Dealers in China are Profitable but Struggle to Sustain Profitability, JD Power Finds

BMW Ranks Highest in Dealer Satisfaction among Luxury Brands; BYD and Dongfeng Honda Rank Highest in a tie among Mass Market Brands

SHANGHAI: 28 April 2022 – New-vehicle sales, which are the major revenue source of automotive dealers in China, are rising and making significant contributions to the growth of dealers’ profit, according to the JD Power 2022 China Dealer Attitude Study (DAS), SM released today. However, on average, revenue from used-vehicle sales and after-sales service is declining, making it far from being a sustainable source of profitability.

The study, which began in 2009, examines authorized dealer attitudes toward auto manufacturers as well as their satisfaction with them. It also provides the business conditions of dealerships and analyzes issues that both manufacturers and dealers are deeply concerned about, based on eight factors: product; marketing and sales activities; sales team; vehicle ordering and delivery process; after-sales team; parts supply; training; and support provided by the manufacturer. Data is compiled from surveys completed by senior managers at each dealership included in the study.

The study finds that more than half (52%) of dealers were profitable in FY2021, and the average dealer revenue increases 12% to RMB 172M (USD 26.6M) from RMB 154M (USD 23.6M) in FY2020, dealer profit rises to RMB 3.78M (USD 582K) with a 38% increase, from RMB 2.74M (USD 422K) in FY2020.

The study also finds that new-vehicle sales—the biggest component of dealer revenue—rises to 84% from 77% in FY2020. However, the percentage of used-vehicle sales remains at 2% as a year ago and after-sales service revenue drops to 6% from 9%.

“Dealer satisfaction is an important index that every automotive manufacturer with long-term development strategy should pay attention to, and an important reference for dealership investors when making investment choices,” said Joseph Yang, director of automotive dealer network management and automotive finance practice, JD Power China. “The study this year surveyed general managers or investors at 2,680 4S stores in China and covered dealer networks of 45 automotive brands, ensuring that the study results to reflect the market accurately.”

“In the light of the slight growth of new-vehicle sales, the dramatic increase of dealer profitability brings strong confidence to the automotive market,” Yang said. “However, under the optimistic financial performance of dealers, there still is a long way to forge a healthy and sustainable profitability model for dealers, since the used-vehicle business lags the rapid growing used-vehicle market in China, and the after-sales services business of dealers are far from meeting manufacturers’ plans and expectations.”

Following are additional findings of the 2022 study:

- Profitability noticeable among luxury brand dealers and Chinese domestic brand dealers: Luxury brand dealers have the highest proportion of profitability, with 63% being profitable compared with 50% of mass market brand dealers being profitable. The percentage of Chinese domestic brand dealers that are profitable increased 14 percentage points, the highest year-over-year improvement.

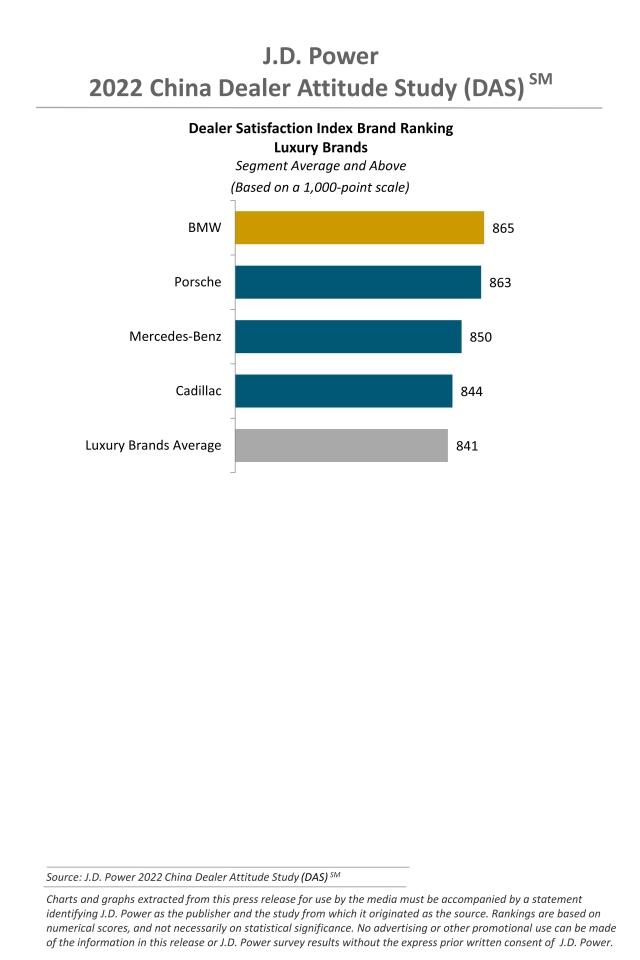

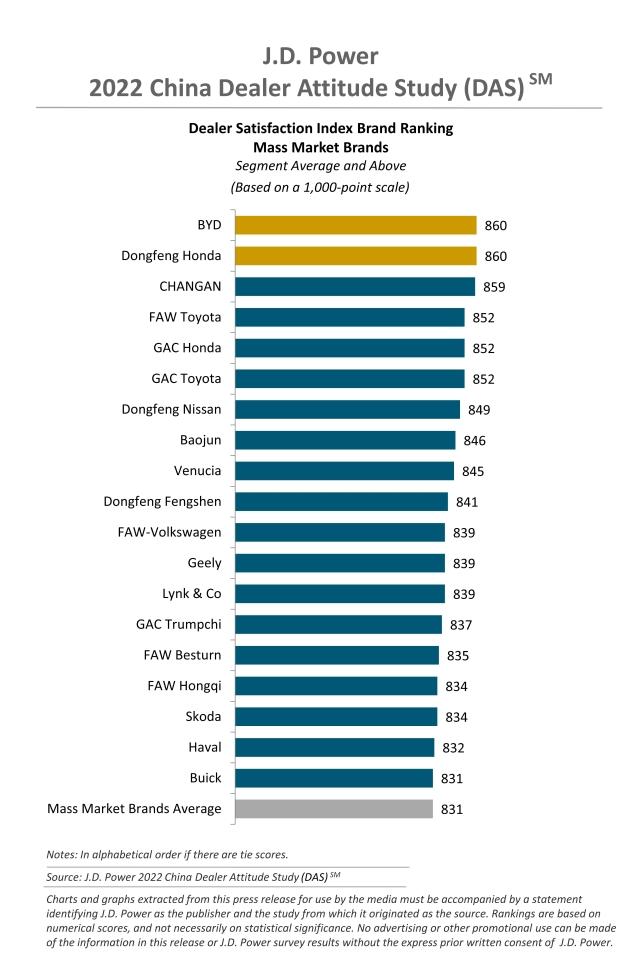

- Dealer satisfaction with automakers improves consistently: Dealer satisfaction with automakers increases to 833 (on a 1,000-point scale) from 808 in 2019. Compared with a year ago, dealer satisfaction with luxury brands rises 7 points to 841, while satisfaction with mass market brands remains at 831.

- Japanese brands lead in dealer satisfaction despite year-over-year decrease: Japanese brands have the highest level of dealer satisfaction—even though it is 14 points lower than 2021. Korean brands have the greatest improvement, increasing 27 to 805 from 778 in 2021.

Study Rankings

BMW ranks highest in dealer satisfaction among luxury brands with a score of 865. Porsche (863) and Mercedes-Benz (860) rank second and third, respectively.

BYD and Dongfeng Honda rank highest in a tie in dealer satisfaction among mass market brands with a score of 860. CHANGAN (859) ranks third.

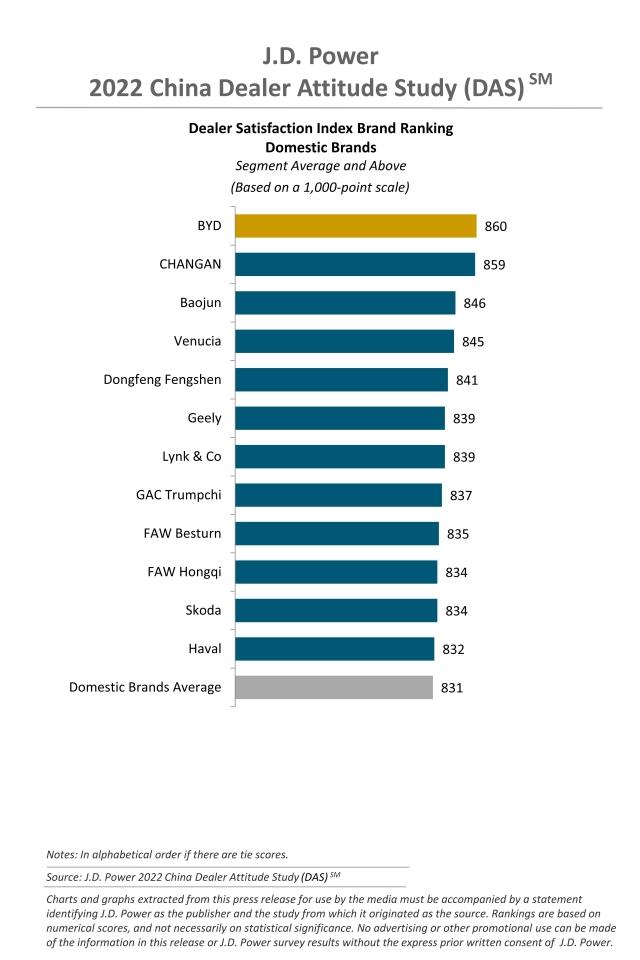

BYD is also the highest-ranked Chinese domestic brand, followed by CHANGAN and Baojun (846).

The JD Power China Dealer Attitude Study (DAS) is an effective tool to evaluate the health of the relationships between dealers and manufacturers and provides the basis for manufacturers to adjust business policies. The study was fielded from December 2021 through March 2022.

About JD Power

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Shana Zhuang, JD Power; China; +86 21 8026 5719; shana.zhuang@jdpa.com

Geno Effler, JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info