Startup Automakers in China Lead Advanced Technology Battle, JD Power Finds

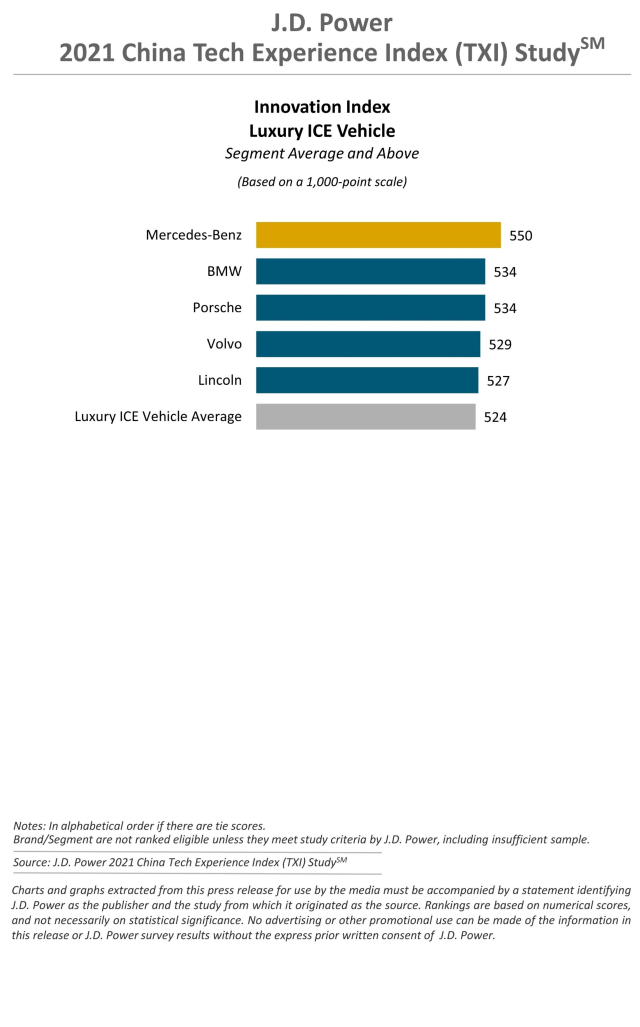

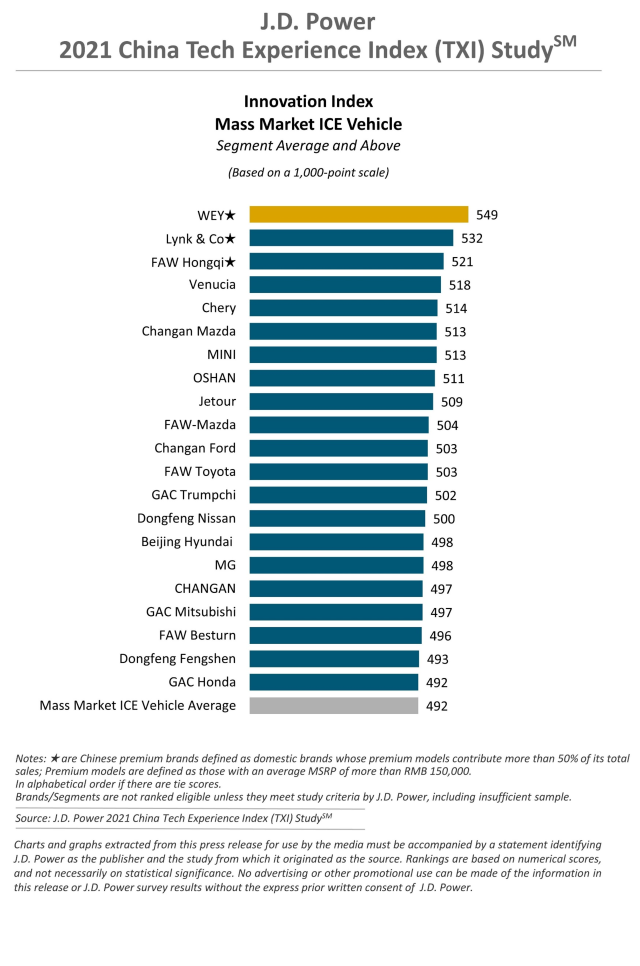

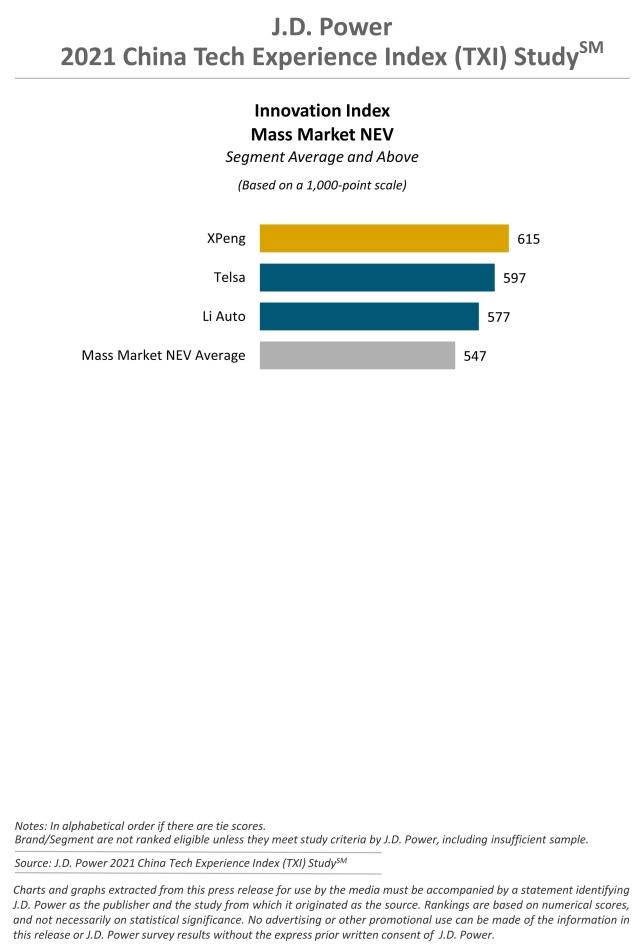

Mercedes-Benz, WEY and XPeng Rank Highest in Respective Segments

SHANGHAI: 5 Aug. 2021— Startup automakers in China perform notably better in technology innovation than other automakers, exceeding them in both the adoption of advanced technologies and user experience with the technologies, according to the JD Power 2021 China Tech Experience Index (TXI) Study,SM released today.

The study, now in its second year, focuses on new-vehicle owners’ perceptions of 42 in-vehicle technologies, 26 of which are advanced technologies when first introduced in the market. The TXI Innovation Index measures how effectively each automotive brand brings these technologies to market. The index combines the level of adoption of new technologies for each brand with the excellence in execution. The execution measurement examines how much owners like the technologies and how many problems they experience while using them.

The study finds that the overall innovation index for the industry this year is 504 (on a 1,000-point scale). New Electric Vehicle (NEV) startups in China surpass other brands in the overall index, with a score of 590, as well as in the level of adoption and in the excellence in execution.

The study also finds that the innovation index for mass market Internal Combustion Engine (ICE) vehicles (492) lags far behind others; however, the Chinese domestic premium brands demonstrate a notable lead over international brands, earning the top three ranked positions among mass market ICE vehicles.

“There is no doubt that more and more players are getting into the intelligent vehicle field, with both the first mover and the new joiner thriving to grasp the only opportunity to win the new battle,” said Jeff Cai, general manager of auto product practice at JD Power China. “The more competitive the field, the more automakers need to delve into user demand and user experience. By investing resources in the areas where users most need, while consistently improving the perceived quality and user experience of the advanced technologies, brands can gain a good footing in the new intelligent vehicle field.”

Following are additional findings of the 2021 study:

- Automakers in China are cautious of introducing advanced technologies: The installation rate of advanced technology features increases slightly compared with 2020, among which electric vehicle energy assistant and trip recorder increase the most, each with an increase of nine percentage points, while the installation rate of phone-based digital key and dynamic driving assistance each increase by less than one percentage point.

- Usage rate of advanced technologies increases gradually: All 14 advanced technologies included in the 2021 and 2020 studies see an increased usage rate at different levels. Usage among owners who use face identification often or every time increases 19 percentage points, and usage among owners who use rear driving assistance and interior gesture controls each increases 17 percentage points.

- Technologies with highest levels of quality complaints: Three features with the highest levels of quality complaints are camera rear-view mirror (18.5 problems per hundred vehicles, or PP100); remote parking (17.7 PP100); and touch ID (16.8 PP100). Complaints about camera rear-view mirror and remote parking are primarily due to inconsistency/inaccuracy and complaints about touch identification are due to difficult to understand/use.

- Owner satisfaction with effectiveness and responsiveness yet to improve: Owner satisfaction with the effectiveness (rating of 7.14 on a 10-point scale), responsiveness (7.15) and usefulness (7.16) of smart driving-related features are the lowest among all seven measurements included in the study. Similarly, owner satisfaction with intelligent cockpit-related features are lower in effectiveness (7.21) and responsiveness (7.22) as well, and are only slightly better than interface appearance (7.20).

Highest-Ranked Brands

Mercedes-Benz ranks highest among luxury ICE vehicles, with a score of 550. BMW and Porsche rank second in a tie, each with a score of 534. WEY ranks highest among mass market ICE vehicles with a score of 549, followed by Lynk & Co (532) and FAW Hongqi (521). XPeng ranks highest among mass market NEVs, with a score of 615. Tesla (597) ranks second and Li Auto (577) ranks third. In the luxury NEV segment, criteria for awards were not met, thus no awards are given this year.

The 2021 study is based on responses from 32,141 ICE vehicle owners who purchased their vehicle between June 2020 and March 2021, as well as 3,976 NEV owners who purchased their vehicle between September 2020 and March 2021. The study includes 264 ICE vehicle models from 58 brands and 50 NEV models from 28 brands and was fielded from December 2020 through May 2021 in 70 major cities across China.

The study, which complements the China Initial Quality Study (IQS)SM and the China Automotive Performance, Execution and Layout (APEAL) Study,SM is used extensively by automakers and suppliers worldwide to provide an overview of how vehicle owners perceive the advanced technology features and to help the industry address any problematic areas before the technologies are made widely available across automotive portfolios, thus improving the future owner experience.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Shana Zhuang, JD Power; China; +86 21 8026 5719/ shana.zhuang@jdpa.com

Geno Effler, JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

# # #

NOTE: Three charts follow.