China New-Vehicle Quality Decreases as Design-Related Problems Increase, JD Power Finds

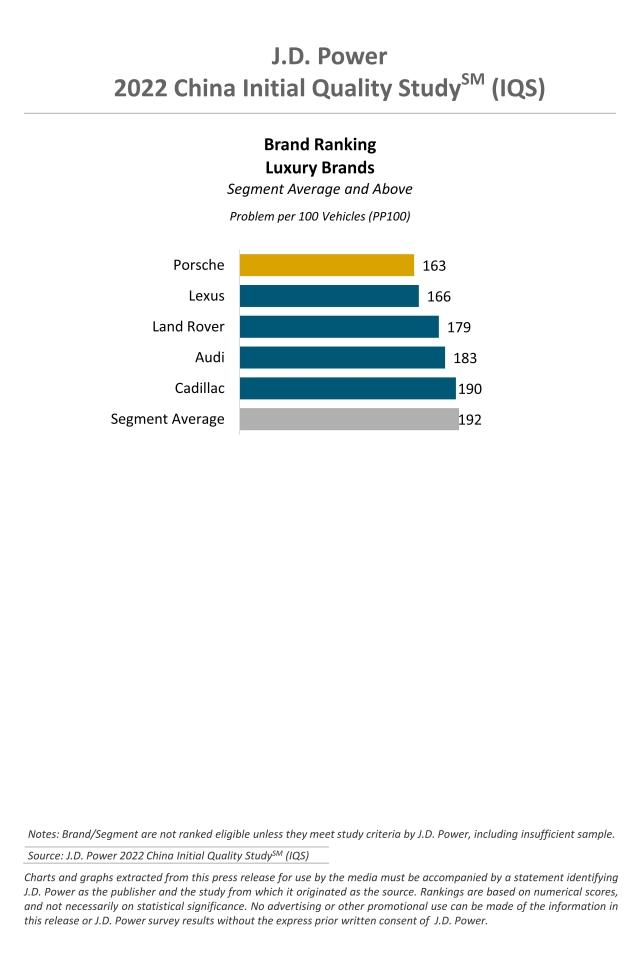

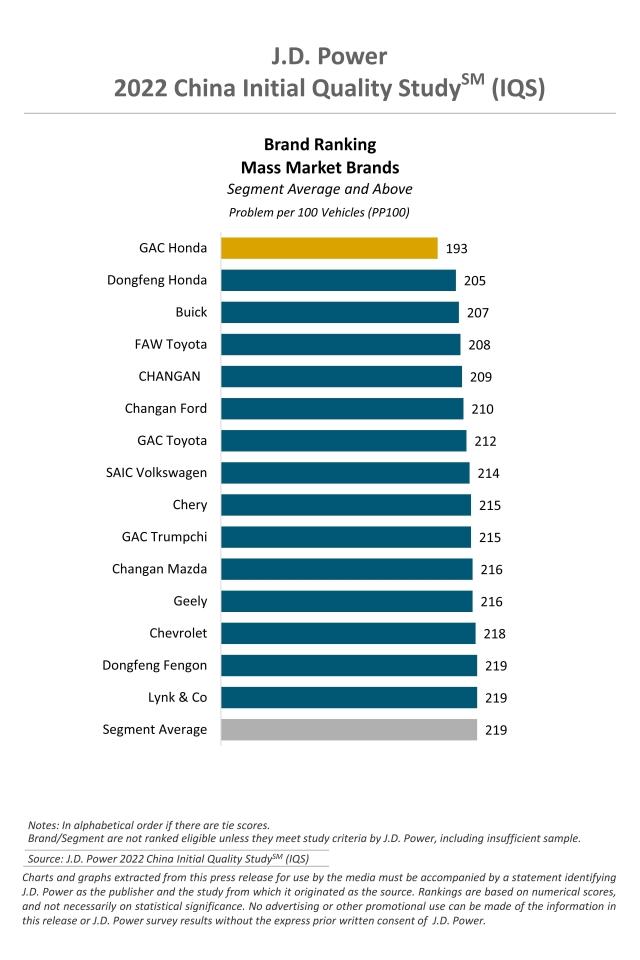

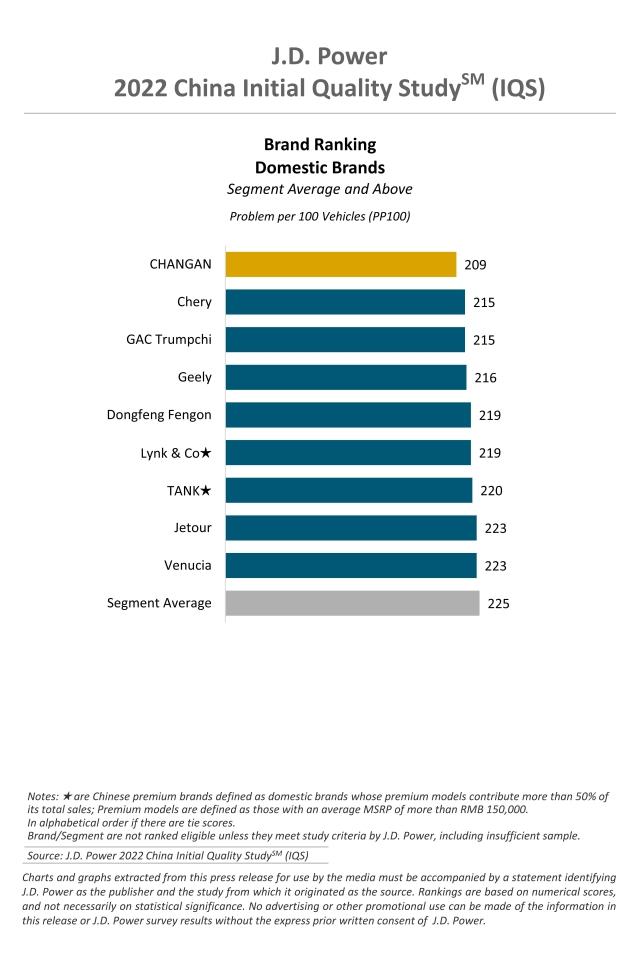

Porsche, GAC Honda and CHANGAN Rank Highest in Respective Segments

SHANGHAI: 1 Sept. 2022 – Overall new-vehicle quality in China averages 213 problems per 100 vehicles (PP100), which is 2.8 PP100 more than 2021, according to the JD Power 2022 China Initial Quality StudySM (IQS), released today. Specifically, the quality problems are mostly design-related as the number of problems is 143 PP100, 4.2 PP100 more than 2021.

The study, now in its 23rd year, measures initial vehicle quality by examining problems experienced by new-vehicle owners within the first two to six months of ownership. Overall initial quality is determined by problems cited per 100 vehicles, with a lower number of problems indicating higher quality.

Additionally, infotainment, driving assist and air conditioning are the categories that improved the most, with problems decreasing by 4.1, 2.2 and 1.5 PP100, respectively.

“The improvement of vehicle quality is not overnight,” said Elvis Yang, general manager of auto product practice, JD Power China. “From the beginning of design to the quality management system, production process optimization and the collaboration of the supply chain, every part needs to be refined to achieve the final quality improvement. With the advent of the intelligence era, the quality problems caused by design is rising. Manufacturers should pay more attention to the R&D and design stage to improve new-vehicle quality.”

Following are additional findings of the 2022 study

- Exterior becomes most problematic category: In 2022, exterior becomes the most problematic category, with an increase of 2.7 PP100, while the proportion of exterior in the overall quality problems increases to 15% from 13% in 2021. Among the exterior category, excessive road noise and headlights not bright enough are the top two problems with the highest increases in complaints.

- Interior smell is one of the most-often-cited problems: Unpleasant interior smell (9.4 PP100) is a top-cited problem by owners. This and excessive road noise are two problems that have been listed in the top three quality problems for three consecutive years. Additionally, excessively sensitive brakes and excessively uncomfortable seat increase obviously, reflecting the owner requirements for riding experience and comfort are increasing.

- Quality among luxury brands improves significantly: The average number of quality problems among luxury brands is 192 PP100, 24 PP100 less than 2021. The number of infotainment system problems decreases 9 PP100 from 36 PP100 in 2021.

Highest-Ranked Brands and Models

Porsche ranks highest in initial quality among luxury brands with 163 PP100, followed by Lexus (166 PP100) and Land Rover (179 PP100).

GAC Honda is the highest-ranked mass market brand for a third consecutive year with 193 PP100. Dongfeng Honda (205 PP100) ranks second and Buick (207 PP100) ranks third.

CHANGAN is the highest-ranked Chinese domestic brand with 209 PP100. Chery (215 PP100) and GAC Trumpchi (215 PP100) rank second in a tie.

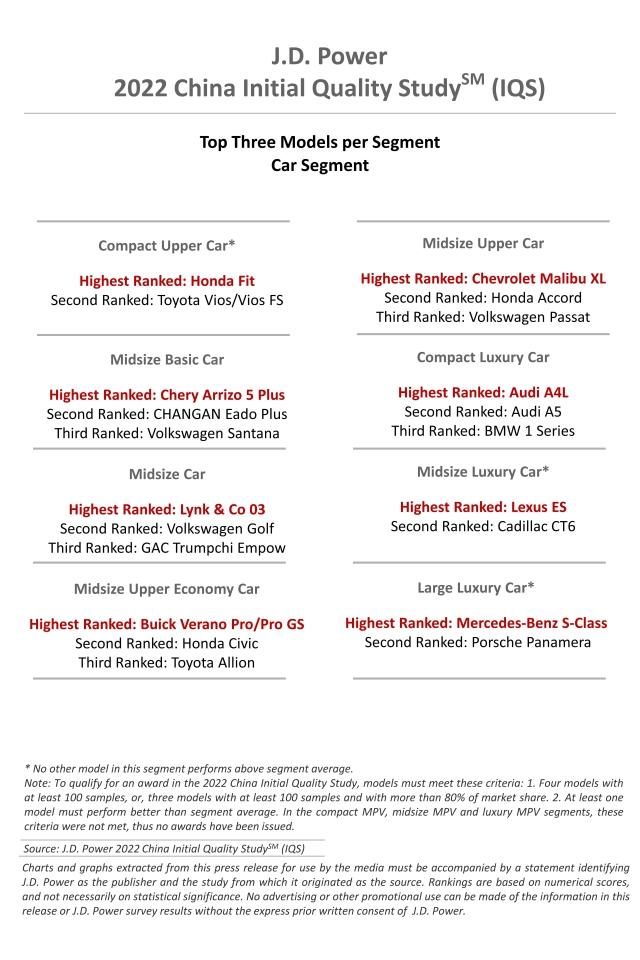

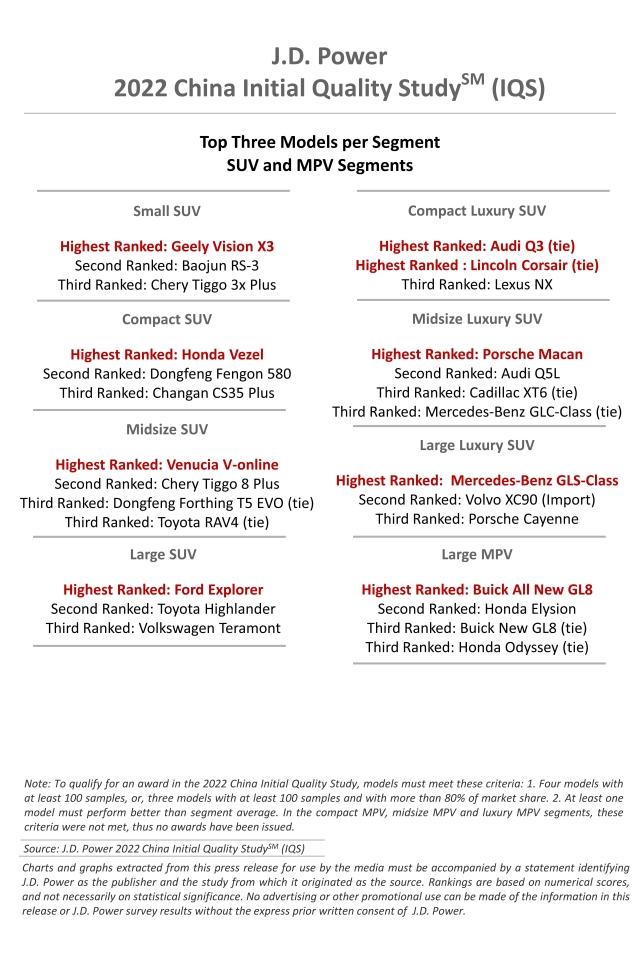

There are 17 models from 12 brands receiving awards across 16 segments in the 2022 study.

- Audi models that rank highest in their respective segments are Audi A4L and Audi Q3.

- Buick models that rank highest in their respective segments are Buick Verano Pro/Pro GS; Buick All New GL8.

- GAC Honda models that rank highest in their respective segments are Honda Fit and Honda Vezel.

- Mercedes-Benz models that rank highest in their respective segments are Mercedes-Benz S-Class and Mercedes-Benz GLS-Class.

Other models that rank highest in their respective segments are Chevrolet Malibu XL; Chery Arrizo 5 Plus; Ford Explorer; Geely Vision X3; Lexus ES; Lincoln Corsair; Lynk & Co 03; Porsche Macan; Venucia V-online.

The China Initial Quality Study measures new-vehicle quality by examining problems in two segments: design-related problems and defects/ malfunctions. Specific diagnostic questions include 218 problem symptoms across nine categories: features/ controls/ displays; exterior; interior; infotainment system; seats; driving experience; driving assistance; powertrain; and climate. This is also the second year since

JD Power launched a new IQS research platform in both the China and U.S. markets, which aims to provide manufacturers with more comprehensive information to facilitate the identification of problems and drive product improvement.

The 2022 study is based on responses from 3,914 vehicle owners who purchased their vehicle between June 2021 and March 2022. The study includes 247 models from 56 different brands and was fielded from December 2021 through May 2022 in 70 major cities across China.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Mengmeng Wang, JD Power; China; +86 21 8026 5719; mengmeng.wang@jdpa.com

Geno Effler, JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info