Dealers in China Expect Support from Automakers in Difficult Time, J.D. Power Finds

FAW Toyota Ranks Highest in Dealer Satisfaction

SHANGHAI: 23 April 2020 – Dealers in China suffered both revenue and profit decline in fiscal year 2019 and are experiencing unprecedented crisis due to the COVID-19 pandemic in 2020. Timely support from manufacturers could help both sides get through these tough times, according to the J.D. Power 2020 China Dealer Attitude Study(DAS), SM released today.

Started in 2009, the study examines authorized dealers’ attitudes toward and satisfaction with auto manufacturers. It also provides the operational conditions of dealerships and analyzes issues that both manufacturers and dealers are deeply concerned about. All the information comes from the senior managers of the dealers surveyed.

The study shows that the revenue of dealers decreased 5% in FY 2019 compared with the previous fiscal year. The three main sources of revenue for dealers—new-vehicle sales, after-sales service and parts sales—all have declined. Additionally, the total profit of dealers slumped 19%, among which the contribution of after-sales service and parts to the overall profit decreased 3%.

Dealer business has been further affected by the COVID-19 pandemic. In February 2020, when nearly the entire country was on lockdown, each dealer sold 14 units new cars, on average, with 16% of dealers reporting zero sales and average inventory index rising to 2.6 from 1.8 before the outbreak. The number of after-sales services delivered by dealers is less than 100, 85% less than that before the outbreak.

"The aftermath of COVID-19 on the automotive market is yet to be seen and dealers need to prepare for a long-lasting battle," said Eileen Ren, vice president of digital customer experience at J.D. Power China. “When revenue falls, the importance of efficiency improvement and cost management grows. At the same time, the changes in consumer demand and behavior brought about by the outbreak require dealers to strive to improve their capabilities such as online marketing and sales as well as remote services. All of these cannot be achieved by dealers alone. As a close partner with the same interests as dealers, manufacturers providing timely support will help both parties to overcome the difficulties.”

Following are additional findings of the 2020 study:

- New-car sales declines in revenue but grows in contribution to profit: Although revenue of new car sales has declined to RMB 147M (USD 20.7M) in FY2019 from RMB 154M (USD 21.7M) in FY2018, its contribution to dealer profit has increased by 3% to 23%. Improved inventory level (-13%) and higher sales rebates (+13%) are the main reasons for the new car sales profit increase, but the average number of new vehicles sold per month is still in a downward trend (-8%).

- The profitability of after-sales services continues to be weak: The average number of dealers’ after-sales service per month has decreased 16%, compared with the previous fiscal year. The revenue from after-sales service business has fallen to RMB 7.2M (USD 1M) in FY2019 from RMB 7.6M (USD 1.1M) in FY 2018, while revenue from spare parts business drops to RMB 3.2M (USD 452K) in FY2019 from RMB 3.8M (USD 536K) in FY 2018.

- Dealer digital retailing business stalls: As sales leads could not be effectively tracked and converted, customer traffic and deals brought by digital retailing activities has been less than 30% during the past five years. The stalled business in reverse affects dealer’s enthusiasm in digital retailing, as dealers with digital retailing departments have fallen to 83% in 2020 from 93% in 2017.

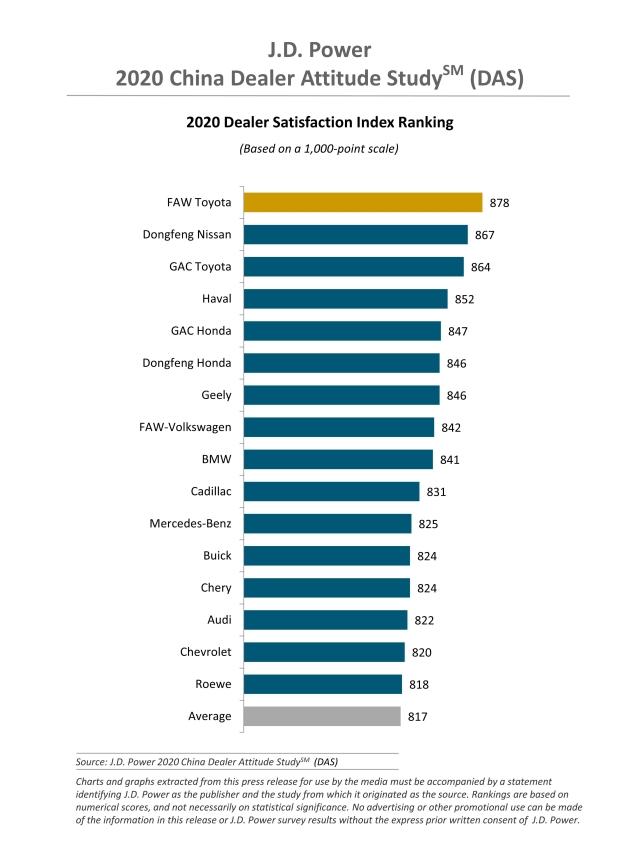

Study Rankings

FAW Toyota (878) is the highest ranked brand. Dongfeng Nissan (867) ranks second and GAC Toyota (864) ranks third.

The J.D. Power China Dealer Attitude Study (DAS) measures dealer satisfaction with automotive manufacturers on eight measurements: support provided by OEM (30%); training (12%); sales team (12%); after-sales team (11%); marketing and sales activities (11%); parts supply (10%); product (7%); and vehicle ordering and delivery process (6%). It is an effective tool to evaluate the health of the relationships between dealers and manufacturers and is also the basis for manufacturers to adjust business policies.

The 2020 study is based on responses from 2,125 dealers in 85 cities and covering 46 brands. The field work was conducted from December 2019 through March 2020.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power has offices serving North America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on J.D. Power WeChat and Weibo.

Media Relations Contacts

Damon Liu; J.D. Power; China; +86 21 8026 5721; damon.liu@jdpa.com

Geno Effler; J.D. Power; Costa Mesa, California, USA; 001-714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

# # #

NOTE: One chart follows.