High Satisfaction Scores May Boost Financing Portfolios By as Much as 6 Million RMB Per Dealer Annually, JD Power Finds

Toyota Motor Finance Ranks Highest in Retail Credit Segment; Shanghai Automotive Group Finance Ranks Highest in Floor Planning Segment

Shanghai: 25 May 2016— Improving dealer satisfaction could generate as much as 6 million RMB in additional financing per dealer annually, according to the JD Power 2016 China Dealer Financing Satisfaction (DFS) StudySM released today.

The study, now in its third year, examines dealer satisfaction with finance providers in two segments: retail credit and floor planning. In the retail credit segment, satisfaction is measured in three factors: application/ approval process; finance provider offerings/ products; and sales representative relationship. In the floor planning segment, satisfaction is measured in four factors: finance provider credit line; floor plan portfolio management; floor plan support; and sales representative relationship.

High levels of dealer satisfaction are not only critical indicators of dealer profitability, but also finance providers’ market share. The study finds 51% of dealers say they “definitely will” increase their portfolio in the next 12 months with providers that earn high satisfaction scores, while only 27% of dealers will do the same with providers with low satisfaction scores. Accordingly, finance providers with high satisfaction scores could gain as much as 6 million RMB annually in additional portfolio per dealer.

“Our study shows significant disparity in satisfaction scores among different segments of financial service companies,” said Geoff Broderick, vice president and general manager, Asia Pacific Operations, JD Power. “Dealers are more willing to work with financial providers with high satisfaction scores. China’s auto finance market is growing more and more mature. For example, the operational efficiency level in China is approaching the U.S. standard. This leads to service convergence and fierce competition. Understanding the most critical factors and achieving the key performance indicators are essential for them to improve satisfaction.”

KEY FINDINGS

- Dealer Satisfaction with Finance Providers Improves: Overall satisfaction with retail credit providers increases to 809 (on a 1,000-point scale) in 2016, compared with 794 in 2015, while overall satisfaction with floor planning providers increases to 817 from 804. Among the 22 providers in the retail credit segment, only two have lower satisfaction scores than last year, while the scores of five of 19 providers in the floor planning segment have declined.

- Operational Efficiency Becomes the Key Differentiator in the Retail Credit Segment: The single factor driving the highest degree of customer satisfaction with auto financing companies is the application/approval process (38%). Nearly two-thirds (62%) of dealers say captives release funds within 2 days after customers submit all materials (up from 49% in 2015), whereas in the U.S. it is 84%.[1] The study indicates that 38% of the banks and 44% credit card companies release funds within 2 days.

- Disparity Emerges in Different Areas: In the retail credit segment, the gap between captives and banks is 26 index points in the east region of China and 102 index points in the west. In the floor planning segment, the gap is higher for captives than for banks in larger-tier cities. However, in smaller-tier cities, satisfaction scores of banks are significantly higher than those of captives.

Segment Rankings

Toyota Motor Finance (China) Co., Ltd. ranks highest in the retail credit segment (captives and banks) with a score of 863. GMAC-SAIC Automotive Finance Co., Ltd. ranks second (846) and Shanghai Automotive Group Finance Co., Ltd. ranks third (844).

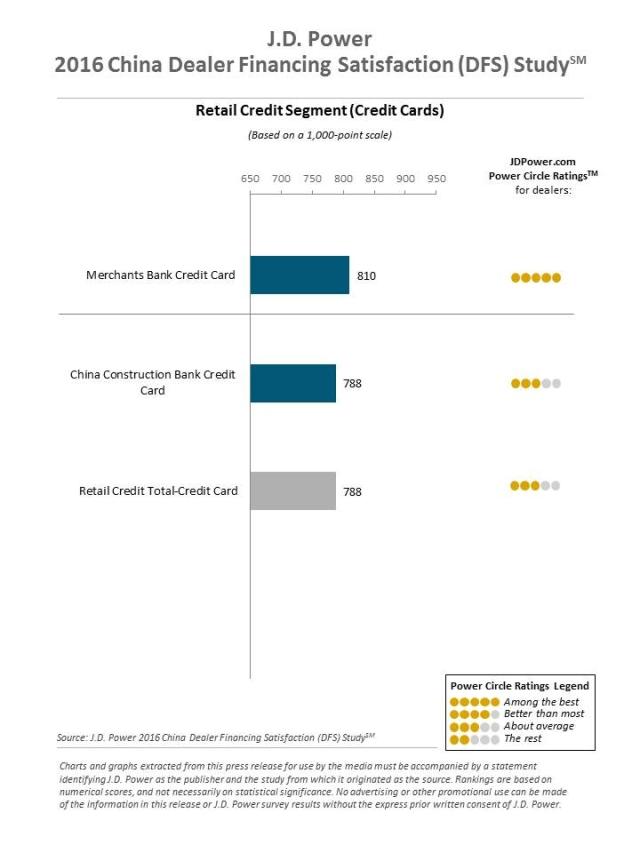

Merchants Bank Credit Card ranks highest in the retail credit segment (credit cards) with a score of 810. China Construction Bank Credit Card ranks second (788).

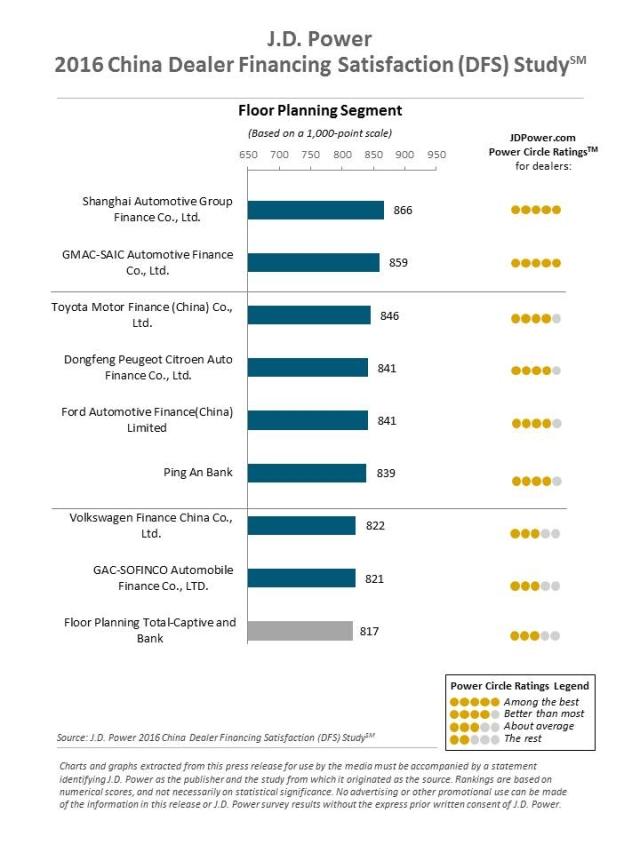

In the floor planning segment, Shanghai Automotive Group Finance Co., Ltd. ranks highest with a score of 866. GMAC-SAIC Automotive Finance Co., Ltd. ranks second (859) and Toyota Motor Finance (China) Co., Ltd. ranks third (846).

The study is based on responses from 2,061 dealers, representing 48 vehicle brands across 78 cities throughout China, who were surveyed on their business performance between January 2016 and April 2016.

Media Relations Contacts

Michelle Meng; JD Power; Beijing, China; +86 01 6569 2702; yutian.meng@jdpa.com

John Tews; JD Power; Troy, Michigan USA; 001 248 680 6218; john.tews@jdpa.com

About JD Power Asia Pacific

JD Power has offices in Tokyo, Singapore, Beijing, Shanghai, Malaysia and Bangkok that conduct customer satisfaction research and provide consulting services in the automotive, information technology and finance industries in the Asia Pacific region. Together, the six offices bring the language of customer satisfaction to consumers and businesses in Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Taiwan, Thailand, and Vietnam. Information regarding JD Power and its products can be accessed through the Internet at asean-oceania.jdpower.com.

About JD Power and Advertising/Promotional Rules www.jdpower.com/about-us/press-release-info