Vehicles in China are Losing Appeal among Owners Born after 1990, JD Power Finds

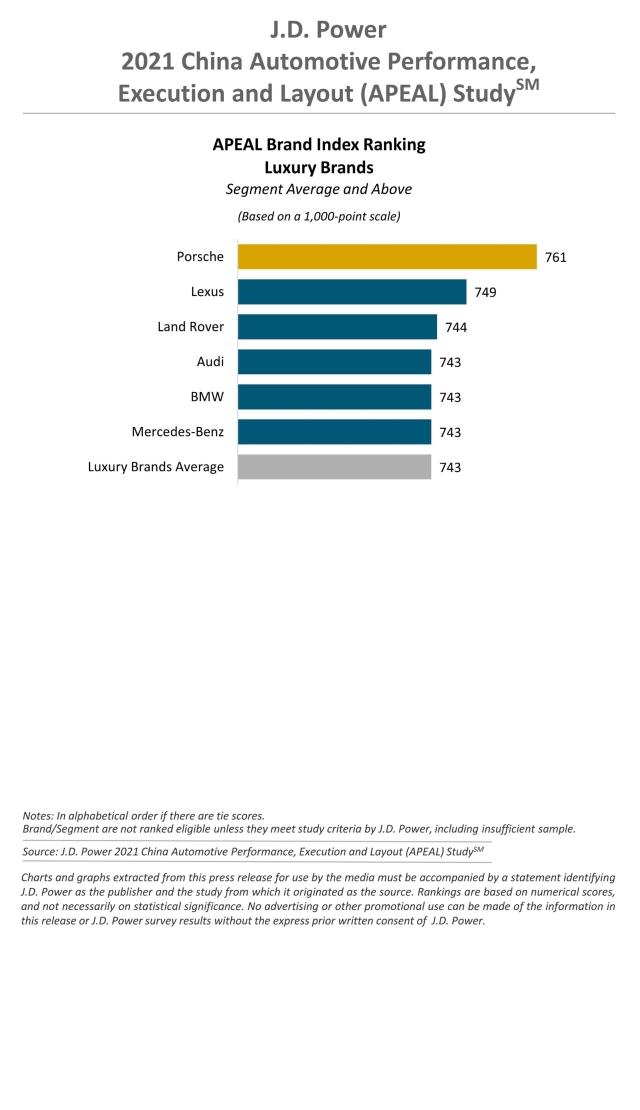

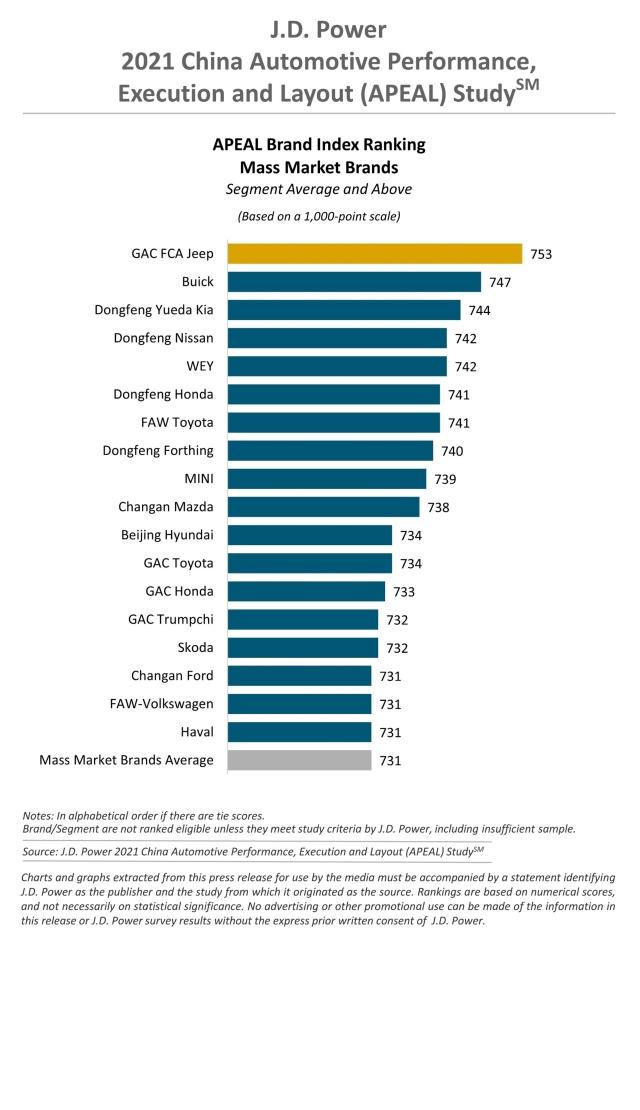

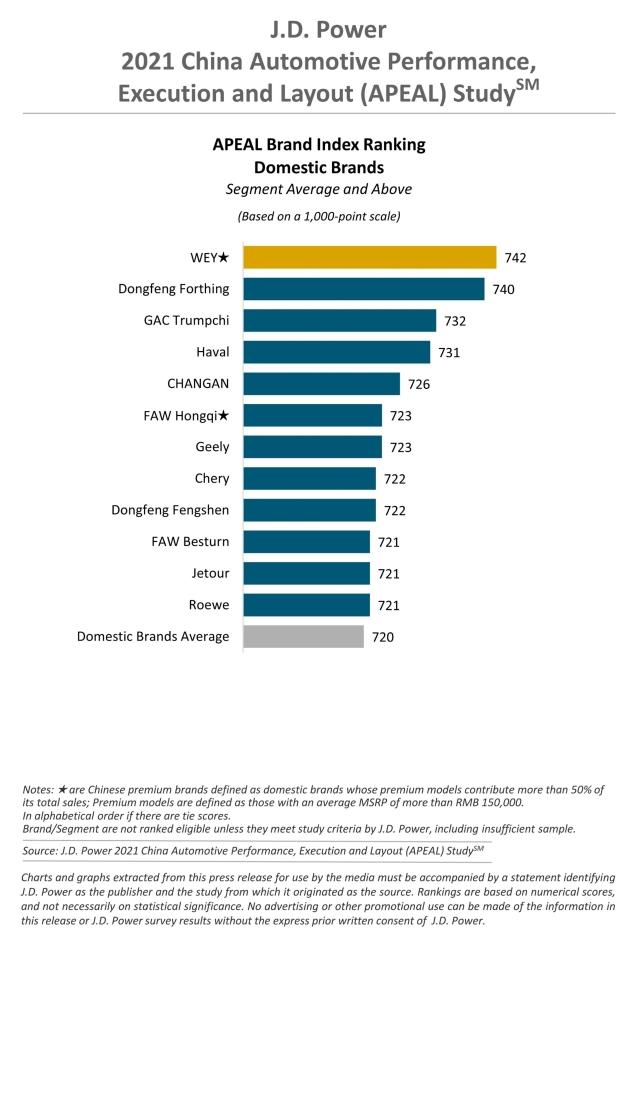

Porsche, GAC FCA Jeep and WEY Rank Highest in Respective Segments

SHANGHAI: 19 Aug. 2021 – Vehicles in China are gradually losing their attractiveness to young customers, as satisfaction is lowest among new-vehicle owners born after 1990, compared with other age groups, according to the JD Power 2021 China Automotive Performance, Execution and Layout (APEAL) Study,SM released today. Specifically, satisfaction among owners born before 1980 is 769 (on a 1,000-point scale), 755 among owners born in the 1980s and only 718 among owners born after 1990. The three categories with the biggest gap in satisfaction scores between post-90s customers and those in the other two groups are vehicle performance, driving comfort and driving feel. As for the specific attributes the study measures, owners born after 1990 are less satisfied with using the navigation system and the usefulness of infotainment system functions.

The study, now in its 19th year, examines new-vehicle owners’ assessments of their experience with their new vehicle within the first two to six months of ownership. The data is used extensively by manufacturers to help them design and develop more appealing models. The overall APEAL score for the industry in 2021 is 733, which is one point higher than in 2020.

“Customers born after 1990 now account for more than half of owners of internal combustion engine (ICE) vehicles; however, they are the least satisfied and the least excited with their vehicles,” said Jeff Cai, general manager of auto product practice at JD Power China. “This generation is more demanding in fashion, technology and intelligent features than other generations, which requires the automakers to incorporate their special needs in the product plan and design phase as early as possible to ensure that vehicles proactively meet the demands of future customers.”

Following are additional findings of the 2021 study:

- Importance of vehicle design increases: The importance of vehicle design to customers increases to 20% this year from 17% in 2019. Additionally, there is a high correlation between APEAL score and brand reputation: the higher the APEAL score, the higher will be owners’ willingness to recommend the brand to others.

- Luxury vehicles score highest while small vehicles score lowest: Owner satisfaction with luxury vehicles surpasses other vehicle segments with a score of 743, followed by satisfaction with SUVs (733). While satisfaction with midsize vehicles, MPVs and small vehicles all rank below the industry average, satisfaction with small vehicles is the lowest, with a score of 723.

- ICE vehicles lag behind new energy vehicles (NEVs): Satisfaction with their vehicle experience is slightly higher among NEV owners (735) than among owners of ICE vehicles (733). NEVs perform much better in vehicle exterior and styling, which is 18 points higher than for ICE vehicles. Among the NEVs, vehicles of Chinese startups earn the highest APEAL score of 754.

- Newly launched models are less appealing than existing models: The APEAL score this year for newly launched models is 726, which is six points lower than for new models in 2020 and eight points lower than for existing models in 2021. Additionally, new models decrease the most in score in the metrics for setting up and starting; interior; and driving feel.

Study Rankings

Porsche ranks highest in APEAL among luxury brands, with a score of 761. Lexus (749) ranks second and Land Rover (744) ranks third.

GAC FCA Jeep is the highest-ranked mass market brand, with a score of 753, while Buick (747) ranks second and Dongfeng Yueda Kia (744) ranks third.

WEY is the highest-ranked Chinese domestic brand, with a score of 742. Dongfeng Forthing (740) ranks second and GAC Trumpchi (732) ranks third.

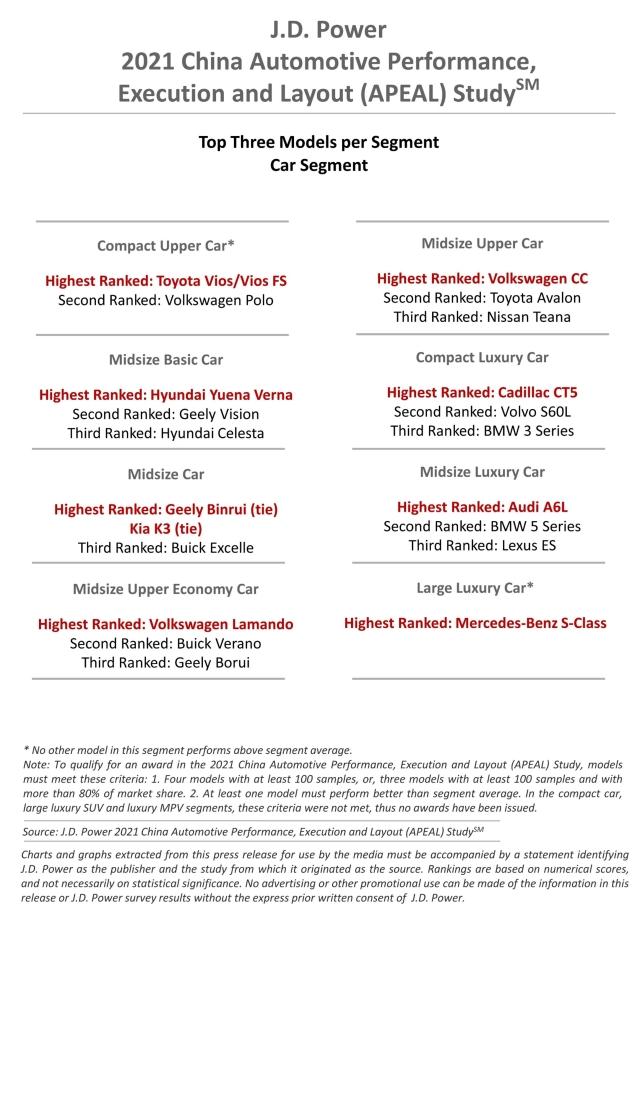

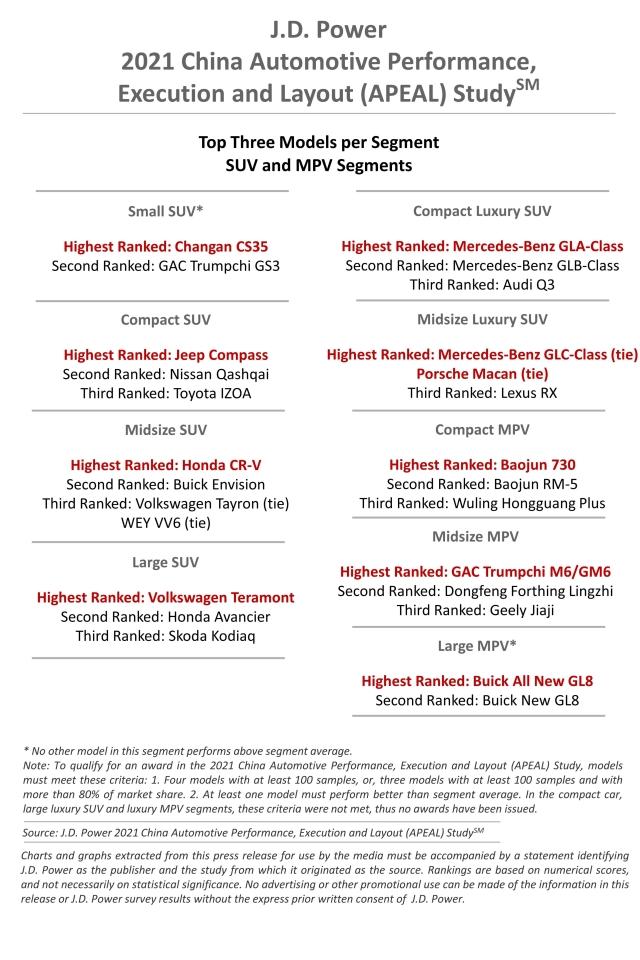

There are 19 models from 17 brands eligible for awards across 17 segments in the 2021 study. The segment-level APEAL awards by brand are the Mercedes-Benz S-Class, Mercedes-Benz GLA Class, and Mercedes-Benz GLC Class; and Volkswagen Lamando and Volkwagen Teramont.

Other models that rank highest in their respective segments are Audi A6L; Baojun 730; Buick All New GL8; Cadillac CT5; Changan CS35; GAC Trumpchi M6/GM6; Geely Binrui; Honda CR-V; Hyundai Yuena Verna; Jeep Compass; Kia K3; Porsche Macan; Toyota Vios/Vios FS; and Volkswagen CC.

The 2021 China Automotive Performance, Execution and Layout (APEAL) Study measures owners’ emotional attachment to and level of excitement with their new vehicle across 37 attributes in 10 vehicle experience groups: exterior; setting up and starting; getting in and out; interior; performance; driving feel; keeping your safe; infotainment; driving comfort; and fuel economy.

The study is based on responses from 34,572 ICE vehicle owners who purchased their new vehicle between June 2020 and March 2021. The study includes 264 models from 58 different brands and was fielded from December 2020 through May 2021 in 70 major cities across China. Another JD Power study, China New Energy Vehicle – Automotive Performance, Execution and Layout (NEV-APEAL) Study,SM measures the satisfaction of NEV owners’ experience with their vehicles.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Shana Zhuang, JD Power; China; +86 21 8026 5719; shana.zhuang@jdpa.com

Geno Effler; JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

# # #

NOTE: Five charts follow.