New Energy Vehicle Technology in China Continues to Pull Ahead, JD Power Finds

Mercedes-Benz, Lynk & Co, Li Auto and and Xpeng Rank Highest in Respective Segments

SHANGHAI: 3 Aug. 20233— The overall industry Tech Experience Index (TXI) Innovation Index score this year reaches a study record high of 528 (on a 1,000-point scale), an increase of 23 points from 2022, according to the JD Power 2023 China Tech Experience Index (TXI) Study,SM released today. The index scores for new energy vehicles (NEV) and internal combustion engine vehicles (ICE) are 556 and 519, respectively. The index for NEVs expands its lead over ICE vehicles by 37 points, up 10 points from 2022.

The study, now in its fourth year, focuses on new-vehicle owners’ perceptions of 30 advanced technologies and eight basic technologies when first introduced in the market. The TXI Innovation Index—which consists of the Technology Execution Index[1] and Market Depth Index,[2] both of which are equally weighted—measures how effectively each automotive brand brings these technologies to market. The index combines the level of adoption of new technologies for each brand with the excellence in execution. The execution metric examines how much owners like the technologies and how many problems they experience while using them.

The study finds that the scores in the Market Depth Index is 151 and reaching record highs with an increase of 31 points from 2022. Meanwhile, Technology Execution has notably increased, to 854 in 2023 from 829 in 2022.

“With the transformation and upgrading of China's auto market, smart vehicles equipped with advanced technologies are becoming important choices for consumers when buying vehicles. According to this year's China New Vehicle Intender Study,SM the impact weight of tech experience on vehicle purchases has risen by two percentage points to 14%,” said Elvis Yang, general manager of auto product practice at JD Power China. “For automakers, installing advanced technologies in their vehicles does not necessarily mean that owners’ user tech experience will be positive. Finding what technologies owners really want and presenting them in a way they can easily be used will improve their tech experience.”

Following are additional findings of the 2023 study:

- Built-in online navigation system and intelligent voice assistant have become the two configurations with the highest awareness: In 2023, the penetration rates of built-in online navigation system and intelligent voice assistant have reached 59% and 51% respectively, becoming the two advanced technologies with the highest awareness. These two, in addition to the onboard communication app (39%) and OTA(Over-The-Air technology) update (38%) are the top four awareness configuration combinations by vehicle owners.

- Overall quality of technologies has improved: The industry problem rates this year is 30.1 problems per 100 vehicles (PP100), which has decreased by 2.3 PP100 from 2022, reflecting improved quality. The quality for smart cockpit is 23.9 PP100, improving by 3.2 PP100, while smart driving is 10.8 PP100, improving by 5.6 PP100.

- Complaints about difficult to use/understand problems increase: Complaints related to difficult to use/understand have increased for two consecutive years, reaching 34% for smart cockpit and 36% for smart driving. These increases shows that as advanced technologies penetrate from the early market to the mainstream market, such advanced technologies are exposed to more users. Ease of use and understanding has become the key point regarding whether these technologies will become widely accepted.

[1] The Technology Execution Index is formulated from respondents’ overall experience and the total problems experienced with the advanced technologies they have and use. The index weights are derived from survey responses using multivariate linear regression. As a result, the index weights could differ by study market or study year.

[2] The Market Depth Index is a measurement of the penetration level of advanced technologies. The calculation encompasses the popularity of equipping and usage of advanced technologies.

Highest-Ranked Brands

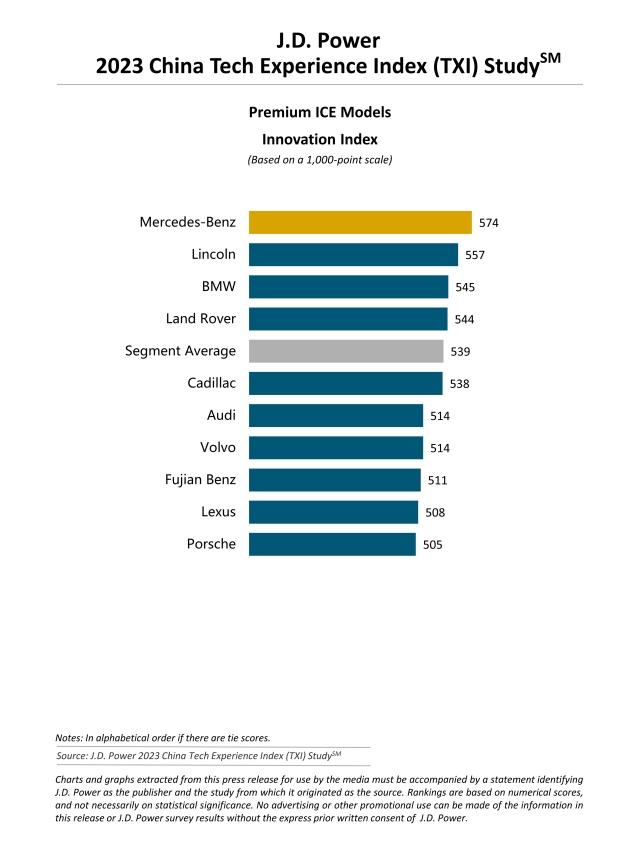

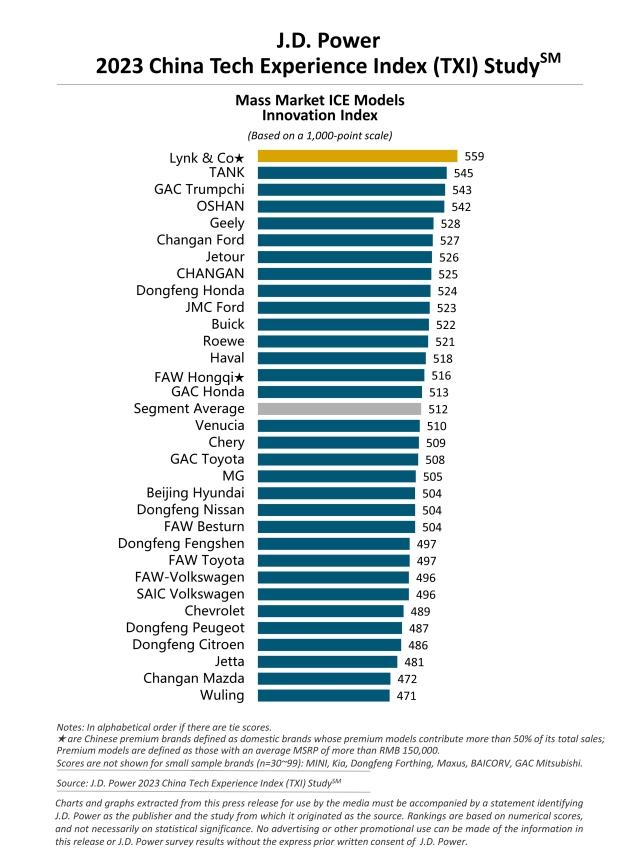

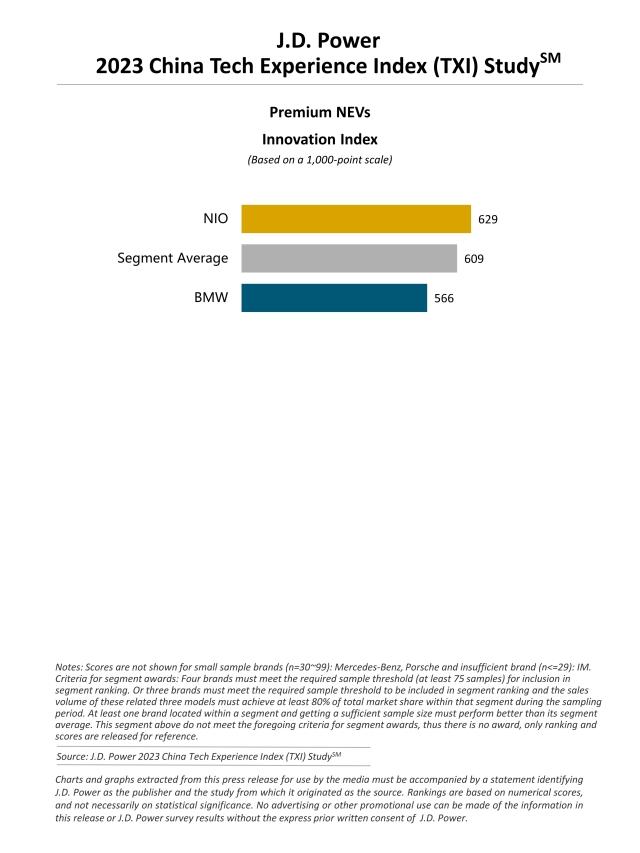

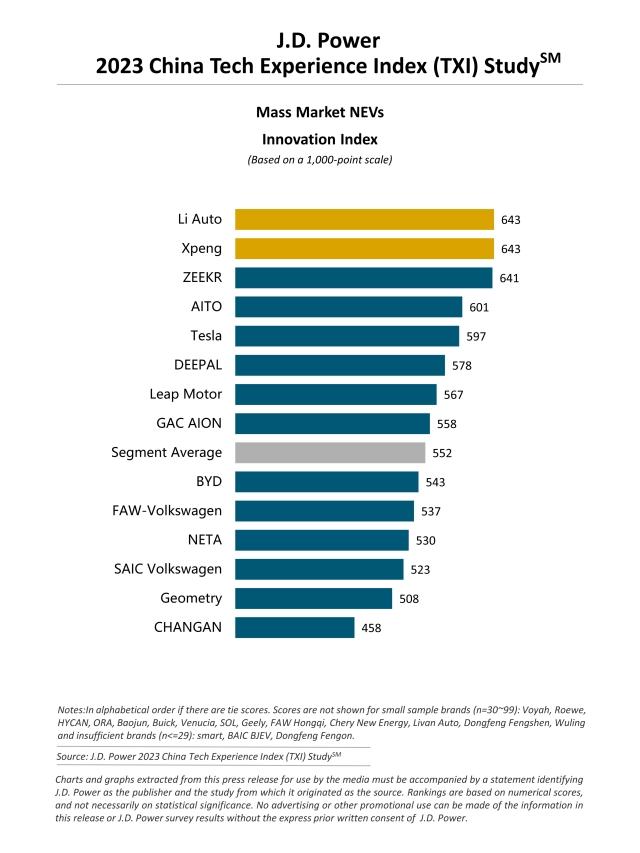

Mercedes-Benz ranks highest among premium internal combustion engine (ICE) models with a score of 574, followed by Lincoln (557) and BMW (545). Lynk & Co ranks highest among mass market ICE models with a score of 559, followed by TANK (545) and GAC Trumpchi (543). NIO (629) ranks highest among premium new energy vehicles (NEVs); no other brand in this segment performs above segment average. Li Auto and Xpeng rank highest in a tie among mass market NEVs, each with a score of 643. ZEEKR (641) ranks third.

The 2023 China Tech Experience Index (TXI) Study is based on responses from 35,159 ICE vehicle owners who purchased their vehicle between June 2022 and March 2023, as well as 7,189 NEV owners who purchased their vehicle between July 2022 and January 2023. The study includes 230 ICE models from 48 brands and 76 NEV models from 36 brands. The study was fielded from December 2022 through May 2023 in 81 major cities across China.

The China Tech Experience Index (TXI) Study, which complements the JD Power China Initial Quality Study SM (IQS) and the JD Power China Automotive Performance, Execution and Layout (APEAL) Study, SM is used extensively by automakers and suppliers worldwide to provide an overview of how vehicle owners in China perceive the advanced technology features in their new vehicles and to help the industry address any problematic areas before the technologies are made widely available across automotive portfolios, thus improving the future owner experience.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Mengmeng Wang, JD Power; China; +86 21 8026 5719; mengmeng.wang@jdpa.com

Geno Effler, JD Power; USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info