Usage of Used-Vehicle Financing Ties That of New-Vehicle Financing for First Time, JD Power Finds

Changan Auto-Finance, Industrial and Commercial Bank of China and SAIC Finance Rank Highest in Respective Segments

SHANGHAI: 18 May 2023 – The penetration of used-vehicle financing tied that of new-vehicle financing for the first time in 2022 at 64% and reaching record highs, according to the JD Power 2023 China Dealer Financing Satisfaction (DFS) Study,SM released today.

The study, now in its ninth year, examines dealer satisfaction with finance providers in two segments, retail credit and floor planning. Retail credit is defined as the credit granted by auto financial providers to new-vehicle buyers while floor planning allows dealers to obtain loans from auto finance companies or banks to finance their inventory. The study systematically measures leasing, used-car retail credit and auto insurance service offerings and more. This year the study expanded the scope from the fuel car auto finance market to also include the NEV auto finance market.

The study finds that the penetration of new-vehicle financing in 2022 is 64%, 2 percentage points higher than 2021. Although the penetration of new-vehicle financing remains high, the number of new-vehicle purchases is trending down, while used-vehicle purchases are increasing.

In 2022, the penetration of used-vehicle financing was also 64%, a significant increase of 10 percentage points from 2021. The increase in the used-vehicle stock and financial institutions investment in used-vehicle financing are the two main driving factors for the significant increase in the penetration of used-vehicle financing.

“China's automotive market has moved from the era of increment to inventory,” said Joseph Yang, director of auto finance practice at JD Power China. “With the continuous growth of new energy vehicle sales and the gradual increase of market share of domestic brands, a series of new changes has also taken place in auto financing market. If financial institutions engaged in auto financing cannot take the initiative to meet the demands of dealers and sales channels in the new scenario, such as new energy auto financing, used-vehicle financing, auto financing value-added services and comprehensive financial services based on vehicles, they will face great challenges in the future competition. The competitive pattern of automobile financing has begun to emerge in 2023. The next five years will be the key for China's auto financing companies to survive."

Following are additional findings of the 2023 study:

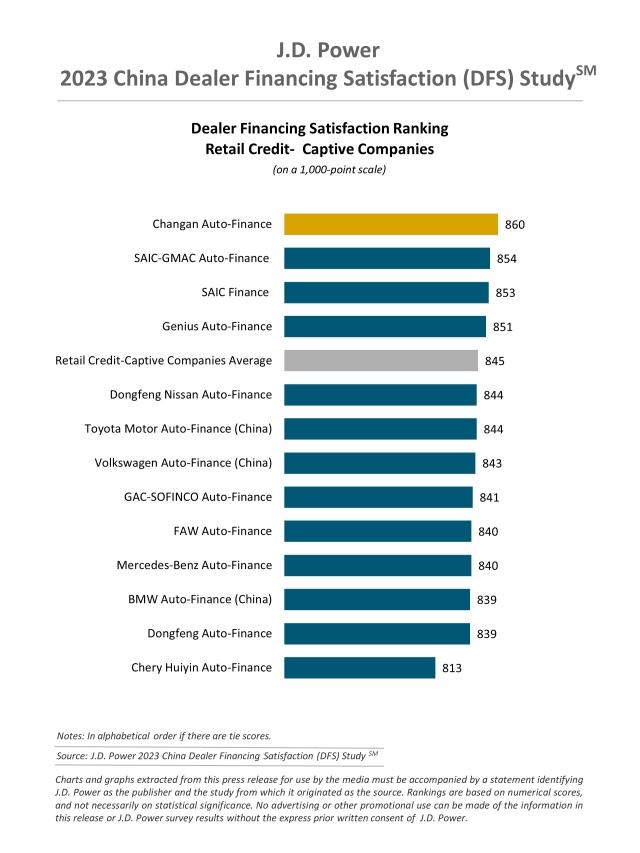

- Retail credit segment satisfaction declined: Overall dealer satisfaction with retail credit providers is 822 (on a 1,000-point scale) in 2023, 16 points lower than a year ago and lowest in the past three years. Financial leasing company (806) has significantly declined by 24 points. Captive companies (845) and banks (817) have declined to varying degrees from last year.

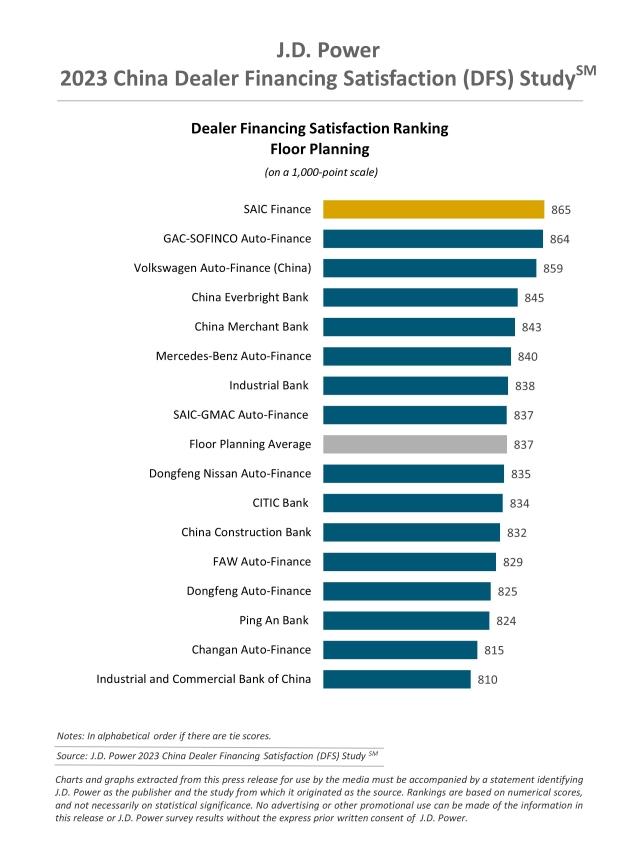

- In the floor planning segment, captive companies have improved: Dealer satisfaction with floor planning providers is 837 in 2023, which is 2 points lower than in 2022. However, overall satisfaction is relatively stable compared with the retail credit segment. Auto finance companies (843) has increase from 2022 (841) and banks (832) has a slight decrease from 2022 (836).

- Finance business and car insurance commissions account for one-fourth of dealership profits: Commissions from auto finance business and car insurance business commissions directly related to auto finance account for 13% and 12%, respectively, of the dealership's overall profits and the combined profits by the two businesses account for 25% of the dealership's profits.

Study Rankings

In the retail credit—captive companies segment, Changan Auto-Finance ranks highest with a score of 860 followed by SAIC-GMAC Auto-Finance (854) and SAIC Finance (853).

In the retail credit—banks segment, Industrial and Commercial Bank of China ranks highest with a score of 842 followed by China Construction Bank (834) and China Merchant Bank (828).

In the floor planning segment, SAIC Finance (865) ranks highest, followed by GAC-SOFINCO Auto-Finance (864) and Volkswagen Auto-Finance (China) (859).

The study is based on responses from 2,509 dealers, covering 55 vehicle brands and 90 finance providers across 87 cities in China. The study was fielded between December 2022 and March 2023 and examines dealer satisfaction with finance providers in two segments: retail credit and floor planning. In the retail credit segment, satisfaction is measured in finance provider offerings/products; application/approval process; and sales representative relationship. In the floor planning segment, satisfaction is measured in finance provider credit line; floor plan portfolio management; floor plan support; and salesperson representative relationship.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Mengmeng Wang; JD Power; China; +86 21 8026 5721; mengmeng.wang@jdpa.com

Geno Effler; JD Power; Costa Mesa, California, USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info