Consumers in China Shop Less; Brand Plays More Influence on Purchase Decisions, JD Power Finds

BMW and FAW-Volkswagen are Highest-Ranked Luxury and Mass Market Brands in Brand Influence, Respectively

BMW and FAW-Volkswagen are Highest-Ranked Luxury and Mass Market Brands in Brand Influence, Respectively

SHANGHAI: 26 March 2020 – Consumers in China are visiting auto dealers less often during the car-selection phase, but their decision-making process is accelerating. According to the JD Power 2020 China New Vehicle Intender StudySM (NVIS), released today, brand influence and early connection between brands and consumers become even more important.

The study, now in its 12th year, examines consumer perceptions of vehicles and the purchase behaviors of those who intend to purchase a new vehicle within the next 12 months. The study also measures purchase decision factors when considering a vehicle for purchase, brand recognition, favorability and impression, as well as consumer interest in new technologies.

The study finds that the decision-making process of intended buyers in China is speeding up. In 2020, intended buyers visit 1.65 brands’ dealerships, down 8% from 1.79 brands in 2019, and the total number of dealer visits by intended buyers decreases 17% (2.9 in 2020 vs. 3.5 in 2019).

“Potential buyers have already eliminated several brands from their choices before visiting brands or dealers in person, which indicates that brand perceptions and impressions are playing more influence on purchase decisions. We have noticed the similar trend in the JD Power China Sales Satisfaction Index (SSI) Study, which shows that consumers know exactly which brand they would buy before purchase increased to 18% in 2019 from 10% in 2016, showing automotive brands need to strive to enter the mind of consumers at the very beginning of their purchase decisions,” said Edward Wang, managing director of syndicated research at JD Power China. “Meanwhile, with the effect of the COVID-19 outbreak, intended buyers are less likely to visit dealers while automotive brands relying more on digital retailing such as selling cars on live streaming platforms, making it more crucial for brands and dealers to leverage each single offline contact with customers and deliver better service experience, thus, to facilitate their purchase decisions.”

Following are additional findings of the 2020 study:

- Importance of vehicle configurations on purchase increases: The configurations-related reasons to potential buyers' choice of intended models has grown to 43% in 2020, up from 17% in 2016.According to the demand degree of potential buyers, the vehicle configurations can be categorized into high demand configurations, differentiated configurations and user experience enhancement configurations.

- Demand for safety features increases: The requirements of intended buyers for safety features, such as automatic emergency braking, built-in night vision camera and surround-view, has increased 10% in 2020 compared with 2019, which is higher than driving assistance features, user experience enhancement features and multi-media features.

- Purchase budget drops for a second year in a row: The average price of a considered car by intended buyers has dropped 18% to RMB 201K (USD 28.4K) in 2020, from RMB 244k (USD 34.5K) in 2018.

- Purchase intention of New Energy Vehicles (NEVs) increases for five consecutive years, but concerns remain: NEV has surpassed small car, MPV and premiere car to become the third vehicle type that consumers intend to buy, just after SUV and Mid-size car. Limited driving range (25%) and immaturity of NEV technologies (21%) remain major concerns.

- Domestic brands prospects are less likely to consider other brands: Although purchase intention of mass market international brands is higher, most intended buyers will consider other brands. On the contrary, despite the purchase intention is lower, consumers who intend to buy domestic brands have higher brand loyalty and are less likely to buy other brands.

Study Rankings

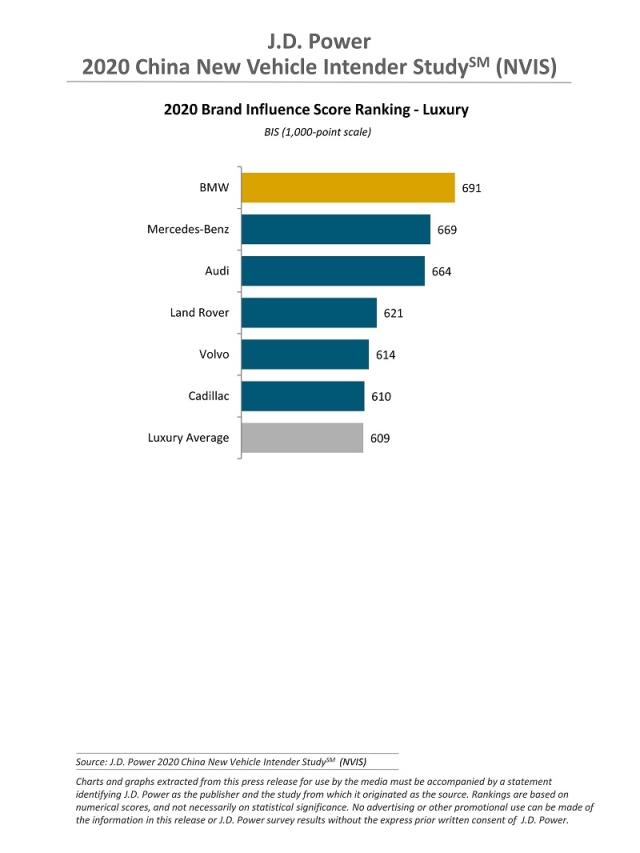

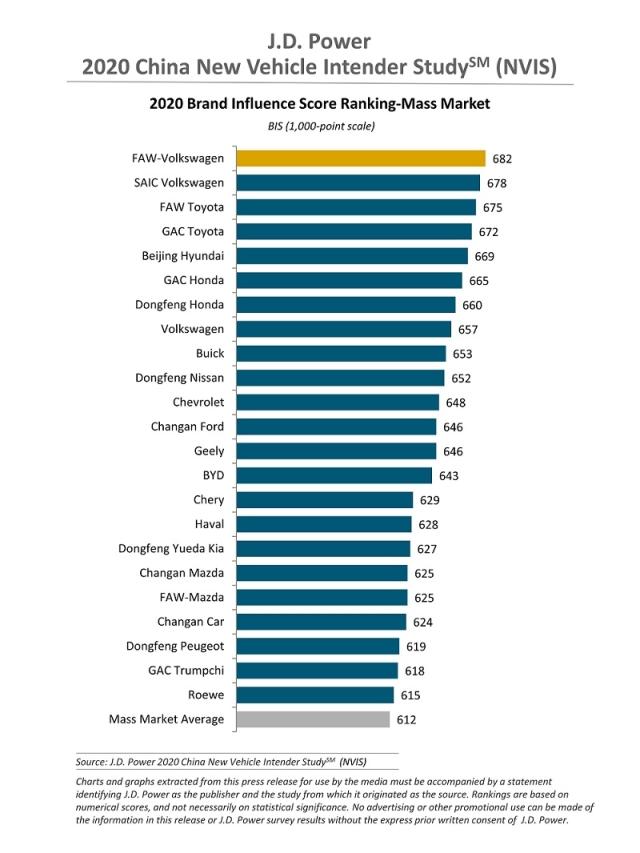

The study also includes a brand influence score (BIS) which measures familiarity and favorability of automotive brands among intended new-vehicle buyers in China.

BMW achieves the highest BIS among luxury brands with a score of 691 (on a 1,000-point scale), followed by Mercedes-Benz (669) and Audi (664). FAW-Volkswagen (682) is highest ranked mass market brand, SAIC Volkswagen (678) ranks second and FAW-Toyota (675) ranks third.

The 2020 China New-Vehicle Intender Study is based on responses from 11,881 intended new-vehicle buyers. The study includes 66 brands and was conducted online from December 2019 through January 2020. The data collection was conducted prior to the COVID-19 outbreak, thus the direct effects of the disease on purchase intentions is not reflected in this year’s study.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

# # #

NOTE: Two charts follow.