Problems Experienced by Luxury Car Owners with ACEN Technology Create Opportunities and Challenges for China Market

Porsche Ranks Highest in Initial Quality among Luxury Brands; Beijing Hyundai Ranks Highest among Mass Market Brands and Receives Four Model-Level Awards

Shanghai: 30 October 2015 — The only problem category in which luxury car owners experience more problems with their vehicle than mass market vehicle owners is with their audio, communication, entertainment and navigation (ACEN) system, according to the JD Power 2015 China Initial Quality StudySM (IQS) released today.

Now in its 16th year, the study serves as the industry benchmark for new-vehicle quality by examining problems experienced by new-vehicle owners within the first two to six months of ownership in two distinct categories: design-related problems and defects and malfunctions. For 2015, the China IQS has been redesigned to include more specific diagnostic questions around eight problem categories: interior; exterior; engine/ transmission; driving experience; features/ controls/ displays; seats; audio/ communication/ entertainment/ navigation; and heating/ ventilation/ air conditioning. The overall initial quality score is determined by problems reported per 100 vehicles (PP100), with a lower number of problems indicating higher quality.

With the emergence and evolution of technology in new vehicles, owners of both luxury and mass market vehicles expect and demand increasing levels of functionality. Notably, ACEN is the only category in which owners of luxury vehicles experience more problems than owners of mass market vehicles. Additionally, the largest gap in the number of problems experienced by luxury car owners vs. mass market owners is 3 percentage points in the ACEN problem category (10% vs. 7%, respectively). According to the 2015 U.S. Initial Quality Study (IQS), 4 of the top 10 initial quality problems are in the ACEN category, which echoes the prevalence of this issue in that market also.

“As ACEN is incorporated into mass market vehicles, usage will increase and more problems will be reported. It is expected that the incidence of such design-related problems will surpass those related to defects and malfunctions,” said Dr. Mei Songlin, vice president and managing director at JD Power. “In the China market, it is critical for automakers to address problems with ACEN and other technologies now to reduce problems, increase satisfaction and foster loyalty with the brand.”

Dr. Songlin also noted that effective use of ACEN typically requires proper training. In many cases, first-time new-vehicle buyers are not familiar with such systems, and by showing them how the system works, dealers can help reduce related issues and improve satisfaction.

Key Findings

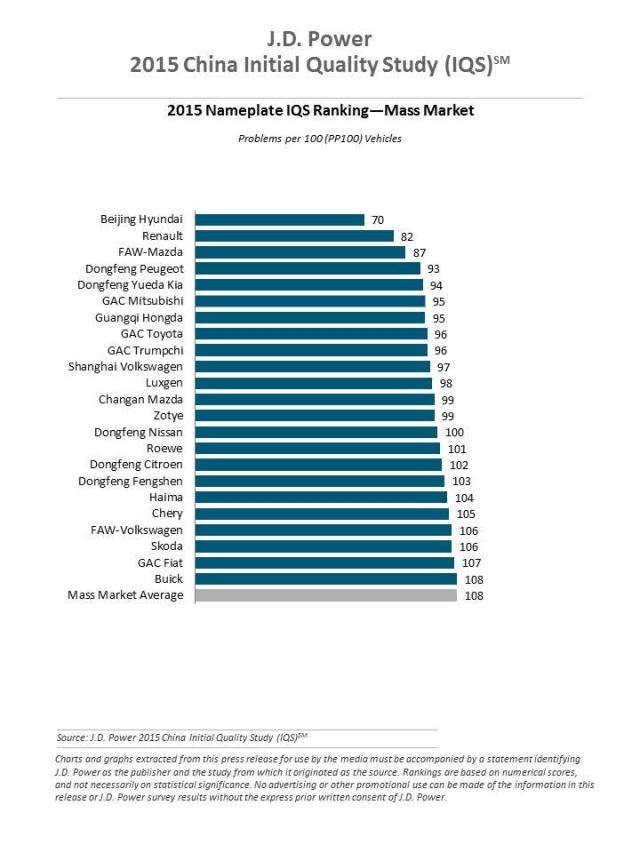

- Overall initial quality averages 105 PP100 in 2015. Korean brands (80 PP100) outperform other brands for a fourth consecutive year, while initial quality for domestic Chinese brands is 120 PP100 and 98 PP100 for international brands.

- The gap in quality scores between domestic brands and international brands in 2015 is 22 PP100. The largest gaps in quality between domestic and international brands are with engine/ transmission (23 PP100 vs. 16 PP100, respectively); exterior (23 PP100 vs. 18 PP100); and driving experience (13 PP100 vs. 10 PP100).

- Unpleasant interior smell/ odor is the most frequently reported as well as the most severe problem this year. That problem, along with excessive fuel consumption; excessive road noise; engine loses power when A/C is on; and excessive wind noise are the top five most reported problems.

2015 China IQS Ranking Highlights

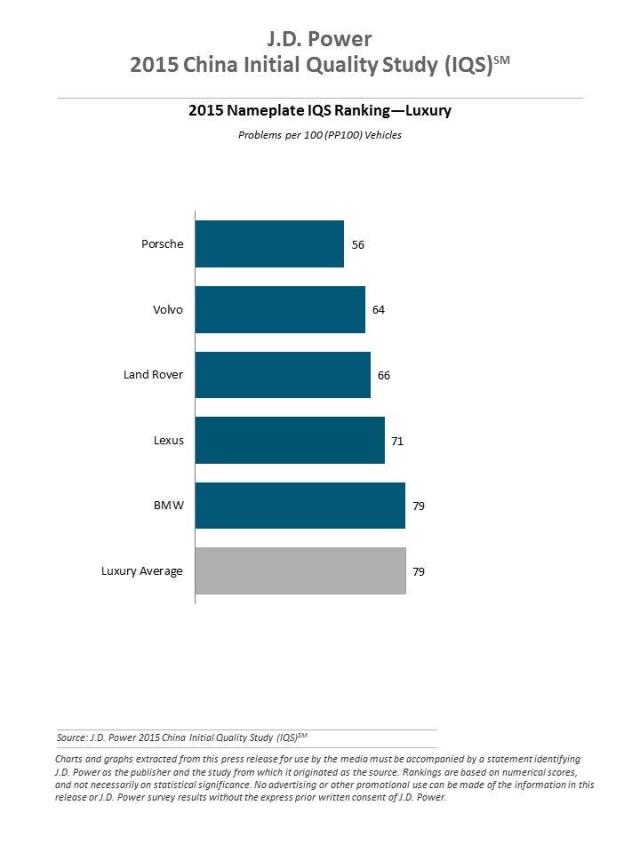

Among luxury nameplates, Porsche ranks highest in initial quality with a score of 56 PP100. Volvo (64 PP100) ranks second among luxury brands and Land Rover ranks third (66 PP100).

Among mass market nameplates, Beijing Hyundai ranks highest with a score of 70 PP100 and receives four model-level awards. Renault ranks second (82 PP100) and FAW-Mazda ranks third (87 PP100).

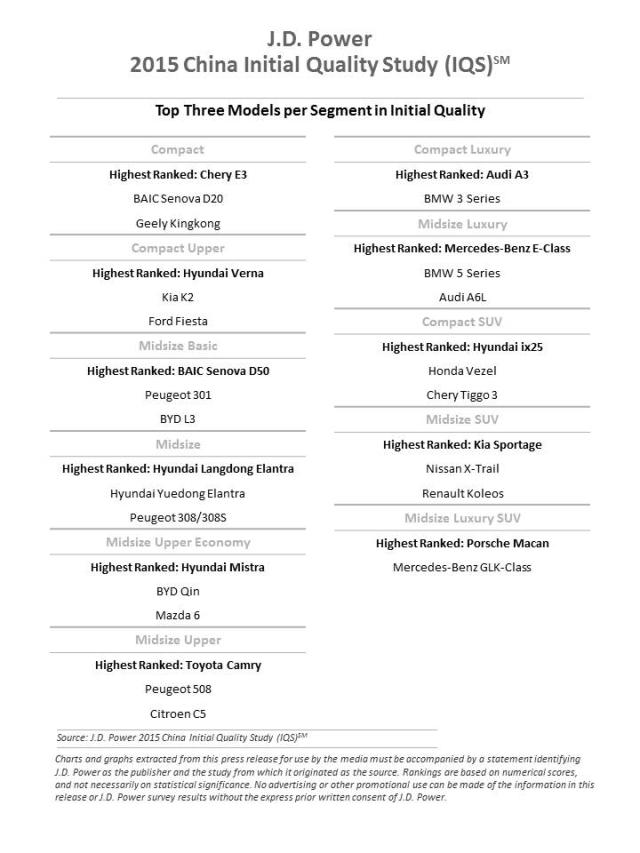

In total, 11 vehicle segments are eligible for awards in the 2015 China Initial Quality Study. Models receiving segment awards are:

- Compact: Chery E3

- Compact Upper: Hyundai Verna

- Midsize Basic: BAIC Senova D50

- Midsize: Hyundai Langdong Elantra

- Midsize Upper Economy: Hyundai Mistra

- Midsize Upper: Toyota Camry

- Compact Luxury: Audi A3

- Midsize Luxury: Mercedes-Benz E-Class

- Compact SUV: Hyundai ix25

- Midsize SUV: Kia Sportage

- Midsize Luxury SUV: Porsche Macan

The 2015 China Initial Quality Study (IQS) is based on evaluations from 21,707 owners of new vehicles purchased between October 2014 and June 2015. The study analyzes models in 21 vehicle segments and includes 270 different passenger-vehicle models from 71 different brands. The study was fielded from April to August 2015 in 57 major cities across China.

Media Relations Contacts

Michelle Meng; Beijing, China; +86 01 6569 2702; yutian.meng@jdpa.com

John Tews; Troy, Michigan USA; 001 248 680 6218; john.tews@jdpa.com

About JD Power Asia Pacific: www.jdpower.com

About JD Power and Advertising/Promotional Rules www.jdpower.com/about-us/press-release-info

About McGraw Hill Financial www.mhfi.com