Average Auto Dealer Profit Rises 20% in China, JD Power Finds

GAC Honda Ranks Highest in Dealer Satisfaction

SHANGHAI: 22 April 2021 – While dealer new-vehicle sales and after-sales services revenue decreases in China for a fourth consecutive year, dealer profit increases 20% due to strong support from auto manufacturers and the number of profitable dealers slightly increases compared with 2020, according to the JD Power 2021 China Dealer Attitude Study (DAS), SM released today.

Begun in 2009, the study examines authorized dealers’ attitudes toward auto manufacturers as well as their satisfaction with them. It also provides the business conditions of dealerships and analyzes issues that both manufacturers and dealers are deeply concerned about. Data is compiled from surveys completed by senior managers at each dealership included in the study.

The study finds that due to the effects of the COVID-19 pandemic, dealer revenue slumped 12% in FY2020 to RMB 154M (USD 23.6M) from RMB 175M (USD 26.7M) in FY2019, continuing the downward trend since FY2017. Fortunately, as manufacturers adjusted sales targets and increased new-vehicle sales incentives, dealer profit rose from RMB 2.28M (USD 350K) in FY2019 to RMB 2.74M (USD 420K) in FY2020. Additionally, the percentage of dealers who are profitable or breakeven increased by 6 percentage points year over year.

The study also finds that in FY2020, the average number of dealers’ after-sales service per month and number of customers decreased 9% and 16%, respectively, declining most among dealers of mass market brands.

“The timely adjustment of business policies by auto manufacturers and the increase of rebates for new-vehicle sales ensured dealers' profitability during the pandemic, which was the win-win result of the cooperation between the two sides,” said Ann Xie, managing director of digital retail practice at JD Power China, “However, as dealer revenue continues to decline and new-vehicle sales are very likely to grow at a moderate rate, automakers should pay particular attention to the long-term profitability of dealers’ after-sales service business, which requires the manufacturers to empower dealer business processes by building digital tools and enhancing dealer staff capabilities.”

Following are additional findings of the 2021 study:

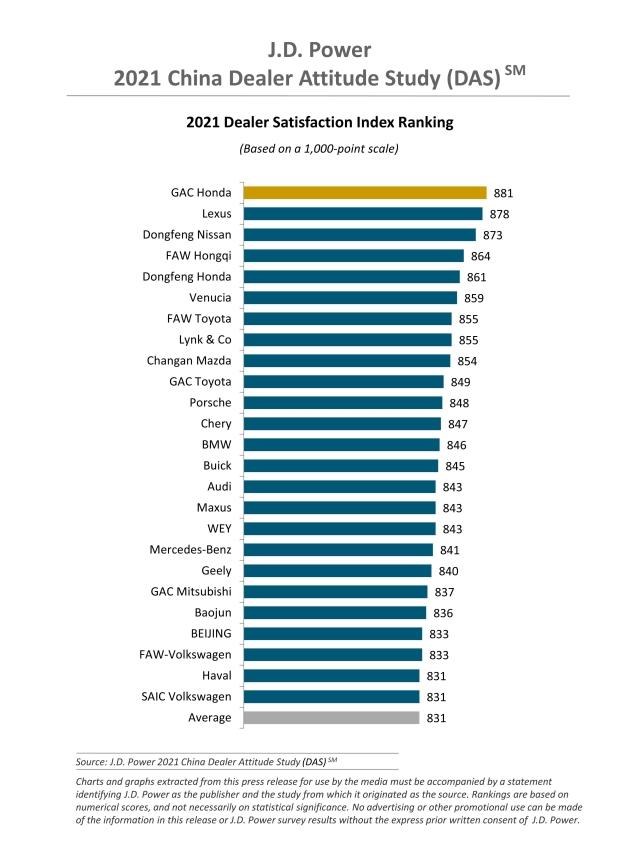

- Dealer satisfaction with automakers improves: Dealer satisfaction with automakers increases to 831 points (on a 1,000-point scale) in 2021, 14 points higher than 2020. The improvements occur in all eight factors, with support provided by manufacturers improving the most (+18 points).

- Korean brand dealers are the only dealers to decline in satisfaction: Dealers of Japanese brands have the highest satisfaction (860), followed by dealers of European, Chinese, American and Korean brands. Satisfaction among Korean brand dealers decreases to 778, which is 53 points below average.

- Dealers expect more guidance on digital marketing from manufacturers: In 2021, the remarkable effects of video marketing with supports by manufacturers resulted in dealers expecting more digital marketing training and guidance from manufacturers. The variance of satisfaction among dealers who were provided digital guidance by manufacturers versus those who were not provided such guidance has increased to 95 in 2021 from 79 in 2020, a gap of 16 points.

Study Ranking

GAC Honda ranks highest in dealer satisfaction with a score of 881. Lexus (878) ranks second and Dongfeng Nissan (873) ranks third.

The JD Power China Dealer Attitude Study (DAS) measures dealer satisfaction with automotive manufacturers in eight factors: support provided by OEM (30%); training (12%); sales team (12%); after-sales team (11%); marketing and sales activities (11%); parts supply (10%); product (7%); and vehicle ordering and delivery process (6%). The study is an effective tool to evaluate the health of the relationships between dealers and manufacturers and also provides the basis for manufacturers to adjust business policies.

The 2021 study is based on responses from 2,792 dealers in 85 cities and covers 46 brands. The field work was conducted from December 2020 through March 2021.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Shana Zhuang; JD Power; China; +86 21 8026 5719; shana.zhuang@jdpa.com

Geno Effler; JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

# # #

NOTE: One chart follows.