Domestic and International Brand Vehicle Initial Quality Gap Continues to Narrow, JD Power Finds

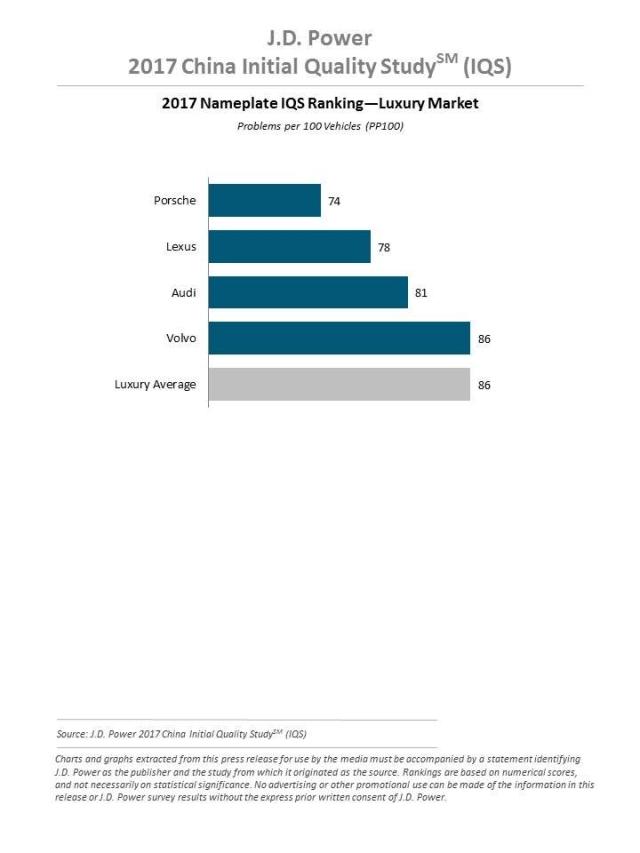

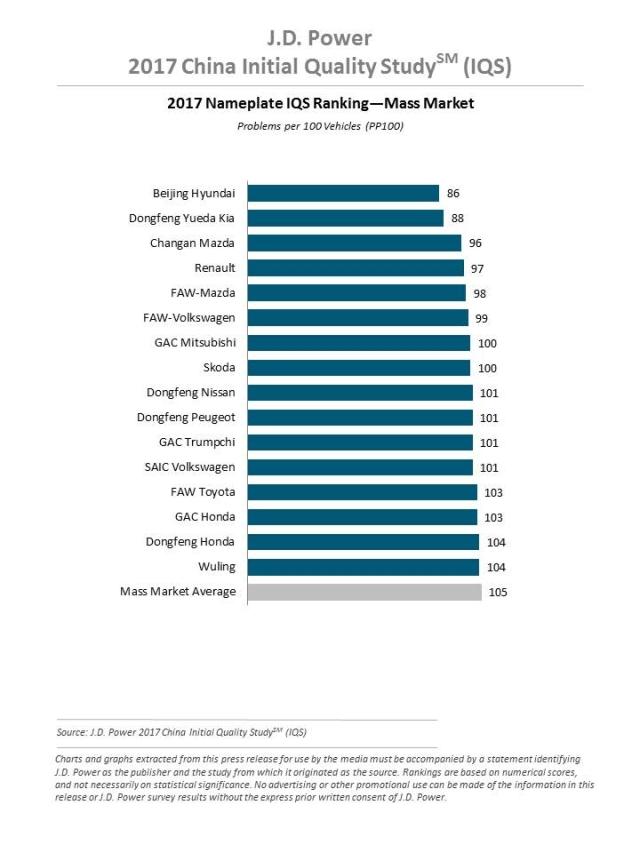

Porsche and Beijing Hyundai Rank Highest in Their Respective Segments; Beijing Hyundai Receives Three Model-level Awards; Audi Receives Two

BEIJING: 28 Sept. 2017 – The new-vehicle quality gap between Chinese domestic brands and international brands is 13 PP100 (problems per 100 vehicles) in 2017, which marks the seventh consecutive year of a narrowing gap, according to the JD Power 2017 China Initial Quality StudySM (IQS). The gap between the two segments has narrowed dramatically since JD Power first launched its Initial Quality Study in China in 2000, when the gap was 396 PP100.

The study shows that Chinese domestic brands, for the first time, slightly outperform international brands in three of the eight problem categories: vehicle interior (0.3 PP100 less); features/ controls/ displays (0.2 PP100 less); and audio/ communication/ entertainment/ navigation (0.1 PP100 less). However, the gap remains in engine/ transmission (5.8 PP100 more); vehicle exterior (3.7 PP100 more); and driving experience (2.2 PP100 more).

The most often reported problem by vehicle owners in China continues to be Unpleasant interior smell or odor (16.4 PP100) this year. Complaints about Excessive fuel consumption has increased significantly to 7.8 PP100, with 2.8 PP100 and 2.3 PP100 more than in 2015 and 2016, respectively.

“The overall trend, based on our annual study, is that the new-vehicle quality in China has been improving continuously and substantially,” said Jeff Cai, General Manager of Auto Product Practice at JD Power China. “In this journey, Chinese domestic brands have made remarkable progress in producing a quality vehicle as they gain on international brands year by year in initial quality of their products. To truly stand out in an increasingly competitive market, it is highly critical for automakers to respond to consumer feedback regarding new-vehicle quality. For Chinese domestic brands, they will still need to proactively address consumers’ concerns and complaints on both design-related problems and defects/ malfunctions in a timely manner.”

Following are additional findings of the study:

- Owners of new-energy vehicles continue to report several problems: Whilenew-energy vehicles (plug-in hybrid) perform better in engine/ transmission and driving experience, they perform worse in the other six categories, compared with traditional fossil fuel vehicles. The most often reported problems by owners of plug-in hybrid electric vehicles are Park assist/ backup warning broken or not working; Built-in Bluetooth mobile phone/ device has frequent pairing/ connectivity issues; and Body panels gaps/ poor fit/ misaligned.

- Chinese new-vehicle owners care about smell and noise most: Eight of the top 20 reported problems are related to smell or noise: Unpleasant interior smell/ odor; Excessive road noise; Excessive wind noise; Brakes noise; Seat squeaks or rattles; Abnormal engine noises; Fan/ Blower excessive noise; and Center console squeaks/ rattles.

- Korean brands (87 PP100) stand out in new-vehicle quality for sixth consecutive year: Korean brands are followed byEuropean brands (95 PP100), Japanese brands (103 PP100), U.S. brands (106 PP100) and Chinese brands (112 PP100).

Highest-Ranked Brands and Models

- Porsche ranks highest in initial quality among luxury brands, with a score of 74 PP100. Lexus (78 PP100) ranks second and Audi ranks third (81 PP100).

- Beijing Hyundai ranks highest among mass market brands, with a score of 86 PP100, followed by Dongfeng Yueda Kia with 88 PP100 and Changan Mazda with 96 PP100.

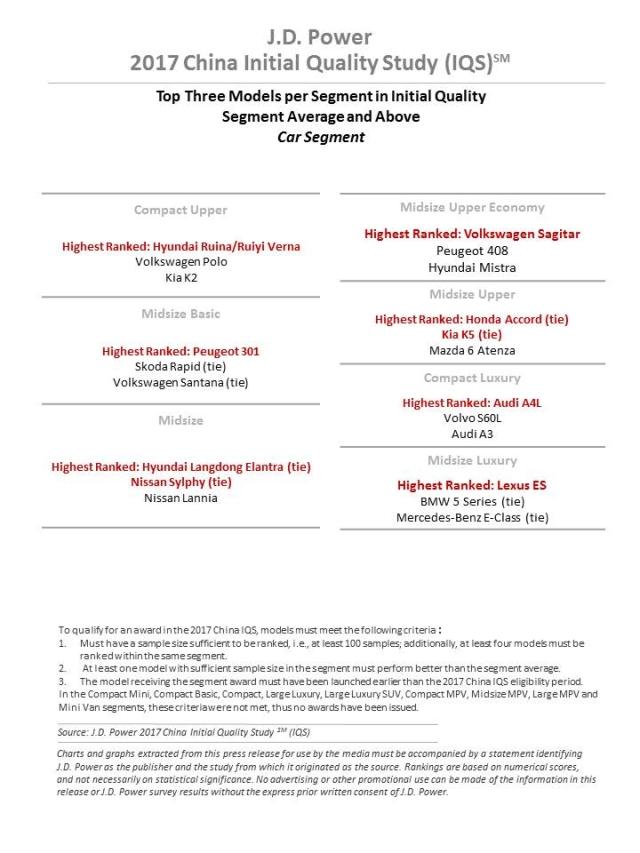

- Beijing Hyundai has three models (Hyundai Ruina/ Ruiyi Verna; Hyundai Langdong Elantra; and Hyundai Tucson) that receive segment awards.

- Audi modelsreceive two segment awards (Audi A4L and Audi Q5).

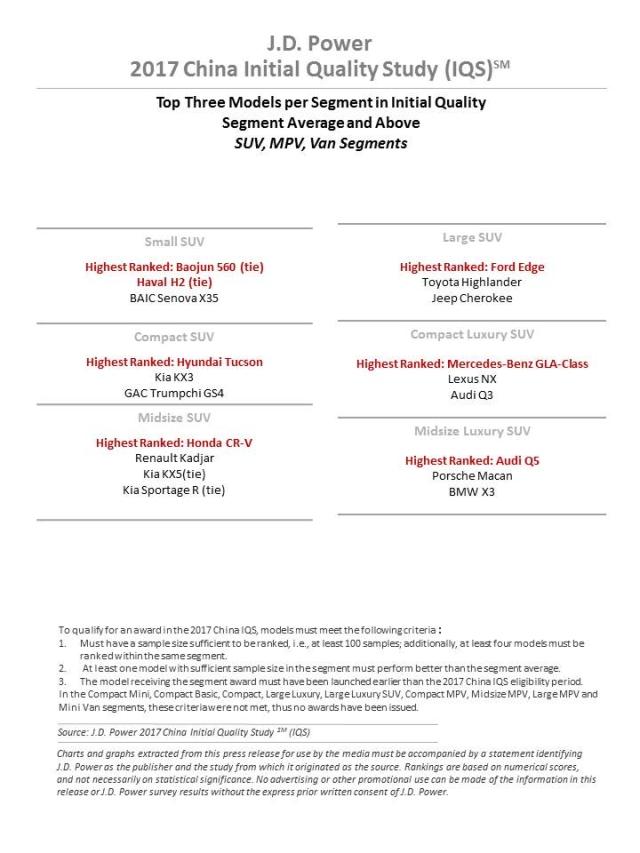

Other models that rank highest in their respective segments are the Peugeot 301; Nissan Sylphy; Volkswagen Sagitar; Honda Accord; Kia K5; Lexus ES; Baojun 560; Haval H2; Honda CR-V; Ford Edge; and Mercedes-Benz GLA-Class.

The 2017 China Initial Quality Study measures new-vehicle quality by examining problems experienced by owners within the first two to six months of ownership in two categories: design-related problems and defects/ malfunctions. Specific diagnostic questions are included in eight problem categories: interior; exterior; engine/ transmission; driving experience; features/ controls/ displays; seats; audio/ communication/ entertainment/ navigation; and heating/ ventilation/ air conditioning. The overall initial quality score is determined by problems reported per 100 (PP100) vehicles, with a lower number of problems indicating higher quality.

The study, now in its 18th year, is based on evaluations from 23,993 owners of new vehicles purchased from September 2016 and May 2017. The study includes 251 different models from 68 different brands. The study was fielded from March through July 2017 in 67 major cities across China.

JD Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable JD Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, JD Power is headquartered in Costa Mesa, California, and has offices in Shanghai, Beijing, Tokyo, Singapore, Malaysia and Bangkok serving the Asia Pacific region. JD Power is a portfolio company of XIO Group, a global alternative investments firm headquartered in London, and is led by its four founders: Athene Li, Joseph Pacini, Murphy Qiao and Carsten Geyer. For more information, please visit china.jdpower.com or stay connected with us on JD Power WeChat and Weibo.

Media Relations Contacts

Shana Zhuang; JD Power; China; +86 21 2208 0831; shana.zhuang@jdpa.com

Geno Effler; JD Power; Costa Mesa, California, USA; 001-714-621-6224; media.relations@jdpa.com

About JD Power and Advertising/ Promotional Rules www.jdpower.com/about-us/press-release-info