Penetration of New-Vehicle and Used-Vehicle Financing in China Surges to 62% and 54%, Respectively, JD Power Finds

GAC-SOFINCO Auto Finance and BMW Financial Services Rank Highest in Respective Segments

SHANGHAI: 26 May 2022 – Automotive financing plays an critical role in driving the growth of the passenger vehicle market in China, with 62% of new-vehicle and 54% of used-vehicle transactions financed in 2021, according to the JD Power 2022 China Dealer Financing Satisfaction (DFS) Study,SM released today.

The study, now in its eighth year, examines dealer satisfaction with finance providers in two segments, retail credit and floor planning. Retail credit is defined as the credit granted by auto financial providers to new-vehicle buyers while floor planning allows dealers to obtain loans from auto finance companies or banks to finance their inventory. The 2022 study is the first year the systematic measurements of used-vehicle retail credit, auto insurance and digital platform experiences have been included.

The study finds that the finance penetration of new-vehicle sales increased to 62% in FY2021, compared with 58% in FY2020 and 35% in FY2015. More than four in 10 (41%) dealers in China provide financing services for used-vehicle transactions, accounting for more than 54% of overall used-vehicle sales.

The JD Power 2022 China Dealer Attitude Study SM (DAS), released in April, found that the percentage of auto finance commissions that comprise dealers’ overall profits rose to 14% in FY2021 from 9% in FY2020.

“In contrast to the volatile growth of passenger vehicle sales in recent years, the development of automotive finance is more stable and faster, and its contribution to dealers' profits has increased as well,” said Joseph Yang, director of auto finance practice at JD Power China. “With new retailing and smart mobility-related business models emerging, the automotive market in China will be full of opportunities and challenges, thus finance service providers need to solidify product and service innovation and embrace changes proactively.”

Following are additional findings of the 2022 study

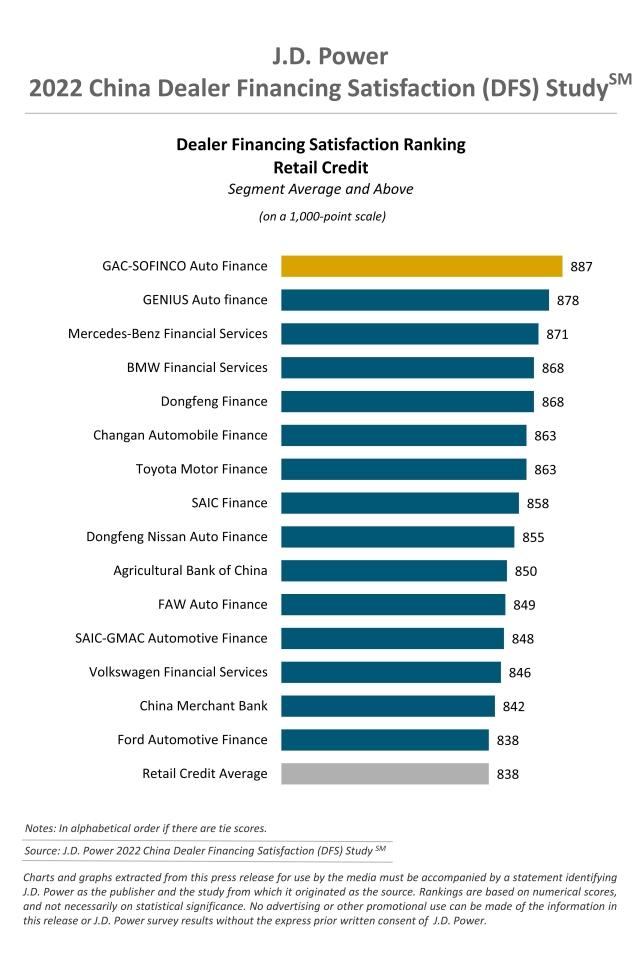

- In the retail credit segment, captive companies exceed in dealer financing satisfaction while banks are quickly catching up: Overall dealer satisfaction with captive companies is 858 (on a 1,000-point scale), 20 points higher than the average satisfaction score in the retail credit segment. Banks have the lowest satisfaction but have made dramatic progress year over year, increasing by 31 points.

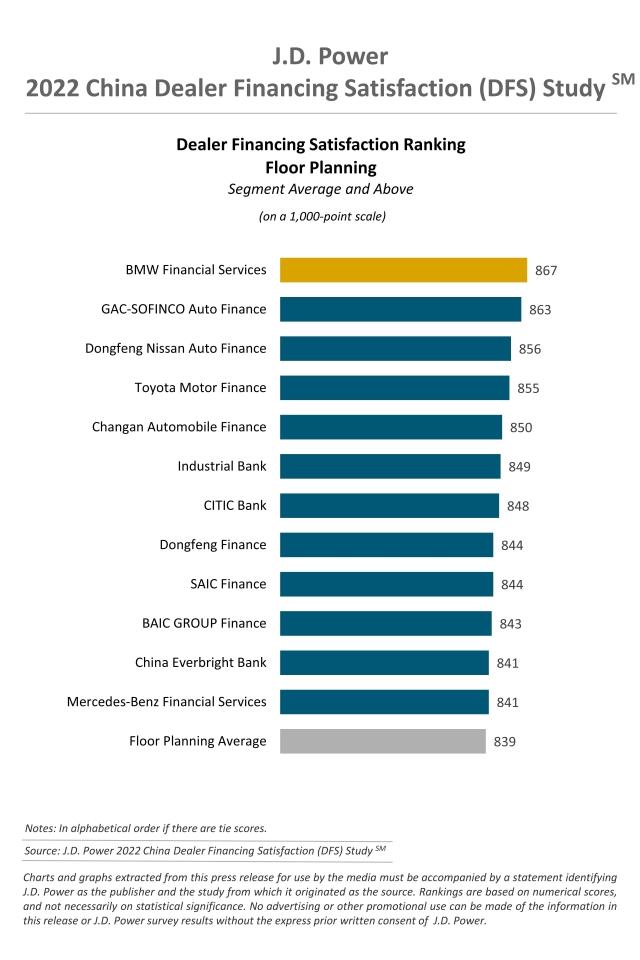

- In the floor planning segment, captive companies decline in dealer financing satisfaction while banks narrow the gap: In 2022, the average overall satisfaction of floor planning is 839 points. Satisfaction with captive companies is 841 points, a 3-point decrease from last year. Satisfaction with banks is 836 points, which increases by 7 points from last year and narrows the gap with the average.

- Dealers need retail finance performance review and advice the most: In the retail credit segment, the most needed but unmet needs of dealers are regular summary/review of retail finance performance and dealer overall performance consulting. Satisfaction among dealers who receive these is 53 points higher than among those who do not receive them.

Study Rankings

GAC-SOFINCO Auto Finance ranks highest in the retail credit segment with a score of 887, followed by GENIUS Auto Finance (878) and Mercedes-Benz Financial Services (871).

In the floor planning segment, BMW Financial Services (867) ranks highest, followed by GAC-SOFINCO Auto Finance (863) and Dongfeng Nissan Auto Finance (856).

The study is based on responses from 2,902 dealers, covering 45 vehicle brands and 95 finance providers across 85 cities in China. The study was fielded from December 2021 through March 2022 and examines dealer satisfaction with finance providers in two segments: retail credit and floor planning. In the retail credit segment, satisfaction is measured in finance provider offerings/products; application/approval process; and sales representative relationship. In the floor planning segment, satisfaction is measured in finance provider credit line; floor plan portfolio management; floor plan support; and salesperson representative relationship.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Phyllis Zuo; JD Power; China; +86 21 8026 5719; phyllis.zuo@jdpa.com

Geno Effler; JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info