Automakers in China Need to Consider Users When Introducing New Technologies, JD Power Finds

Land Rover Ranks Highest Overall for Tech Innovation

SHANGHAI: 26 Nov. 2020 — “Do not need” and “do not know how to use” are the primary reasons vehicle owners in China cite for not utilizing certain advanced technology features, according to the inaugural JD Power China Tech Experience Index (TXI) Study,SM released today. This study finds that automakers need to fully consider user experiences and preferences when introducing new technologies to ensure their successful introduction and to gain a competitive advantage in the marketplace.

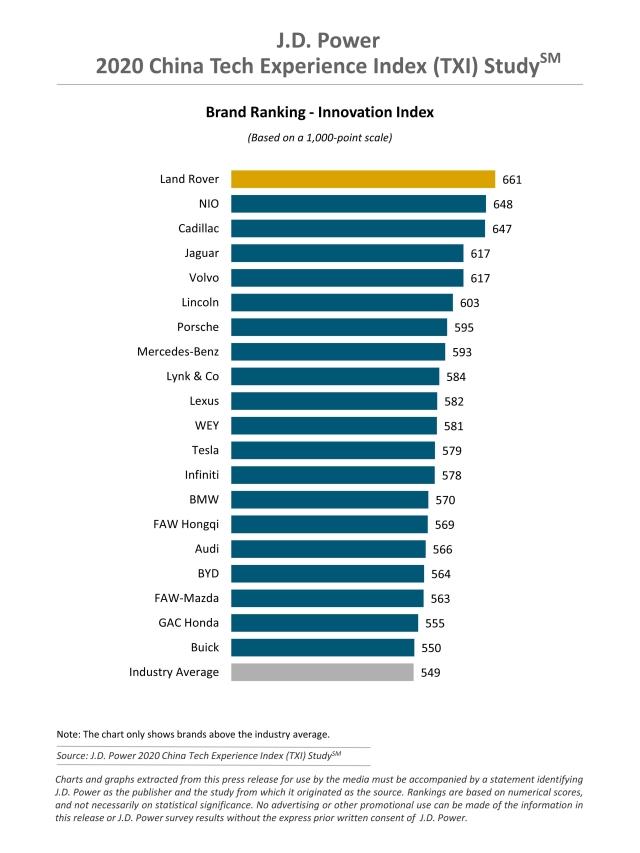

New to JD Power in China, the TXI Study focuses on vehicle owner perceptions of 26 advanced technologies when they are first introduced in the market. The TXI Innovation Index measures how effectively each automotive brand brings these technologies to market, measured on a 1,000-point scale. The index combines the level of adoption of new technologies for each brand with the excellence in execution. The execution measurement examines how much owners like the technologies and how many problems they experience while using them.

The study, which complements the JD Power Initial Quality Study (IQS)SM and the JD Power Automotive Performance, Execution and Layout (APEAL) Study,SM provides automakers with an overview of how vehicle owners perceive the advanced technology features through the whole technology lifecycle and offers insight to aid automakers in developing improvement plans.

“Intelligent and connected vehicles is the direction of strategic transformation for both the global and China automotive industries,” said Eileen Ren, vice president of the new energy vehicle and smart vehicle practice, JD Power China. “The degree of intellectualization of vehicles will determine whether the brands may gain competitive advantages in the future. The TXI Study measures problems encountered and the user experience with advanced technologies as they first enter the market, affording automakers time to address any problematic areas before the technologies enter the ‘mass availability’ stage.”

According to the study, 45% of vehicle owners say they never use certain technology features because they do not need them—the three features cited most often are mobile office service (71%); safe exit assist (53%); and dynamic driving assistance (47%). Among owners who would like to use advanced technology features, many cited “do not know how to use/need more training” as one of the main reasons for not using.

“Automakers must take user-related factors into account when carrying out technological innovation,” said Lin Pei, director of digital customer experience at JD Power China. “These include in what context owners would use the features; whether the features are easy to understand and to use; and whether the features are reliable. Together, these factors can help determine whether vehicle owners will pay for the advanced technology features and, ultimately, determine the success or failure of automakers’ innovation initiatives.”

Following are additional findings of the 2020 study:

- Reversing assistant is most often used and satisfying among the top three installed features: The top three advanced technology features with the highest installation rate in the China market are intelligent voice assistant (29%); reversing assistant (22%); and active lane change assist (13%). The reversing assistant has the highest usage rate and highest customer satisfaction.

- Features most likely to be installed: Among the top 10 features that owners indicate they are most likely to install in their next vehicle, seven are for ADAS (Active Driving Assistance Systems) and automated features, among which the three most often considered are: OEM-installed trip recorder/dash camera (37%); reversing assistant (35%); and rear cross traffic warning (30%).

- China domestic brands more innovative than international mass market brands: Luxury brands hold a significant lead with an overall Innovation Index score of 586. The index score for China domestic brands (538) is three points higher than that of international mass market brands (535), mainly due to a higher installation rate.

Highest-Ranked Brands

Land Rover ranks highest overall with an Innovation Index score of 661, followed by NIO (648) and Cadillac (647).

The 2020 study is based on responses from 32,536 conventional energy vehicle owners who purchased their vehicle between June 2019 and June 2020, as well as 3,276 new energy vehicle owners who purchased their vehicle between May 2019 and May 2020. The study includes 241 conventional energy models from 57 brands and 40 new energy models from 20 brands, and was fielded from December 2019 through August 2020 in 70 major cities across China.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Shana Zhuang, JD Power; China; +86 21 8026 5719/ shana.zhuang@jdpa.com

Geno Effler, JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info