Infotainment Systems Garner Most Quality Problems among Vehicle Owners in China, JD Power Finds

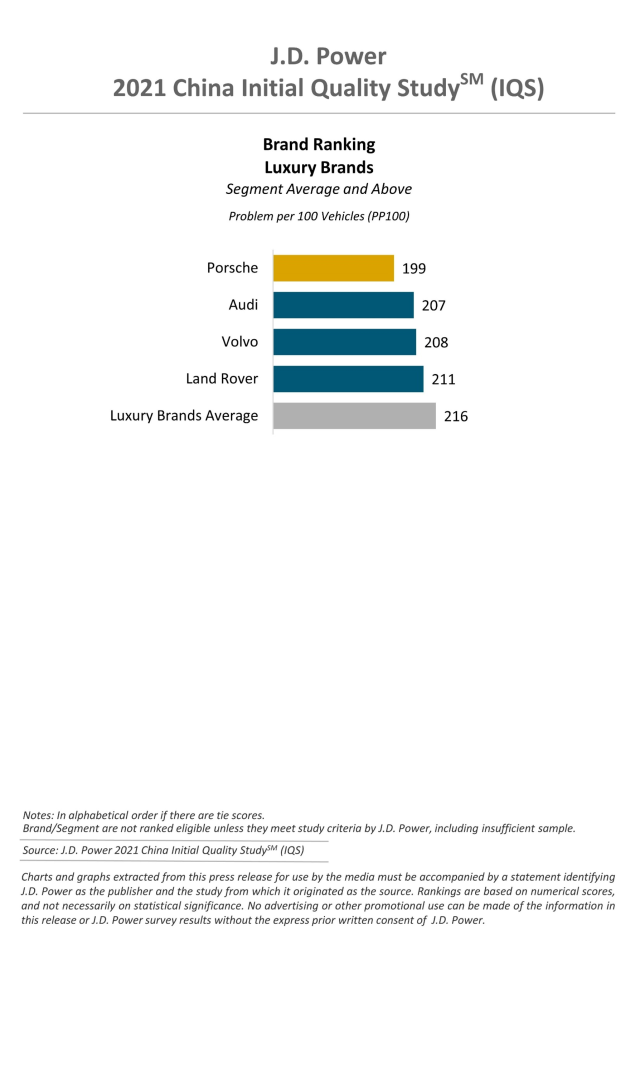

Porsche, GAC Honda and CHANGAN Rank Highest in Respective Segments

SHANGHAI: 2 Sept. 2021 – As more technologies are introduced in new vehicles in China, quality problems increase. This year, the highest number of problems are related to infotainment systems, according to the JD Power 2021 China Initial Quality StudySM (IQS), released today.

The study, now in its 22nd year, measures initial vehicle quality by examining problems experienced by new-vehicle owners within the first two to six months of ownership. Overall initial quality is determined by problems cited per 100 vehicles (PP100), with a lower number of problems indicating higher quality.

The 2021 study finds that the infotainment system is the area with the highest number of problems (33.4 PP100), of which 90% are design-related problems, referring to components or features that may be functioning properly but are still perceived as problems by owners because they are difficult to understand or use.

According to the study, the percentage of problems in the traditional quality area significantly decreases year over year, with powertrain and exterior decreasing by eight and four percentage points, respectively. However, the percentage of problems related to tech features notably increases, with infotainment system increasing to 16% from 11% in 2020 and driving assistance increasing to 8% from 3%.

“With the development of automotive intelligence, related quality problems have gradually emerged,” said Jeff Cai, general manager of auto product practice, JD Power China. “Compared with problems in the traditional quality areas, quality problems with smart and connected features are due more to poor design. This requires automakers to not only pay more attention to the user experience design of technology features, but also establish an effective quality management mechanism for software and better cope with challenges in the era of software-defined vehicles.”

Following are additional findings of the 2021 study:

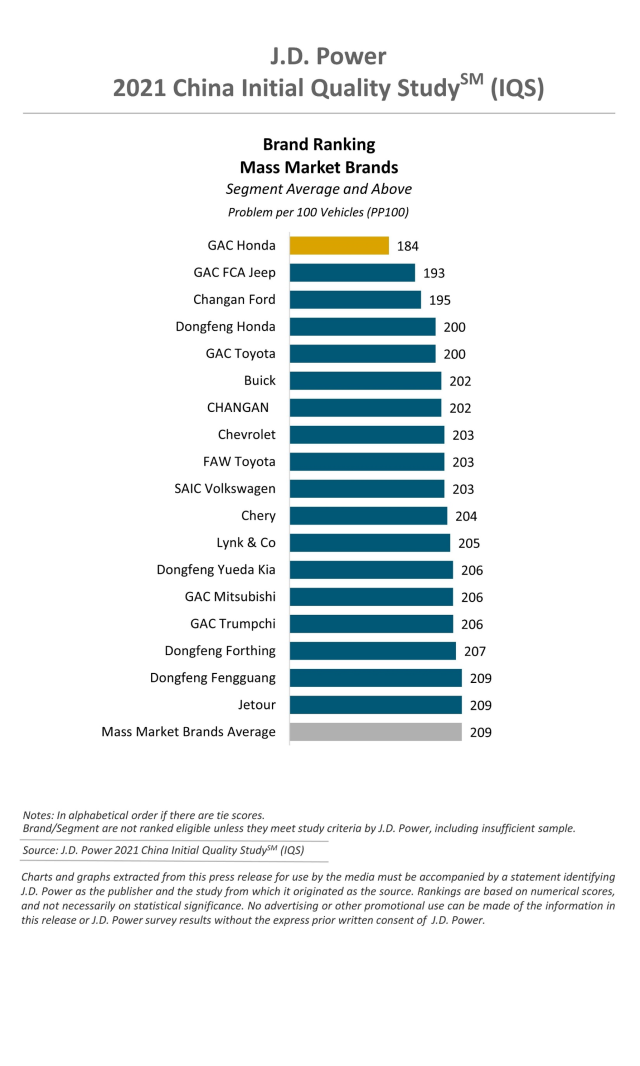

- New-vehicle quality of mass market brands surpasses luxury brands for the first time: The average initial quality among mass market brands in 2021 is 209 PP100, which is 7 PP100 lower than luxury brands. Mass market brands exceed luxury brands in PP100 in the infotainment and features/ controls/ displays categories but lag in the exterior category. It’s notable that the JD Power 2021 U.S. Initial Quality Study SM finds that the PP100 for mass market brands in that country have been lower than luxury brands for the past five years.

- Internal Combustion Engine (ICE) vehicles have more problems for smart features than New Energy Vehicles (NEVs): ICE vehicles perform better in the driving experience and vehicle exterior categories but lag in the driving assistance and infotainment categories.

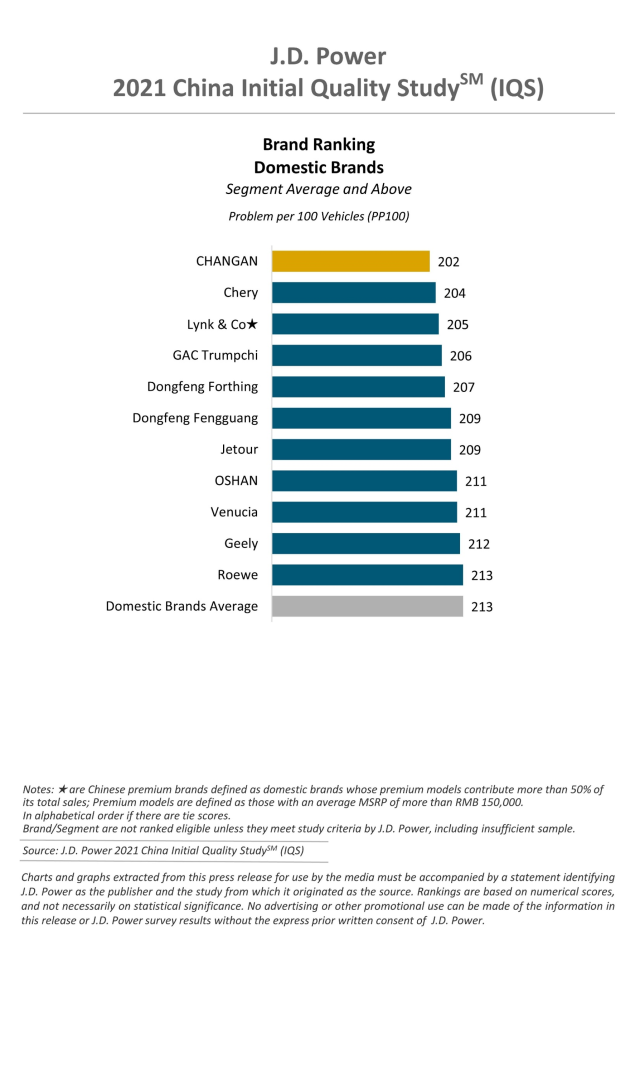

- Brand image of Chinese domestic brands improves in all aspects: The quality gap between Chinese domestic brands and international brands narrows to 5 PP100 from 10 PP100 in 2020. The brand image of Chinese domestic brands improves in all metrics, especially in reputation and environment-friendly, each by 10 percentage points year over year.

- Most-often-cited problem changes: Power plug/USB port charges too slowly (8 PP100) becomes the most frequent problem for the first time, followed by unpleasant interior smell (7.8 PP100) and excessive road noise (7.5 PP100). Previously, unpleasant interior smell was the problem cited most often during each of the six previous years.

Highest-Ranked Brands and Models

Porsche ranks highest in initial quality among luxury brands with 199 PP100, followed by Audi (207 PP100) and Volvo (208 PP100).

GAC Honda is the highest-ranked mass market brand for the second consecutive year with 184 PP100. GAC FCA Jeep (193 PP100) ranks second and Changan Ford (195 PP100) ranks third.

CHANGAN is the highest-ranked Chinese domestic brand with 202 PP100. Chery (204 PP100) and Lynk & Co (205 PP100) rank second and third, respectively.

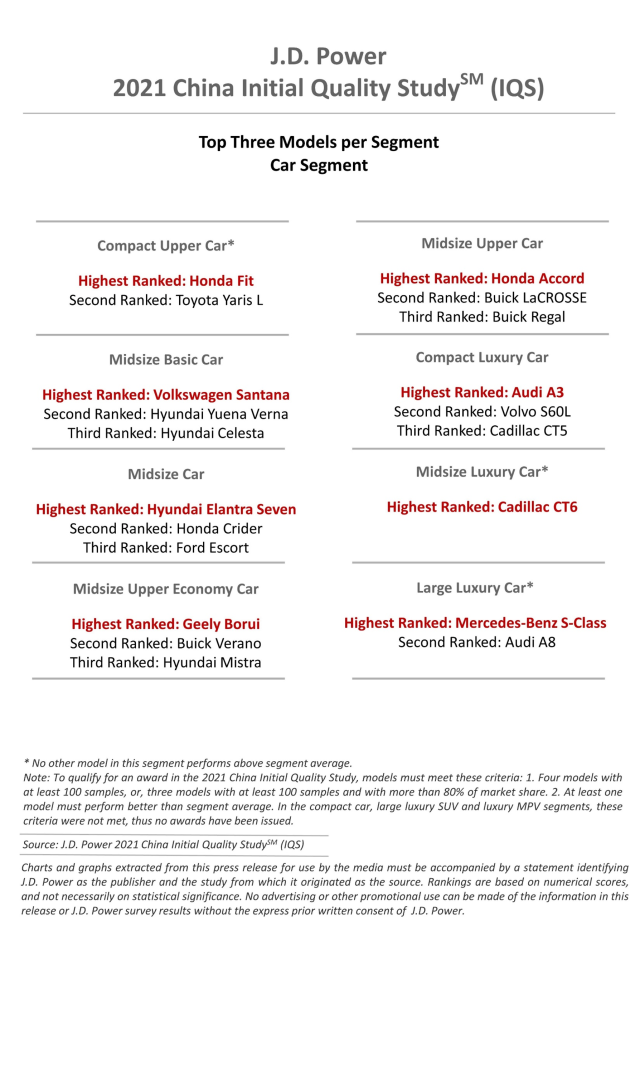

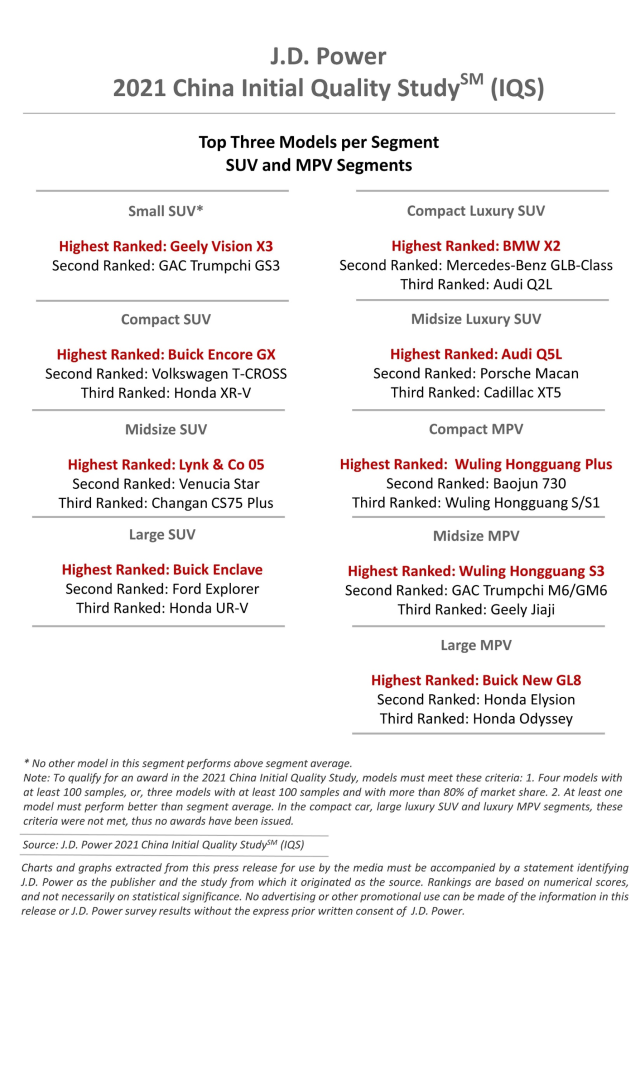

There are 17 models from 12 brands receiving awards across 17 segments in the 2021 study.

- Buick models that rank highest in their respective segments are Buick Encore GX; Buick Enclave; and Buick New GL8.

- Audi models that rank highest in their respective segments are Audi A3 and Audi Q5L.

- GAC Honda models that rank highest in their respective segments are Honda Fit and Honda Accord.

- Geely models that rank highest in their respective segments are Geely Borui and Geely Vision X3.

- Wuling models that rank highest in their respective segments are Hongguang Plus and Honguang S3.

Other models that rank highest in their respective segments are BMW X2; Cadillac CT6; Hyundai Elantra Seven; Lynk & Co 05; Mercedes-Benz S-Class; and Volkswagen Santana.

The China Initial Quality Study measures new-vehicle quality by examining problems in two segments: design-related problems and defects/ malfunctions. Specific diagnostic questions include 218 problem symptoms across nine categories: features/ controls/ displays; exterior; interior; infotainment system; seats; driving experience; driving assistance; powertrain; and climate. This is also the second year since

JD Power launched a new IQS research platform in both the China and U.S. markets, which aims to provide manufacturers with more comprehensive information to facilitate the identification of problems and drive product improvement.

The 2021 study is based on responses from 34,158 vehicle owners who purchased their vehicle between June 2020 and March 2021. The study includes 264 models from 58 different brands and was fielded from December 2020 through May 2021 in 70 major cities across China.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Shana Zhuang, JD Power; China; +86 21 8026 5719; shana.zhuang@jdpa.com

Geno Effler, JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

# # #

NOTE: Five charts follow.