One-Fourth of Vehicle Shoppers in China Stop Shopping before Visiting Dealership, J.D. Power Finds

Audi Ranks Highest among Luxury Brands; Beijing Hyundai and GAC Honda Rank Highest in a Tie among Mass Market Brands

SHANGHAI: 19 Sept. 2019 — The competition for new-vehicle sales starts even before shoppers visit the dealership. More than one in four potential buyers reject a brand when searching vehicle information or communicating with dealers before visiting in person, according to the J.D. Power 2019 China Sales Satisfaction Index (SSI) Study,SM released today.

The study, now in its 20th year, measures satisfaction with the sales experience among new-vehicle buyers and rejecters, who are defined as those who shop a dealership but purchase elsewhere. According to the study, although the majority of buyers are “lost” after visiting the dealer, the percentage has dropped to 74% this year from 90% in 2017, while customers lost before visiting the dealership in person has increased to 26% from 10% in the same time frame.

Before visiting the dealer, among shoppers who do not have a clear idea of what vehicle to purchase, the decision is easily affected by factors such as first impression; price; and others’ opinions. The three main reasons rejecters stop the vehicle purchasing process is because the brand/model does not meet their needs; the brand/model is too expensive; and the brand/model has many negative reviews.

"Consumers' purchase decision is formed in the very beginning of their purchase behavior. Offering consumers with opportunities such as test drive at their initial decision-making phase, could enhance consumers' understanding and experience of the vehicle, increase brand favorability and credibility, and then avoid the customer loss caused by price or negative comments,” said Eileen Ren, Vice President of Digital Customer Experience at J.D. Power China.

The negative effect of pre-visit communication with the dealership is another reason for customer loss, including the salesperson not understanding the vehicle buyers’ needs completely; the salesperson applying too much pressure; the dealer staff being rude; and the price is not transparent.

" Acquiring vehicle information through various communication channels is a direct way for customers to quickly understand the product. Improving the response speed and shopper experience in pre-visit communications could not only help avoid customer loss but also offers a good opportunity to effectively identify customer demands and then ease the pressure of in-store sales service, improving sales,” said Ren.

Following are additional findings of the 2019 study:

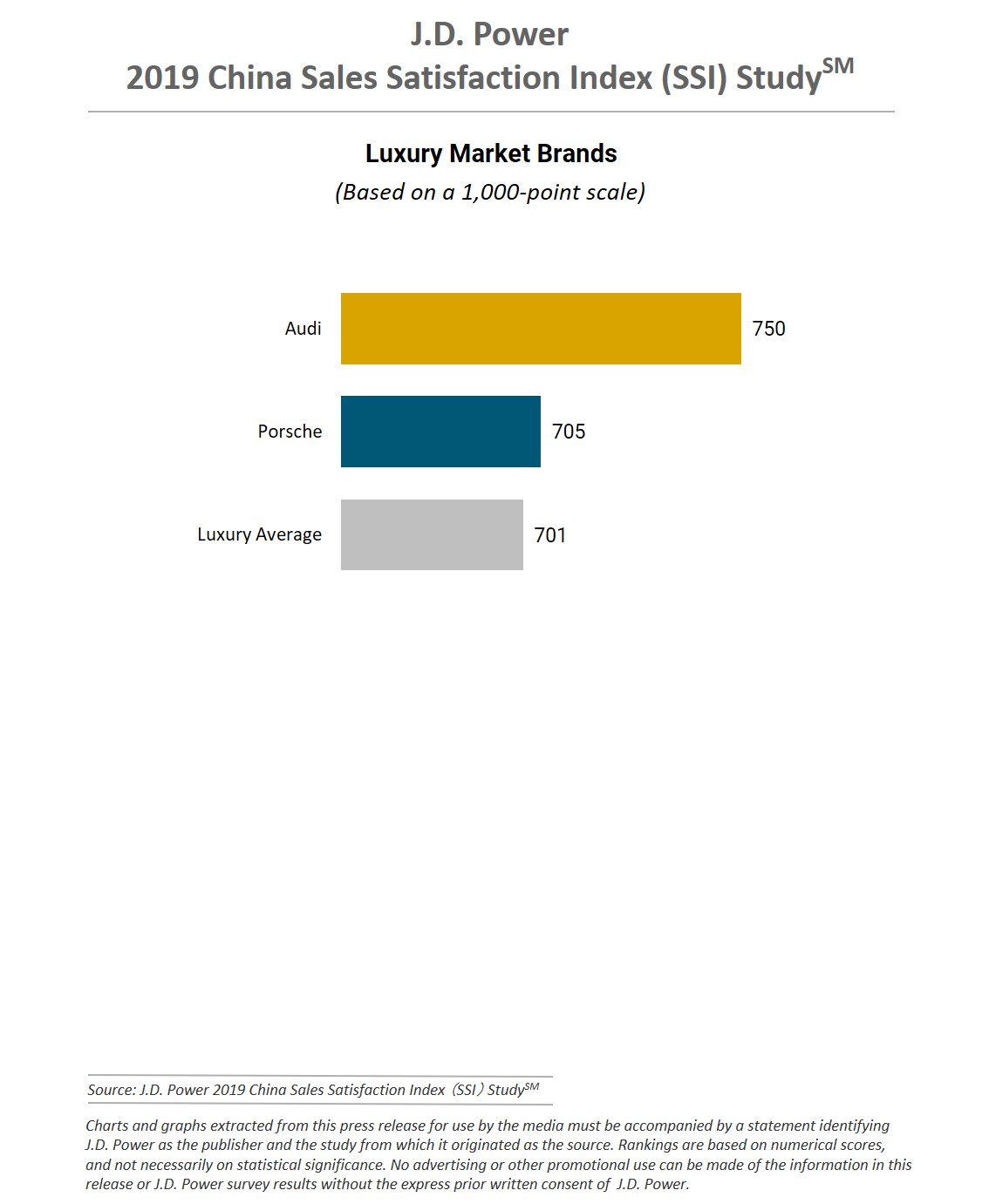

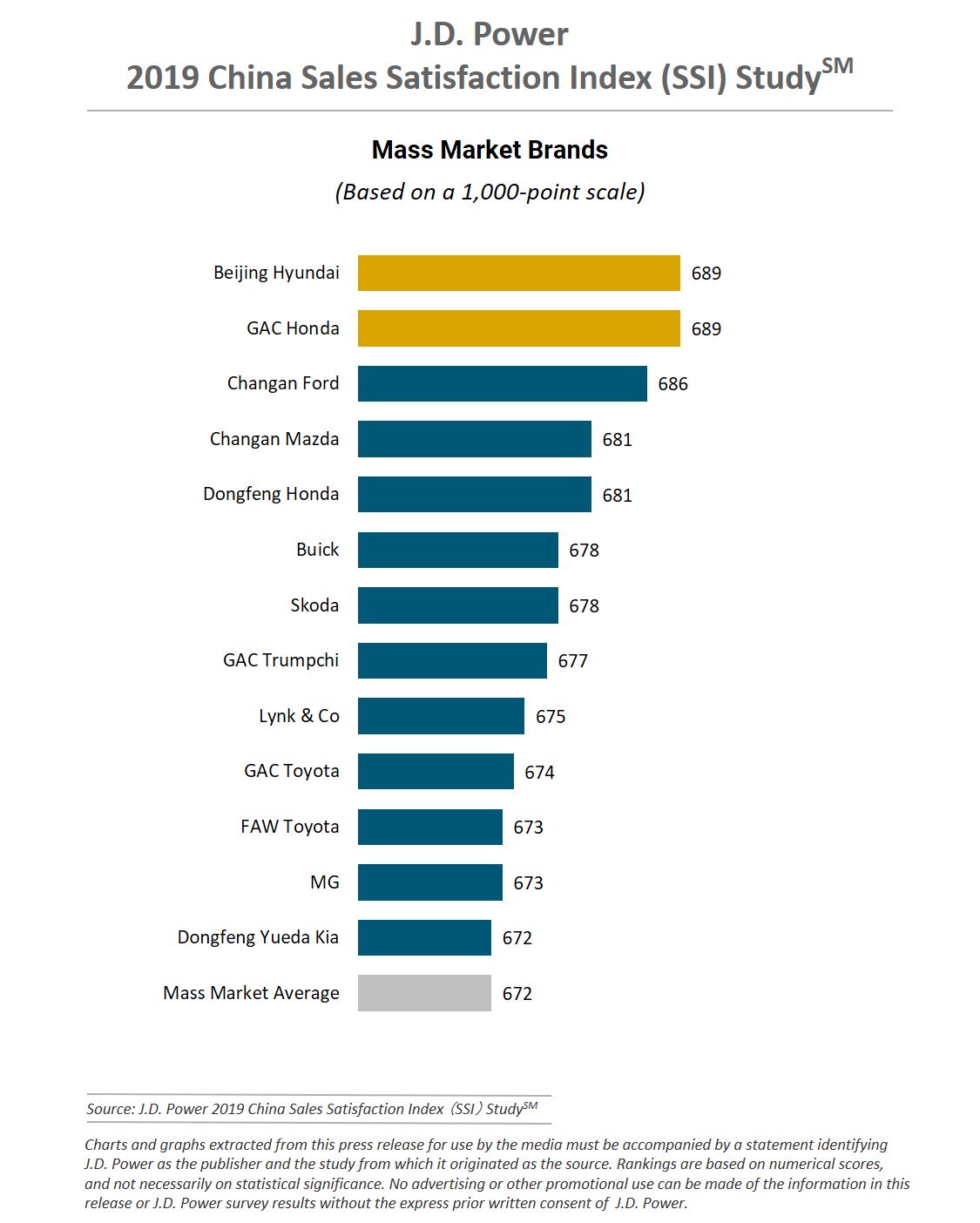

- Luxury brands sales satisfaction is significantly higher than mass market brands: Overall sales satisfaction this year is 677 (on a 1,000-point scale). Luxury brands (701) perform much better than mass market brands (672). Chinese domestic brands (666) have the lowest sales satisfaction compared with other brands.

- Satisfaction with OEM-owned online information channels is higher: Although customers rely less on OEM-owned online information channels than third-party online channels for pre-purchase research, they are more satisfied with the former (12 points higher), especially in terms of vehicle information display.

- Third-party car purchasing platforms reflect a positive effect on customer experience: Third-party platforms play important roles in brand/model decision; negotiation/agreement on contract prices; and vehicle delivery support. In addition, customer satisfaction among those who purchase vehicles through third-party platforms is 23 points higher than among those who purchase vehicles at dealerships.

Study Rankings

For a seventh consecutive year, Audi ranks highest among luxury brands with a score of 750. Porsche ranks second with a score of 705.

Beijing Hyundai and GAC Honda rank highest in a tie among mass market brands, each with a score of 689, followed by Changan Ford at 686. GAC Trumpchi (677) is the highest-ranked Chinese domestic brand.

The J.D. Power 2019 China Sales Satisfaction Index (SSI) Study measures sales satisfaction among new-vehicle buyers and rejecters. Buyer satisfaction is based on six measures: online experience (15%); salesperson (19%); dealer facility (19%); deal (16%); paperwork (15%); and delivery process (17%). Rejecter satisfaction is also based on six measures: online experience (20%); dealer facility (21%); variety of inventory (22%); salesperson (17%); price fairness (11%); and negotiation (11%).

The 2019 China Sales Satisfaction Index (SSI) Study is based on responses from 23,197 vehicle owners in 75 major cities who purchased their new vehicle between July 2018 and May 2019. The study was fielded from January 2019 through July 2019.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power has offices serving North America, South America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on J.D. Power WeChat and Weibo.

Media Relations Contacts

Shana Zhuang; J.D. Power; China; +86 21 8026 5719; shana.zhuang@jdpa.com

Geno Effler; J.D. Power; Costa Mesa, California, USA; 001-714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/business/about-us/press-release-info

# # #

NOTE: Two charts follow.