Mass Market Automotive Brands in China Exceed Luxury Brands in Sales Satisfaction for the First Time in 22 Years, JD Power Finds

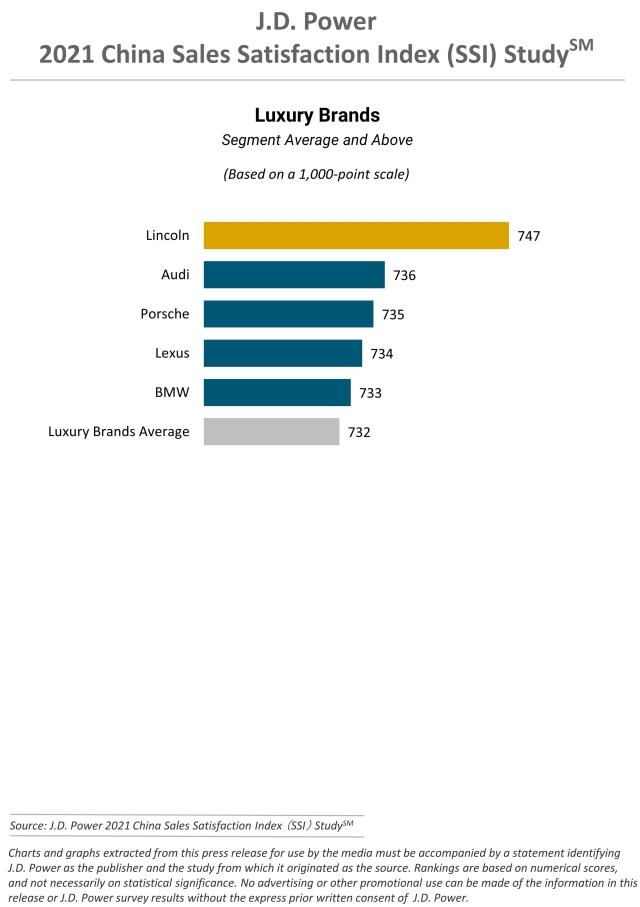

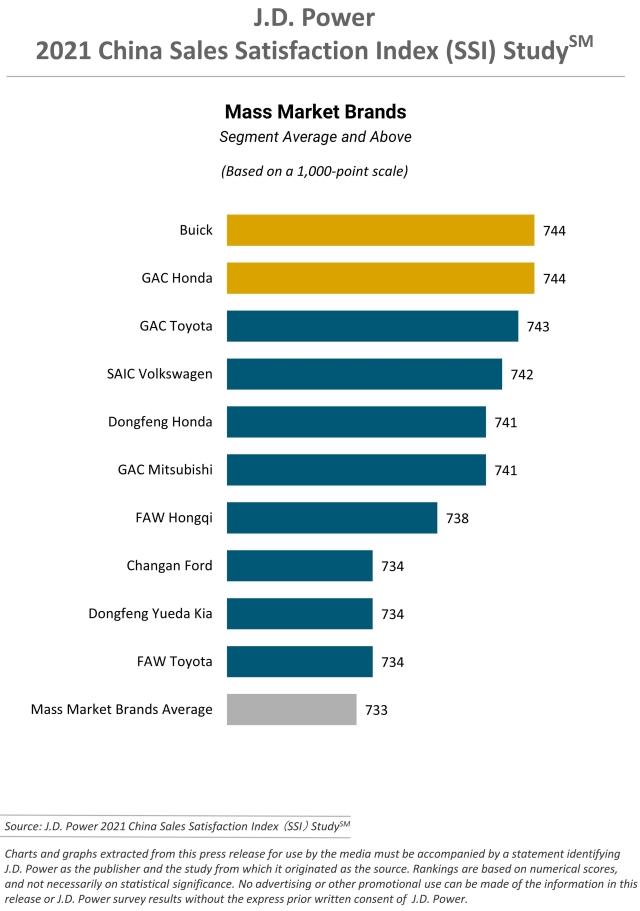

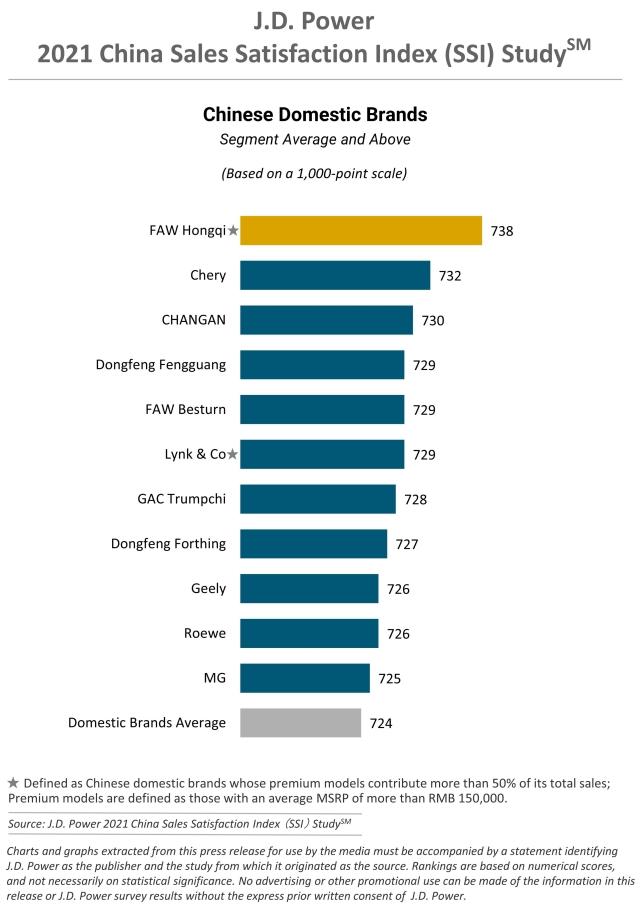

Lincoln, Buick, GAC Honda and FAW Hongqi Rank Highest in Respective Segments

SHANGHAI: 30 June 2021 – Mass market automotive brands in China surpass luxury brands in sales satisfaction for the first time in the 22 years the study has been published, according to the JD Power 2021 China Sales Satisfaction Index (SSI) Study,SM released today.

The study measures customer satisfaction with the purchase experience among new-vehicle buyers as well as rejecters, defined as those who consider a brand seriously but ultimately buy another brand.

The 2021 study shows that sales satisfaction in the mass market segment (733 on a 1,000-point scale) is one point higher than in the luxury segment, which marks a notable turnaround compared with the past 21 years. Among the measures that comprise the study, the overall scores for reception and showroom visit are notably close in both segments. Luxury brands outperform mass market brands in online shopping experience while scores for mass market brands are higher in communication before visit and test drive.

The study also finds that the percentage of customers who know the exact brand or model they want to purchase when first shopping has increased to 75% in 2021 from 68% in 2020 and the number of times customers visit dealer shops has decreased to 2.33 times from 2.46 in 2020.

“As auto customers in China tend to make their decision in the early stage of vehicle purchase and thus shorten the buying process, the online retail experience becomes increasingly important,” said Ann Xie, digital retail consulting practice at JD Power China. “Especially as luxury and mass market brands are nearly even in score for online retail, managing the customer lifecycle experience by leveraging digital marketing tools, privatizing traffic resources and innovative approaches such as subscription services to ensure that customers take their vehicle away joyfully and quickly, will become the new opportunity and challenge for automakers and dealers.”

Following are additional findings of the 2021 study:

- Customers who reject a brand before visiting a dealership continues to increase: The percentage of potential buyers who reject a brand when searching vehicle information online or communicating with dealers before visiting has increased for the fifth straight year, to 62% in 2021 from 10% in 2017 and represents a year-over year increase of nine percentage points.

- Key indicators that drive satisfaction of luxury and mass market brand buyers varies: Among satisfaction measures, luxury car buyers care more about the usage of digital tools in vehicle introduction and price negotiation, while mass market brand buyers care more about test drive. Among both luxury and mass market brand buyers, salesperson’s vehicle introduction and the efficiency of delivery as well as the attitude of salesperson on delivery day have significant impact on satisfaction.

- Satisfaction of female buyers is lower than of male buyers: In 2021, the sales satisfaction of female buyers (716) is 23 points lower than that of male buyers. The gap mainly lies in scores for deal, delivery process and reception. The study shows that kind, active, dedicated and patient service has a more significantly positive impact on the purchase experience of females than of males.

Study Rankings

Lincoln ranks highest for the first time among luxury brands with a score of 747. Audi (736) and Porsche (735) high second and third, respectively.

Buick and GAC Honda rank highest in a tie among mass market brands, each with a score of 744. GAC Toyota (743) ranks third.

To foster the development of Chinese domestic brands, in 2021, JD Power releases the sales satisfaction ranking of Chinese domestic brands for the first time, among which FAW Hongqi (738) is the highest-ranked brand as well as the highest-ranked premium brand,[1] followed by Chery (732) and CHANGAN (730).

The JD Power 2021 China Sales Satisfaction Index (SSI) Study measures sales satisfaction among new-vehicle buyers and rejecters. Buyer satisfaction is based on seven measures: online experience (18%); communication before visit (10%); reception (15%); showroom visit (13%); test drive (8%); deal (16%) and delivery process (20%). Rejecter satisfaction is based on six measures: online experience (31%); communication before visit (30%); reception (17%); showroom visit (11%); test drive (6%); and negotiation (6%).

The 2021 study is based on responses from 25,412 vehicle owners in 70 major cities who purchased their new vehicle between May 2020 and February 2021. The study was fielded from November 2020 through April 2021.

For more information about the JD Power China Sales Satisfaction Index (SSI) Study, visit HERE.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Shana Zhuang; JD Power; China; +86 21 8026 5719; shana.zhuang@jdpa.com

Geno Effler; JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

[1] Defined as Chinese domestic brands whose premium models contribute more than 50% of its total sales; Premium models are defined as those with an average MSRP of more than RMB 150,000.

NOTE: Three charts follow.