New Energy Vehicles Facing Traditional and NEV-Specific Quality Problems, J.D. Power Finds

NIO Ranks Highest in China NEV New-Vehicle Quality

SHANGHAI: 31 July 2019 – Addressing both new and traditional vehicle quality problems is crucial for New Energy Vehicle (NEV) manufacturers to improve product competitiveness and win consumers' favor, according to the J.D. Power Inaugural China New Energy Vehicle Experience Index (NEVXI) Study, SM released today.

New to J.D. Power in 2019, this study measures new-vehicle quality by examining problems experienced by NEV owners within the first two to six months of ownership. The new-vehicle quality score is determined by problems cited per 100 vehicles (PP100), with a lower number of problems indicating higher quality. This study also measures NEV owners’ satisfaction with sales service, after-sales service and product.

The study shows that the most cited problems by NEV owners are traditional vehicle quality problems. The top three most-frequently cited complaint categories are interior (16.3 PP100); exterior (15.8 PP100); and driving experience (14.7 PP100). Complaints about battery and electric motor, the core components of new energy vehicles, are less, with 7.4 PP100 and 3.4 PP100, respectively.

In terms of the NEV-specific problems, the top four complaints by NEV owners are insufficient engine power (2.7 PP100); slow charging speed (1.9 PP100); abnormal reduction of endurance mileage (1.8 PP100); and abnormal powertrain noises (1.4 PP100).

“With the fading of government support, consumers will be paying more attention to new energy vehicles,” said Jeff Cai, General Manager of Auto Product, J.D. Power China. “New-vehicle quality, as one of the most important elements for product competitiveness and consumers’ purchase decision, largely determines which side consumers will prefer when making choices between fossil-fuel vehicles and new energy vehicles. Although challenging, new energy vehicle manufacturers should not overlook the solutions to traditional quality problems while developing NEV core technologies and view it as an opportunity to win the favor of the market and consumers.”

Following are additional findings of the 2019 study:

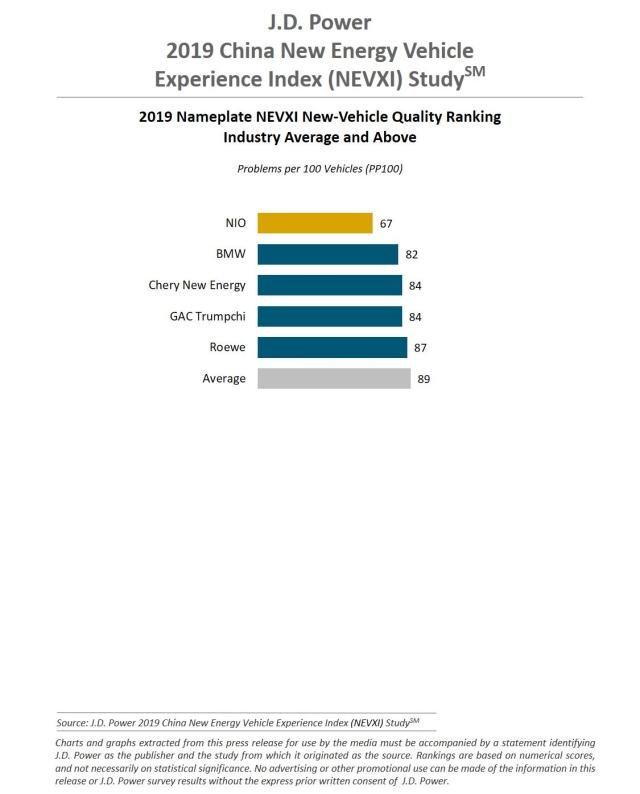

- Luxury NEV brands (69 PP100) outperform others in NEV new-vehicle quality: The industry average level of problems reported this year is 89 PP100.Chinese NEV brands by traditional manufacturers (90 PP100) have the most problems.

- NEV owners are satisfied with their overall user experience: Vehicle appearance/ styling/ design gets the highest score (7.6 on a 10-point scale), followed by driving experience (7.5) and interior design/ color/ material quality (7.5). Scores of battery performance and in-vehicle high-tech features are slightly lower, at 7.4.

- User experience with vehicle operation system (OS) needs to be improved: Vehicle OS are not yet widely accepted by NEV owners. The study finds that 64% of respondents have never tried the feature of over-the-air vehicle software updates. More user scenarios for vehicle OS are waiting to be explored. In addition, the most reported problems by NEV owners when using vehicle OS are few functions (31%); poor interface (26%); poor/ slow network (19%); and system crash/ slow (16%).

Study Rankings

NIO ranks highest in new energy vehicle new-vehicle quality among all brands, with a score of 67 PP100. BMW ranks second with a score of 82 PP100. Chery New Energy (84 PP100) and GAC Trumpchi (84 PP100) rank third in a tie.

BYD Tang PHEV ranks highest in the mass market plug-in hybrid segment. NIO ES8 ranks highest in the midsize/large BEV segment. In the Luxury PHEV and Small BEV segments, criteria for awarding are no meet, thus no awards are issued.

The J.D. Power Inaugural China New Energy Vehicle Experience Index (NEVXI) Study measures new-vehicle quality by examining problems experienced by NEV owners in two categories: design-related problems and defects/ malfunctions. Specific diagnostic questions are included in nine problem categories: features/ controls/ displays; interior; exterior; seats; driving experience; battery; audio/ communication/ entertainment/ navigation; electric motor/ transmission; and heating/ ventilation/ air conditioning.

The study is based on responses from 2,770 vehicle owners who purchased their cars between September 2018 and March 2019. The study includes 41 models from 21 different brands and was fielded from March through May 2019 in 30 major provinces across China.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power has offices serving North America, South America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on J.D. Power WeChat and Weibo.

Media Relations Contacts

Shana Zhuang; J.D. Power; China; +86 21 8026 5719; shana.zhuang@jdpa.com

Geno Effler; J.D. Power; Costa Mesa, California, USA; 001-714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info