J.D. Power 2017 China Sales Satisfaction Index Study (SSI)

BEIJING: 29 June 2017— New-vehicle buyers in China are more satisfied after receiving differentiated sales and delivery services, and are becoming increasingly open to considering additional brands, according to the J.D. Power 2017 China Sales Satisfaction Index (SSI) StudySM ,released today.

At the same time, more than half (57%) of new-vehicle buyers received delivery of a new vehicle with a fuel tank that was near empty, resulting in the lowest overall satisfaction score of 651 (on a 1,000-point scale). Sales satisfaction increases to 689 when a vehicle is delivered with a fuel tank that is above three-fourths full or with a full tank.

“In addition to filling the fuel tank, carefully designed sales and delivery processes are often very helpful in terms of improving satisfaction,” said Frank Hu, general manager of auto retail at J.D. Power China. “The key is to provide individualized services. A lot of processes in sales and delivery cost very little but have a huge effect on customer satisfaction. For example, overall satisfaction among buyers increases when they are introduced to service personnel at delivery. Following up with customers post-delivery also is a low-cost, high-benefit strategy.”

The study also finds that fewer new-vehicle buyers have determined in advance of shopping what brand they will purchase and buyers are also shopping more brands than in the past. When new-vehicle buyers first begin the shopping process, 70% already know the brand or model they want to purchase, down from 78% in 2016. On average, customers considered 2.3 brands in 2017, compared with 1.8 last year.

The proportion of shoppers who are open to purchasing any brand or model has increased to 30% this year from 22% last year. In 2016, dealers encountered only 0.7 rejecters for each new buyer, while this year that number has increased to 1.1 rejecters for each new buyer.

“We’ve noticed that more and more buyers are becoming open to different makes,” said Ann Xie, senior research director at J.D. Power China. “This trend actually provides more exciting opportunities to dealers as they are increasingly able to convert more shoppers into buyers.”

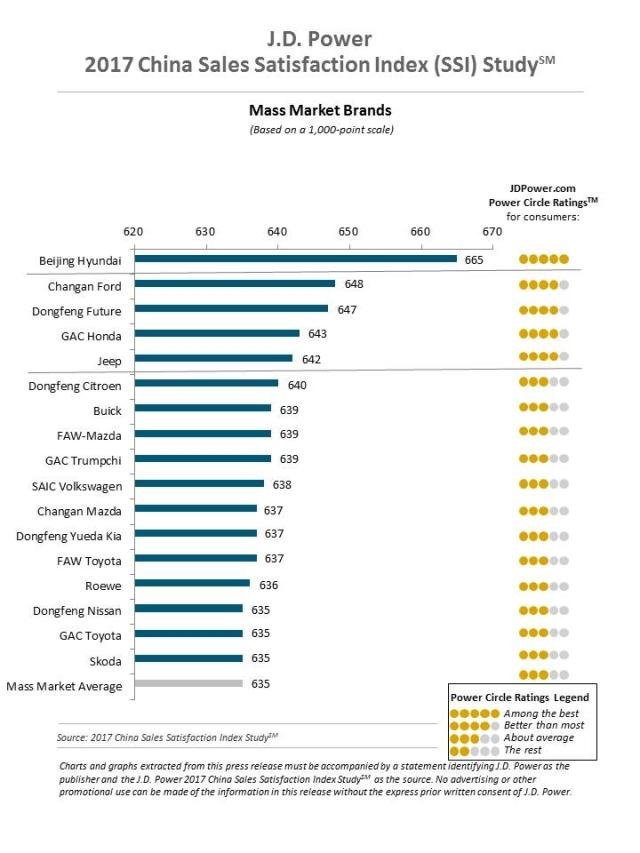

Sales Satisfaction Rankings

Audi ranks highest among luxury brands with a score of 683, marking the fifth consecutive year as the highest-ranked brand. Porsche ranks second with a score of 680. Beijing Hyundai ranks highest among mass market brands with a score of 665. Changan Ford (648) ranks second.

Following are some other study findings:

-

The salesperson remains the most important factor to satisfaction among both buyers and rejecters. Salespeople who explain features on a tablet earns substantially higher satisfaction(above 686).

-

Online channels are being used more oftento select vehicles. While recommendations from friends/ relatives remain the most frequent (72%) and influential (39%) information source, 65% of new-vehicle buyers used at least one online channel to research their purchase and one-fourth (25%) of them considered the online channel as the most influential.

-

High satisfaction leads to loyal customers. Specifically, 62% of satisfied buyers, among whom satisfaction averages 674, say they “definitely would” service their vehicle at the selling dealer, compared with only 33% of less satisfied buyers (satisfaction averages 646) who say they “probably would” do the same.

-

Satisfaction is notably higher when the buyer and salesperson agree on the vehicle price within one week. Half (50%) of all buyers were able to finalize the deal in less than one week, which increases sales satisfaction (670 for less than one week vs. 654 for more than 3 weeks).

-

Overall satisfaction is higher among customers who use a loan/ installment plan (687) than among those who do not (657). While younger buyers in China are much more likely to finance the purchase of their vehicle, 82% of all buyers in the country continue to use cash when purchasing a new vehicle.

The study, now in its 18th year, measures sales satisfaction among new-vehicle buyers (67%) and rejecters(33%). Buyer satisfaction is based on six measures (in order of importance): dealer facility (19%); salesperson (19%); deal (18%); delivery process (18%); sales initiation (17%); and online experience (8%). Rejecter satisfaction is based on five measures (in order of importance): salesperson (32%); variety of inventory (24%); dealer facility (23%); fairness of price (11%); and experience negotiating (9%).

The 2017 China Sales Satisfaction Index (SSI) Study is based on responses from 23,815 vehicle owners in 67 cities who purchased their new vehicle between May 2016 and March 2017. The study was fielded from November 2016 through May 2017.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power is headquartered in Costa Mesa, California, and has offices in Shanghai, Beijing, Tokyo, Singapore, Malaysia and Bangkok serving the Asia Pacific region. J.D. Power is a portfolio company of XIO Group, a global alternative investments firm headquartered in London, and is led by its four founders: Athene Li, Joseph Pacini, Murphy Qiao and Carsten Geyer. For more information, please visit china.jdpower.com or stay connected with us on J.D. Power WeChat and Weibo.

Media Relations Contacts

Shana Zhuang; J.D. Power; China; +86 21 2208 0831 ; shana.zhuang@jdpa.com

Geno Effler; J.D. Power; Costa Mesa, California, USA; 001-714-621-6224; media.relations@jdpa.com

About J.D. Power and Advertising/ Promotional Rules www.jdpower.com/about-us/press-release-info