Big Banks Edge Out Payment Specialists in Competitive Battle for Merchant Services Satisfaction, J.D. Power Finds

U.S. Bank Payment Solutions Ranks Highest

TROY, Mich.: 27 Feb. 2020 — With new business applications in the U.S. climbing to post-recession highs,1 merchant services providers are locked in a competitive battle to become small businesses’ preferred means of accepting credit card and mobile payments. According to the J.D. Power 2020 U.S. Merchant Services Satisfaction Study,SM released today, the large U.S. banks are currently leading the way by delivering the best overall customer experience for both e-commerce and brick-and-mortar small businesses, but fintech payments specialists such as PayPal and Square are hot on their heels.

The study evaluates satisfaction among small businesses with 31 merchant services providers and explores the key variables that influence engagement, brand image and satisfaction based on five factors (in order of importance): cost of service; security and chargeback management; payment processing; equipment and technology; and service interactions. Three peer groups of merchant services providers were evaluated: Banks (Bank of America, BB&T, Capital One, Chase, Citi, PNC, Santander, SunTrust, U.S. Bank, Wells Fargo); Payment Specialists (Adven, Braintree, CardConnect, EVO Payments, Intuit Quickbooks, Paya, PayPal, PaySafe, Shopify, Square, Stripe); and Merchant Acquirers (Elavon, First American, First Data, FIS, Global Payments, Heartland Payment Systems, North American Bancard, OpenEdge, TSYS, Worldpay). Nineteen of these providers are include in the final study satisfaction rankings.

“Traditional banks have a natural advantage in providing merchant services to small businesses by virtue of their existing relationships with business owners,” said Paul McAdam, senior director of banking intelligence at J.D. Power. “Similarly, payment specialists such as PayPal and Square have built strong brands and satisfaction by providing small businesses with easy, reliable ways to accept a variety of card and digital payment options. They provide the technology and security a small business requires, along with fee structures that are easily understood.”

Following are key findings of the 2020 study:

- Banks slightly outperform payment specialists: On a peer group basis, small business merchant services offerings from large banks have the highest levels of overall satisfaction, scoring 863 (on a 1,000-point scale). They are closely followed by the payment specialists peer group (854), which includes PayPal, Square, Stripe, Intuit Quickbooks and others.

- Many business owners poised to switch providers: Not all small business owners are happy with their current provider; 27% say they “definitely will” consider switching to another merchant services provider during the next 12 months.

- Bank/merchant acquirer partnerships show promise: While banks deliver higher levels of merchant services customer satisfaction when compared to payment specialists and merchant acquirers on their own, the highest overall levels of customer satisfaction found in the study occur when banks are partnered with merchant acquirers. Overall satisfaction among bank small-business clients that have encountered a third-party merchant acquirer within their business banking relationship averages 873 vs. 854 among those small businesses that have no knowledge a third-party merchant acquirer’s involvement.

- E-commerce small businesses more satisfied than physically based businesses: Overall satisfaction with their merchant services provider is highest among e-commerce merchants (860). Overall satisfaction is significantly lower among physically based businesses that accept card present or digital wallet payments (808). Small businesses that accept payments through mobile or wireless card readers are more satisfied (830) than those that use a credit card terminal attached to a point-of-sale system (800).

- Younger business owners significantly more satisfied: Millennial and Gen Z2 business owners have the highest overall merchant services satisfaction when compared with older age groups. Both Millennials and Gen Z business owners provide the highest satisfaction ratings to bank-owned merchant services providers compared with specialist providers.

“These are indicators that the combination of bank strengths and acquirer partner strengths has contributed to the strong satisfaction scores of large banks,” McAdam said. “This is positive for banks, and likely a necessity, as this study tells us that large banks and payment specialists such as PayPal, Square and Stripe will be locked in a competitive battle to provide payment and other types of financial services to small businesses.”

Study Rankings

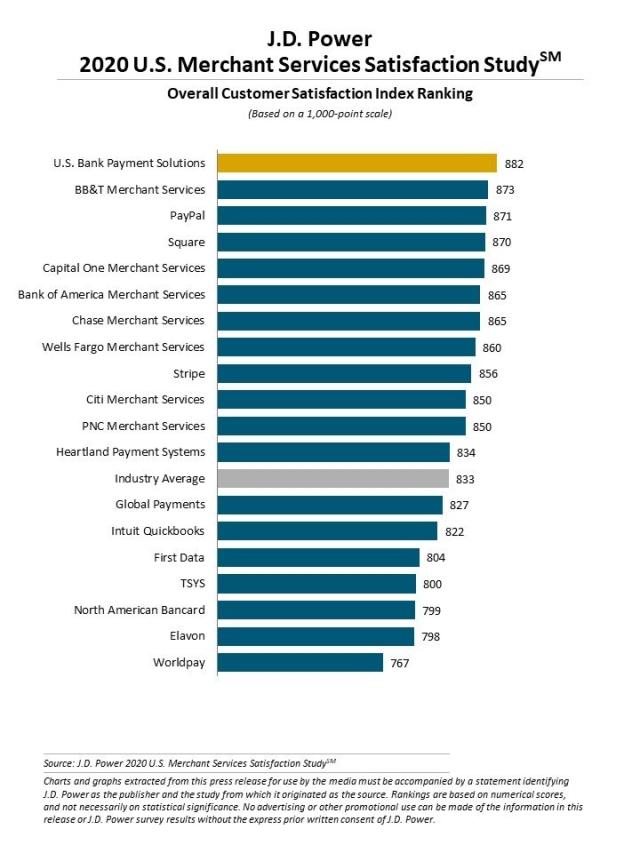

U.S. Bank Payment Solutions ranks highest in merchant services satisfaction with a score of 882. BB&T Merchant Services (873) ranks second and PayPal (871) ranks third. Seven of the top 10 ranked providers are banks and three are payment specialists. U.S. Bank Payment Solutions provides merchant services to its small business clients through its subsidiary, Elavon.

The study rankings reveal the effects of the various distribution, sales and operating models used in the fragmented, small merchant market. Most of the banks included in the study provide merchant services to their small business clients via deep business relationships with merchant acquirers including First Data (Fiserv), Worldpay (FIS) and TSYS (Global Payments). See the table below for the primary merchant acquirer partnered with each bank at the time of study fielding. These merchant acquirers also manage direct, standalone merchant services businesses that appear in the study rankings. Given the prevalence of outsourced processing relationships—and occasionally having less control over pricing and servicing due to ISO/reseller relationships—it is not unexpected that merchant acquirers achieve lower satisfaction in some of the markets they serve.

|

Primary Merchant Acquirer |

|

|

Bank of America Merchant Services |

First Data (Fiserv) |

|

BB&T Merchant Services |

TSYS (Global Payments) |

|

Capital One Merchant Services |

Worldpay (FIS) |

|

Chase Merchant Services |

Chase |

|

Citi Merchant Services |

First Data (Fiserv) |

|

PNC Merchant Services |

First Data (Fiserv) |

|

Santander Merchant Services* |

First Data (Fiserv) |

|

SunTrust Merchant Services* |

First Data (Fiserv) |

|

U.S. Bank Payment Solutions |

Elavon (U.S. Bank) |

|

Wells Fargo Merchant Services |

First Data (Fiserv) |

*Santander Merchant Services and SunTrust Merchant Services are included in the study, but not included in the satisfaction index rank chart because their sample sizes fall below the minimum requirement for study rankings.

The J.D. Power 2020 U.S. Merchant Services Satisfaction Study is based on responses from 5,344 small business customers of merchant services providers. The study was fielded in October-November 2019.

For more information about the U.S. Merchant Services Satisfaction Study, visit https://www.jdpower.com/business/resource/us-merchant-services-study.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power has offices serving North America, Asia Pacific and Europe.

Media Relations Contacts

Geno Effler, J.D. Power; Costa Mesa, Calif.; 714-621-6224; media.relations@jdpa.com

John Roderick; Huntington, NY.; 631-584 2200; john@jroderick.com

1U.S. Census Bureau Business Formation Statistics, Fourth Quarter 2019. https://www.census.gov/econ/bfs/pdf/bfs_current.pdf.

2Generational grouping: Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1981); Millennials (1982-1994); and Gen Z (1995 to present).