China Daily: Zooming Into New Automobile Era

Everyone knows e-commerce and modern retail have transformed shopping in China, but not many are aware that the same innovative spirit is revving up a revolution in automotive sales in the world's largest car market.

These days, supermarkets are not just for shopping for groceries and household items. You can drive a brand new Maserati, Cadillac, BMW, Mercedes Benz or Audi off the supermarket shelf.

If that sounds like too much work still, how about going online and ordering a Porsche for express home delivery next day?

This is not fantasy but the reality of the world of e-commerce and digital technologies like big data, and a consequence of reform, restructuring and modernization of the auto sales sector.

At Suning Automobile Supermarket in Nanjing, capital of East China's Jiangsu province, a crowd of curious consumers got a taste of this reality last month as buyers drove off in new cars they just bought.

In two days after the car supermarket opened on July 15, more than 30 cars, mostly luxury brands worth millions of dollars, were bought. In addition, buyers picked up automobile parts, car decoratives and engine oil.

In doing so, they saved quite a bit because the prices were lower than those in the traditional market.

The scene was a contrast to the past, when car dealers in China dominated the segment of auto sales.

The manufacturer-dealer nexus was too strong; they could armtwist the consumer into accepting arbitrarily set prices and other terms and conditions for after-sales service.

Now, new regulations have introduced alternatives and empowered consumers. Coupled with innovative finance for buyers and restructuring of sales channels, the Chinese auto industry is driving into a new era.

First signs of the change appeared on April 14 when the Ministry of Commerce issued new guidelines for car sales. Under the new regime, auto trading companies can sell vehicles without any authorization from carmakers. The measures took effect in July.

That means, both authorized and unauthorized car sales are allowed. Auto supermarkets of the kind that Suning opened in Nanjing, exclusive multi-brand car stores and even e-commerce platforms sell cars now in China.

The ministry hopes the new measures will improve sales and after-sales service across different auto brands, an approach that is expected to save resources and boost efficiency.

As if on cue, Suning said it expects to open more than 100 auto supermarkets in first-and second-tier cities in China.

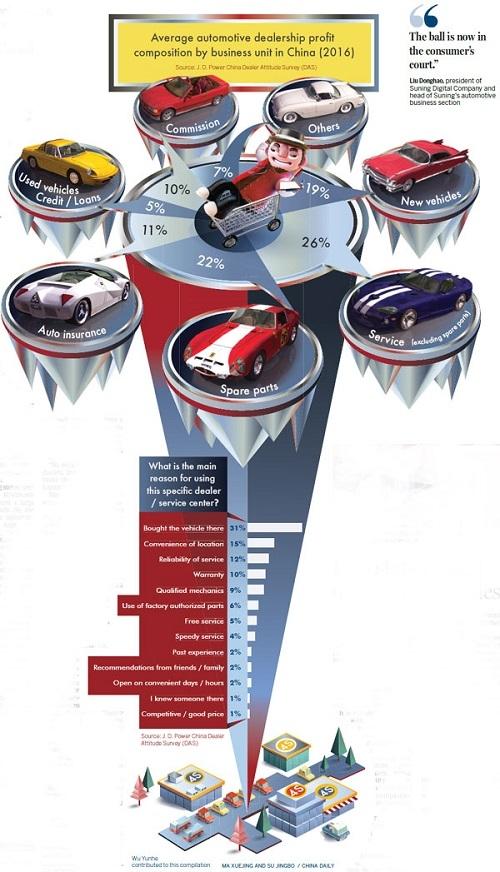

Liu Donghao, head of Suning's automotive business section, told reporters at the Nanjing store opening that the venture marks the starting point of the company's wider car-related business.

Suning's offline and online platforms will cover automobiles, electric motorbikes, automobile electronics, car decoratives, engine oils, rental and used cars. The platforms will deal with buyers directly with no middlemen in between.

"It's not right to say we have the lowest price. But our pricing is transparent, products offered are diverse and we guarantee quality," said Liu, who is also the president of Suning Digital Company. "The ball is now in the consumer's court."

Suning is collaborating with Ping An Automobile Butler to offer auto finance and auto insurance services in a one-stop-shop model.

Gome, another major retail player in China, is planning to add a car section at most of its 1,700 stores in the country. The project is expected to start within a year.

Gome's existing stores, usually located in downtown urban areas, record a large number of footfalls. So, the potential for the upcoming car business is high, said Zhang Haifeng, head of Gome's car business, in a meeting with potential investors in Kunming, Yunnan province, last month.

He said e-commerce alone won't suffice as an alternative auto sales channel, so brick-and-mortar stores are important too.

Alternative channels need not be seen as competition to existing dealer networks. Instead, Gome's planned auto foray will help both carmakers and dealers to sell cars.

"So, if you think we're going to replace car dealers, then you have misunderstood our business model."

He said Gome is building a system that is open to car dealers and carmakers. It is up to them to decide what car models they would offer to consumers through the new system. But, if the new approach gives customers a stronger voice, car dealers and carmakers would naturally offer better-selling products and better prices, Zhang said.

"So, we're not going to fight dealers. Instead, we'd like to invite them over to huddle together for warmth."

Meanwhile, Tmall, the e-marketplace owned by Alibaba, announced plans on July 26 to unveil an ultramodern real-world garage resembling a snack or beverage vending machine by the year-end.

Tmall consumers can push a button to select their car and drive away in it in a jiffy, according to Yu Weixuan, general manager of Tmall Automobile, the division of Tmall that is driving the garage venture.

Consumers with a good credit score can make 10 percent down payment to buy the car of their choice in 20 minutes.

Sesame Credit, a credit scoring system developed by Ant Financial Services Group, the online finance firm backed by Alibaba founder Jack Ma, will use big data to track online shoppers' behavior and payment record to award points. Anyone with over 750 credit points becomes eligible to buy a car off the garage.

For example, a car priced 150,000 yuan ($22,058) would require a consumer to pay 15,000 yuan toward down payment and a mortgage of about 2,000 yuan.

In the era of offline-and-online sales called New Retail, Tmall has become the preferred e-marketplace for automobile industry players to set up their digital stall. Nearly 500 car dealers have already set up their shops on Tmall.

The implications for the consumer are enormous.

Without middleman, car prices are trending lower. And the online channel offers better auto finance options.

This marks significant progress for China's vehicle market where numbers tend to be staggering.

Some 29.4 million new cars are forecast to be sold in China this year, up 5 percent year-on-year, according to the China Association of Automobile Manufacturers.

Passenger car sales volume could increase by 5 percent to 25.7 million vehicles this year.

The CAAM said 4.93 million branded passenger cars were sold in the first six months of this year in China, up more than 4 percent year-on-year.

Last year, 10.05 million branded passenger cars were sold, up more than 20.5 percent year-on-year.

The association paints an optimistic picture for the market as more families will make their first purchases and more will replace their vehicles.

Zhang Xiaodong, senior manager of Auto Retail Practice of JD Power China, said the alternative sales channels will have a major impact on the automobile manufacturing and trading industry, providing massive convenience to consumers.

However, given the large-scale nature of transactions involved, there could be initial difficulties in integrating dealers, traders, suppliers and other distribution channels, said Zhang.

The challenge is how to provide spare parts online for different brands, he said.

Typically, a conventional car dealer provides a combination of services like new car sales, repairs, maintenance and sale of parts. So, the new channels have to build a management and operations system to match or even exceed the current range of services offered by traditional dealers, Zhang said.

"Car dealers won't be replaced," he said emphatically. So, the real question is how to update and maximize their services in the right direction.

Dealers have to deepen their customers' trust through better marketing. Uncomplicated financing and an exchange for used cars are the way forward. From a monopoly-like situation, dealers need to head in the direction of working with car retailers to learn best practices fit for today's world, he said.

本文原载于2017年8月14日出版的《中国日报》,点击阅读原文。