Startup Vehicle Brands in China Lead NEV Owner Satisfaction, J.D. Power Finds

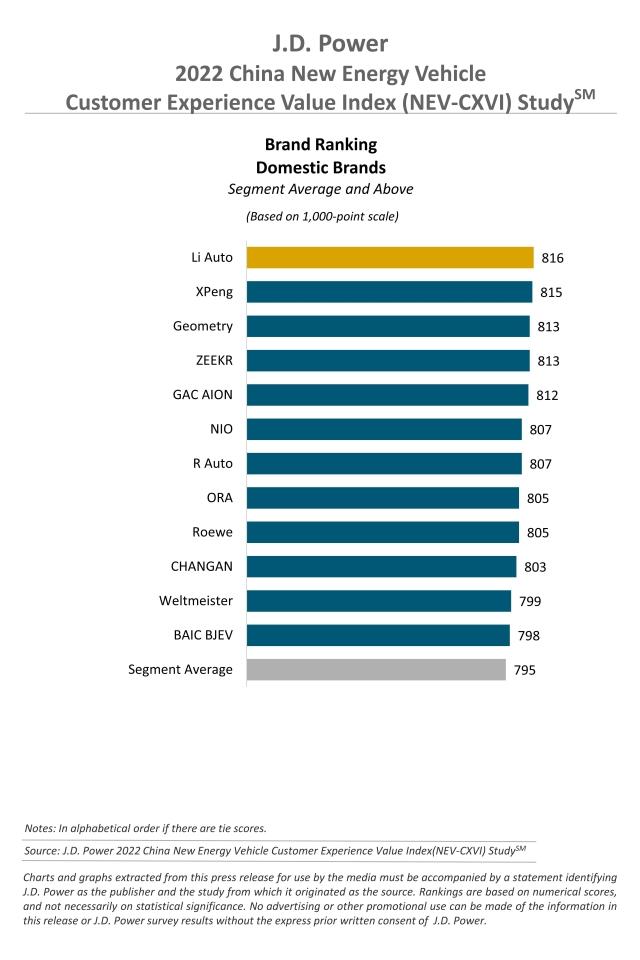

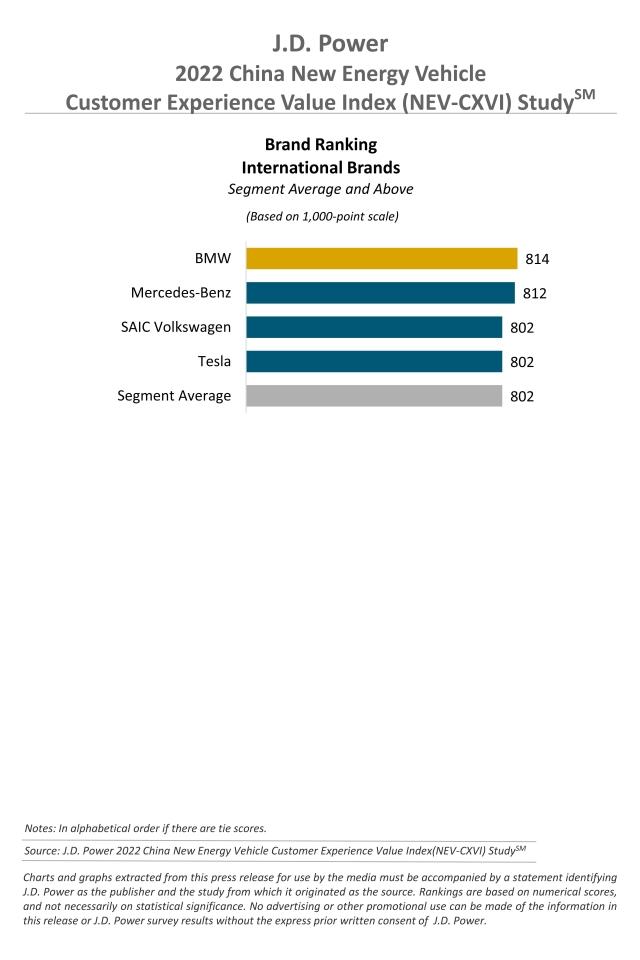

Li Auto and BMW Rank Highest in Respective Segments

SHANGHAI: 20 Oct. 2022 — A new study conducted by J.D. Power in China evaluates the ownership experience of new energy vehicle (NEV) owners in the first 2 to 12 months after purchase of their vehicle. The overall score among these owners is 796 (on a 1,000-point scale), according to the inaugural J.D. Power China New Energy Vehicle Customer Experience Value Index (NEV-CXVI) Study,SM released today. Notably, startup vehicle brands in China lead the industry by 10 points with a score of 806.

The study utilizes a Customer Experience Value Index (CXVI) to evaluate the experience of NEV owners whose ownership is between 2 and 12 months. The study focuses on specific action guidelines for satisfying emotional needs of customers in various scenarios, and is designed to provide the industry with advisement to continuously build a more efficient and holistic customer-oriented experience. The scores are based on evaluations of different customer groups on various measures at three experience stages of purchase, usage and service.

The study shows that the customer experience value index of Chinese startup brands in 2022 is 806, 10 points higher than the industry average with leading performance in purchase, usage and service. International brands follow with a score of 802, while traditional brands lag the industry average with 792. Among them, the startups have a 16-point lead in score for service experience (809), compared with international brands, and a 23-point lead over traditional independent brands. The study also finds that the usage experience stage (806) is the peak experience of the whole ownership journey, while the purchasing experience stage scores 788, ranking lowest among the three experience stages, and indicates there is still large room for improvement.

“In the era of automobile electric intelligence, the transformation of auto products is rapidly driving the change of consumer demand,” said Ann Xie, general manager of the digital retail consulting practice at J.D. Power China. “The reason why startups seize the lead position is that they have a keen sense of customers’ needs. User-centered and demand-driven, the startup sector has achieved remarkable results in customer operation. For automakers, whether a new or a traditional brand, the goal of customer experience management needs to be changed from the perspective of financial gain to viewing the whole ownership life cycle of user value returns. Depending on the experience integration externally and the management system integration internally, it is imperative to enhance customers’ experience and increase their loyalty for driving brand growth.”

Following are additional findings of the 2022 study

- New energy vehicle buyers prefer to obtain information from online channels: New energy vehicle buyers use more online channels than fuel vehicle buyers to look for information, and especially prefer the official apps and video websites provided by manufacturers. Nearly one-fifth (16%) of new energy vehicle buyers use the official auto manufacturer app to obtain information, which is 4.1% higher than among fuel vehicle buyers. The proportion of new energy vehicle buyers who use video websites to obtain information is 11%, which is 3.5% higher than among fuel vehicle buyers. In terms of information content, new energy vehicle buyers pay more attention to the introduction of new technologies and third-party evaluation than do fuel vehicle buyers.

- The experience score declines as the ownership period goes on. The long-term operation of experience needs to be strengthened: The usage indices of new energy vehicle owners at 2 and 6 months of ownership are 820 and 813, respectively. While there is only a slight difference in score between them, the score at 7 months of ownership drops to 767.This slump in experience score is very notable. The main reasons leading to the decline in experience include a change in the service attitude of sales staff being more indifferent than previously; a number of problems that affect charging efficiency and convenience; and customer equity gradually loses attractiveness, among others.

- Brand official app helps improve customer experience: The customer experience value index score is frequently higher among vehicle owners who log in often to the brand official app. The experience value index score among owners who log in to the official app several times a day is 830, compared with 782 points among vehicle owners who log in every 2-3 days, a gap of 48 points.

Highest-Ranked Brands

Li Auto ranks highest in customer experience value among Chinese brands with a score of 816. XPeng ranks second with a score of 815. Geometry (813) and ZEEKER (813) rank third in a tie.

BMW ranks highest in customer experience value among international brands with a score of 814. Mercedes-Benz ranks second with a score of 812. SAIC Volkswagen (802) and Tesla (802) rank third in a tie.

The 2022 study is based on responses from 3,968 new energy vehicle owners who purchased their vehicle between June 2021 and May 2022. The study includes 41 brands and was fielded in June-July 2022 in 56 major cities across China.

The 2022 China New Energy Vehicle Customer Experience Value Index (NEV-CXVI) Study measures the purchase stage across iInformation collection (16%); sShowroom eExperience (14%); product experience (13%); purchase plan (17%); customer follow-up (19%); and delivery (22%). The measures for the usage stage include customer service (23%); energy service (38%); and customer equity (38%); and the measures for the service stage include service initiation (41%); service process (29%); and service quality (30%).

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on J.D. Power WeChat and Weibo.

Media Relations Contacts

Mengmeng Wang, J.D. Power; China; +86 21 8026 5719; mengmeng.wang@jdpa.com

Geno Effler, J.D. Power; USA; 001-714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info