Vehicle Dependability Gap Narrows Between Domestic and International Brands in China, JD Power Finds

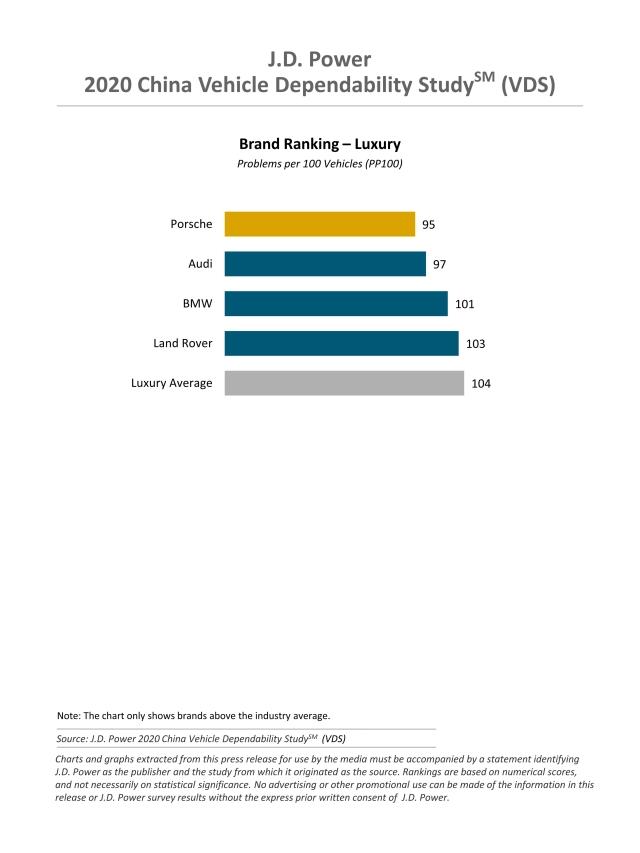

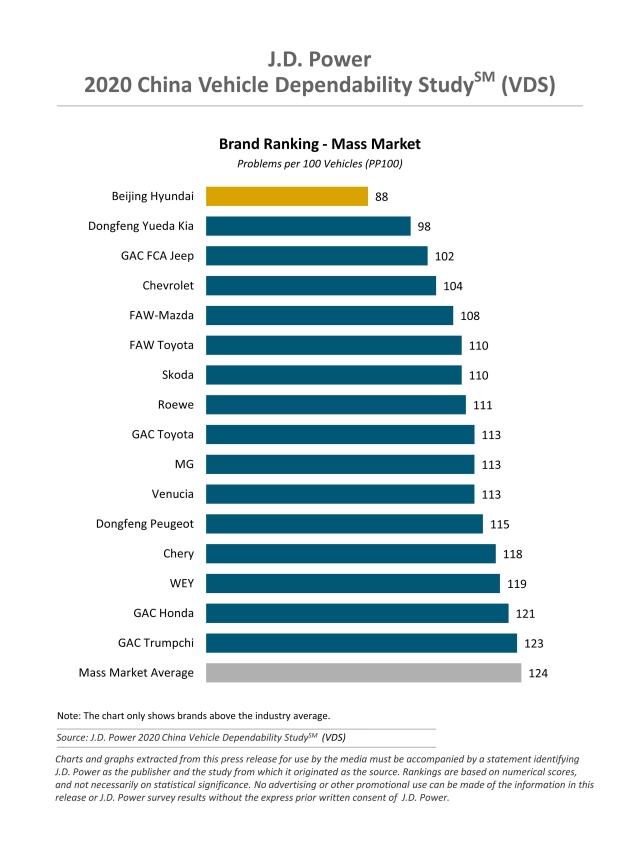

Porsche (Luxury) and Beijing Hyundai (Mass Market) Rank Highest in Respective Segments

SHANGHAI: 19 Nov. 2020 — The gap between Chinese brands and international mass market brands in vehicle dependability narrows, making it the smallest since 2010, according to the JD Power 2020 China Vehicle Dependability Study (VDS), SM released today.

The study, now in its 11th year, measures the number of problems experienced per 100 vehicles (PP100) during the past six months by vehicle owners of 13- to 48-month-old vehicles. A lower score reflects higher quality. The study covers 177 specific problems grouped into eight major vehicle categories: vehicle exterior; vehicle interior; driving experience; features/ controls/ displays; audio/ communication/ entertainment/ navigation; heating/ ventilation/ air conditioning; seats; and engine/ transmission.

According to the study, the gap between domestic brands (130 PP100) and international mass market brands (121 PP100) in vehicle dependability narrows to 9 PP100 from 11 PP100 in 2019. Domestic brands have made significant progress in engine/ transmission and continuously narrow the gap with international mass market brands in this category. However, domestic brands lose their leading position in audio/ communication/ entertainment/ navigation (ACEN) category, with 1.1 PP100 more than international mass market brands.

“There is certain correlation between the complaints increase of ACEN and the increase of installation rate, the installation rate of ACEN for domestic brands has increases 32.2% since 2015,” said Jeff Cai, general manager of auto product at JD Power China. “However, considering the ACEN installation rate of domestic brands is similar to that of international mass market brands, which are 41.7% and 44.1%, respectively, domestic brands still have a lot of room to improve.”

Following are additional findings of the 2020 study:

- Overall vehicle dependability declines slightly: The overall vehicle dependability this year is 121 PP100 (7 PP100 increase from 2019). Complaints increase in most categories except vehicle exterior, with the highest increase in engine/ transmission (+3.5 PP100).

- Chinese brands more dependable than most international brands in largest segment: The midsize car segment is the largest segment in mass market, with a market share of 24.3%, while domestic brands only account for 5.6% of the midsize car segment. Domestic brands could achieve greater success in the midsize car segment by leveraging their quality advantages.

- Vehicle dependability in SUV segment trails sedan segment for first time in five years: The dependability of mass market SUVs lag behind small car and midsize car with 8 PP100 and 4 PP100, respectively, and the luxury SUVs lag behind luxury car with 2 PP100.

- Complaints of seats and ACEN significantly increase after six months of ownership: Compared with 2 to 6 months of ownership, complaints about seats increase 84% in 12 to 18 months of ownership, while the complaints about ACEN increase 44%. The most common complaints about seat and ACEN are abnormal noises and poor radio signal, respectively.

Highest-Ranked Brands and Models

Porsche ranks highest in vehicle dependability among luxury brands with 95 PP100. Audi ranks second with 97 PP100. BMW (101 PP100) ranks third.

Beijing Hyundai is the highest-ranked mass market brand with 88 PP100. Dongfeng Yueda Kia ranks second with 98 PP100. GAC FCA Jeep (102 PP100) ranks third.

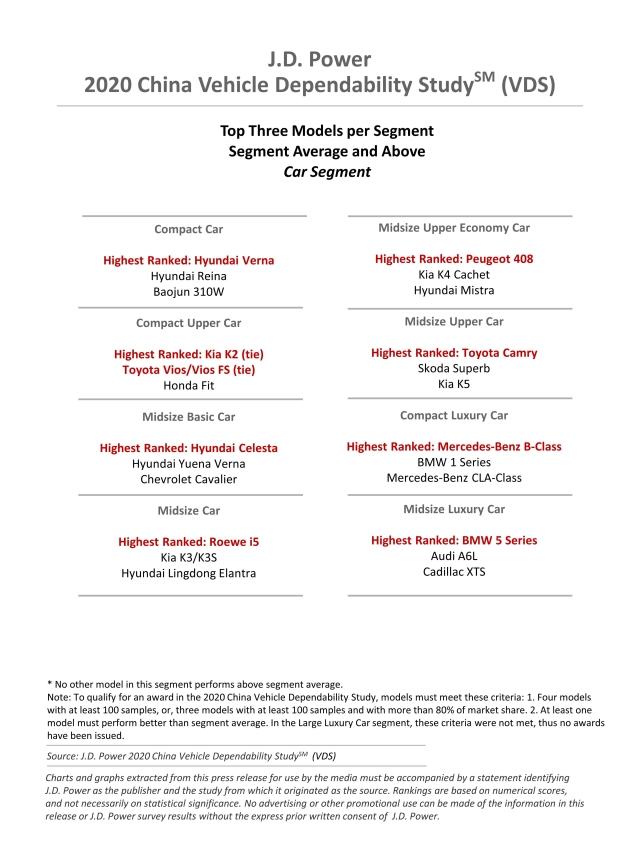

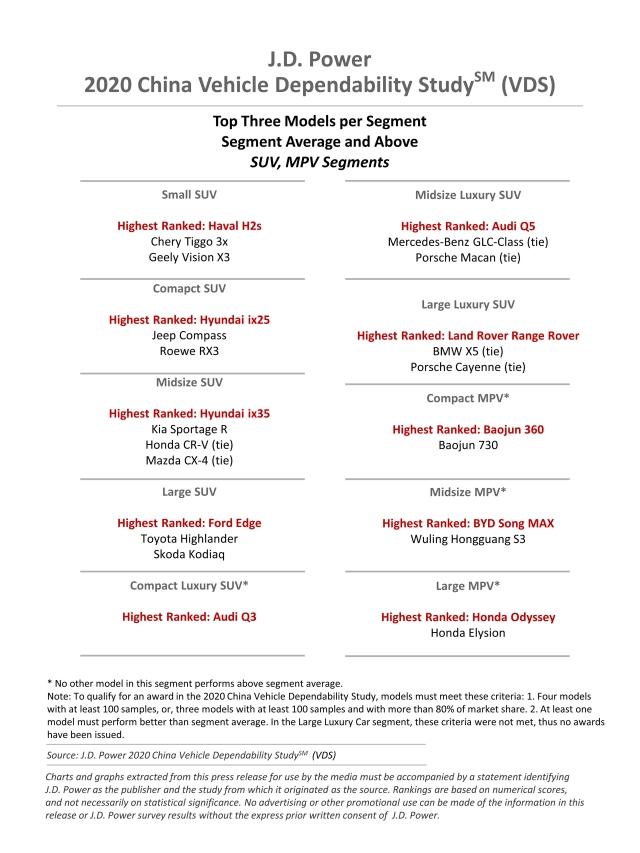

Beijing Hyundai has four models rank highest in their respective segments: Hyundai Celesta; Hyundai Verna; Hyundai ix25; and Hyundai ix35.

Audi has two models rank highest in their respective segments: Audi Q3 and Audi Q5.

Other models that rank highest in their respective segments are Baojun 360; BMW 5 Series; BYD Song MAX; Ford Edge; Haval H2s; Honda Odyssey; Kia K2; Land Rover Range Rover; Mercedes-Benz B-Class; Peugeot 408; Roewe i5; Toyota Camry; and Toyota Vios/ Vios FS.

The 2020 study is based on responses from 34,395 vehicle owners who purchased their cars between February 2016 and July 2019. The study includes 239 models from 50 different brands and was fielded from March through August 2020 in 70 major cities across China.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Damon Liu, JD Power; China; +86 21 8026 5721; damon.liu@jdpa.com

Geno Effler, JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info