Experience with Intelligent Features Becomes Key Factor in Vehicle Shoppers’ Purchase Decisions in China, JD Power Finds

BMW and FAW-Volkswagen Rank Highest in Respective Vehicle Segments

SHANGHAI: 17 Sept. 2021 – Among consumers in China who intend to buy a new vehicle in the next six months, nearly one-fourth (24%) consider their experience with vehicle intelligence features to be the decisive purchase factor, according to the JD Power 2021 China New-Vehicle Intender StudySM (NVIS), released today.

The study, now in its 13th year, examines consumer perceptions of vehicles and interest in new technologies, and includes the purchase behaviors of those who intend to buy a new vehicle within the next six months and their decision factors when considering a vehicle for purchase. Additionally, the study provides brand influence scores (BIS), which measure familiarity and favorability of automotive brands among intended new-vehicle buyers.

The 2021 study finds that the demand for advanced technology configurations has notably increased in China. Among all seven factors affecting consumer purchase decisions, experience with vehicle intelligence features has the importance weight of nearly 14%, and 24% of intended buyers consider it to be the most crucial factor of their purchase decision. Additionally, lack of technology features is among the top three concerns when considering a vehicle.

“With vehicle intelligence becoming a key factor for consumer purchase decisions, automakers need to leverage different strategies for different tech features,” said Edward Wang, managing director of syndicated research at JD Power China. “For example, for those tech features with high demand but low customer satisfaction, automakers will need to improve the customer experience to avoid negative feedback. However, for those features with low demand but high customer satisfaction, improving customer acceptance and market penetration will help consumers more fully understand the advantages such features can provide.”

Following are additional findings of the 2021 study:

- Purchase preferences of different groups considerably vary: Female customers under the age of 26 most prefer new-energy vehicles (NEVs), while male customers between ages 30 and 40 are more likely to buy internal combustion engine (ICE) vehicles made by international brands. Three primary reasons for both male and female shoppers to choose one model over another are attractive design and styling exterior; good purchase experience; and powerful driving experience.

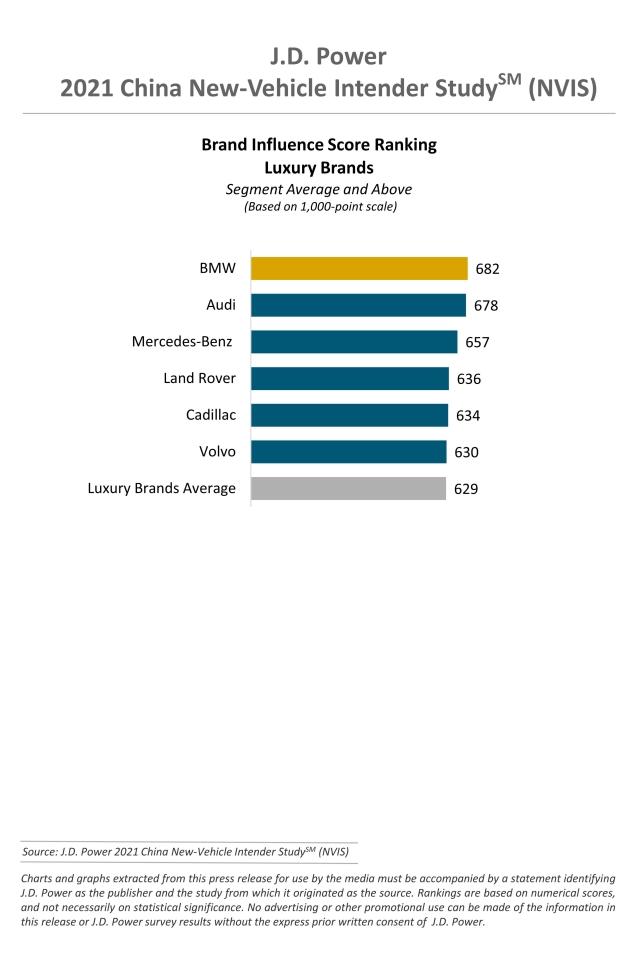

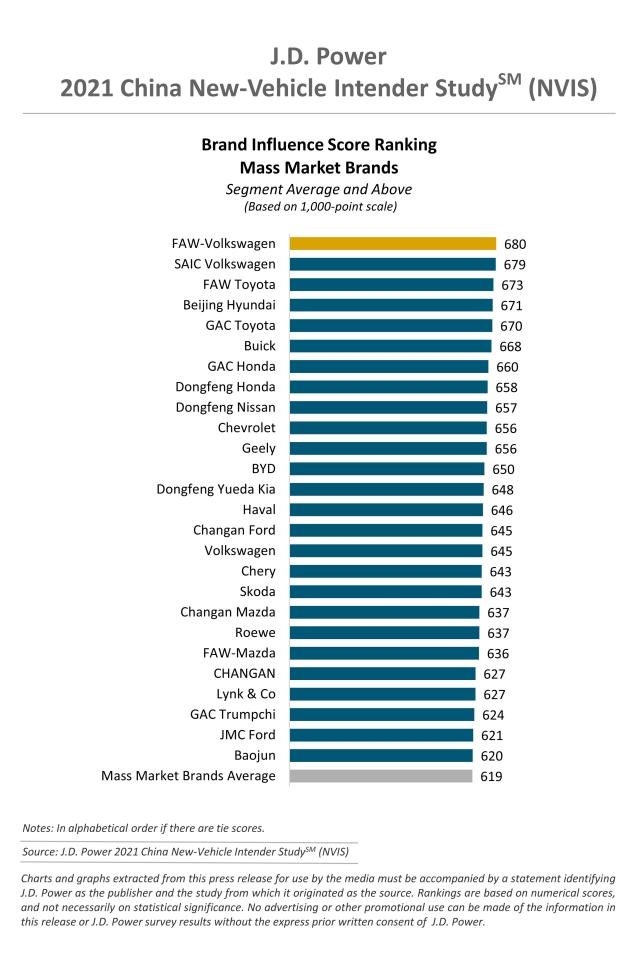

- Industry average BIS increases in 2021: The industry average brand influence score is 621 (on a 1,000-point scale) in 2021, 10 points higher than in 2020. The average BIS for luxury brands this year is 629, an increase of 20 points from 2020, and for mass market brands the score is 619, an increase of seven points.

- Brand influence of domestic brands continues to improve: International brands take the lead in brand influence, while domestic brands, particularly the NEV startups, show notable improvement this year. Some domestic brands are recognized as having high awareness and high favorability in 2021, which had previously been ranked high in these metrics by international brands during the past few years.

Brand Influence Score (BIS) Rankings

BMW achieves the highest BIS among luxury brands with a score of 682, followed by Audi (678) and Mercedes-Benz (657). FAW-Volkswagen (680) is the highest-ranked mass market brand, while SAIC Volkswagen (679) ranks second and FAW Toyota (673) ranks third.

The 2021 China New-Vehicle Intender Study is based on responses from 11,266 intended new-vehicle buyers. The study includes 67 brands and data was collected online via two waves in January and June 2021.

For more information about the China New-Vehicle Intender Study (NVIS), visit HERE.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Phyllis Zuo; JD Power; China; +86 21 8026 5719; phyllis.zuo@jdpa.com

Geno Effler; JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info