New Energy Vehicle Quality Problems Increase in China as Growth Slows, JD Power Finds

Infotainment Systems Remain the Most Problematic Category

SHANGHAI: 5 June 2025 – The overall average initial quality of new energy vehicles (NEVs) this year is 226 problems per 100 vehicles (PP100), an increase of 16 PP100 from 2024, according to the JD Power 2025 China New Energy Vehicle Initial Quality Study (NEV-IQS), released today. A lower number of problems indicates higher quality.

The study, first published in 2019, is based on the annual JD Power U.S. Initial Quality Study (IQS). The NEV-IQS measures new-vehicle quality by examining problems experienced by NEV owners in China within the first two to six months of ownership in two categories, design-related problems and defects/ malfunctions.

This year’s findings indicate that, despite the overall increase in problems, the pace of increase has moderated. From 2023 to 2024, the pace increased 37 PP100 and from 2024 to 2025, the pace increased 16 PP100. Malfunction-related problems have climbed 9 PP100 year over year. The PP100 for battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) is 220 and 234, respectively, an increase of 9 PP100 and 26 PP100 from 2024.

“With the continuous iteration of battery technologies, problems related to batteries and charging are decreasing,” said Elvis Yang, general manager of auto product practice at JD Power China. “Concerns about range anxiety and charging convenience are gradually fading. Additionally, as NEVs penetrate deeper across all price segments, the user experience for different vehicle types is becoming more diverse. For example, the increasingly popular ‘boxy’ rugged SUV design resonates with users’ desire for adventure and freedom, however, their actual usage is mostly urban commuting. In this context, balancing bold styling with noise, vibration and harshness control and comfort has become a key test of OEMs’ capabilities."

Following are some key findings of the 2025 study:

- Infotainment systems remain most problematic: In 2025, infotainment systems remain the most problematic category with 31 PP100. Among the 10 problem areas, the largest increase is in configuration/control systems/instrument panels (+3.5 PP100), highlighting OEMs’ lack of focus on fundamental quality amid rapid tech upgrades. Battery/ charging is the only area to show improvement (-3.2 PP100), with the largest drop in problems in the pure electric range area—reflecting reduced owner anxiety as battery capacities improve.

- PHEV and REEV models see sales surges despite decline: The market share for PHEVs has increased by 8 percentage points year over year, especially in the RMB 100,000–200,000 segment. Range Extend Electric Vehicle (REEV) model market share has increased by 3 percentage points in the RMB 200,000–300,000 segment. However, all PHEVs and REEVs are facing product quality problems, with 2025 scores of 234 PP100 and 235 PP100, respectively—much higher than for BEVs (220 PP100). PHEVs show a significant increase in design-related problems (+12 PP100), while REEVs see a sharp rise in malfunction-related problems (+17 PP100). Infotainment system problems have risen by 5 PP100 for PHEVs and 7 PP100 for REEVs. Also, driver assistance problems have surged for REEVs (+6 PP100).

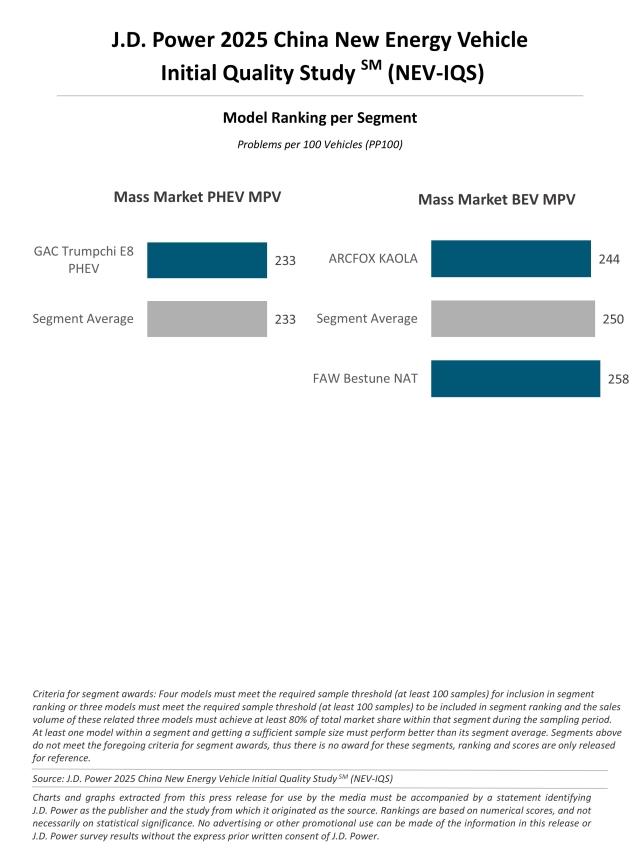

- MPVs and off-roaders are popular, but quality lags: Diversified demand is driving interest in NEV MPVs and off-road vehicles. MPV sales in tier-one cities have risen 4.4% year over year, driven by family needs and road-trip demand.[1] However, quality remains a concern, with MPVs showing the highest PP100 increase among the three body types at 20.8%. Of the top 20 problems for MPVs, four are seat-related—mainly affecting the second and third rows—and include issues like limited seat adjustment range, seat noise at high speed and poor seatbelt fit. Off-road NEVs, favored for their driving fun, have a share that is 8.2 percentage points higher in tier-two cities compared to non-off-road models. However, while these vehicles attract attention with their bold designs, their quality often falls short. Five of the top 20 problem areas in the off-road segment relate to noise and abnormal sounds.

Highest-Ranked NEV Models

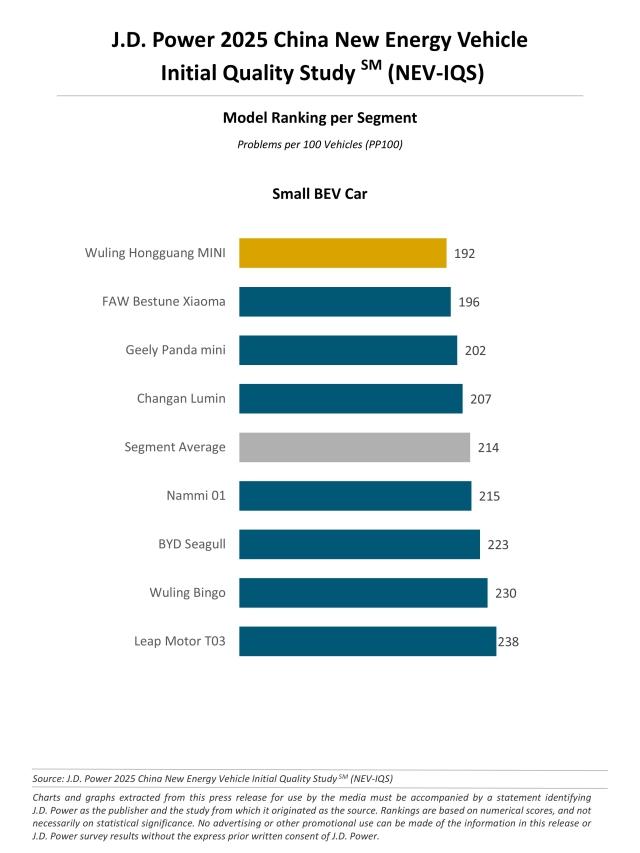

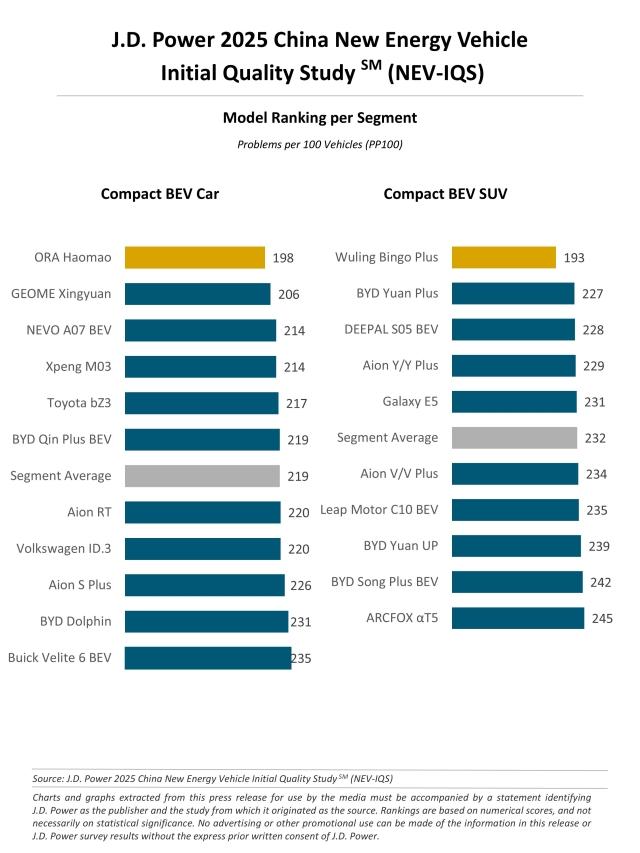

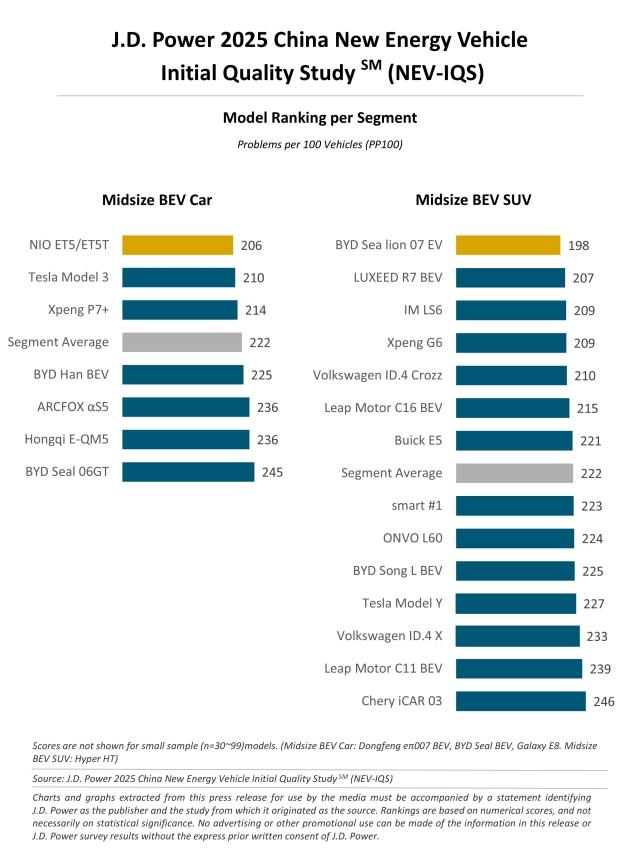

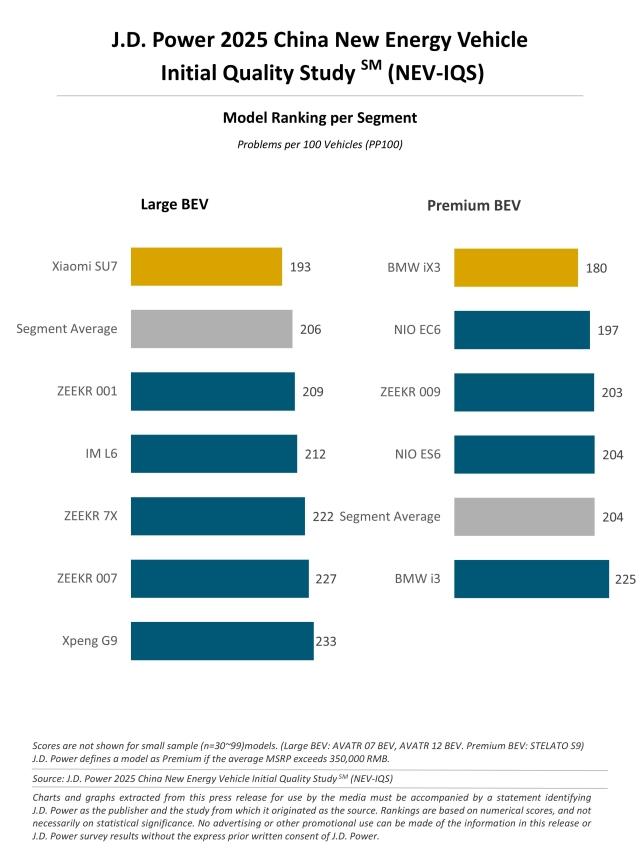

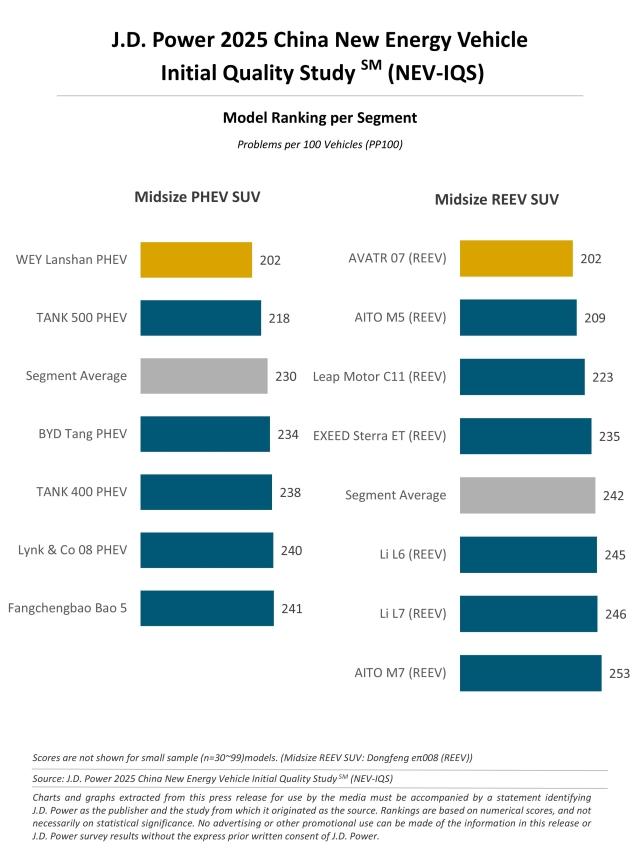

Models that rank highest in their respective segment are:

- Small BEV Car: Wuling Hongguang MINI

- Compact BEV Car: ORA Haomao

- Compact BEV SUV: Wuling Bingo Plus

- Midsize BEV Car: NIO ET5/ET5T

- Midsize BEV SUV: BYD Sea lion 07 EV

- Large BEV: Xiaomi SU7

- Premium BEV: BMW iX3

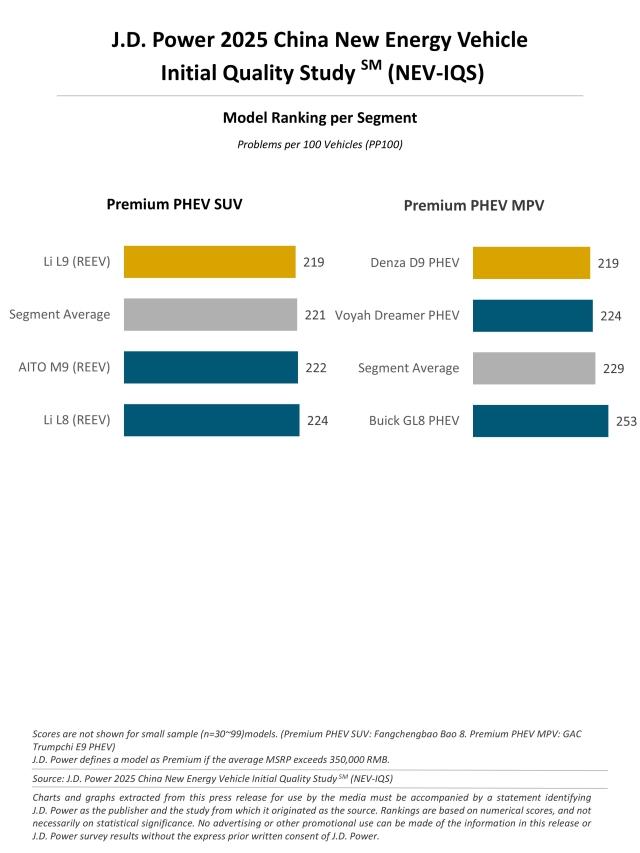

- Premium PHEV SUV: Li L9 (REEV)

- Premium PHEV MPV: Denza D9 PHEV

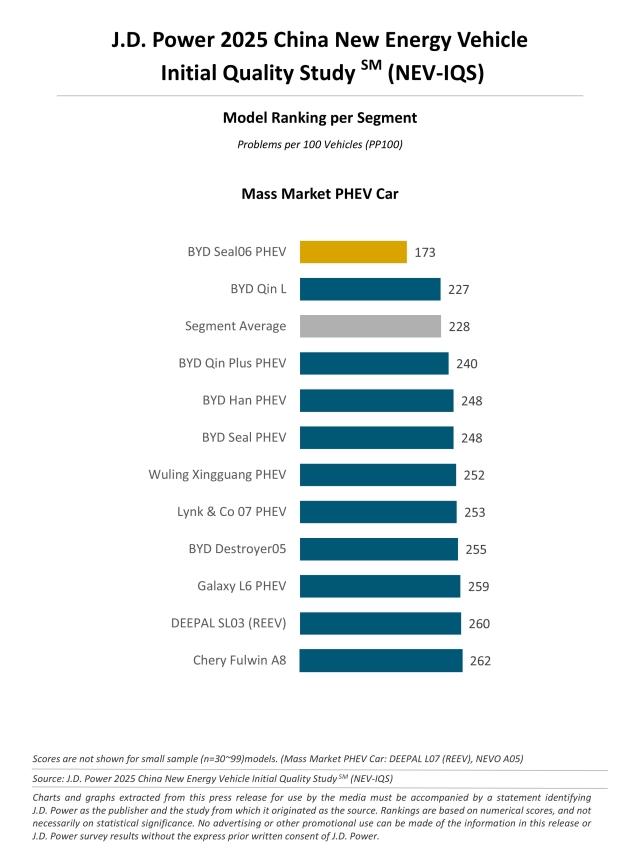

- Mass Market PHEV Car: BYD Seal06 PHEV

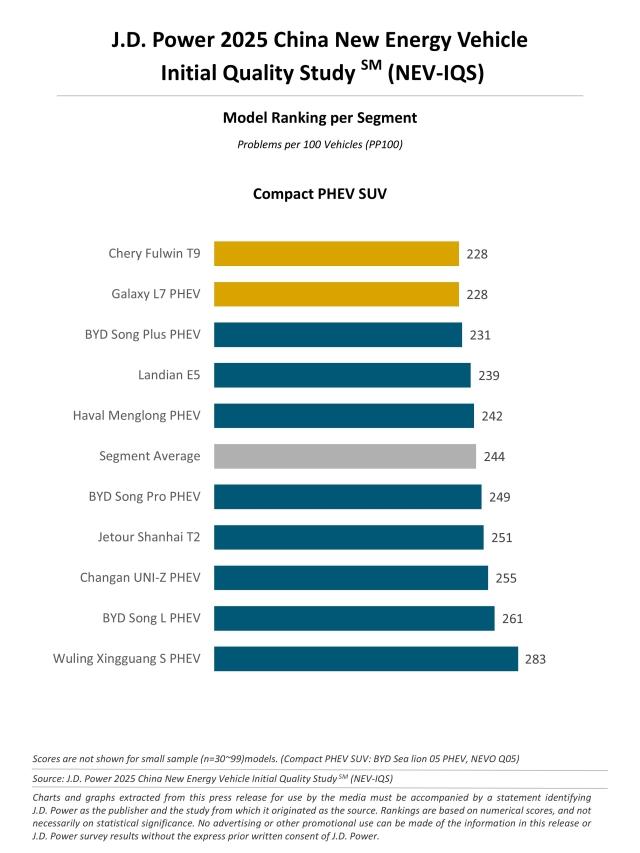

- Compact PHEV SUV: Chery Fulwin T9, Galaxy L7 PHEV

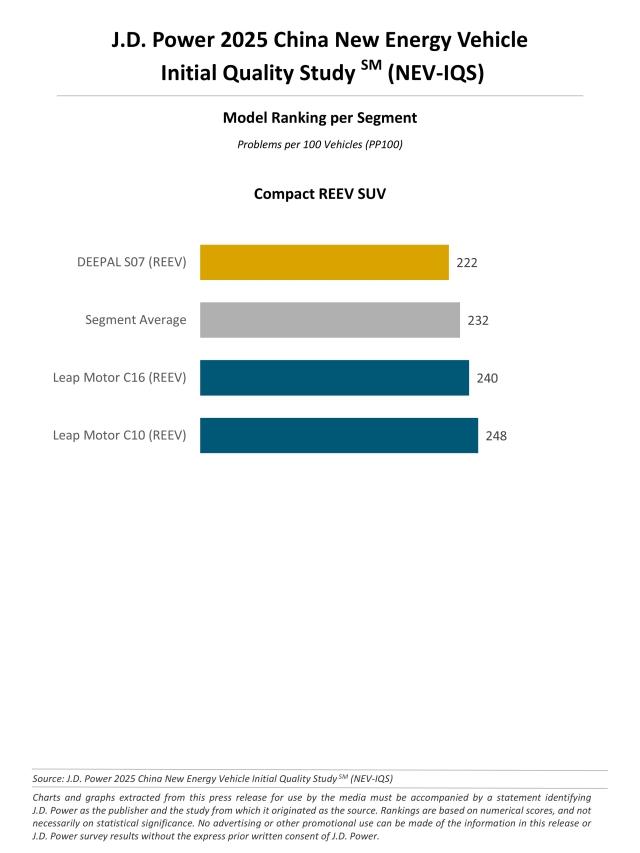

- Compact REEV SUV: DEEPAL S07 (REEV)

- Midsize PHEV SUV: WEY Lanshan PHEV

- Midsize REEV SUV: AVATR 07 (REEV)

Award criteria in the Small BEV SUV, Premium PHEV Car, Mass Market PHEV MPV and Mass Market BEV MPV segments were not met, therefore, no awards are given this year in those segments.

The China New Energy Vehicle Initial Quality Study (NEV-IQS) measures new-vehicle quality by examining problems experienced by NEV owners in two segments: design-related problems and defects/ malfunctions. Specific diagnostic questions include 236 problem symptoms across 10 categories: features/ controls/ displays; exterior; interior; infotainment system; seats; driving experience; driving assistance; powertrain; battery/ charging; and climate.

The study this year is based on responses from 20,829 vehicle owners who purchased their NEV between July 2024 and January 2025. The study includes 122 models from 48 different brands, among which 107 models have sufficient samples. The study was fielded from January 2025 through March 2025 in 81 cities across China.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Wenjing Ji, JD Power; China; +86 21 8026 5719; wenjing.ji@jdpa.com

Geno Effler, JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

[1] Reference: JD Power 2024 China New Energy Vehicle Customer Experience Value Index (NEV-CXVI) Study