Luxury Brands in China Losing Ground in Vehicle Dependability, JD Power Finds

Porsche, GAC FCA Jeep and FAW Hongqi Rank Highest in Respective Segments

SHANGHAI: 4 Nov. 2021 –Luxury brands are losing their edge over domestic brands in vehicle dependability, especially during the past three years, according to the JD Power 2021 China Vehicle Dependability StudySM (VDS), released today. The number of problems experienced by luxury vehicle owners has notably increased and surpasses those experienced by owners of mass market brands, after 30 months of ownership.

The study, now in its 12th year, measures the number of problems experienced per 100 vehicles (PP100) during the past six months by owners of 13- to 48-month-old vehicles. A lower score reflects higher quality. The study covers 177 specific problems grouped into eight major vehicle categories: vehicle exterior; vehicle interior; driving experience; features/ controls/ displays; audio/ communication/ entertainment/ navigation; heating/ ventilation/ air conditioning; seats; and engine/ transmission.

According to the 2021 study, the gap in vehicle dependability between luxury brands and mass market brands is 5 PP100 and has narrowed during the past three years. The ratio of Luxury brands PP100 to industry average PP100 has increased to 97% in 2021 from 79% in 2018, which indicates that their advantage in vehicle dependability over industry average has been shrinking. Luxury vehicle owners experience more problems than mass market vehicle owners in driving experience, vehicle interior, and engine/ transmission as the tenure of ownership increases. Additionally, the number of problems experienced by luxury owners increases more rapidly than by mass market vehicle owners over time—during 13 to 18 months of ownership, luxury brands have 5.9 PP100 fewer than mass market brands in performance; however, at 30 to 48 months of ownership, luxury brands increase to 6.4 PP100 more than mass market brands.

“Luxury brands losing an advantage in dependability indicates manufacturers are failing to keep up with the evolving expectations of vehicle owners in China,” said Jeff Cai, general manager of auto product practice, JD Power China. “Compared with mass market brands, especially domestic brands, luxury brands are relatively conservative in design and installation of infotainment systems and configurations, which might make owners feel good early in the ownership cycle, but those owners experience more and more problems over time, such as incompatibility and impracticality.”

Following are additional findings of the 2021 study:

- Percentage of engine/ transmission and exterior problems decreases: Although vehicle exterior is still the top problem category, the percentage of problems in engine/ transmission and vehicle exterior decreases this year by 5 and 3 percentage points, respectively, compared with 2020.

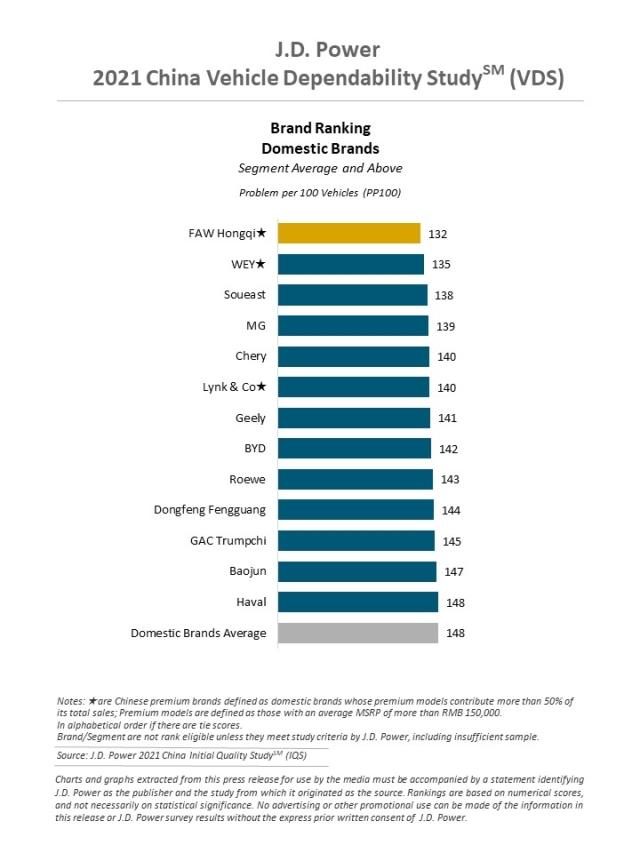

- Dependability of Chinese domestic brands continues to improve: The gap in vehicle dependability between domestic brands and international mass market brands narrows to 6 PP100 in 2021 from 9 PP100 in 2020. Domestic brands improve notably in engine/ transmission, which decreases by 6 percentage points in 2021, compared with 2020.

- Improving problems related to broken/worn items are essential for long-term quality: The percentage of problems related to items that are broken/not working and worn/damaged rise 25 and 8 percentage points. respectively, during 30 to 48 months of ownership, compared with problems experienced during 13 to 18 months and 19 to 29 months of ownership. Improving these types of problems are critical for long-term quality.

Highest-Ranked Brands and Models

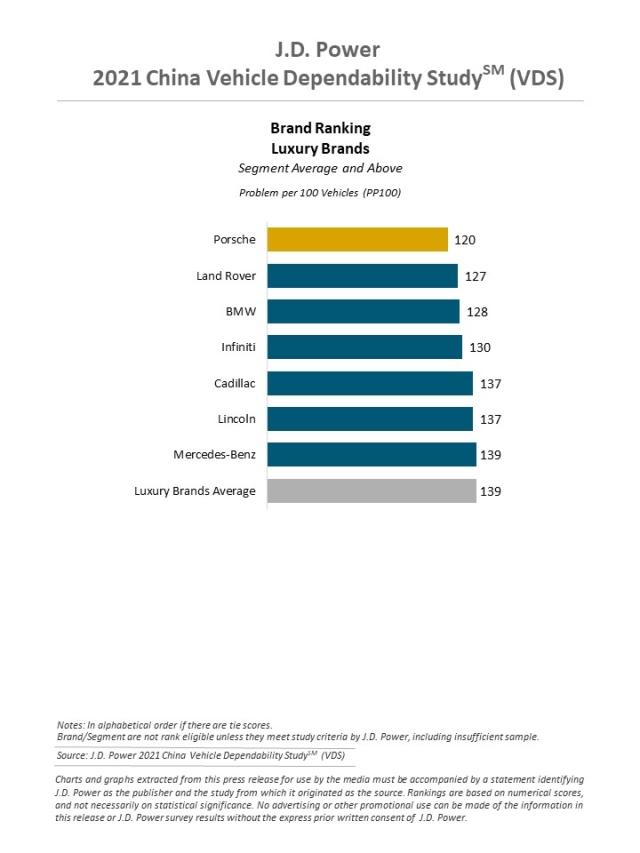

Porsche ranks highest in vehicle dependability among luxury brands with 120 PP100, followed by Land Rover (127 PP100) and BMW (128 PP100).

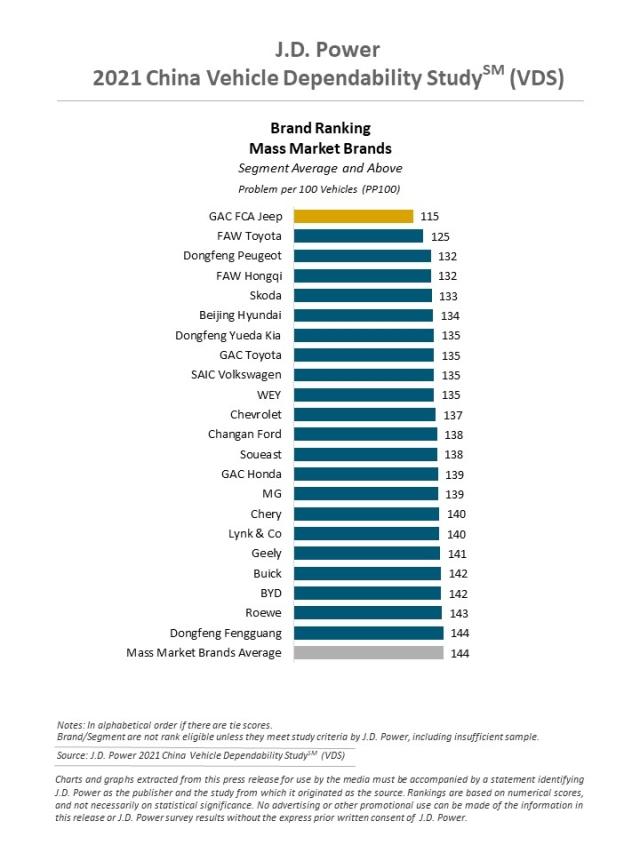

GAC FCA Jeep is the highest-ranked mass market brand with 115 PP100. FAW Toyota (125 PP100) ranks second and Dongfeng Peugeot (132 PP100) and FAW Hongqi (132 PP100) rank third, in a tie.

FAW Hongqi is also the highest-ranked Chinese domestic brand (132 PP100). WEY (135 PP100) and Soueast (138 PP100) rank second and third, respectively.

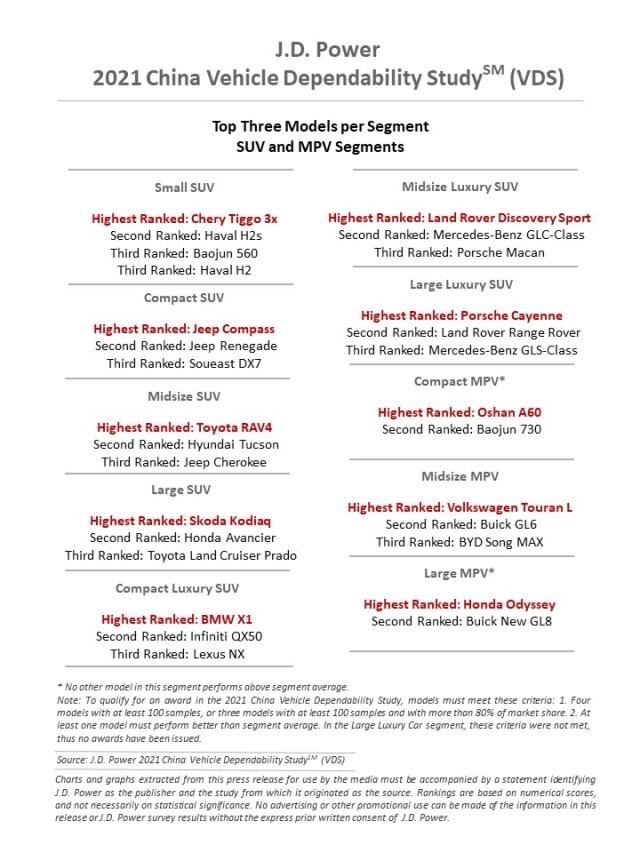

There are 18 models from 15 brands eligible for awards across 18 segments in the 2021 study.

- FAW Toyota models that rank highest in their respective segments are Toyota Vios/Vios FS; Toyota Crown; and Toyota RAV4.

- BMW models that rank highest in their respective segments are BMW 3 Series and BMW X1.

Other models that rank highest in their respective segments are Buick Verano/GS; BYD Qin Pro; Chery Tiggo 3x; Chevrolet Cavalier; Honda Odyssey; Hyundai Reina; Jeep Compass; Land Rover Discovery Sport; Oshan A600; Porsche Cayenne; Skoda Kodiaq; Toyota Camry; and Volkswagen Touran L.

The 2021 study is based on responses from 36,860 vehicle owners who purchased their vehicle between December 2016 and May 2020. The study includes 239 models from 49 different brands and was fielded from January 2021 through June 2021 in 70 major cities across China.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Phyllis Zuo, JD Power; China; +86 21 8026 5719; phyllis.zuo@jdpa.com

Geno Effler, JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info