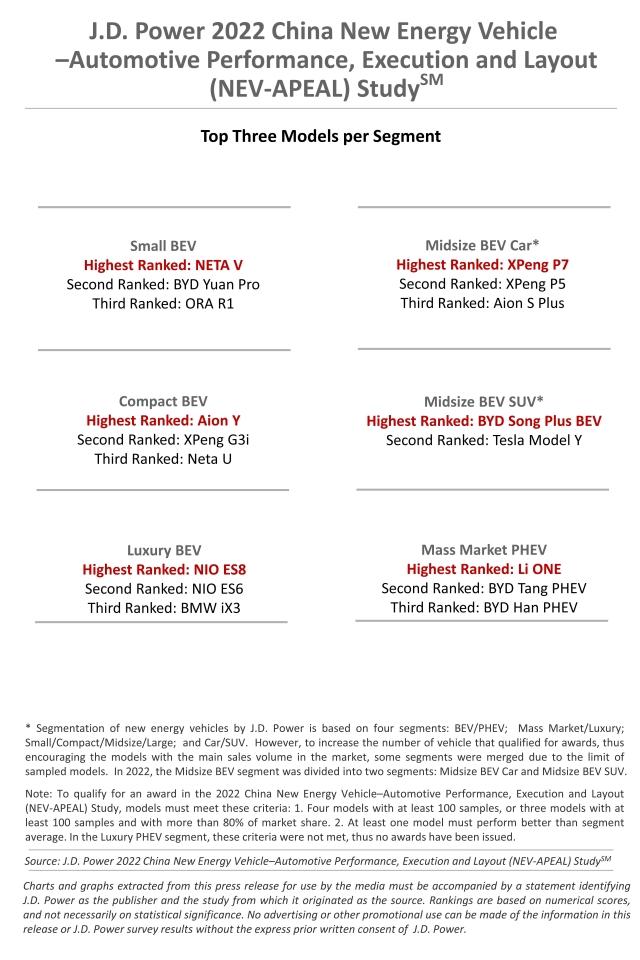

Highest-Ranked Models

Models that rank highest in their respective segments are:

- Small BEV segment: NETA V

- Compact BEV segment: Aion Y

- Midsize BEV car segment: XPeng P7

- Midsize BEV SUV segment: BYD Song Plus BEV

- Luxury BEV segment: NIO ES8

- Mass market PHEV segment: Li ONE

In the luxury PHEV segment, criteria for awards were not met, thus no awards are given this year in this segment.

The China New Energy Vehicle–Automotive Performance, Execution and Layout (NEV-APEAL) Study measures NEV owners’ emotional attachment to and level of excitement with their new vehicle across 45 attributes in 11 vehicle experience categories: exterior; setting up and starting; getting in and out; interior; performance; driving feel; keeping you safe; infotainment; driving comfort; fuel economy and driving range; and charging experience.

The study is based on responses from 5,686 new energy vehicle owners who purchased their vehicle between September 2021 and March 2022. The study includes 65 models from 36 different brands, among which 45 models have sufficient samples. The study was fielded from March through May 2022 in 56 cities across China.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Phyllis Zuo, JD Power; China; +86 21 8026 5719; phyllis.zuo@jdpa.com

Geno Effler, JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

[1] China startup automakers included in 2022 NEV-APEAL Study are HiPhi, Leap Motor, Letin, Li Auto, NETA, NIO, Weltmeister and XPeng.